Unified form INV-11 – this is a unified act form used to reflect the results of an inventory of future expenses. This procedure is carried out once a year as part of the annual traditional inventory of the property and liabilities of the enterprise.

Inventory of future expenses consists of reconciling the data of accounting account 97 (its turnover) with the indicators of primary documentation confirming the existence of expenses and their subsequent sequential assignment to expenses. This reconciliation allows you to track the correctness and timeliness of the write-off process.

How is an inventory of deferred expenses carried out?

The procedure is entrusted to the members of a specially created inventory commission, the composition of which is determined by the manager’s administrative document, for example, an order of the unified form INV-22.

Deferred expenses are those expenses that are not written off immediately in their entirety at the current moment, but are expensed gradually over a long period of time. This type of assets in the accounting records of an enterprise is reflected separately in account 97: the turnover on the debit of the account shows the total amount of expenses for future periods, and the turnover on the loan shows their share already allocated to expenses in the current period.

When inventorying such assets, the turnover in the debit and credit of account 97 is reconciled with the data reflected in the documents, on the basis of which costs are written off as expenses. Accounting and documentary indicators must coincide in the case of correct organization of accounting for future expenses.

The assets in question include those types of costs that are written off in the amount of a certain part of the total amount over a specified period (this can be months or years), this can include costs for:

- Licensed software;

- Upcoming construction work (for example, costs of materials transferred to the construction site);

- Other types of expenses for which there are no clear instructions in the PBU regarding their classification as expenses (for example, expenses for voluntary medical insurance, certification).

During the reconciliation, an inventory report is filled out in form INV-11 in two copies - for the accounting department and members of the commission. It is allowed to immediately fill out two copies with identical information or prepare one copy, then duplicate it using copying equipment and sign it.

This act is prepared for completion in advance, before the start of the inventory. It is possible that the members of the commission prepare it themselves, or this function is assigned, for example, to the accounting department, which issues a prepared form for the commission to fill out.

Modern companies, as a rule, keep records using special programs; in this case, the inventory report is prepared with their help. The columns in which information is entered on the basis of accounting are filled in immediately, after which the prepared act is printed for the members of the commission.

Briefly about BPO inventory

To keep records of BPO, account 97 is used. It can reflect expenses such as:

- construction;

- contributions to SRO;

- purchase of licensed software;

- purchasing licenses or certificates;

- for health insurance.

Inventory is a reconciliation of information, debit and credit turnover, on account 97 with what is indicated in the primary documentation. Typically, the procedure is carried out once a year, at the end, before the formation of annual reporting. The purpose of the inventory is to reconcile the data and find out whether there were errors when writing off funds.

First of all, the manager must issue an order to conduct an inventory in the INV-22 form. In it, he must indicate the composition of the commission that will carry out the procedure (usually accountants, clerks, economists, representatives of the organization’s management), and the period for its implementation. During the inventory process, the RBP fill out the report form.

Reference! Deferred expenses are those expenses that the company incurred in previous or current periods, but they must be included in the cost of goods, work or services in subsequent periods.

Inventory report form of the unified form INV-11

To reflect the results of the reconciliation, the standard form of inventory report INV-11, approved by the State Statistics Committee of Russia back in 1998 (Resolution No. 88), is usually used.

This form has a standard structure for similar inventory forms and consists of a title section with general information, a table with a list of the types of assets being inspected and their distinctive features, as well as the signatures of responsible persons and commission members.

Among the members of the commission there are usually employees of accounting, economic or technical departments, and a representative of the management team of the enterprise. It is not allowed to include in the commission financially responsible persons who are in charge of the assets being inspected.

The organization has the right not to use a unified form, but to prepare its own act form, which will reflect information about expenses for future periods. You can also take the existing INV-11 form as a basis and adjust it to suit your needs. In this case, the accounting policy must indicate which forms the organization will use to conduct inventory.

After filling out the INV-11 act, one copy must be submitted to the accounting department, whose employee will check the correctness of the inventory form.

The INV-11 form includes indicators characteristic of inventory lists (acts) and matching statements, that is, if inconsistencies are identified, they do not need to be transferred to matching statements. Discrepancies and conclusions from them are shown directly in the INV-11 form.

Inventory procedure 97 accounts

At the end of the calendar year, it is necessary to carry out an inventory of account 97. The act in this case may be a standard form (INV-11), but the company can develop the form of the act independently. And inventory is necessary in order to determine whether costs are reflected correctly in account 97. If expenses are written off based on inventory results, an accounting certificate is drawn up. The need to take inventory of account 97 by the end of the year is also due to the fact that an explanatory note will need to be drawn up for the annual reporting. And if the expenses are significant, then they should be noted separately. This can only be neglected if account 97 has a small balance.

Inventory of account 97 is carried out separately for each type of expense. Depending on the results, an accounting policy will be drawn up. There are two options:

- Account 97 is saved and the period during which the expense will be written off is indicated.

- Count 97 is not used.

This should be done for each individual type of cost attributed to this account.

