According to the new rules, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Decrees of the Government of the Russian Federation dated April 21, 2011 No. 294 and dated December 1, 2018 No. 1459). The employer is only required to submit the relevant documents to the fund's branch. The procedure for sending documents to the FSS is described in the video.

In the pilot regions, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Decrees of the Government of the Russian Federation dated April 21, 2011 No. 294 and dated December 1, 2018 No. 1459). The employer is only required to submit the relevant documents to the fund’s branch. The procedure for sending documents to the FSS is described in the video.

A pilot project for sending sick leave to the Social Insurance Fund is taking place in the following regions

- 01 - Republic of Adygea;

- 02 - Bashkortostan;

- 03 - Republic of Buryatia;

- 04 - Altai Republic;

- 05 - Dagestan;

- 06 - Republic of Ingushetia;

- 07 - Kabardino-Balkarian Republic;

- 08 - Republic of Kalmykia;

- 09 - Karachay-Cherkess Republic;

- 10 - Republic of Karelia;

- 11 - Komi Republic;

- 12 - Republic of Mari El;

- 13 - Republic of Mordovia;

- 14 - Republic of Sakha (Yakutia);

- 15 - Republic of North Ossetia - Alania;

- 16 - Republic of Tatarstan;

- 17 - Republic of Tyva;

- 18 - Udmurt Republic;

- 19 - Republic of Khakassia;

- 20 - Chechen Republic;

- 21 - Chuvash Republic;

- 22 - Altai region;

- 23 - Krasnodar region;

- 24 - Krasnoyarsk region;

- 25 - Primorsky Krai;

- 26 - Stavropol Territory;

- 27 - Khabarovsk Territory;

- 28 - Amur region;

- 29 - Arkhangelsk region;

- 30 - Astrakhan region;

- 31 - Belgorod region;

- 32 - Bryansk region;

- 33 - Vladimir region;

- 34 - Volgograd region;

- 35 - Vologda region;

- 36 - Voronezh region;

- 37 - Ivanovo region;

- 38 - Irkutsk region;

- 39 - Kaliningrad region;

- 40 - Kaluga region;

- 41 - Kamchatka region;

- 42 - Kemerovo region;

- 43 - Kirov region;

- 44 - Kostroma region;

- 45 - Kurgan region;

- 46 - Kursk region;

- 47 - Leningrad region;

- 48 - Lipetsk region;

- 49 - Magadan region;

- 50 - Moscow region;

- 51 - Murmansk region;

- 52 - Nizhny Novgorod region;

- 53 - Novgorod region;

- 54 - Novosibirsk region;

- 55 - Omsk region;

- 56 - Orenburg region;

- 57 - Oryol region;

- 58 - Penza region;

- 59 - Perm region;

- 60 - Pskov region;

- 61 - Rostov region;

- 62 - Ryazan region;

- 63 - Samara region;

- 64 - Saratov region;

- 65 - Sakhalin region;

- 66 - Sverdlovsk region;

- 67 - Smolensk region;

- 68 - Tambov region;

- 69 - Tver region;

- 70 - Tomsk region;

- 71 - Tula region;

- 72 - Tyumen region;

- 73 - Ulyanovsk region;

- 74 - Chelyabinsk region;

- 75 - Transbaikal region;

- 76 - Yaroslavl region;

- 77 - Moscow;

- 78 - St. Petersburg;

- 79 - Jewish Autonomous Region;

- 80 - Transbaikal region;

- 81 - Perm region;

- 83 - Nenets Autonomous Okrug;

- 84 - Krasnoyarsk region;

- 85 - Irkutsk region;

- 86 - Khanty-Mansiysk Autonomous Okrug - Ugra;

- 87 - Chukotka Autonomous Okrug;

- 88 - Krasnoyarsk region;

- 89 - Yamalo-Nenets Autonomous Okrug;

- 90 - Moscow region;

- 91 - Crimea;

- 92 - Sevastopol;

- 93 - Krasnodar region;

- 95 - Chechen Republic;

- 96 - Sverdlovsk region;

- 97 - Moscow;

- 98 - St. Petersburg;

- 99 - Moscow.

