Procedure for calculating VAT

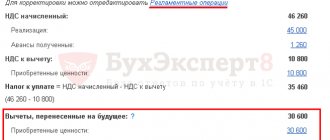

Tax calculation is simple. According to Chapter 21 of the Tax Code of the Russian Federation, the amount payable is the difference between outgoing and incoming VAT.

Output VAT is the amount of tax you add to the price when you sell a product or service. This amount is written: “including VAT.” All payers and tax agents are required to assess tax.

Input VAT is the amount of tax charged to you by a supplier or contractor. The Tax Code allows it to be deducted to reduce the tax payable (Article 171 of the Tax Code of the Russian Federation). But this is only possible if:

- goods and services purchased for use in activities subject to VAT;

- purchased goods are accepted for accounting;

- you have an invoice from the supplier and primary documents (bill of lading, act, etc.);

- 3 years have not yet passed since the inventory items were accepted for accounting.

It is impossible to deduct VAT if the supplier is not its payer or if goods and materials and services were acquired for use in non-VAT taxable activities.

Incoming VAT is recorded in the purchases ledger, and outgoing VAT is recorded in the sales ledger. These documents are part of the VAT return.

Example. Albion LLC received revenue of 1,200,000 rubles for the 1st quarter, including output VAT of 200,000 rubles. During the same period, goods and materials were purchased in the amount of 600,000 rubles, including input VAT of 100,000 rubles.

We calculate the tax payable:

200,000 - 100,000 = 100,000 rubles.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

VAT on imports of goods from EAEU countries

From the beginning of 2015, a new union of states began to operate, replacing the previously existing Customs Union, which included (according to the Treaty on the Eurasian Economic Union dated May 29, 2014, hereinafter referred to as the Treaty):

- Russian Federation;

- Republic of Belarus;

- The Republic of Kazakhstan;

- Republic of Kyrgyzstan;

- Republic of Armenia.

The main provisions on imports into the EAEU are discussed in the material “ Customs Union of the Eurasian Economic Union (nuances)” .

The nuances of import VAT are discussed in separate materials.

What to do if goods imported from the EAEU countries are stolen, read the article “Goods imported from Belarus are stolen. What to do with VAT? .

When importing goods from the territory of the EAEU countries, it is necessary to submit a declaration on indirect taxes no later than the 20th day of the month following the month in which the imported goods were registered. From December 2022, a new indirect tax declaration form will be used. You can download it here .

Please note that indirect tax returns can be submitted on paper. Read more about this in the material “Rules of the Tax Code of the Russian Federation on electronic filing of VAT returns do not apply when declaring “import” tax .

Along with the declaration, it is necessary to submit the documents provided for in clause 20 of Appendix 18 to the Treaty on the EAEU.

You can find a more detailed list of these documents in this article .

An application for the import of goods and payment of indirect taxes is one of the documents confirming the import of goods from the EAEU countries. To accept import VAT for deduction when importing from EAEU countries, a mark from the tax authority is required on this application.

What kind of mark this is is stated in the publication “When importing from Belarus, the Russian Federal Tax Service puts a mark on the application .

For the position of the Ministry of Finance of the Russian Federation on the period during which VAT can be accepted for deduction, read the material “Deduction for “Eurasian” VAT can be obtained within 3 years .

The import of goods is not always accompanied by the payment of tax. VAT is not paid when goods not subject to VAT are imported. Read more about such situations in the material “We imported non-taxable goods from the EAEU - “Eurasian” VAT is not paid .

VAT payment deadlines

VAT is a quarterly tax. It is paid in equal installments within three months following the reporting quarter (Article 174 of the Tax Code of the Russian Federation). For example, accrued VAT for the first quarter must be paid in equal parts for April, May and June. The deadline for payment is the 25th of each month. If the day falls on a weekend, the deadline is moved to the next working day. In the table we have collected the deadlines for paying VAT in 2022 for individual entrepreneurs and LLCs on OSNO.

| Taxable period | Payment deadline |

| 4th quarter 2022 | January 25, 2021 |

| February 25, 2021 | |

| March 25, 2021 | |

| 1st quarter 2022 | April 26, 2021 |

| May 25, 2021 | |

| June 25, 2021 | |

| 2nd quarter 2022 | July 26, 2021 |

| August 25, 2021 | |

| September 27, 2021 | |

| 3rd quarter 2022 | October 25, 2021 |

| November 25, 2021 | |

| December 27, 2021 |

Tax agents are required to remit VAT within the same time frame. But there are exceptions for agents who buy goods or services for sale in the Russian Federation from a foreign company that is not registered in Russia. Such agents must pay VAT on the same day they transfer the remuneration to the foreign company.

