First, let's remember the concepts that are familiar to us all, and many use in their activities. These are “outsourcing” and “outstaffing”.

Outsourcing is the transfer by an organization of certain business processes, functions or tasks (usually non-core) to another company specialized in this area. The transferred functions are carried out by the performing company on the basis of a contract and by its employees, that is, it provides a service to the customer. The process of providing it is not important for the customer - what is important is the result. The workers are under the control of the performing company; there is no relationship between them and the customer company. In particular, non-core functions such as accounting, IT, and cleaning are most often outsourced.

The situation is different with outstaffing. Its essence is as follows. The contractor (organization or entrepreneur) transfers a certain number of employees to the customer (another organization or entrepreneur). Employees work for the customer, but the employer is the contractor who concludes employment contracts, maintains personnel records, pays wages and benefits, etc. That is, employees work in an organization outside of labor or civil law relations. As a rule, the subject of an outstaffing agreement is the rental of personnel. In essence, agency labor is the form of labor that is used under an outstaffing agreement.

Outsourcing-related relationships do not fall under the new rules governing the provision of personnel.

As for outstaffing contracts, it is better to terminate ongoing contracts that carry over into 2016, because agency labor (“staff leasing”) is prohibited from January 1, 2016.

New type of services

New Chapter 53.1 of the Labor Code defines agency work as work performed by an employee at the order of the employer in the interests, under the management and control of an individual or legal entity that is not the employer of the employee. Agency labor is now prohibited.

But a new type of activity was introduced - “activities for providing labor to workers (personnel)” (Article 18.1 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”).

note

Services for the provision of personnel labor are subject to VAT (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation and paragraph 6, clause 4, clause 1, article 148 of the Tax Code of the Russian Federation, as amended by Law No. 116-FZ of May 5, 2014). The costs of these services can be taken into account when calculating income tax as part of other expenses associated with production and sales (clause 19, clause 1, article 264 of the Tax Code of the Russian Federation as amended by Law No. 116-FZ).

Organizations applying special tax regimes will not be able to be private employment agencies (Clause 6, Article 18.1 of Law No. 1032-1). In this regard, since 2016, paragraph 3 of Article 346.12 of the Tax Code expressly states that private employment agencies engaged in providing labor for workers (personnel) do not have the right to use the “simplified tax system”.

Certain organizations, in cases, on conditions and in the manner established by labor legislation, may send their employees temporarily and with their consent to an individual or legal entity that is not an employer for these employees, to perform labor functions specified in employment contracts in the interests, under the management and control of the receiving party (Article 341.1 of the Labor Code of the Russian Federation).

That is, there is a possibility of attracting “foreign” workers, but with significant restrictions. Among them, the main ones are the temporary nature of the provision of personnel and the presence of the employee’s consent.

Personnel outsourcing: how to register under Russian law

The term “outsourcing” is derived from the English “outsourcing” and literally means attracting third-party resources. In economics, outsourcing is used in various fields. There is business process outsourcing, sales outsourcing, accounting and tax accounting outsourcing, etc. In all of these cases, the company transfers some of its functions to external performers. That is, some problems are solved using externally attracted resources.

When outsourcing personnel as third-party resources, the organization receives additional personnel for a period of time. Let's talk about this in more detail.

What is personnel outsourcing

If an organization does not have enough personnel to solve current problems and is not ready to expand its staff, then the company can use personnel outsourcing. Support functions are usually outsourced: accounting, IT support, cleaning, etc. When outsourcing, tasks in these areas must be handled by outsourced specialists - employees of another organization. We will explain how this happens below.

Providing staff: how it works

Let’s say there is a company “X” that needs to develop and implement an IT project. Upon completion, the employees required to perform this work will no longer be needed. And it is difficult to quickly find qualified specialists who agree to a fixed-term employment contract. Therefore, “X” (the customer) turns to the company “Igrek” (the contractor), which has the necessary personnel. They enter into a civil contract - GPA, and employees of the Igrek company provide services or perform work for the X company. As a rule, they do this at their usual workplaces in the Igrek company, and not at the customer’s premises (of course, if the nature of the services/work allows this). After all, it is absolutely not necessary for an IT specialist, for example, to be personally present in the organization for which he must develop a database.

At the same time, the employment contracts of the hired workers, as before, are valid with the Igrek company. She sets tasks for them (transfers them from company X), and monitors the progress of work. As you can see, outsourcing is not much different from providing services and performing work.

What is outstaffing

Many employers use the terms outsourcing and outstaffing interchangeably. However, this is not true. At their core, these concepts are not equivalent.

Outstaffing is also called agency labor. When outstaffing on the basis of the GPA between the customer company and the performing company, some of the customer’s functions are also performed by the contractor’s employees, but they do this at the customer company’s workplaces and under its leadership. That is, under the control of a person who is not the employer for these workers.