Registers of sick leave (disability certificates) are transferred by policyholders or insured persons to the Social Insurance Fund for the calculation of disability benefits to insured persons.

The following types of benefits are available at Extern:

Insured events and conditions for payment of benefits are established by Federal Law No. 255-FZ dated December 29, 2006.

| Insurance case | Conditions for payment of benefits |

| Temporary disability | Paid in the following cases: - illness, injury; - caring for a sick family member; — quarantine of the insured person or child under 7 years of age; — after-care in sanatorium-resort institutions |

| Occupational diseases and injuries | Paid in case of loss of ability to work due to an accident at work or occupational disease (detailed conditions are described in Federal Law No. 125-FZ of July 24, 1998) |

| Pregnancy and childbirth | It is paid to the woman in total for the entire period of leave (in the absence of complications and the birth of one child, the period is 70 days before and after childbirth). Features of benefit payment are described in Chapter. 3, art. 10 255-ФЗ |

| Early pregnancy | Paid as a lump sum to women who registered with medical institutions in the early stages of pregnancy |

| birth of a child | One-time benefit for the birth of a child |

| Baby care | Monthly child care allowance until the child reaches the age of one and a half years |

| Burial | Social benefits for funerals are paid in accordance with Federal Law No. 8 of January 12, 1996 |

| Payment of 4 additional days off for one of the parents to care for disabled children | Four additional paid days off per month are provided to one of the working parents (guardian, trustee) to care for disabled children and people with disabilities from childhood to 18 years (Article 262 of the Labor Code of the Russian Federation) |

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Creating documents in Extern

You must click on the “Create a new document” button.

In the window that opens, select the type of benefit, mark the desired employee in the list and click “Create document”.

The list of employees in the “FSS Benefits” service is common with the service for preparing reports to the pension fund Kontur-Otchet PF.

If the required employee is not in the list, then click the “Add new employee” button.

In the window that appears, fill in your full name and SNILS and click “Add employee.” The added employee will appear in the list and will be selected by default, and will also appear in the PF Contour-Report service.

Next, you should start filling out the form in the window that opens.

Uploading a finished file into the system

Click the “Load from file” button.

In the window that opens, select a file and click “Open”. The file accepted into the system must be generated in the format established by the FSS and have an xml extension.

The uploaded documents will appear in the list. To check a document and send it to the FSS, click on the line with the required document. A form for editing and submitting will open.

Filling out the document

There are three sections that must be completed in the benefit payment document. Depending on the selected type of manual, the following sections will be displayed:

- "General information".

- "Certificate of incapacity for work" . The section is displayed in disability benefits, maternity benefits, occupational injury benefits, and illness benefits.

- "Calculation of benefits."

- "Additional documents". The section is displayed in the maternity benefit (if the “Registered in the early stages of pregnancy (up to 12 weeks)” checkbox is checked in the disability benefit), early pregnancy benefit, childbirth benefit and child care benefit.

All required fields will be highlighted in red.

What an employee needs to know about the duration of sick leave

The validity period of sick leave is determined by the laws of the Labor Code of the Russian Federation. The provisions of the code state that a document confirming incapacity for work is valid for only six months from the date of issue. That is, an employee who wishes to receive a calculation must submit the document to the accounting department as soon as possible. Financial compensation may be paid along with salary or advance payment. There are other restrictions in this area of legislation.

An employee who was fired from the company less than thirty days ago may seek disability compensation from former management. In this case, sick leave is paid in the amount of sixty percent of the employee’s average salary for the last two years. A former employee cannot demand financial compensation for caring for relatives. In this case, the company pays for the illness of only the employee; this rule does not apply to members of his family. But officially working specialists can count on support of this nature.

Section "General information"

In this section, information about the employee, the employing organization and the method of payment of benefits is filled out. The completed data is saved within the employee; when creating a new sheet, this section will be filled in automatically.

1. «Applicant” - it should be noted who is the recipient of the benefit:

- “Benefit recipient” - the benefit is received by the applicant himself.

