Main deduction

When purchasing an apartment/house using mortgage funds, you can receive two tax deductions: the main deduction (clause 3, clause 1, Article 220 of the Tax Code of the Russian Federation) and a deduction for mortgage interest (clause 4, clause 1, Article 220 of the Tax Code of the Russian Federation).

The main deduction when purchasing an apartment with a mortgage is no different from the deduction for a regular purchase. We will not consider it in detail, but will only recall the main points:

- The maximum deduction amount is 2 million rubles. You can return 13% of this amount - 260 thousand rubles. Read more “Amount of deduction when purchasing a home.”

- The right to deduction arises after receipt of the Acceptance and Transfer Certificate of the apartment (when purchasing under an equity participation agreement) or the date of registration of ownership according to an extract from the Unified State Register (if purchasing under a purchase and sale agreement). You can submit documents for a deduction to the tax authority at the end of the year in which the right to it arose. Read more “Information on property deduction”, “When the right of deduction arises”.

- You can include both your own and borrowed funds in the deduction. From a legal point of view, loan funds are also considered your expenses.

The list of required documents and the process of obtaining a deduction are described in the articles: “List of documents for obtaining a deduction” and “The process of obtaining a deduction.”

Example: In 2022 Dezhnev G.S. took out a mortgage loan from the bank in the amount of 2 million rubles and bought an apartment worth 2.2 million rubles. The certificate of registration of ownership was also issued in 2022.

In 2022 Dezhnev G.S. filed a 3-personal income tax return for 2022 with the tax office and declared the main deduction in the maximum amount of 2 million rubles (for a return of 260 thousand rubles) despite the fact that Dezhnev spent only 200 thousand rubles of personal funds. He can also claim a deduction for mortgage interest.

How to get a property deduction for mortgage interest

To take advantage of the right to a property deduction and return part of the expenses for paying the mortgage, after the end of the calendar year, you must independently calculate the amount due for return and fill out a tax return 3-NDFL.

This can be done on any day during the year following the billing year. Returns are filed in 2022 to receive a tax refund on expenses incurred in 2022.

The first thing you need to do is contact your employer for a certificate of income for 2022. Based on this certificate, you can fill out a declaration. You also need to obtain a bank statement showing the interest paid.

Form 3-NDFL can be filled out on paper, on a computer, in the Declaration 2022 program, or in the taxpayer’s personal account on the Federal Tax Service website.

Step-by-step instructions using an example of how to fill out the 3-NDFL declaration in your personal account when buying an apartment.

When filling out the form yourself without using a program or personal account, you need to make sure that the form is relevant for the current year.

In 2022, the 3-NDFL form has changed - the barcodes have changed, as well as the contents of some declaration sheets.

The declaration can be completed at any time during 2022. It is submitted to the Federal Tax Service office at the place of residence of the person who paid the mortgage interest. Copies of pages of the passport, mortgage loan agreement, payment documents for repayment of mortgage interest are attached to the 3-NDFL. If the declaration is submitted through a representative, then a power of attorney is additionally required.

If interest on the mortgage was paid in 2022, but in 2022 the individual does not file a declaration and does not declare his right to a property deduction, then it does not expire. The funds can be returned next year, 2023, immediately for 2022 and 2022.

The main thing is to make sure that personal income tax was withheld from the income of an individual in the accounting year. If income tax was not remitted, then there will be nothing to return. In this case, you can claim a mortgage deduction in subsequent years.

That is, the personal income tax that was paid by the individual is subject to refund. If a person does not receive income subject to income tax at a rate of 13%, for example, he is a self-employed person, then he will not be able to take advantage of the deduction.

New form 3-NDFL from 2022

Since 2022, the form of the 3-NDFL declaration has been changed - the new form was approved by Order of the Federal Tax Service No. ED-7-11 / [email protected] dated 10/15/2021.

What has changed in the new form 3-NDFL since 2022.

It is important to check the relevance of the form when filling it out so that you do not have to fill out and submit the declaration again. Tax authorities will not accept 3-NDFL on the old form.

.

How to fill out a mortgage tax refund return - step-by-step instructions

The new form has 15 pages, but to receive a mortgage deduction, you just need to fill out the following:

- title page;

- Section 1 - refundable personal income tax amount;

- appendix to section 1 - application for tax refund;

- section 2 - calculation of indicators;

- Appendix 1 - income and withheld personal income tax;

- Appendix 7 - calculation of the mortgage deduction.