With outstaffing, workers are “transferred” from one company to another. It makes sense to resort to outstaffing when you need a certain number of specific specialists with whom you want to work directly, but for some reason are not ready to enter into employment contracts. If you need certain services to be provided to you (non-core for your company) and no matter by what means, then it is easier to use outsourcing.

Currently, leasing of personnel is prohibited in the Russian Federation. Accordingly, outstaffing too. But there is an exception. It is provided for private employment agencies (read about this below).

Outsourcing and outstaffing: how they differ and how they are similar

So, outsourcing and outstaffing are not identical concepts.

| Outsourcing | Outstaffing | |

| What is the purpose of concluding a GPA | provision of services to the customer or performance of work for him | providing the customer with workers who will work in his interests, under his control |

| Where is the staff place of work? | usually on the territory of the contractor, less often - on the territory of the customer | at the customer's premises |

| Who manages the staff | executor | customer |

| Who can be a contractor under a contract? | in general, any organization | private employment agency |

More details about the differences between outsourcing and outstaffing are written in the Ready-made solution “How outsourcing, outstaffing and agency labor relate.” You can view the material with free access.

What unites outsourcing and outstaffing is that in both cases the company benefits from other people’s employees. After all, their employment contracts are concluded with the performing company. It is she who pays their salaries, withholds personal income tax and calculates insurance premiums (Letter of the Ministry of Finance dated November 6, 2008 N 03-03-06/8/618).

Pros and cons of outsourcing

Outsourcing has several advantages.

- Convenience and, in some cases, efficiency in solving problems. By attracting workers as part of outsourcing, the organization does not have to search for the necessary specialists. Including if additional workers are needed part-time or to implement a specific project.

- Increase in the number of workers at the same personnel costs. Of course, this does not mean that the customer organization does not incur expenses at all. But at least she doesn't have to pay insurance premiums on benefits for outsourced workers.

- Absence of duties established by the Labor Code of the Russian Federation towards other people's employees. Since the customer organization does not have employment contracts with externally recruited personnel, it should not fulfill obligations to them as an employer (pay sick leave, provide vacations, etc.).

Disadvantages of outsourcing.

- Risk of poor-quality provision of services / performance of work. Here the situation is the same as with any new counterparty. Outsourced specialists are completely unknown to you. You may be shown their qualifications, or you may find reviews of their work. However, this still cannot guarantee 100% that they will perform their functions perfectly.

- Inability to work directly with outsourced workers. You are not their employer. Accordingly, you assign a task to the executing company, and it, through its representative, conveys this information to employees. It may turn out to be a game of broken phone. You will be able to control the progress of work if you provide for this in the GAP. But you will not have the right to give orders to such external workers. How can you not require them to comply with local regulations in force in your company if such employees work on the territory of your enterprise (for example, internal labor regulations).

- Risk of leakage of internal company information. Attracting human resources from outside always creates a threat of copying and leakage of important information and documents. We are talking not only about the risk of industrial espionage and copying of technical documentation, but also, of course, about unauthorized access to personal data of employees and clients. On the black market, personal data databases are a hot commodity.

Legal regulation of outsourcing: legislative framework

There is neither the concept of outsourcing nor the concept of outstaffing in Russian legislation. As mentioned above, with outsourcing, in essence, employees of another company provide services to the customer organization or perform work for it. Therefore, an outsourcing agreement, in general, is concluded according to the same rules as service or contract agreements. That is, it is regulated by civil law.

Providing personnel for outsourcing: how to draw up an agreement

As with any GPA, the outsourcing agreement must define:

- subject of the contract. It is necessary to specify exactly what services must be provided, or what work must be performed and what the result of this work should be (clause 1 of Article 702, clause 2 of Article 779 of the Civil Code of the Russian Federation). You can also highlight the stages of providing services / performing work;

- price of services, works;

- procedure for providing services (performing work). Here you can indicate on whose territory the additional employees involved will work, who will act as a representative of the performing company (contractor company), etc.;

- responsibility of the parties. Due to poor performance of an outsourced employee’s duties, the customer organization may incur additional costs. For example, if due to an error in outsourced tax accounting, the company will be fined. It is better to provide for such cases in the contract and indicate that the amounts of fines received due to the fault of the employee of the performing company will be reimbursed by the same company.

Also, when performing work, it is important to specify the deadlines for their completion. The start and completion dates of work are an essential condition of the contract (Clause 1, Article 708 of the Civil Code of the Russian Federation).