- “Authorized representative” - the benefit is received by the applicant’s representative.

When you select the latter, a block opens in which you should enter information about the authorized representative - full name and passport details.

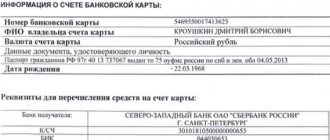

2. “Information about the benefit recipient” - you must fill in the details of the benefit recipient, such as full name, SNILS, date of birth, address, gender, registration status and identification document.

Information about employees is available simultaneously both in the “FSS Benefits” service and in the PF Contour-Report. If you change information about an employee in one service, it will change or be deleted in the other.

3. “Information about the employer (organization)” This section is filled in automatically from the payer’s details. All lines except the TIN can be changed manually. If you change the details of the employing organization here, they will also change in the details.

4. “Benefit payment method” - you must choose one of two payment methods:

- Transfer through a bank;

- To the “WORLD” card;

- Postal transfer;

- Through another organization.

5. The “General Information” section is completed, you need to move on to the next section. The “Save changes to the document?” window will appear, click the “Save” button and proceed to filling out the next section.

Section “Certificate of incapacity for work”

The section is present in the following types of benefits:

- disability benefits;

- maternity benefits;

- benefits for occupational injury, illness.

Filled out based on the certificate of incapacity for work submitted by the employee. The layout of the fields corresponds to the paper form that is issued at the medical institution.

1. “Incapacity sheet No.” - the number of the incapacity sheet should be indicated in the cell: a 12-digit code under the barcode in the upper right corner of the incapacity sheet form.

2. Indicate whether the sheet is primary or continuation; duplicate or original.

- If the disability sheet being generated is not a continuation of another sheet, check the “Primary” box.

- If a certificate of incapacity for work is issued to replace a lost one, Fr.

- If the sheet is a continuation of another sheet, the number of the primary sheet should be indicated in the “Continuation of disability sheet No.” field. There is no need to check the “Primary” box.

3. Fill out all the required fields below (they will be highlighted in red), just like on a paper form issued by a medical facility.

Some filling features:

- Depending on which reason for disability code is selected, the required fields will be highlighted in red frames below.

- The code book does not contain the values 04 (work accident or its consequences) and 07 (occupational disease or its exacerbation). A document containing these reasons for disability cannot be sent electronically. These data should be submitted to the Social Insurance Fund on paper.

- If you have chosen a part-time job, then in the “No.” field you should indicate the number of the certificate of incapacity for work presented at the main place of work.

- If another sheet was issued, which is a continuation of the one being filled out, then its number should be indicated at the very bottom of the section.

4. The “Sheet of Incapacity for Work” section is completed, click the “Save” button and move on to the next one.

Where to go if sick leave is not paid

The FSS explains on the official website how to find out when the money for sick leave will arrive - contact the territorial department in person or call the hotline. Regional Social Insurance hotlines have been opened for each constituent entity of the Russian Federation.

In Moscow:

Here's where to call about sick leave in St. Petersburg:

Find out by calling the territorial departments how long sick leave must be paid for, giving the number of the certificate of incapacity for work. If the sick leave is filled out correctly and the policyholder has submitted all the required documents, the benefit will be transferred within 10 days.

Section "Calculation of benefits"

In this section, fill in the data necessary to assign benefits to an employee by the regional branch of the Social Insurance Fund. All required fields will be highlighted in red.

1. “Information attribute” - you should select the “Primary information” item if the benefit is sent to the Social Insurance Fund for the first time. The “Recalculation” item is selected if the benefit has been sent and adjustments need to be made.

2. “Date of submission of documents to the policyholder” - the date when the benefit recipient submitted the application and additional documents to the employer should be indicated.

3. Indicate the regional coefficient, rate, insurance period, year and amount of earnings.

If you need to specify information about replacing billing years, you should check the “Fill in information about replacing years” checkbox. Additional fields will appear to indicate the years to be replaced.

