When conducting any transaction, great attention must be paid to whether closing documents are available and properly executed. And we are not talking about bills, receipts, bank statements, which are also mandatory and very important.

Closing documents are papers in which both parties confirm the completion of the transaction in terms of the partners’ fulfillment of the very subject of the agreement.

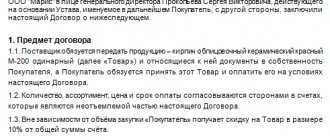

To ensure that counterparties do not have any misunderstandings or misunderstandings regarding any details of the transactions being carried out, it is recommended that all the nuances are always carefully spelled out in the contract. It would not be superfluous to specifically indicate what documents are necessary in order for the agreement to be considered fulfilled.

Why are closing documents needed?

In order for a transaction to be legally considered completed, and not just paid, there must be confirmation of this fact in writing. This is why there are various closing documents.

The accounting of each enterprise requires strict accounting of transactions and the availability of all papers related to them. If money is transferred for a product or service, then the accountant must have a document stating that the company received it. And vice versa, the counterparty company uses the same documents to close the transaction for the receipt of funds and confirms exactly why it was paid this amount.

For different types of transactions, there are various contracts, as well as papers that confirm their implementation. We will consider what closing documents are for each of them below.

Full list

Closing documents for accounting include:

- Contracts.

- Accounts.

- Receipts (both sales and cash receipts) and receipts.

- Money orders.

- Bank statements if payment was made through a bank.

- Cash order. It confirms that certain monetary transactions were carried out with money within the company.

- Advance report: required to note that their general cash was spent on any needs. It is accompanied by papers that can confirm that the money was spent on what it was allocated for (for example, checks).

- An invoice or act confirming the provision of services.

- Commodity transport report (abbreviated TTN). A document containing all the data on the transportation of goods. Route, travel start date, travel time and arrival date, quantity of goods, cost per unit, weight, full information about the driver and car.

- Time sheet. They indicate the time that each employee must work and data on how much he has already worked. And

- Payroll and payroll. One states how much money needs to be issued in the form of wages or bonuses, and the other statement states how much has been issued and the recorded fact of issuance.

- Invoice.

Mandatory invoice details

When selling goods, the supplier is required to issue an invoice in two copies: for himself and the buyer. It should contain the following details:

- title and date of the document;

- Supplier name;

- description of the transferred values;

- quantity and unit of measurement (in natural and monetary equivalents);

- signature of the responsible person, indicating his position and initials.

The law does not establish a mandatory form of invoice. Any company can develop its own form. However, the above details, according to the Federal Law on Accounting, must be included in all closing documents under the supply agreement.

If you have any doubts about the correctness of compiling the form yourself, you can successfully use form No. TORG-12, which was considered mandatory until 2013.

How to get the original contract

Add a legal entity in the Bank and select payment under the agreement according to the instructions. After saving the details, an agreement in PDF format will be sent to the email specified in the Account. It must be printed, signed, stamped and sent to the address 190005, St. Petersburg, Izmailovsky Prospekt, 18, lit. D, assistant 22Н, 26Н

. When we receive it, we will send you an agreement signed on our part. If EDF work is activated in your Account, you can send the contract as follows:

- Go to the Bank page and click Accounts and Documents

. - Select the payer and click Actions with the contract

. - In the pop-up window, select Sign the agreement via EDO Diadoc

.

Example

For a sample, you can consider the following invoice:

Invoice No. 12 dated March 19, 2015

Sender: Chip LLC.

Recipient: Astra LLC.

Basis for release of goods: contract No. 7 dated January 13, 2015.

Power of attorney No. 25 dated February 28, 2015 through procurement manager E. G. Viktorov.

| No. | Name | Unit change | Qty | price, rub. cop. | Amount, rub. cop. |

| 1 | Cartridge | PC. | 1 | 3000,00 | 3000,00 |

| TOTAL | 3000,00 | ||||

Only one name released

Amount: Three thousand rubles. 00 kop.

Shipped by director _____________________ A. A. Sergeev

Product received _______________________

M.P.

Confirmation of fulfillment of the service agreement

If the subject of the contract is services or work, then the main document closing the contract will be the act. As with the invoice, the transaction must be confirmed in the original.

However, there are some exceptions. If closing documents for services are not a mandatory condition of the contract, and the law allows their absence, then copies of acts can be placed under the accounting registers (if necessary). However, these papers can only be used for accounting convenience. Such cases occur when concluding lease agreements and offers.

A certificate of completion of work (services rendered) is a document that proves not only the completion of the transaction, but also the absence of claims from the customer. It acts as the main confirmation that allows you to account for the costs of the transaction and include them in tax returns. The act is printed in two copies, and they are kept by each of the parties to the transaction.

Invoice

A document that has a strict form and which is the basis for the deduction or reimbursement of tax (for example, for transportation) for its value. In essence, this is a special case of an invoice, i.e. additional document. It is used only by those who participate in the general taxation system and pay VAT.

Private organizations that have the type of individual entrepreneur, simplified tax system or UTII are not required to provide this document. However, there are special cases for this, which the tax service will notify.

As with all such documents, the invoice must have two copies. One must be kept by the seller, and he must transfer the other to the buyer.

Transferred no later than 5 days from shipment of the goods. When checking the tax authorities, this document is very important, so its presence is mandatory first of all.

Consignment note (form TORG-12)

Required details

The law has not introduced a unified form of work completion certificate. At each enterprise, closing documents under a service agreement are developed independently, but their execution must strictly comply with established standards.

The main details that must be present are:

- name and numbering of the document;

- what date it was compiled;

- name of the contractor and customer;

- operation description;

- unit of measurement and quantity (natural and cost indicators);

- signatures of the persons responsible for the operation, indicating their positions and initials.