Sample outsourcing agreement (to download, get free access to Consultant Plus)

Personnel for rent: ban on agency work and outstaffing agreement

According to the current civil legislation, only things can be transferred for rent (Article 606 of the Civil Code of the Russian Federation). In addition, agency labor is expressly prohibited by the Labor Code of the Russian Federation (Article 56.1 of the Labor Code of the Russian Federation). Employers who decide to ignore this ban will face administrative liability. For legal entities, the fine may be 50 thousand rubles, for a repeated violation - 70 thousand rubles. (Parts 1, 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Then the question arises: isn’t outsourcing combined with outstaffing prohibited? No, because with outsourcing, the performing company provides services to the customer (performs work) using its own employees, and does not transfer them to the customer. Therefore, outsourcing does not fall under the concept of agency labor. Accordingly, outsourcing in the Russian Federation, unlike outstaffing, is not prohibited. And an outsourcing agreement can be concluded quite legally. By the way, it will be easier for everyone if the term “outsourcing” does not appear in the title or text of the contract.

Outstaffing: who can provide personnel services and to whom

Although outstaffing is prohibited in the Russian Federation, an exception is provided for some organizations. Today, only private employment agencies (PEAs), which we mentioned above, can provide personnel services. These are specialized organizations that have been accredited for the right to carry out this type of activity and do not apply special tax regimes (clause 1, clause 3, clause 8, article 18.1 of the Law of the Russian Federation of April 19, 1991 N 1032-1, hereinafter referred to as the Law of the Russian Federation N 1032- 1).

Legal entities that have:

- the authorized capital is at least 1 million rubles;

- there are no debts on taxes, contributions and fees to the budget system of the Russian Federation;

- the manager has a higher education and work experience in the field of employment or promoting employment in the Russian Federation for at least 2 years over the last 3 years;

- the manager has no criminal record for crimes against the person or in the economic sphere (clause 6 of article 18.1 of RF Law No. 1032-1).

Accreditation is carried out by the territorial body of Rostrud at the location of the PrEA and enters information into the register. As of the beginning of 2022, the register includes more than 700 active organizations.

A private employment agency has the right to provide personnel to organizations and individual entrepreneurs if workers are needed (Article 341.2 of the Labor Code of the Russian Federation):

- in connection with the temporary expansion of production for a period of 9 months;

- to replace absent employees whose jobs are retained during their absence in accordance with labor legislation (for example, to replace an employee who has taken maternity leave or an employee on long-term sick leave).

However, in some cases the provision of personnel services is not permitted. For example (clauses 12, 13 of article 18.1 of the Law of the Russian Federation N 1032-1):

- to replace workers taking part in a strike at the customer enterprise;

- upon introduction of bankruptcy proceedings against the customer;

- to perform work in workplaces with hazardous working conditions of 3 or 4 degrees or hazardous working conditions.

You can read about the outstaffing agreement by signing up for free access in the Ready-made solution “How to draw up an agreement for the provision of personnel.”

Sample outstaffing agreement (to download, get free access to Consultant Plus)

Formally, other legal entities could also provide personnel services, although only to certain organizations. For example, affiliated persons (clause 2, clause 3, article 18.1 of the Law of the Russian Federation N 1032-1). This is provided for by the Law “On Employment in the Russian Federation”. But the conditions for the provision of personnel for companies that are not PrEA must be defined in federal law. But there is no such law at the moment. Therefore, other legal entities (except PrEA) currently do not have the right to conduct activities to provide personnel services.

Source: glavkniga.ru

01/31/2022, 10:01 Subscribe to the magazine

Who has the right to provide workers

Activities for the provision of personnel have the right to carry out a very limited number of performers.

This:

- private employment agencies;

- legal entities for their affiliates or for an organization that is a party to a shareholder agreement.

In order for private employment agencies to provide personnel services, they must obtain accreditation. Accreditation is carried out by Rostrud. To obtain accreditation, a private employment agency must meet the following criteria:

- authorized capital of at least 1 million rubles;

- there are no debts to pay taxes, fees and other obligatory payments;

- the head of the agency has a higher education; his work experience in the field of employment or promotion of employment for at least two years over the past three years;

- the head of the agency has no criminal record for committing crimes against the person or in the economic sphere.

The rules for accreditation of private employment agencies were approved by Decree of the Government of the Russian Federation of October 29, 2015 No. 1165.

Other legal entities, including foreign ones, will be able to carry out activities to provide labor for workers only if, with their consent, the workers are temporarily sent:

- to an affiliated organization;

- to a joint-stock company, if the sending party is a party to a shareholder agreement on the exercise of rights certified by shares of such a joint-stock company;

- to an organization that is a party to a shareholder agreement with the sending party (clause 3 of Article 18.1 of Law No. 1032-1).

The procedure for formalizing labor relations between a private agency and an employee, the rights and obligations of the employee, the sending party and the receiving party, as well as the procedure for investigating accidents that occurred with such employees are regulated by the Labor Code. The specifics of formalizing labor relations with employees of organizations that are not private employment agencies must be reflected in the federal law (Article 341.3 of the Labor Code of the Russian Federation). Currently, there is no such law yet.