4. “Benefit payment period” - you should select whether the benefit is paid entirely at the expense of the employer or whether there is a period for which the benefit is paid at the expense of the Social Insurance Fund. In the second case, in the field “Benefit at the expense of the Social Insurance Fund for the period”, be sure to indicate the beginning and end of the period for which the benefit is accrued at the expense of the Social Insurance Fund.

5. The “Benefit Calculation” section is completed; click the “Check and Submit” button.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Section "Additional Documents"

The section is present in the following types of benefits:

- maternity benefit (if the disability benefit checkbox “Registered in the early stages of pregnancy (up to 12 weeks)”);

- early pregnancy benefits;

- childbirth benefit;

- child care allowance.

Some filling features:

- It is mandatory to fill in the data from the child’s birth document - type of document, series and number, date of issue, full name, date of birth.

- If necessary, you can fill in information about a certificate from the other parent about non-receipt of benefits, information about an adoption or guardianship document, and information about an agreement on transfer to a foster family.

After filling out the section, click the “Save” button.

When can the Social Insurance Fund pay benefits directly?

The provisions of regulations 677n and 678n coincide in terms of the circumstances, upon the occurrence of which you can apply for them to the Fund, namely:

- the employer has ceased to operate;

- bankruptcy proceedings have been initiated against him;

- there are not enough funds in the company’s (IP) accounts;

- the court determined that the employer must pay benefits, but it is impossible to determine the location of him or his property, which can be recovered.

Checking and sending

1. To send, you must first open the document, then click the “Check and Send” button.

If you need to send several documents at the same time, you should open the “Details and Settings” menu and click the “Enable bulk sending mode” button.

After this, you will be able to send several documents.

2. The scan will begin.

- If the verification is successful, you should select a certificate to sign the document and click “Send document to the FSS.”

The list will display only qualified certificates whose TIN matches the organization’s TIN from the document.

The registration number of the policyholder in the certificate must match the registration number of the organization indicated in the document.

If the document is sent for a separate unit (in this case, the subordination code ends with 2), then the registration number of the policyholder in the certificate must match the additional FSS code specified in the document.

After sending, the document will appear first in the list with the status “Queue for sending”.

- If errors are found during the check, you should click the “Close and proceed to correct errors” button. Fields with errors will be highlighted in red; you should correct them and resend.

Why are payments delayed?

The policyholder is obliged to submit the completed certificate of incapacity for work and accompanying documents to the Social Insurance Fund. Only after this the employee will be paid benefits. The deadline for payment of sick leave from the Social Insurance Fund to an employee from the moment it is submitted is 10 days, the deadline for transferring the sick leave from the policyholder to Social Insurance is 5 days.

If the employer violates the deadline for transferring his part of the benefit (the first 3 days), he will pay a fine and penalty for each overdue day (Article 236 of the Labor Code of the Russian Federation, Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the deadlines for transferring funds from the Social Insurance Fund are violated, the employee needs to figure out why such a delay occurred and when the money will arrive.

The provisions of 255-FZ establish how many days after the Social Insurance Fund pays sick leave to a bank card in 2022: Social insurance makes payments to the insured person within 10 days (Part 2 of Article 15 255-FZ). The employee checks the status of payment of the sheet in the special Social Insurance information system - the personal account of the insured person. If the sick leave is paid, it is assigned status 080. If the money does not arrive on time, the employee contacts Social Security for clarification.

The main reasons for late payment of sick leave:

- The doctor or policyholder made a mistake when filling out the document.

- The employee provided incorrect (invalid) bank card or account details for transferring funds.

- The employer sent the employee’s certificate late or did not send it in a timely manner.

- The accountant did not include accompanying documents in the payment application and did not create a register.

- There were technical failures in the Social Insurance system.

IMPORTANT!

If the delay occurred due to the fault of the Social Insurance Fund, the employee has the right to request compensation.

ConsultantPlus experts looked at how an employee can receive benefits in the event of an accident at work. Use these instructions for free.

to read.

Processing statuses

- “Created” - the document was created, but not sent to the FSS. The date and time the document was last modified is indicated.