When purchasing an apartment (or other real estate) with a mortgage, the buyer has the right to two types of property deductions:

- for the cost of a real estate property - you can return 13 percent of the costs of purchasing housing within the deduction of 2 million rubles;

- for payment of mortgage interest - you can return 13 percent of the cost of mortgage interest within the deduction of 3 million rubles.

The annual amount that can be returned is limited, first of all, by the personal income tax that was paid this year.

Usually, when buying an apartment with a mortgage, a person first returns tax on the cost of the apartment, after which he begins to return tax on mortgage interest expenses. If the personal income tax paid is sufficient, then both types of property deductions can be declared in one declaration.

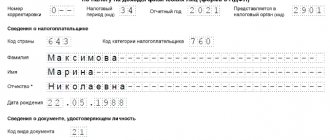

Title page

A standard sheet that provides general information about the return and the taxpayer. An example of filling out this page of the 3-NDFL declaration is given below. It is important to fill in all fields correctly:

- TIN;

- page number - 001;

- adjustment - 0;

- tax period - 34;

- year - 2021;

- Federal Tax Service code - number of the department at the place of residence;

- country code - 643 for the Russian Federation;

- taxpayer category 760;

- Full name of the taxpayer (the person who paid the interest on the mortgage);

- Date of Birth;

- ID document code - 21 (for a Russian passport);

- passport series and number;

- status - 1;

- valid telephone number;

- number of completed declaration pages - can be completed after 3-NDFL is prepared;

- number of pages of attached documents;

- confirmation of authenticity - 1 when submitting 3-NDFL in person, 2 - when submitting through a representative.

An example of filling out the title page of the declaration:

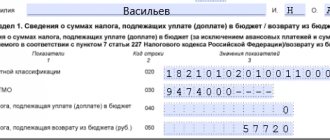

Section 1

To be completed last after calculating personal income tax for refund:

- 020 - KBK (for tax withheld by a tax agent at a rate of 13% - 18210102010011000110);

- 030 - OKTMO (find out on the Federal Tax Service website);

- 050 - returned personal income tax (from line 160 of section 2).

An example of filling out section 1 for a mortgage deduction (provided that mortgage interest in the amount of 50,000 rubles was repaid in 2022, 6,500 (13% of 50,000) are subject to return):

Appendix to section 1

From 2022, the 3-NDFL declaration includes an application for a tax refund; there is no need to prepare it separately.

It is necessary to fill in lines from 075 to 150:

- 075 - number 1;

- 080 — amount to be returned from line 050 of section 1;

- 090 - KBK from line 010 of section 1;

- OKTMO - from line 020 of section 1;

- 110 - bank name;

- 120 - bank BIC;

- 130 - 02, if the money should be returned to the current account, 07 - if to the deposit account;

- 140 — current account number;

- 150 - Full name of the individual, account holder.

An example of filling out the appendix to section 1 when returning tax on a mortgage in the amount of 6500:

Section 2

The main section where the deduction and personal income tax for return are calculated in accordance with completed appendices 1 and 5:

- income code - taken here, in this case you need to specify 10;

- 010 - annual earnings from field 070 of Appendix 1;

- 030 - annual income is re-entered;

- 040 - mortgage deduction from Appendix 5;

- 060 - base for calculating tax taking into account deductions (030 - 040);

- 070 - tax calculated from the tax base (13% * 060);

- 080 - tax actually withheld for 2022 (from line 080 of Appendix 1);

- 160 - tax refundable, which can be returned in connection with the deduction (080 - 070).

An example of filling out section 2 of form 3-NDFL, provided that for 2021 an income of 900,000 was received, from which a tax of 117,000 was withheld, while mortgage interest in the amount of 50,000 was repaid. 13% of 50,000 are subject to refund:

Annex 1

Filled out on the basis of a certificate of income, showing details of sources of income (Russian organizations and individual entrepreneurs), earnings for the year and withheld tax:

- 010 - income code 10;

- 020 — tax rate 13;

- 030-060 - details of the tax agent from the first section of the income certificate (former 2-NDFL);

- 070 - total annual income from section 5 of the certificate;

- 080 - withheld tax from section 5 of the certificate.

If there were several employers, a separate income certificate is obtained from each and lines 010 to 080 are filled in.

An example of filling out Appendix 1 of the 3-NDFL declaration, provided that 900,000 was earned in 2022, from which 117,000 personal income tax was withheld:

Appendix 7

The required deduction is calculated. Filling out depends on the time the individual returns personal income tax on the mortgage. In one declaration, you can show both property deductions - for expenses on purchasing a home and for paying interest on a mortgage.