Companies and entrepreneurs using the simplified tax system may also have to pay VAT. The table lists such situations and payment deadlines.

| Situation | Payment deadline |

| The simplifier issued an invoice by mistake | 25th day of the month following the quarter in which the invoice was issued |

| Imported goods from EAEU countries | The 20th day of the month following the month the goods were accepted for accounting or the month following the month in which the payment due date under the leasing agreement occurred |

| Simplified - tax agent | On the day of transfer of money to a foreign company. |

Payment of VAT in 2022: payment deadlines in the table

Here are other VAT payment deadlines for 2020:

| Period for which VAT is paid | Payment deadline |

| For the 1st quarter of 2022 | 04/27/2020 05/06/2020 – transfer due to non-working days for companies from the SME Register that did not work during quarantine and belong to industries affected by coronavirus |

| 25.05.2020 | |

| 25.06.2020 | |

| For the 2nd quarter of 2022 | 27.07.2020 |

| 25.08.2020 | |

| 25.09.2020 |

Quarterly payment of VAT

As a general rule, VAT must be paid in equal installments over the three months following the reporting quarter. The payment deadline is no later than the 25th of each month.

If you wish, you can pay the tax early: transfer the entire amount at once after the end of the quarter or divide it into two payments instead of three. There are three payment methods:

- The standard method is monthly payment. VAT is transferred based on the results of the quarter in equal payments over three months no later than the 25th of each month.

- Early one-time payment - quarterly payment. VAT based on the results of the quarter is transferred no later than the 25th day of the first month following the reporting quarter.

- Early payment in installments - payment twice a quarter. The first payment based on the results of the quarter is transferred no later than the 25th day of the first month - its amount should not be less than ⅓ of the tax amount. The balance is due the following month no later than the 25th.

Example. For the 1st quarter, VAT payable amounted to 900,000 rubles. Let's consider three options for paying tax.

- Monthly payments in equal installments. During the next quarter they are made no later than:

April 25 - 300,000 rubles;

- May 25 - 300,000 rubles;

- June 25 - 300,000 rubles.

- Quarterly one-time payment. The full amount of VAT must be paid no later than the 25th day of the first month following the reporting quarter. That is, there will be one payment - 900,000 rubles until April 25. There will be no payments in May and June.

- Payment twice a quarter. You can split the payment in any convenient way, but it is important to pay no less than ⅓ in April and no less than ⅓ in May. For example, you can distribute payments like this:

April 25 - 300,000 rubles;

- May 25 - 600,000 rubles;

- June 25 - 0 rubles.

You cannot make the first payment in the second or third month following the quarter - this would violate the tax payment deadlines. The fine is 20% of the amount of tax not paid on time. And if the inspection proves that the violation is intentional, the fine will increase to 40% (Article 122 of the Tax Code of the Russian Federation).

If the company from our example does not pay 300,000 rubles in April, it will be late. For this she will receive a fine of 60,000 rubles, and maybe even 120,000 rubles. In addition, the tax office can block the account (clause 3 of Article 76 of the Tax Code of the Russian Federation).

When to pay VAT to tax agents?

A Russian company that is a tax agent must pay VAT accrued or withheld in the tax period (quarter) in equal monthly payments no later than the 25th day of each of the three months following this quarter (Clause 1 of Article 174, Article 163 of the Tax Code RF).

If the deadline falls on a weekend, it is postponed to the next working day.

The exception in this case is the deadline for transferring VAT on work or services, the contractor for which is a foreign company that is not registered in Russia. In such a situation, the tax agent needs to pay VAT simultaneously with the payment of funds to foreign companies. (Clause 4 of Article 174 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated November 1, 2010 No. 03-07-08/303).

At the same time, banks do not have the right to accept payment orders for the transfer of payment to the contractor, if the customer has not presented a payment order for the transfer of VAT to the budget.