Sample of filling out an inventory report for deferred expenses

At the top of the inventory report the following is filled in:

- information about the organization in which the reconciliation of documentary and accounting data for writing off deferred expenses is carried out - name, OKPO, division, type of main activity according to OKVED;

- information about the document establishing the procedure for conducting the inspection - name (the desired option is selected from those proposed, the rest are crossed out), number and date (copied from the document);

- information about the inventory - the timing (dates of the first and last day of the procedure) is taken from the administrative document defining the procedure for the reconciliation ⊕ the timing of the cash register inventory in 2022;

- details of the act - number and date (numbering is affixed in accordance with the rules established by the organization, may contain digital, alphabetic designations, as well as signs; the date corresponds to the actual day of registration).

To fill out the INV-11 act, the data from account 97 is used - its debit and credit turnover. Also, to reconcile accounting indicators, data is taken from documents confirming the existence of deferred expenses and their subsequent write-off.

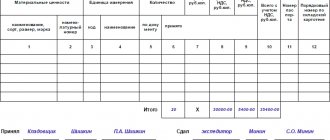

The tabular part of the INV-11 form contains data from account 97 with details by type. Each individual row of the table reflects information about a separate type of expense that is subject to gradual write-off and reflected in account 97.

There are 15 columns in the inventory act table: in columns 1 to 9, data is entered on the basis of accounting, from 10 to 15 - filled in during the inventory process. When maintaining accounting in a special program, the INV-11 act is printed for members of the commission with the first nine columns completed. The remaining indicators are filled out by the commission members themselves.

Example

On September 1, VEGA LLC entered into an agreement for access to the electronic service. The company was issued an act dated September 1 on the opening of rights to use this resource for 12 months in the amount of 24,000 rubles (excluding VAT). On the date on which the act was issued, the company must take into account the transferred amount in account 97, after which it will be written off monthly as expenses. The postings in this case will be as follows:

| Business transaction | date | Wiring | Amount, rubles |

| The cost of using the electronic service is reflected in deferred expenses | September 1 | D97 K60(76) | 24 000,00 |

| Expenses for using the service in September were written off | September 30th | D26(44) K97 | 2,000.00 (24,000.00 / 12 months) |

Filling out the INV-11 table

| Column number | Information to be filled in |

| 1 | The sequence number of the table row. |

| 2 | Type of expenses related to future periods (this can include not only the costs of licensed software and construction, but also other expenses for which clear write-off rules are not established, and therefore, in the accountant’s opinion, they can be classified as expenses of future periods) . Typically, if expenses in tax accounting are written off gradually, then in accounting they are also included as expenses over a long period. |

| 3 | Expense type code, filled in if appropriate coding is available. |

| 4 | The amount of costs incurred in the current period and related to future periods, or costs incurred in previous periods and not completely written off in the current period. The column is filled in based on the account balance 97. |

| 5 | Cost incurrence date:

|

| 6 | The period over which costs must be written off as expenses, expressed in months. |

| 7 | The amount of costs that should be written off on the date of the inventory is filled in based on the calculations made. |

| 8 | The actual amount of written-off costs on the day of reconciliation according to accounting data. |

| 9 | The unwritten off balance as of the day of the inventory according to accounting data. |

| 10 | The number of months that have passed since costs were recorded as deferred expenses. |

| 11, 12 | The amount of costs to be attributed to the cost of production, according to primary documents. |

| 13 | The unwritten-off balance of costs at the time of inventory, determined by calculation. |

| 14, 15 | Inventory results are the amount of costs that need to be written off or restored based on the reconciliation data. Columns are filled in if there are discrepancies in columns 9 and 13. |

The results of the table are summarized in the last row.

The reflected results of the inventory of future expenses are certified by the signatures of the commission members. The signatures of financially responsible persons are also affixed, who, by signing the act, confirm that the information contained in it corresponds to reality, these persons have no complaints or claims to the information presented.

After completing all the necessary manipulations with the inventory report INV-11, it is transferred to the accounting department for verification. It is not necessary to draw up an additional comparison statement if discrepancies are identified in the act, since it includes the functions of such a statement.

The employee, who has checked the data given in the inventory act, indicates his position, writes his last name, and signs. Such acts must be kept for at least 10 years.

What is not BPR?

Despite the presence of controversial issues in the legislation when reflecting RBP in accounting, there are types of expenses that cannot be included in RBP, although at first glance it would seem that they should be included.

These are all types of advances to suppliers, for example:

- for periodicals: subscriptions to magazines, newspapers, information and technical support (including them in the BPR is a common mistake of accountants);

- advertising in the media;

- annual subscription for consulting services;

- Internet and mobile phone access fees;

- prepayment for rent of an office and other real estate (it happens that the landlord asks for prepayment for a quarter or even a year in advance).

In all these cases, there is an advance payment, which can always be requested back at any time, and thus the expense will not actually be incurred. All advances are closed by acts received in future periods.

RBP are those services and works that have already been received and consumed in the current period, but their cost cannot be written off in the current period, because this would be a violation of accounting and tax laws. This is their fundamental difference from advances.

RBP also does not include insurance costs, periodic royalty payments under concession agreements, payments for participation in SRO for auditors and builders - they are written off at a time.

Long-term repair costs

When a company faces long-term repairs to its building, these costs will relate to future reporting periods and can therefore be recognized as deferred expenses. Repair costs are reflected in section 1 of the balance sheet. If this amount of costs is significant for the company, then it should be reflected in a separate line. For example, as “Long-term repair of fixed assets” under group of articles 1150. If the amount is not significant for the company, then it can be reflected as other non-current assets.