Payment documents

Checks – are used if the goods were paid for in cash. Orders - have the same function as checks, but if the goods were paid for by bank transfer. In addition, the payment order proves that a transfer was made from one person to another using the details specified in it.

There is a so-called strict reporting form. Its function is that when providing services to individuals, it can replace a cash receipt, but this works until July 1, 2022, and for catering employees until July 1, 2022 (replaces a check when purchasing food in a public catering facility).

The cash receipt must be printed using cash register equipment. If there is none (but there is a device that can print), then in some cases there is a deferment for entrepreneurs working with UTII or on the basis of a patent.

A sales receipt until July 1, 2022 is equivalent to a cash receipt for retail trade and catering until July 1, 2022.

The choice of certain payment documents depends on the type of activity and tax system. The form has its own, but must have mandatory details. The strict reporting form is printed in a printing house; printing on a regular printer is prohibited.

According to the rules of the tax organization, invoices are not a mandatory document. However, in case of discrepancies, the invoices will provide direct evidence that a particular condition has been met.

In addition to this function, accounts have practical benefits, since they reflect the list and quantity of goods, their cost and details for transferring funds. If the invoice spells out all the terms in detail, it can replace the contract.

Sample

Act No. 98 dated December 12, 2014 on acceptance and delivery of work performed (services provided).

The Contractor LLC "Chip" represented by Director A. A. Sergeev on the one hand and the Customer LLC "Astra" represented by the supply manager I.V. Kulebyakin on the other hand drew up an act stating that the Customer accepted the work performed and made no claims regarding it It has.

| No. | Name | Unit change | Qty | price, rub. cop. | Amount, rub. cop. |

| 1 | Cartridge refilling | PC. | 1 | 500,00 | 500,00 |

| TOTAL | 500,00 | ||||

Total amount: Five hundred rubles 00 kopecks.

Executor:

Director of Chip LLC_______________________ A.A. Sergeev

Customer:

Purchasing Manager of Astra LLC______________________ I.V. Kulebyakin

Payment stage

If we talk about primary documentation in accounting, what it is at the payment stage, then we should mention cash receipts, receipts, BSO and bank statements. The first three apply when using cash.

A current account statement is a so-called register of payments, from which you can see when funds were sent (received), to whom (from whom) and in what quantity. The document is issued by the bank in which the organization’s account is opened (in paper or electronic form). However, an account statement not only provides information, but is also a supporting document for tax audits.

One of the most common primary accounting documents is a cash receipt , which is issued during settlements with customers. According to federal law 54-FZ, it can be printed using cash register equipment (cash register equipment) or in electronic format.

In accordance with Federal Law 54 (Article 4, paragraph 7), the check must contain certain details, including the document number, cash register registration number, date and time of purchase, name and INN of the seller, QR code, etc.

Important

One of the latest requirements is the need to indicate the taxation system on the check (from 01/01/2021).

An alternative to a cash receipt (only for settlements with the public) is the BSO - a strict reporting form, which is issued for the provision of household services. From 2022, such a document is issued through an online cash register, through which payment information is immediately transmitted to the tax office.

Some entrepreneurs are allowed not to use a cash register (for example, individual entrepreneurs who repair shoes and work on a patent). They may not issue a check, but use printed forms or even print them on a printer.

As with a cash receipt, the BSO must contain the following mandatory details:

- name (BSO);

- serial number for the shift;

- day, time of settlement;

- address;

- name and TIN of the organization;

- taxation system;

- Services list;

- unit price;

- QR code, etc.

One of the primary documents that entrepreneurs sometimes give to the buyer is a receipt . However, according to the law, upon receipt of money by the seller, either a check or (for some categories of individual entrepreneurs) a BSO with certain details must be issued. It is incorrect to use only one receipt.

Lack of closing documents

Invoices and acts must necessarily complete the transaction. Only after this is it considered complete and closed according to all the rules.

However, sometimes cases arise when closing documents are lost due to various circumstances. Or the head of the company has to deal with the negligence of his subordinates, and as a result of inspections, the absence of such papers is discovered.

One of the negative consequences of such unpleasant incidents is additional taxes. After all, the company’s accountant did not have the right to include in the declarations expenses that were not supported by documents. In this case, the income tax turns out to be underestimated, and you have to not only pay it extra, but also list all the fines and penalties. In addition, they will also be punished for the lack of documents themselves.

To avoid such consequences and not to spoil the company’s reputation and relations with tax authorities, it is necessary to carefully monitor the state of document flow and accounting at the enterprise. It is important to complete all paperwork on time and in the appropriate form.

If a manager doubts the competence or responsibility of his accountant, it is better to pay an audit firm and conduct an audit than to later pay tens or even hundreds of times more for the lack of documents.

Types of primary documents

What is included in this class of papers?

All reports on any financial activity. Based on the characteristics and characteristics of the forms of primary documents, they are divided into: By purpose:

- administrative (instructions);

- performing (statements).

By filling method:

- combined (advance report);

- strict (coupons or tickets).

By volume:

- primary (cash orders);

- summary (statements of expenses).

By type of operation:

- one-time (reports);

- accumulative (limit-fence cards).

By place of compilation:

- internal (invoices or advance reports);

- external (supplier invoices, payment requirements).

They can be standard (registration of transactions) or specialized (for highly specialized transactions).

What applies to primary documents? Their list is as follows:

- bank and cash statements;

- money orders;

- advance payment reports (with attached receipts from hotels, travel cards, receipts for stationery, etc.);

- sales receipts;

- invoices;

- accounts;

- working time records;

- statements.

All these forms are used by any company that carries out any financial activity.

Time sheet

This is interesting! What is a raider takeover?