The procedure for filling out this application:

- 010 - code of the property for the purchase of which a mortgage was taken out, you can see here (1 for a residential building, 2 for an apartment, 3 for a room, etc.);

- 020 - sign can be viewed here (sign 01 applies to homeowners);

- 030 - to be filled out only for residential buildings (1 - for construction, 2 - for purchase);

- 031 - if the cadastral number of an apartment or other purchased object is known, then it is set to 1, otherwise - 2;

- 032 - cadastral number (if known, you can look it up in the sales contract);

- 033 - address of the apartment or house (must be filled out if the cadastral number is not known);

- 040 — date of the acceptance certificate;

- 050 - date of registration of the right to housing;

- 060 - date of registration of land rights (if a land plot is purchased);

- 070 - size of share in case of equity participation;

- 080 - expenses for the purchase of real estate are shown (the cost of the apartment is within the property deduction of 2 million rubles);

- 090 - reflects the amount of mortgage interest paid for the entire period for this property (the amount within the deduction of 3 million rubles). If the home was purchased in 2022, then this field reflects the mortgage costs for 2022. If the apartment was purchased earlier, and the 3-NDFL declaration is not being filled out for the first time, then in this line you need to show the entire amount of mortgage interest expenses for all years up to 2022 inclusive;

- 100 - deduction for expenses for paying for the cost of an apartment (other object), used in previous years on the basis of previously submitted declarations or notifications (if the right to a deduction for this object has already been claimed earlier, that is, it was purchased before 2022). If the property was purchased in 2022, then the field is not filled in;

- 110 - deduction for mortgage interest for previous years, if the taxpayer has previously applied to the tax office. If the apartment was purchased in 2022, then the field is not filled in;

- 120 - deduction for purchase or construction expenses received in 2022 through the employer on the basis of a tax notice, the field is filled in if the taxpayer received such a notice;

- 121 - deduction for housing expenses provided in a simplified manner (new line in the 3-NDFL declaration), the field will be filled in if the taxpayer used the simplified procedure for obtaining a deduction in accordance with Art. 221.1 of the Tax Code of the Russian Federation (this right exists if the tax office has data on the taxpayer’s income and the bank participates in the data exchange procedure);

- 130 - deduction for mortgage interest received in 2022 according to a tax notice from the employer;

- 131 - mortgage deduction received in a simplified manner;

- 140 - tax base for property deduction (annual income from line 010 of section 2 minus already provided deductions from lines 120, 121, 130, 131 of appendix 7);

- 150 - expenses to pay for the cost of real estate, which are applied as a deduction for 2022 (costs must be supported by documents) - no more than the figure from line 140;

- 160 - expenses for paying mortgage interest, which are used as a deduction for 2022 (expenses must be documented) - the amount should not be more than the difference between the indicators of lines 140 and 150. That is, the deduction for expenses for paying for real estate is used first, after which, if the tax base allows, a deduction for mortgage expenses is used;

- 170 - the balance of the deduction for expenses for the purchase of an apartment (line 080 minus the indicators of lines 100, 120, 121, 150). If an apartment or other object was purchased in 2022, then the indicator is determined as the maximum deduction from line 080 minus the deduction provided for 2022 from lines 120, 121, 150;

- 180 - the balance of the mortgage deduction (line 090 minus the indicators of lines 110, 130, 131, 160) - is carried forward to subsequent years.

Control ratios:

- (Page 150 + Page 160) < Page 140;

- (Page 100 + Page 120 + Page 121 + Page 150 + Page 170) < the required deduction for purchase expenses (within 2 million rubles);

- (Page 110 + Page 130 + Page 131 + Page 160 + Page 180) < mortgage deduction RUB 3 million.

Let’s assume that in 2022 an apartment was purchased with a mortgage for 5 million rubles. The buyer is entitled to the following types of deductions:

- for purchase costs - 2 million rubles;

- for expenses on mortgage interest - 3 million rubles.

Deduction of 2 million rubles. buyer fully used in 2019-2021. In addition, the deduction for mortgage interest was partially used - personal income tax has already been returned from 400,000.

In 2022, this individual had an income of 900,000, on which a tax of 117,000 was withheld. The cost of repaying mortgage interest in 2022 was 50,000 rubles.

With these initial data, Appendix 7 of the 3-NDFL declaration will look like this:

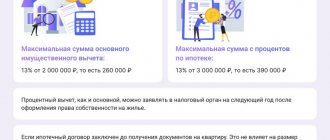

Mortgage interest deduction

When purchasing a home with a mortgage, in addition to the main deduction, you can also receive a deduction for the loan interest paid and return 13% of the actual mortgage interest paid.

Note: Your mortgage payments are divided into two parts: principal payments and loan interest payments. You can receive this deduction only for payments on credit interest (payments on the principal debt will not be included in the deduction).