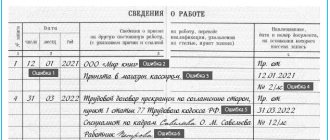

Registration of labor relations with employees

A private employment agency is obliged to conclude an employment contract with an employee who will be temporarily sent to work in another organization or to an individual and make an entry in his work book (Part 9 of Article 341.2 of the Labor Code of the Russian Federation). The receiving party does not enter any information into the workers’ work book.

Employment contract

The employee’s employment contract must stipulate that he will work in the interests, under the management and control of an individual or organization that is not his employer. At the same time, this condition can be included in the employment contract only in strictly specified cases, namely (Article 341.2 of the Labor Code of the Russian Federation):

- if an employee is temporarily sent to an individual who is not an individual entrepreneur for the purpose of personal service or assistance with housekeeping;

- if an employee is sent to an organization or individual entrepreneur to temporarily perform the duties of absent employees, who retain their place of work;

- if an employee is sent to an organization or individual entrepreneur to carry out work related to a deliberately temporary (up to nine months) expansion of production or the volume of services provided. If through an employment agency it is intended to attract more than 10 percent of the average number of workers to such work, then when making this decision it is necessary to take into account the opinion of the trade union (clause 10 of article 18.1 of Law No. 1032-1).

Who can be referred

Categories of workers who can be sent to work for the receiving party have been determined. These include:

- persons studying full-time;

- single and large parents raising minor children;

- persons released from institutions executing a sentence of imprisonment.

And cases when a private agency can recruit personnel to perform temporary work for a customer are contained in Article 59 of the Labor Code on a fixed-term employment contract. All these conditions are determined by the nature of the proposed work.

In particular, a fixed-term employment contract is concluded for the period of:

- performing the duties of an absent employee;

- performing seasonal work;

- performing temporary (up to two months) work;

- carrying out work beyond the normal activities of the employer.

In addition, Article 59 of the Labor Code highlights cases when a fixed-term contract can be concluded by agreement of the parties. Moreover, without taking into account the nature of the proposed work. For example, if you hire an old-age pensioner, a full-time student, a part-time student, a manager, or a chief accountant.

As for drawing up a fixed-term employment contract with a foreign worker temporarily staying in Russia, this case is not included in the mandatory cases in the Labor Code. Fixed-term contracts with foreign workers and stateless persons are concluded on a general basis (Article 327.1 of the Labor Code of the Russian Federation). This does not depend on the period for which the patent was issued, that is, if the conditions established by Article 59 of the Labor Code are met, the contract will be fixed-term; if not, it will be for an indefinite period (letter of Rostrud dated October 23, 2013 No. PG/9509-6- 1). However, due to the expiration or deprivation of the foreign worker's right to work, the contract must be terminated due to circumstances beyond the control of the parties, in accordance with Article 77 of the Labor Code.

Additional agreement

The working conditions of the host party are specified in an additional agreement to the employment contract, which is concluded by the employee and the private employment agency. The data that must be included in the additional agreement is listed in Article 341.2 of the Labor Code.

This is information about the receiving party, including the name of the receiving party (last name, first name, patronymic of the receiving party - an individual), information about identification documents of the receiving party - an individual, the taxpayer identification number of the receiving party (with the exception of the receiving party - an individual, not being an individual entrepreneur), as well as information about the place and date of conclusion, number and validity period of the contract for the provision of labor for employees (personnel).

If, during the period of validity of the employment contract, a private employment agency sends an employee to work for another receiving party under another contract for the provision of labor for workers (personnel), the private employment agency and the employee enter into a new additional agreement to the employment contract indicating information about the new receiving party.

In cases where this is provided for in the contract for the provision of labor to employees (personnel), additional agreements to the employment contract specified in parts 5 and 6 of Article 341.2 of the Labor Code of the Russian Federation may provide for the following conditions:

- on the right of the receiving party to demand from the assigned employee the performance of his job duties, careful treatment of the property of the receiving party (including the property of third parties located in the receiving party, if the receiving party is responsible for the safety of this property) and the property of the receiving party’s employees, compliance with the internal labor regulations of the receiving party;

- on the obligation of the receiving party to provide the assigned employee with equipment, tools, technical documentation and other means necessary for the performance of his job duties;

- on the obligation of the receiving party to provide for the everyday needs of the assigned employee related to the performance of his job duties;

- on the obligation of the receiving party to remove from work or not allow the assigned employee to work in the cases specified in part one of Article 76 of the Labor Code. The receiving party is obliged to notify the employer immediately of cases where a posted employee is suspended from work or is not allowed to work.

A private employment agency is obliged to monitor whether the sent workers actually perform the labor functions specified in the employment contracts, and also whether the receiving party complies with the norms of labor legislation (Article 341.2 of the Labor Code of the Russian Federation).

