Under what circumstances is a deferment granted?

You can rely on deferred payment if the following circumstances arise:

- If you lose a permanent source of income. It is important for the lender to indicate the reason for leaving a job (for example, layoff). The main thing is that the borrower’s fault is not recorded.

- A disease that requires long-term treatment and large financial costs.

- Loss of a breadwinner, if the borrower is supported by him.

- Due to a change of permanent residence.

- Loss of residence as a result of natural disasters.

- Due to going on maternity leave.

There are a number of circumstances when a bank is ready to provide its clients with a deferment on payments.

Each banking organization checks the borrower’s CI and determines its reliability. If the client previously complied with and properly fulfilled his loan obligations, the most advantageous offers can be developed for him.

Types of deferments

Deferment of payment is a procedure for freezing payments on an existing loan, or reducing the monthly payment with a subsequent extension of the payment period. There are several types of deferment:

- Changing the duration of the contract with subsequent extension.

- Adjustment of the current terms of the loan agreement, restructuring.

- Changing individual items in the current lending program on more favorable terms - refinancing.

The general term “deferment” hides several types of services.

If a client has temporary difficulties with repaying a loan, the most popular method of resolving the situation is deferment of payment. If payments are completely temporarily suspended, the client will have time to find a new job or another solution to financial difficulties.

Supply contract with deferred payment clause: procedure for signing

The supply agreement with the condition of deferred payment is signed by both parties and their authorized persons in the required number of copies. Signatures in the agreement are not required to be certified by a notary, however, if your counterparty is acting on the basis of a power of attorney, it is extremely important to properly verify his authority.

REFERENCE. The main details of a power of attorney are: the authority of the person who issued it, the date of issue, the validity period, the terms of reference for which it is intended (whether he or she has the right to sign this agreement).

Changing repayment terms

The main goal of the program is to provide a deferment in payment of the main body of the loan. The client may not pay the principal amount, but the interest rate continues to apply. As a result, the total cost of the loan will automatically increase. As a rule, the bank agrees to provide a deferment for up to six months.

There are several types of loan repayment holidays:

- exemption from payment of the principal amount of the debt;

- suspension of interest accrual;

- complete exemption from payments for a certain period.

You need to know what options exist in order to know what to talk about with a banking specialist.

The third method is the least common, since it is not beneficial for the banking structure.

Contents of a supply agreement with a deferred payment clause

The contract in question must comply with several norms of the law at once, these are articles 432, 454, 489, 506 of the Civil Code of the Russian Federation.

Directly in the contract when drawing it up, you must indicate:

- The parties, their full data,

- Specific information about the goods supplied,

- Product price,

- Payment order,

- Terms and amounts of payments.

IMPORTANT! If the subject of the contract cannot be determined, then it is not considered concluded (Article 432 of the Civil Code of the Russian Federation).

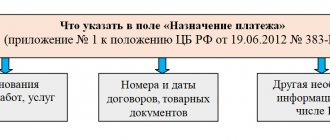

Since we are talking about transferring property to a counterparty without paying for it, it is important to formalize everything strictly according to the law. The quality of the contract directly determines the result of a possible trial to collect the debt for payment for the goods supplied. Therefore, in addition to the subject (information about the product), it is necessary to provide:

- Delivery method and timing,

- Price,

- The procedure for acceptance, quality determination, return,

- The procedure for preparing shipping documents;

- Terms and methods of payment,

- Liability for late delivery and late payment (penalty, fine),

- Jurisdiction (legal or included in the contract),

- Termination procedure.

Despite the fact that the basic requirements are regulated by paragraph 3 of Chapter 30 of the Civil Code of the Russian Federation, it is always safer to specify the general conditions from the law by the contract itself.

Payment restructuring

If the borrower's financial situation worsens, restructuring is another way to resolve the situation. To do this, the client must submit a written application to the organization’s branch with a request to change the current conditions for loan repayment, indicating objective reasons.

If the creditor agrees to provide a restructuring, he must announce new terms of the agreement followed by re-issuance of the loan agreement. As a rule, changes relate to the amount of the monthly payment in the direction of reduction and prolongation of the contract. As a result, the borrower's financial burden will be reduced, but the loan repayment period will be increased.

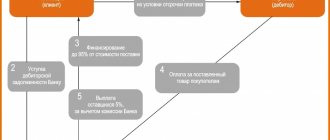

Rules for granting deferred payment

Deferred payment is of great importance for increasing sales, but it means potential risks for the supplier. They consist in the fact that the buyer will be insolvent and will not return the previously received products. To reduce the likelihood of negative consequences, it is recommended to follow the following rules:

- preliminary assessment of the buyer's solvency;

- verification of the counterparty if deferred payment is provided in the B2B sector. It includes studying information about the company from the Unified State Register of Legal Entities, establishing a connection between it and its legal address, studying reviews about the company on the Internet and in business circles;

- drawing up an agreement with the client, which clearly and unambiguously stipulates the terms of the deferment and penalties for failure to transfer funds on time.