Wherein:

1. The right to deduct mortgage interest arises only at the moment the right of the main deduction arises. If the mortgage was issued earlier than the year in which the extract from the Unified State Register (or the Transfer and Acceptance Certificate) was received, then the deduction can still include all the interest you paid on the first mortgage payments.

Example: In 2022 Belsky G.I. he took out a mortgage and entered into a share participation agreement for the construction of an apartment, and in 2022 he received a Certificate of Acceptance and Transfer of the apartment. Despite the fact that the mortgage has been paid since 2022, contact the tax office minus Belsky G.I. maybe only in 2021. But he will be able to receive a deduction for all interest actually paid since 2018.

2. The maximum amount of deduction for mortgage interest is 3 million rubles (to be returned 390 thousand rubles).

Note: if the loan agreement was concluded before January 1, 2014, then the old rules apply and the amount of credit interest deduction is not limited.

Example: In 2022, Ulanova N.N. took out a mortgage loan of 10 million rubles from the bank and bought an apartment worth 12 million rubles. For 2010-2020 Ulanova N.N. paid 4 million rubles in mortgage interest.

In 2022 Ulanova N.N. filed a 3-NDFL declaration for 2022 with the tax office and declared a basic property deduction in the amount of 2 million rubles. (to be returned 260 thousand rubles), as well as a deduction for credit interest in the maximum amount of 3 million rubles. (to be returned 390 thousand rubles).

Only mortgage interest actually paid for previous calendar years can be claimed as a deduction.

Example: In June 2022 Grechikhin S.D. took out a mortgage and bought an apartment. In 2022, he can submit a 3-NDFL declaration for 2022 to the tax office to receive a basic deduction and a deduction for interest paid from July to December 2020. In 2022 Grechikhin S.D. will be able to submit documents for 2022 (add interest paid in 2022 to the declaration), in 2023 – for 2022, etc.

Refund of mortgage interest

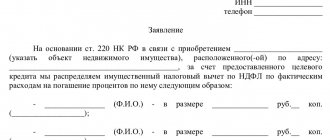

The state offers people to return part of the mortgage interest spent on purchasing an apartment or house. A property deduction can reduce the tax base that is presented for payment or the resident has the right to receive funds in cash. To get a refund, form 3-NDFL is filled out when purchasing an apartment with a mortgage, and the documentation is submitted to the tax office or the employer.

To receive funds from an employer, a citizen applies for compensation during the tax year. And if you need to receive a deduction through the Federal Tax Service, then at the end of the tax period. When returning part of the interest through the authorities, the citizen must first obtain permission from the tax authorities for compensation for the acquisition of property.

It is possible to take into account the interest spent on home loan repayments only in the year following the year in which the apartment was purchased. This will be reflected in the corresponding application of the 3-NDFL form. Repayment of mortgage interest is possible only after payment of the entire loan amount.

For what loans and borrowings can you get an interest deduction?

A deduction for credit interest can be obtained not only under mortgage agreements, but for any targeted loan aimed at the purchase/construction of housing (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation).

For example, if you took out a loan from an employer and the contract states that the loan will be used to purchase a specific apartment, then you will be able to receive a tax deduction on the loan interest paid. If there is no such entry in the agreement, then despite the fact that you spent the loan on the purchase of housing, you will not be able to receive a deduction (Letter of the Ministry of Finance dated 04/08/2016 No. 03-04-05/20053).

Example: In 2022, Shilova K.O. I took out a loan from an organization to buy an apartment. The agreement clearly states that the loan was spent on the purchase of a specific apartment, therefore Shilova K.O. will be able to receive a credit interest deduction.

Example: In 2022, Tamarina E.M. I bought an apartment for 2 million rubles with a loan for consumer purposes in the amount of 1 million rubles. Since the loan is not intended for the purchase of an apartment, Tamarina E.M. will be able to receive a property deduction in the amount of 2 million rubles (for a return of 260 thousand rubles), but will not be able to take advantage of the interest deduction.

Documents for processing mortgage interest deductions

To receive a deduction for mortgage interest, in addition to the main documents for the transaction (see “Documents”), you must submit to the tax office a copy of the loan agreement and a certificate of interest paid.

The certificate can be obtained from the bank where you took out the mortgage. Some banks issue a certificate immediately, and some - a few days after a written request (it is better to check with your bank).

Sometimes the tax authority may also request payment documents for payment of mortgage interest (payment orders, bank statements, receipts, etc.). In this case, you can either provide documents (if available) or refer to the letter of the Federal Tax Service of Russia dated November 22, 2012 N ED-4-3 / [email protected] , which states that a certificate of interest paid from the bank is sufficient and additional payment No documents are required to receive a deduction.