Providing personnel

POLICY FOR PROTECTION OF PERSONAL INFORMATION OF SITE USERS

This Personal Data Privacy Policy (hereinafter referred to as the Privacy Policy) applies to all information that Profreserv LLC can receive about a client or partner while using the website - www.profreserv.ru

1. BASIC CONCEPTS

The following terms and concepts are used in this Privacy Policy:

“ADMINISTRATION www.profreserv.ru (hereinafter referred to as the Site Administration)” - authorized employees of the technology platform management, acting on behalf of www.profreserv.ru, who organize and (or) process personal data, and also determine the purposes of processing personal data, composition of personal data to be processed, actions (operations) performed with personal data. “PERSONAL DATA” - any information relating to a specific individual/legal entity or determined on the basis of such information, necessary for the Company in connection with the fulfillment of its contractual obligations to the User/Client. In addition, personal data includes data that is automatically transferred to the Services during their use using software installed on the User’s device, including IP address, information from cookies, information about the user’s browser (or other program through which access is provided). to Services), access time, address of the requested page. “PROCESSING OF PERSONAL DATA” - collection, systematization, accumulation, storage, clarification (updating, changing), use, distribution (including transfer), depersonalization, blocking, destruction of personal data of Clients. “CONFIDENTIALITY OF PERSONAL DATA” is a mandatory requirement for Company employees who have access to personal data to not allow the dissemination of personal data without the Client’s consent or other legal basis.

2. GENERAL PROVISIONS

2.1. Use of the website www.profreserv.ru by the User/Client means acceptance of this Privacy Policy and the terms of processing of the User/Client’s personal data.

2.2. In case of disagreement with the terms of the Privacy Policy, the User/Client must stop using the website www.profreserv.ru.

2.3. The administration of the site www.profreserv.ru verifies the accuracy of the personal data provided by the Site User.

2.4. The User/Client, when using the Website www.profreserv.ru, confirms that:

— has all the necessary rights allowing him to register (create an account) and use the services of the site www.profreserv.ru;

— indicates reliable information about yourself to the extent necessary to use the services of the Site www.profreserv.ru, mandatory fields for further provision of site services are marked in a special way, all other information is provided by the User/Client at his own discretion.

- understands that information on the Site posted by the User/Client about himself may become available to third parties not specified in this Policy and may be copied and distributed by them;

— is familiar with this Policy, expresses his agreement with it and assumes the rights and obligations specified in it. Familiarization with the terms of this Policy and checking the box under the link to this Policy is the written consent of the User/Client to the collection, storage, processing and transfer to third parties of personal data provided by the User/Client.

3. SCOPE OF THE PRIVACY POLICY

3.1. This Privacy Policy establishes the obligations of the Site Administration for non-disclosure and ensuring a regime for protecting the confidentiality of personal data that

The user provides upon request to the Site Administration when filling out the feedback form on the site www.profreserv.ru

3.2. Personal data permitted for processing under this Privacy Policy is provided by the User/Client by filling out the registration form on the Site

www.profreserv.ru. The administration collects statistics about the IP addresses of its users. This information is used to identify and solve technical problems, to monitor the legality of ongoing advertising campaigns and financial payments.

4. PURPOSES OF COLLECTING USER’S PERSONAL INFORMATION

4.1. The Administration of the website www.profreserv.ru may use the personal data of the User/Client for the purposes of:

Creating an account and further authentication and providing the User/Client with access to their personal account.

Establishing feedback with the User/Client, including sending notifications, requests, mailings, SMS mailings regarding the use of the Site and offers of Profrezerv LLC.

Determining the location of the User/Client to ensure security and prevent fraud.

Confirmation of the accuracy and completeness of personal data provided by the User/Client.

Providing the User/Client with effective customer and technical support when problems arise with the use of the Site.

Providing the User/Client, with his consent, with site/system updates, special offers, newsletters and other information on behalf of the Site.

5. METHODS AND TIMELINES FOR PROCESSING PERSONAL

.1. The processing of the User/Client’s personal data is carried out without a time limit, in any legal way, including in personal data information systems using automation tools or without the use of such tools.

5.2. In case of loss or disclosure of personal data, the Site Administration informs the User/Client about the loss or disclosure of personal data.

5.3. The site administration takes the necessary organizational and technical measures to protect the User/Client’s personal information from unauthorized or accidental access, destruction, modification, blocking, copying, distribution, as well as from other unlawful actions of third parties.

5.4. The site administration, together with the User/Client, takes all necessary measures to prevent losses or other negative consequences caused by the loss or disclosure of the User/Client’s personal data.

5.5. If the User/Client does not agree to receive information from Profreserv LLC and/or Affiliates, the User/Client may unsubscribe from the mailing list:

— by clicking on the Unsubscribe link at the bottom of the letter;

— in your personal account on the Site, by removing previously selected options;

— by sending a notification to [email protected] or by telephone to the contact center.