- “Queued for sending” - the document is queued for sending to the Social Insurance Fund.

- “Submit Error”—errors occurred during the document sending process. You need to send the document to the FSS again. To do this, click on the line with the document and click “Send again”.

- “Not accepted by the FSS” - as a result of checking the document in the FSS, errors were identified. You should correct the errors indicated in the FSS protocol and resend the document.

- “Accepted by the FSS” - the document is sent for consideration to the regional office of the FSS. The receipt can be viewed and printed.

If errors are found during the check at the regional office of the FSS, the notification should be received by Russian Post. In this case, you should make the required changes to the document and send it to the FSS.

Reimbursement of funds for labor protection

In addition to amounts paid for social benefits, you can receive reimbursement from the Social Insurance Fund for labor protection costs.

Funds for preventive measures to reduce injuries and occupational diseases are allocated by the Fund based on the difference between the accrued contributions for “injuries” for the previous calendar year and the amounts used to pay sick leave for accidents and occupational diseases for the same period, but not more than 20% of the total amount contributions for the previous year (in some cases - up to 30%).

Insurance premiums can be used to reimburse expenses for special assessment of working conditions (special assessment of working conditions), training in labor protection, purchasing personal protective equipment for working in hazardous conditions, sanatorium and resort treatment for workers employed in hazardous industries, etc. (the full list is given in paragraph 3 of Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n).

The policyholder must fill out an application in the form approved.

By Order of the Social Insurance Fund dated May 7, 2019 No. 237, and draw up a Financial Support Plan (from the appendix to Order No. 580n). To receive security for 2022, documents must be sent to the Social Insurance Fund before August 1, 2022. More complete information on the topic can be found in ConsultantPlus. Free trial access to the system for 2 days.

View scan results

If the document is accepted for consideration

If the document was submitted for consideration to the regional office of the FSS, the status “Accepted by the FSS” will be displayed. This is the final status.

To view a receipt, you need to click on the line with the document and follow the “View receipt” link.

A window with a receipt will appear on the screen.

The document for which the receipt was received can be edited and sent again to the FSS. To do this, click on the line with the document and click the “Correct errors and resend” or “Create recalculation” button. These functions will also be available if you hover your mouse over the line with the document and click on .

- “Correct errors and send again” - this item should be used if the document passed checks at the FSS gateway and was submitted for consideration to the regional office of the FSS, but during its review, shortcomings were discovered and the FSS sent a notice of errors to the employer (for example, by Russian Post "). You should correct the errors indicated in the notice and resend the document.

- “Create recalculation” - this item should be used if the document passed checks at the FSS gateway and was submitted for review to the regional FSS office, but after receiving the receipt the employer realized that an error was made in the calculation data. When creating a recalculation in the “Benefit Calculation” section, you will need to indicate the reason for the recalculation, correct the necessary data and resend the document.

If the document is not accepted

If the document was not accepted by the FSS, the status “Not accepted by the FSS” will be displayed. To view the log, you need to click on the line with the document and follow the “View error log” link.

A window with the protocol will appear on the screen.

The document for which the protocol was received must be corrected and sent again to the FSS. To do this, click on the line with the document and click the “Correct errors and resend” button. This function will also be available if you hover your mouse over the line with the document and click on .

After selecting “Correct errors and resend”, the document status will change to “Created”. If necessary, you can always view the protocol by clicking on and selecting “ View document flow”.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

If the sick leave deadline has expired

What to do if the ballot was not submitted on time and the deadline for paying sick leave by the employer has passed?

If an employee brings sick leave after the above deadlines, the employer has the right not to accept it. After all deadlines have passed, only the FSS branch can decide whether to pay for such a document or not. There is an indication of this in Part 3 of Art. 12 .

Therefore, the employer can advise the employee to contact the Social Insurance Fund department that supervises the employer himself with a request to take his situation into consideration. The request is made in the form of a written application. It should indicate the reason for failure to submit the certificate of incapacity for work on time. You must also attach a certificate issued by your doctor. If the FSS considers the reason valid, compensation will be paid to the employee.

Please rate your impressions of the article