From 10/01/2020, overpayment of VAT can be offset against the debt for any taxes (clause 22 of Article 1 of Law No. 325-FZ dated 09/29/2019, Letter of the Ministry of Finance dated 08/10/2020 No. 03-02-07 /1/72100). But the abolition of restrictions on the types of taxes for which offsets can be carried out does not matter in this case.

In this situation, the offset procedure specified in clause 1 of Art. 78 Tax Code of the Russian Federation. To repay the VAT debt incurred when purchasing work or services from a foreign company, the tax agent does not have the right to offset the amount of overpayment of other taxes (Letter of the Ministry of Finance dated September 28, 2012 No. 03-02-07/1-231).

The deadline for transferring VAT for foreign tax agent companies is no later than the 25th day of the month following the reporting quarter (Clause 7, Article 174.2 of the Tax Code of the Russian Federation).

Quarterly VAT return

It is important for the tax office to see how you calculated VAT, so after paying the tax, submit your return within the following deadlines:

| Taxable period | Payment deadline |

| 4th quarter 2022 | January 25, 2021 |

| 1st quarter 2022 | April 26, 2021 |

| 2nd quarter 2022 | July 25, 2021 |

| 3rd quarter 2022 | October 25, 2021 |

We recommend the cloud service Kontur.Accounting. Our program is suitable for LLCs and individual entrepreneurs on OSNO. You can easily keep records of VAT-related transactions, create books of purchases and sales, and submit declarations to the Federal Tax Service. We give all newbies a free trial period of 14 days.

Payment in unequal installments

According to the Information Notice of the Tax Inspectorate, value added tax can be paid in unequal installments. But the main thing is that the required amount is paid by the due date and credited to the required cash register. That is, you can pay the entire amount in the first month and not pay for two more months. Or pay half in the first month and half in the second month of the entire required amount for the quarter. Let's look at an example.

Example 2.

Success LLC filed a value added tax return for the 1st quarter of 2022. In the declaration in the first section, the amount indicates the amount of tax that must be paid to the budget in the amount of 38,000 rubles. To pay tax to the budget you need to divide 39,000 by 3 months. 39000/3=13000 rubles. Thus, tax payment will be made as follows:

- Until April 25 - 13,000 rubles;

- Until May 25 - 13,000 rubles;

- Until June 25 - 13,000 rubles.

But you can do it another way: pay, for example, 20,000 rubles before April 25, 6,000 rubles before May 25, and another 13,000 rubles before June 25. The law does not prohibit such splitting if there is an amount in the taxpayer’s personal account of at least 1/3 of the tax amount for the quarter in each month of the quarter following the reporting one, until the 25th day.

Payment of VAT in the general mode

Firms and individual entrepreneurs that are taxpayers within the framework of the general taxation system pay the budget for value added tax according to the same rules.

The tax base and the amount of tax payable are determined based on the results of each of the four quarters of the year. An important point: unlike, for example, income tax and a number of other budget payments, VAT is not considered a cumulative total during the year, that is, the tax period in this case is precisely a single quarter.

The transfer of the tax amount occurs according to the principles prescribed in Article 174 of the Tax Code. VAT payable is divided into three parts and paid during the next quarter, by the 25th day of each of its three months. Thus, payment of VAT, for example, for the 3rd quarter of 2022 will occur on dates before October 25, November 27 and December 25, respectively. In November, the “last” 25th, which falls on a Saturday, is traditionally moved to the next working day.

VAT based on invoice

Companies and individual entrepreneurs under special tax regimes, for example, the simplified tax system or the unified agricultural tax, are not payers of value added tax by default.

But it happens that in transactions with a special-regime supplier, the buyer, using the general taxation system, insists on the allocation of VAT in the price of goods or services. This is recorded in the invoice, that is, in the document that for businessmen on the OSN is the basis for charging VAT on sales. An invoice issued with allocated VAT leads to the need to pay tax to the budget, including by those persons who are exempt from VAT in their ordinary life. The deadline for paying VAT in such a situation is until the 25th day of the month after the end of the quarter to which the issued document relates. Unlike the standard rules for transferring tax, this payment is not divided into three parts, but is paid as a total amount. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.