When notifications are received by email [email protected] or when contacting the contact center for the relevant User/Client by telephone, a request is created based on the information received from the User/Client. The request is processed within a maximum of 24 hours. As a result, information about the User/Client is not included in the mailing segment.

6. OBLIGATIONS OF THE PARTIES

6.1. The User/Client is obliged to:

6.1.1. Provide up-to-date information about personal data necessary for using the Website www.profreserv.ru.

6.1.2. Update and supplement the information about personal data provided by Profrezer LLC if this information changes.

6.2. The site administration is obliged to:

6.2.1. Use the information received solely for the purposes specified in clause 4 of this Privacy Policy.

6.2.2. Ensure that confidential information is kept secret, not disclosed without the prior written permission of the User/Client, and also not sell, exchange, publish, or disclose in other possible ways the transferred personal data of the User/Client, except as required in accordance with the legislation of the Russian Federation.

6.2.3. Take precautions to protect the confidentiality of the User's/Client's personal data in accordance with the procedure usually used to protect this type of information in existing business transactions.

6.2.4. The User/Client can at any time change (update, supplement) the personal information provided by him or its part, as well as its confidentiality parameters, using the function of editing personal data in the section or in the personal section of the relevant Service. The User/Client is obliged to take care of timely changes to previously provided information and its updating, otherwise

IP Kurochkin A.D. is not responsible for failure to receive notifications, goods/services, etc.

7. RESPONSIBILITY OF THE PARTIES

7.1. The site administration that has not fulfilled its obligations is liable in accordance with the legislation of the Russian Federation, except for the cases provided for in paragraphs. 5.2., 5.3. And

7.2. of this Privacy Policy.

7.2. In case of loss or disclosure of Confidential Information, the Site Administration is not responsible if this confidential information:

7.2.1. Became public domain until it was lost or disclosed.

7.2.2. Was received from a third party before it was received by the Site Administration.

7.2.3. Was disclosed with the consent of the User/Client or by the User/Client himself.

8. DISPUTE RESOLUTION

8.1. Before going to court with a claim on disputes arising from the relationship between the User/Client of the site and the Site Administration, it is mandatory to submit a claim (a written proposal for a voluntary settlement of the dispute).

8.2. The recipient of the claim, within 30 calendar days from the date of receipt of the claim, notifies the claimant in writing of the results of consideration of the claim.

8.3. The current legislation of the Russian Federation applies to this Privacy Policy and the relationship between the User/Client and the Site Administration.

9. ADDITIONAL TERMS

9.1. The site administration has the right to make changes to this Privacy Policy without the consent of the User/Client.

9.2. The new Privacy Policy comes into force from the moment it is posted on the Site, unless otherwise provided by the new edition of the Privacy Policy.

9.3. All suggestions or questions regarding this Privacy Policy should be reported to the Site Administration by phone 8(495) 255 78 55 or by email: [email protected]

9.4. The current Privacy Policy is posted on the page at www.profreserv.ru

LLC Profrezerv

INN: 7731470903

OGRN: 1147746502420

BANK: PJSC "BANK URALSIB" MOSCOW BIC 044525787

Registration of relations between the parties to the contract for the provision of personnel

The agreement with the party receiving the workers should be called the “Agreement on the provision of labor for workers (personnel)”. Under the contract, the contractor (private employment agency) temporarily sends its workers, with their consent, to the customer to perform labor functions defined by their employment contracts, in the interests, under the management and control of the customer. The customer is obliged to pay for the services of the contractor (the organization that provided the personnel) and to use the labor of the workers assigned to him in accordance with the labor functions defined by their employment contracts (clause 2 of article 18.1 of Law No. 1032-1).

Such an agreement must necessarily include a condition that the receiving party (customer) is obliged to comply with the obligations established by labor legislation and other regulatory legal acts containing labor law standards to ensure safe conditions and labor protection for the employee.

Ban on contract

The conclusion of contracts for the provision of personnel labor is not allowed in the following cases (clause 12 of article 18.1 of Law No. 1032-1):

- if the host team went on strike;

- to perform work in case of downtime or part-time work, announced in order to preserve jobs in the face of the threat of mass layoffs of workers of the receiving party;

- if the receiving party is in bankruptcy;

- to replace employees of the receiving party who refused to work in cases established by labor legislation, in particular if their salary payment was delayed for more than 15 days.

In addition, private employment agencies will not be able to send their workers to perform certain categories of work, as well as to certain jobs and positions (clause 13 of article 18.1 of Law No. 1032-1):

- for work at hazardous production facilities of hazard classes I and II (the list of such work was approved by order of the Ministry of Labor of Russia No. 858n, Rostechnadzor No. 455 of November 11, 2015);

- to workplaces where working conditions are classified as hazardous working conditions of degrees 3 and 4 or dangerous;

- for positions that are associated with obtaining a license or other special permit to carry out a certain type of activity, a condition for membership in an SRO or the issuance of a certificate of admission to a certain type of work;

- to perform work as crew members of sea vessels and mixed (river-sea) navigation vessels.