To reduce its potential risks, the seller may sign a security deposit agreement with the buyer in addition to the main agreement. You can require the client to provide guarantors or take out a debt insurance policy.

The parties that have entered into a contract with deferred payment may change its terms and conditions in the future. For example, the buyer has the right to request an extension of the deferment period, provide a letter of guarantee indicating the amount of the debt and the obligation to repay it on time. If the supplier agrees, an additional agreement to the main contract is signed, which specifies new details of cooperation.

Refinancing program

Most lenders use this program to increase their customer base. The main goal is refinancing on more favorable terms for the borrower. When concluding a new agreement, you can receive the following benefits:

- prolongation of the current loan agreement;

- reduction in interest rates;

- reduction in the amount of payment per month.

The bank independently decides what advantage to give to the client. For regular borrowers who properly fulfill their obligations, individual, more advantageous offers can be developed.

A new agreement is mandatory, where the bank undertakes to repay the existing loan from another organization, and the client will have to repay the loan from the new institution.

The bank independently decides what advantage to give to the client. But the borrower must also understand what a specific offer means for him

Regardless of the type of deferment, the borrower must contact the bank in advance with an explanation of the current situation. If the agreement does not contain a clause on the provision of credit holidays or deferred payment, this means that the bank will consider this issue individually in each case.

When signing a new agreement, from the next month the borrower must comply with the terms of the new agreement. The deferment will help maintain a positive credit rating and qualify for favorable offers on new bank loans in the future.

5 / 5 ( 2 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Additional agreement on deferred payment

Appendix No. 1to the Sale and Purchase Agreement

dated February 13, 2022 N18-2020

Additional Agreement No. 1

on granting deferred (installment) payment

St. Petersburg May 23, 2022

Furnitura LLC, hereinafter referred to as the “Seller”, represented by General Director P.P. Petrov, acting on the basis of the charter, on the one hand, and IP Shvets I.E., hereinafter referred to as the “Buyer”, on the other hand, have entered into this Additional Agreement as follows:

1. The parties within the framework of the Sale and Purchase Agreement for a batch of buttons (hereinafter referred to as the Goods) dated February 13, 2022 N18-2020 in connection with the coronavirus pandemic and on the basis of Art. 489 of the Civil Code of the Russian Federation agreed on new terms of payment for Goods with deferred payment, including:

1.1. The Buyer pays the Seller the price of the transferred Goods by payment orders with deferred payment until August 23, 2020.

1.2. The Buyer may at any time transfer the entire remaining portion of the price of the Product or contribute funds towards subsequent payment periods.

2. If the Buyer does not make payment for the Goods within the prescribed period, the Seller has the right to refuse to fulfill the contract and demand the return of the Goods, except for cases where the amount of payments received from the Buyer exceeds half the cost of the Goods.

3. No interest is accrued on amounts deferred until the Buyer fulfills his obligations according to the rules of a commercial loan.

4. In case of failure by the Seller to fulfill the obligation to transfer the Goods, the rules provided for in Art. 328 of the Civil Code of the Russian Federation.

5. In the event that the Buyer does not fulfill the obligation to pay for the transferred Goods within the period established by the Agreement and otherwise is not provided for in the Sales and Purchase Agreement dated February 13, 2022 N18-2020, interest is payable on the overdue amount in accordance with Art. 395 of the Civil Code of the Russian Federation from the day when the Goods should have been paid for under the Contract until the day the Buyer pays for the Goods.

6. From the moment the Goods are transferred to the Buyer and until payment is made, the Goods sold with a deferment are recognized as being pledged to the Seller to ensure the Buyer fulfills his obligation to pay for the Goods.

7. Otherwise, the terms of the Sale and Purchase Agreement dated February 13, 2020 N18-2020 remain unchanged.

8. This Additional Agreement comes into force from the moment it is signed by the Parties and is an integral part of the Sale and Purchase Agreement dated February 13, 2022 N18-2020.

9. This Additional Agreement is drawn up in two copies of equal legal force, one copy for each of the Parties.

Salesman:

| Buyer: | |

| ________________________________ | ________________________________ |

| ________________________________ | ________________________________ |

| ________________________________ | ________________________________ |

| Salesman: | Buyer: |

| ________/________ (signature/full name) | ________/________ (signature/full name) |

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya