As the name already suggests, these forms are closely linked to the taxation regime in the form of a single tax on imputed income. Or, more simply put, UTII.

Webinar from Contour “Cancellation of UTII. It's time to act!"

November 10 at 10:00 Moscow time, participation is free

Register

Let us remind you that UTII is applied to certain types of activities (retail, transport, catering, personal services, etc.). The full list is given in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

Each region determines for itself which types of activities are subject to UTII. In Moscow and St. Petersburg, as you know, there is no UTII.

The taxpayer himself subsequently chooses whether to apply UTII for a separate business or not. Sometimes this is economically beneficial, for example, a retail store with a large turnover on UTII, and wholesale trade - on a simplified regime.

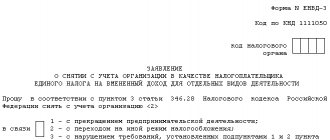

To start applying UTII, organizations must submit a tax application in the form of UTII-1, and individual entrepreneurs - UTII-2.

It will be impossible to switch to UTII from January 1, 2022; this regime will be abolished throughout the country. It's time for UTII payers to choose a new tax regime, and for those who are just planning to open a business, they need to consider alternatives. Choose a favorable tax system for yourself using our online calculator so as not to overpay taxes. And in order not to get confused in the transition period, read the article with expert explanations. If you don’t find the answer to your question, ask it in the comments to the text, we will definitely answer.

When and where to submit UTII-1 and UTII-2?

The application should be submitted to the tax service area where it is intended to conduct activities subject to UTII. If the store is in Alapaevsk, and the legal entity. LLC address in Yekaterinburg, then you need to register under UTII in Alapaevsk.

The application deadline is 5 days from the date of the decision to switch to UTII according to the type of activity.

In fact, when you feel the need, then you can apply.

If you want to switch from the simplified tax system to UTII, you can switch only from the beginning of next year. This is directly stated in paragraph 6 of Article 346.13 of the Tax Code of the Russian Federation.

General standards

An organization can find an application for registration in the Order of the Federal Tax Service dated December 11, 2012 No. ММВ-7-6/ [email protected] Let us immediately remind you that registration should be made at the place of provision of services.

Only if a company will place advertising in transport, carry out transportation, engage in distribution or distribution trade, it should contact the tax authorities at its location. According to the provisions of Art. 346.28 of the Tax Code of the Russian Federation, when switching to a new regime, the taxpayer must submit an application within 5 working days from the start of work on it. At the same time, the date of registration will be the day of the month that the applicant indicates in the UTII-1 form.

For example, the region has adopted the appropriate documents allowing the use of “imputation” for the type of services provided by Primer LLC. The organization began to apply preferential treatment from November 1, 2017. The period of 5 working days begins on November 2, and the last day falls on November 8. That is, the taxpayer must submit the application no later than November 8. If he indicates that he began working under the preferential tax system on November 1, then the tax authorities will “remember” this date for further calculation of the amount of tax to be paid.

Appendix to the UTII-1 application

Contains information about the type of activity that we transfer to UTII. You must indicate the type of activity code. The code can be found in Appendix No. 5 to the Procedure for filling out the UTII declaration.

You also need to fill in the address where the activity will be carried out.

If there are several types of activities (for example, a store and a taxi, or 2 stores in different parts of the city), then you need to indicate each of them separately. For taxis, as a rule, there is no specific address. In this case, we indicate the address of the organization's location.

On our website you can.

Instructions for filling out the UTII declaration

You can download the official instructions for filling out the UTII declaration from this link.

Title page

Field " TIN

" Individual entrepreneurs and organizations indicate the TIN in accordance with the received certificate of registration with the tax authority. For organizations, the TIN consists of 10 digits, so when filling it out, you must put dashes in the last 2 cells (for example, “5004002010—”).

Field " Checkpoint"

" The IP field of the checkpoint is not filled in. Organizations indicate the checkpoint that was received from the Federal Tax Service at the place of registration as a UTII taxpayer. The reason for registration (5-6 checkpoint mark) must have code “35”.