New form 3-NDFL in 2022

Important news: a new tax return form for personal income has been developed for 2022 - the new form can be downloaded in excel below. Before filling out 3-NDFL, it is important to make sure that the current form is taken, otherwise there is a risk that the tax service will not accept the report.

The new current form was approved by Order of the Federal Tax Service of Russia dated October 15, 2021 No. ED-7-11/ [email protected]

In the new form, the barcodes have changed, some pages have been updated. However, the changes will more affect individuals filing a declaration in connection with income from business activities.

Citizens who bought an apartment and want to take advantage of the property deduction will not notice the changes. However, it is necessary to fill out the current version of the declaration. If registration is carried out through the program or in the taxpayer’s personal account, then there is no need to think about it. If filling out is done manually or on a computer without using special programs, then you should check in the upper right corner which order approved the form.

How to fill out 3-NDFL for mortgage deduction in the Declaration 2021 program - step-by-step instructions.

Is it necessary to claim credit interest deduction immediately?

If you have not yet exhausted the main deduction, then you may not immediately claim a deduction for mortgage interest, so as not to submit additional documents to the tax authority. Once the main deduction has been exhausted, you can add information about the credit interest deduction to your return and attach the relevant documents.

Example: In 2022, Khavina M.V. I bought an apartment with a mortgage for 3 million rubles. Income of Khavina M.V. amount to 800 thousand rubles per year (the amount of tax withheld for the year is 104,000 rubles). In this case, in 2022 she will be able to claim the main deduction (since it makes no sense to claim interest).

In 2022, Khavina M.V. will continue to receive the main deduction. In 2023, since the main deduction will be exhausted, she will add to the declaration information about the interest paid from the beginning of payments (from 2020).

Is it necessary to submit documents for deduction every year?

Often a situation arises when the main deduction has already been exhausted, and the amount of interest paid on the mortgage is small. To save time, you can not submit documents to the tax authority every calendar year, but submit them once every few years, including in the declaration all interest paid for these years.

Example: In 2022 Detnev L.P. I bought an apartment with a mortgage. According to the terms of the mortgage, he annually pays mortgage interest in the amount of 100,000 rubles. Income of Detnev L.P. per year exceed 2 million rubles. In 2022, Detnev filed documents with the tax authority and received a basic deduction and a deduction for interest paid in 2022. In 2022, Detnev may not file a declaration, but wait a few years and declare all the interest at once: for example, file documents in 2023 and receive a deduction for interest paid in 2022, 2022 and 2022.

Interest deduction for refinancing (loan refinancing)

If you refinance a loan with another bank, you can receive a deduction for interest on both the original and the new loan (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation). At the same time, it is important that the new agreement clearly states that it was issued to refinance a previous targeted loan.

Example: Golovanov I.V. I bought an apartment in 2019 worth 3 million rubles (of which 1 million rubles were my own funds, and 2 million rubles were borrowed). In 2022, he refinanced the loan with another bank. Then, upon receipt of the interest deduction, Golovanov I.V. will be able to take into account the interest paid on the first and second loans.

Features of deduction registration

By submitting 3-NDFL for a mortgage and the relevant supporting documents to the Federal Tax Service, the applicant can issue the following types of deductions:

- basic, not exceeding 2 million rubles;

- no more than 3 million rubles. on the mortgage interest paid by the beneficiary.

Terms of registration:

- Employment - the applicant for the deduction must have an official job or another source of income from which personal income tax is withheld (13%).

- Availability of a title document for the purchased property. In shared construction, this is an act of acceptance and transfer.

- Targeted loan issuance. The corresponding agreement for its provision must indicate that the funds are allocated for the construction (purchase) of specific housing.

- Refunds are possible only for repaid interest. Accordingly, in 3-NDFL on a mortgage you will need to record only the amount of interest paid.

- The deduction declaration should be submitted in the next year, which follows the formation of ownership. For example, a house was bought in 2020, and the title documents for it were drawn up in 2021. Therefore, you can claim the right to deduction in 2022.

- Those who are going to apply for two types of deductions are allowed to submit one single declaration for them, even if the main amount has already been paid.

- In case of loan refinancing, interest refund is allowed under both agreements. The main thing is that the second agreement specifies the intended purpose, that is, refinancing the primary loan.

What is the deadline for filing a tax return for property deductions established in the Tax Code? The answer to this question is in ConsultantPlus. Get trial demo access to the K+ system and access the material for free.