Personnel leasing: difference from outstaffing and outsourcing

In some cases, it is much more profitable and easier for an employer to attract third-party workers to perform certain work than to add additional employees to the staff of his organization. At the same time, the rational use of labor resources greatly contributes to increasing the efficiency of existing organizations, and the provision of personnel is one of the most well-known ways to optimize taxation.

In the article, the author examines the features of the forms for providing personnel, the need to choose the right form in a given situation, the regulation of relations between the parties when providing personnel, and also recommends how exactly these services should be reflected in the contract so that the tax authorities cannot make claims.

Note The current legislation of the Republic of Belarus does not define the concept of “personnel leasing” (hereinafter referred to as personnel leasing), in addition, there is no legal regulation of contracts of this nature in domestic regulations. At the same time, some issues in this area will be indirectly regulated from January 28, 2020 by the Labor Code (as amended on July 18, 2019). So, according to Part 1 of Art. 32-1 of the Labor Code (as amended on July 18, 2019), the employer has the right to temporarily transfer the employee to another job, including to another location, as well as to another employer in the following cases: 1) written consent of the employee for a period of up to six months within calendar year, unless otherwise provided by the Labor Code (as amended on July 18, 2019); 2) production necessity; 3) downtime. In practice, personnel leasing is a management technology that makes it possible to provide the financial and economic activities of an organization with the necessary labor resources, using the services of a third-party organization. The main feature of personnel leasing is that the organization, providing this type of service, does not sever employment relations with its personnel, but only temporarily places them at the disposal of the customer. The issue of the legal nature of the use of personnel in such a form as personnel leasing is controversial in world practice.

Forms for providing personnel

The main goal of the manager and financial service of any organization is to reduce costs. As a rule, a significant part of the costs falls on payments to the company's employees. Such expenses include contributions to the wage fund, mandatory insurance premiums, etc.

For reference The amounts of compulsory insurance contributions are established by Art. 3 of Law No. 138-XIII.

An important tool that allows you to optimize and more accurately plan an organization’s costs in this part of the costs is the provision of personnel.

Currently, Belarusian enterprises are beginning to use agency labor of freelance workers. Depending on the technology of personnel management, there are:

— personnel leasing;

— outstaffing;

— outsourcing.

All the above concepts are based on the relationship of three parties:

— the main customer organization;

— a provider organization with a staff for their subsequent provision to the customer organization (in most cases, such organizations are recruitment agencies);

— the workers themselves, registered in the provider organization, but performing official duties for the employer of the main customer organization.

Schematically, these relationships can be depicted as follows:

How should the relationship between personnel leasing, outstaffing and outsourcing be regulated?

From a legal point of view, the very name “personnel leasing” cannot be used, since this term does not comply with the legislation of the Republic of Belarus. The object of a financial lease (leasing) agreement can only be property that the lessor undertakes to acquire ownership from a seller determined by the lessee, and not a person or his workforce <*>. Thus, it is incorrect to use the phrases “personnel leasing” or “personnel rental” in the contract.

For a similar reason, it is impossible to transfer workers to a “loan”, which is sometimes used in construction organizations. After all, according to Part 1, Clause 1, Art. 760 of the Civil Code, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things of the same kind received by him and quality.

Of course, employees are not property or a thing, therefore in business practice, when talking about outstaffing or leasing of personnel, one should use the phrases “personnel provision services”, “personnel hiring services” . In this case, the customer organization is provided with the necessary labor resources using the services of a third-party provider.

At the moment, the legislation does not contain normative documents directly regulating such relations. The Civil Code does not provide for this type of agreement as an agreement on the provision of personnel. At the same time, civil legislation provides freedom in concluding an agreement and the right to the parties to enter into an agreement that contains elements of various agreements provided for by law (mixed agreement) <*>.

Moreover, civil rights and obligations arise from the grounds provided for by law, as well as from the actions of citizens and legal entities, which, although not provided for by it, but due to the basic principles and meaning of civil legislation give rise to civil rights and obligations <*>.

In accordance with this, civil rights and obligations arise from contracts and other transactions provided for by law, as well as from contracts and other transactions, although not provided for by law, but not contrary to it <*>.

At its core, the provision of personnel can be attributed to the provision of paid services <*>. Moreover, under a contract for the provision of services for a fee, one party (the contractor) undertakes, on the instructions of the other party (the customer), to provide services (perform certain actions or carry out certain activities), and the customer undertakes to pay for these services <*>.