Field " Adjustment number"

"

It is entered: “ 0—

” (if the declaration is submitted for the first time for the tax period (quarter), “

1—

” (if this is the first correction), “

2—

” (if the second), etc.

Field “ Tax period (code)

"

The code of the tax period for which the declaration is submitted is indicated ( see Appendix 1

).

Field " Reporting year"

" This field indicates the year for which the declaration is being submitted.

Field “ Submitted to the tax authority (code)

" The code of the tax authority to which the declaration is submitted is indicated. You can find out your Federal Tax Service code using this service.

Field “ at place of registration (code)

"

The code for the place where the declaration is submitted to the tax authority is indicated ( see Appendix 3

).

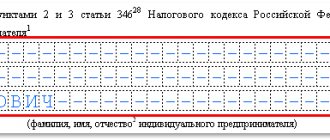

Field " Taxpayer"

" Individual entrepreneurs need to fill out their last name, first name and patronymic, line by line. Organizations write their full name in accordance with their constituent documents.

Field “ Code of the type of economic activity according to the OKVED classifier

" This field indicates the UTII activity code in accordance with the latest OKVED classifier. Individual entrepreneurs and LLCs can find their activity codes in an extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

note

, when filing a UTII declaration in 2022, this code must be indicated in accordance with the new edition of OKVED. You can transfer the code from the old to the new edition using our OKVED code compliance service.

If you carry out several types of UTII activities or the activity includes several OKVED codes, then you must indicate the code of the activity with the maximum income

.

Field “ Form of reorganization, liquidation (code)

" and the field "

INN/KPP of the reorganized organization

".

These fields are filled in only by organizations in the event of their reorganization or liquidation ( see Appendix 4

).

Field " Contact phone number"

" Specified in any format (for example, “+74950001122”).

Field " On pages

" This field indicates the number of pages that make up the declaration (for example, “004”).

Field “ with attached supporting documents or copies thereof

" Here is the number of sheets of documents that are attached to the declaration (for example, a power of attorney from a representative). If there are no such documents, then put dashes.

Block “ Power of attorney and completeness of information specified in this declaration

"

In the first field you must indicate: “ 1

” (if the authenticity of the declaration is confirmed by an individual entrepreneur or the head of an organization), “

2

” (if a representative of the taxpayer).

In the remaining fields of this block:

- If the declaration is submitted by an individual entrepreneur, then the field “last name, first name, patronymic in full” is not filled in. The entrepreneur only needs to sign and date the declaration.

- If the declaration is submitted by an organization, then it is necessary to indicate the name of the manager line by line in the field “last name, first name, patronymic in full.” After which the manager must sign, the seal of the organization and the date of signing the declaration.

- If the declaration is submitted by a representative (individual), then it is necessary to indicate the full name of the representative line by line in the field “last name, first name, patronymic in full.” After this, the representative must sign, date the declaration and indicate the name of the document confirming his authority.

- If the declaration is submitted by a representative (legal entity), then in the field “Last name, first name, patronymic in full” the full name of the authorized individual of this organization is written. After this, this individual must sign, date the declaration and indicate a document confirming his authority. The organization, in turn, fills in its name in the “organization name” field and puts a stamp.

Section 2. Calculation of the amount of single tax on imputed income for certain types of activities

If you are engaged in several types of UTII activities on the territory of one municipality (with one OKTMO), then you need to submit one declaration, but with several sheets of section 2

(filled out separately for each type of activity).

You will also have to fill out several sheets of Section 2 in cases where the activities are carried out in different municipalities (with different OKTMO), but they are geographically related to the same Federal Tax Service

.

Field "TIN"

and

the “Checkpoint” field

(how to fill it out, see the “Title Page” section).

Line "010"

.

It is necessary to indicate the business activity code ( see Appendix 1

).

Line "020"

.

It is necessary to fill in the full address of the place of business activity (if line “010” indicates the type of activity with code 05

,

06

,

10 or 16

, then organizations in line “020” need to write the legal address, and individual entrepreneurs – the address of the place of residence).

Line "030"

. You can find out the OKTMO code using this service.

Line "040"

.

The basic profitability of your activity is indicated here ( see Appendix 1

).

Line "050"

.

In 2022, the deflator coefficient K1 = 1.915

.

Line "060"

.

The correction coefficient K2

is set by municipal authorities in order to reduce the amount of UTII tax. You can find out its meaning on the official website of the Federal Tax Service (select your region at the top of the site, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section).

Lines "070", "080"

And

«090»

:

In column 2

it is necessary to indicate the values of physical indicators for the corresponding type of activity in each month of the quarter (which is a physical indicator

, see Appendix 1

). When filling out the declaration, the values of physical indicators are rounded to whole units according to the rounding rules.

If a physical indicator changed during the quarter (for example, another employee was hired), then this change is reflected in the declaration starting from the same month in which it occurred.

If you carry out one type of activity, but in different places of the same city (with one OKTMO), then you do not need to fill out another sheet of Section 2, just add up the values of physical indicators from each such place.

In column 3

the number of days of activity is indicated. This column is filled out only in cases where the declaration is submitted for a quarter in which you either just registered as a UTII payer (not from the beginning of the month), or completed your activities without waiting for the end of the quarter.

Example

.

You submit your return for the 4th quarter. Let’s say that on October 25 you registered, and on November 5 you wrote an application for deregistration. In this case, in column 3 of line 070

you need to write “

7-

”, and in line

080

indicate “

5-

” (since in October you were active for 7 days, and in November for 5 days).

In line 090

you will need to put

dashes

.

Note

: if during the quarter you did not register (were not deregistered), then dashes must be placed in all cells of column 3.

In column 4,

the tax base (the amount of imputed income) is calculated for each calendar month of the quarter.

To obtain the values of the fields of column 4, it is necessary to perform the product of lines 040

,

050

,

060

, and then multiply the resulting result by the corresponding value of each line of column 2.

Moreover, if you have values in column 3, then the resulting values for column 4 must additionally be multiplied by the corresponding value of each completed line in column 3 and the resulting result divided by the number of calendar days in the month for which the tax base is calculated.

String "100"

. The total tax base for 3 months of the quarter is indicated here (sum of lines 070-090, column 4).

Line "110"

. The tax amount for the quarter is indicated here, which is calculated using the formula:

Row 100 x 15 / 100

Section 3. Calculation of the amount of single tax on imputed income for the tax period

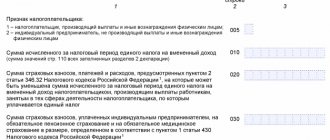

Line "005"

.

It is set to “ 1

” - if an individual entrepreneur or organization makes payments to employees engaged in those areas of activity for which UTII tax is paid, or is set to “

0

” - if an individual entrepreneur does not make payments to individuals.

Line "010"

. You must record the total tax amount for the quarter. This value is calculated as the sum of the values of lines 110 of all completed sheets of the 2nd section of the declaration.

Line "020"

. Organizations and individual entrepreneurs indicate in this line the amount of insurance premiums paid this quarter for employees employed in those areas of activity for which UTII tax is paid. Also, payments and expenses provided for in paragraph 2 of Art. 346.32 Tax Code of the Russian Federation.

Line "030"

. Individual entrepreneurs indicate in this line the amount of insurance premiums paid this quarter for themselves in a fixed amount.

Line "040"

. The total amount of UTII tax payable to the budget is indicated here.

Depending on the value of line 005, it is calculated using one of the following formulas:

If line 005 = 1

, Then:

Line 040 = Line 010 – Line 020

, and the resulting value must be ≥ 50% of line 010.

If line 005 = 0

, Then:

Line 040 = Line 010 – Line 030

, and the resulting value must be ≥ 0.

Section 1. The amount of single tax on imputed income subject to payment to the budget

Field "TIN"

and

the “Checkpoint” field

(how to fill it out, see the “Title Page” section).