At the same time, the parties to the employment contract are the employer and the employee, and the employment contract is an agreement between the employee and the employer, according to which the employee undertakes to perform work in a certain one or more professions, specialties or positions of appropriate qualifications in accordance with the staffing table and to comply with internal labor regulations , and the employer undertakes to provide the employee with the work stipulated by the employment contract, to ensure working conditions provided for by labor legislation, local regulations and agreement of the parties, to pay the employee wages on time <*>. Consequently, an employment contract cannot be concluded between the employer of the customer organization and the provided employees for the reason that these workers are not on the staff of the customer organization.

It should be noted that the Tax Code contains the following concepts:

— “services for the provision and hiring of personnel” <*>;

— “services for search and (or) selection of personnel, hiring of personnel, provision of personnel for carrying out activities” <*>;

— “income from the search and (or) selection of personnel, hiring of personnel, as well as from the provision of personnel to carry out activities in the Republic of Belarus, received by the payer from sources in the Republic of Belarus” <*>.

The main differences between personnel leasing, outstaffing and outsourcing

There is a difference between personnel leasing, outstaffing and outsourcing, and in order not to make a mistake in choosing to optimize your income and expenses, and most importantly - to eliminate friction with the tax office, you need to clearly understand what the difference is between similar services provided by specialized organizations.

What differences exist, read in ilex.

Who pays salary taxes

Since for an employee sent under a contract for the provision of personnel, the employer is the transferring party (a private employment agency), it is the latter who is the tax agent for personal income tax in relation to the employee, that is, it calculates, withholds and transfers tax on the remuneration paid.

The employer also charges and pays insurance premiums to extra-budgetary funds from the remuneration of such employees based on the tariffs it applies.

Insurance premiums for injuries are calculated in a special manner. These contributions must be paid based on the insurance rate determined in accordance with the main economic activity of the receiving party. It is also necessary to take into account the premiums to the insurance rate and discounts to it, established taking into account the results of a special assessment of working conditions at the workplaces to which workers are actually assigned.

In order for the employer to fulfill this requirement, the receiving party is obliged to provide him with information about the main type of activity and the results of a special assessment of working conditions (new paragraph 2.1 of Article 22 of the Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases").

Accidents that occur with employees who are assigned to work under a contract for the provision of personnel labor are investigated by a commission created by the receiving party. It may include a representative of the employer of this employee (Article 341.4 of the Labor Code of the Russian Federation).

Administrative responsibility

In case of violation of the new rules, including the provision banning the use of agency labor, the following measures of administrative liability may occur (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for organizations – a fine from 30,000 to 50,000 rubles;

- for individual entrepreneurs – a fine from 1000 to 5000 rubles;

- for officials - a warning or a fine from 1000 to 5000 rubles.

A repeated violation committed within one year from the date of prosecution for a previous similar violation faces more serious sanctions (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for organizations – a fine from 50,000 to 70,000 rubles;

- for individual entrepreneurs – a fine from 10,000 to 20,000 rubles;

- for officials - a fine of 10,000 to 20,000 rubles or disqualification for a period of one to three years.

Vicarious liability

For the obligations of the employer, including obligations related to the payment of wages and other amounts due to an employee who is sent under a contract for the provision of personnel, the receiving party bears subsidiary liability (Article 341.5 of the Labor Code of the Russian Federation).

In other words, if a private employment agency has a debt to employees that it cannot repay, then the money can be recovered from the receiving party (the organization or individual entrepreneur that used the labor of these workers). In addition to salary, this can be monetary compensation for the employer’s violation of the deadline for paying wages, vacation pay, dismissal payments, etc.

To fulfill the requirement of subsidiary liability, the contract for the provision of personnel can include a condition that the contractor provides the customer with information on a monthly basis (or at other intervals) about the absence of wage arrears to employees.

The terms of remuneration for workers sent under a personnel supply agreement must be no worse than those of employees of the receiving party performing the same functions and having the same qualifications (Article 341.1 of the Labor Code of the Russian Federation).

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>

Briefly about outstaffing

Outstaffing is the so-called agency labor, leasing employees to another company. In Russia, this phenomenon has legal restrictions that were introduced in 2016.

The outstaffing scheme can be presented in this way: the outstaffing organization acts as an intermediary between the company and the employees who work in it. There are employees on the staff of the outstaffing company, which also transfers all kinds of payments to the budget for them and calculates wages, but the workplace is located in another organization.

For your information! Employees are officially employed by the company providing outstaffing.

Outstaffing can be beneficial to an organization in some cases. For example: seasonal work; reluctance of managers to expand staff; the use of migrant labor without obtaining various permits (in this case, all documentation is prepared by the outstaffing company).

Companies sign an agreement, which will indicate various nuances regarding timing, cost of work, number of employees, their personal data, etc. As mentioned above, an annex to the contract will be an act on the provision of workers under the contract for the provision of personnel.