Line "010"

. Here you indicate the OKTMO code of the municipality in which the activity is carried out (where you are registered as a UTII taxpayer). If the code contains 8 characters, then the three free cells on the right are filled with dashes (for example, “12345678—”). You can find out the OKTMO code using this service.

Line "020"

.

The total amount of UTII tax payable to the budget is indicated here ( Line 040 section 3

).

If you carry out UTII activities in several municipalities (with different OKTMO), but which belong to the same Federal Tax Service

, then the total amount of tax (Line 040 of the 3rd section) must be broken down separately for each OKTMO (see formula below) and the required number of Lines 010 and 020 must be filled in.

Calculation formula:

Line 040 of section 3 x (Sum of lines 110 of all sheets of section 2 for this OKTMO / Line 010 of section 3)

.

Appendix 1. Types of UTII activities (codes, physical indicators, basic profitability)

| Activity code | Kind of activity | Physical indicators | Basic income per month |

| 01 | Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| 02 | Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| 03 | Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| 04 | Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| 05 | Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| 06 | Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

| 07 | Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| 08 | Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| 09 | Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| 10 | Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| 11 | Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| 12 | Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| 13 | Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| 14 | Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| 15 | Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| 16 | Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| 17 | Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1000 |

| 18 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6000 |

| 19 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| 20 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| 21 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

| 22 | Sales of goods using vending machines | Number of vending machines | 4500 |

Appendix 2. Tax period codes

| Period code | Name of period |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

Appendix 3. Codes of the place of submission of the declaration to the Federal Tax Service

| Location code | Name of place |

| 120 | At the place of residence of the individual entrepreneur |

| 214 | At the location of the Russian organization that is not the largest taxpayer |

| 215 | At the location of the legal successor who is not the largest taxpayer |

| 245 | At the place of activity of the foreign organization through a permanent representative office |

| 310 | At the place of activity of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 331 | At the place of activity of the foreign organization through a branch of the foreign organization |

Codes "120

and “

214

” are indicated only if you carry out the following types of activities:

- delivery or peddling retail trade (10);

- advertising on vehicles (16);

- provision of motor transport services for the transportation of passengers (06) and cargo (05);

Note

: the activity code in accordance with

Appendix 1

.

Appendix 4. Codes of reorganization and liquidation forms

| Form code | Form name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

How can I submit an application for UTII-1 and UTII-2?

The application can be submitted in person, by mail, or via the Internet via telecommunications channels.

If the application is submitted in person, you need to print it out in 2 copies. You will keep one copy with the tax office’s acceptance stamp, and you will give the second copy to the inspector. This is necessary so that when you submit your UTII return, the tax authorities will not have any questions as to what date you are applying for UTII and whether you even have the right to do so.

Try working in Kontur.Accounting - a convenient online service for maintaining accounting and sending reports via the Internet.

Free for 14 days

UTII mode: what and how

This system is applied within the framework of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation and applies to certain types of activities. When applying such a system, it does not matter at all what real income the organization or entrepreneur received. The amount of imputed income is of paramount importance.

The company may apply this special regime subject to the following conditions:

- An organization that has decided to apply UTII should not have more than 100 employees

- Before choosing a taxation system, you must find out whether the regime applies in a particular region

- The share of a third party in the authorized capital cannot exceed 25%

- Activities that are carried out within the framework of a trust agreement and a simple partnership agreement do not fall within the scope of UTII.

- The company should not rent out gas stations

- In addition, educational, medical or social activities cannot be conducted. Ensuring

When working in the mode, do not forget that you can reduce the amount of tax by 50% of the amount of insurance premiums (clause 2 of Article 346.32 of the Tax Code of the Russian Federation)

The tax return is submitted every quarter, before the 20th, and its form is approved by Order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] Starting from the 3rd quarter of 2022, it is necessary to use the declaration form approved by Letter of the Federal Tax Service of Russia No. SD-4-3/ 14369 dated July 25, 2018.

The deadline for paying taxes to the budget is the 25th.