Accounting account 97 is used to reflect summarized information about the amounts of expenses actually incurred in the current reporting period, but relating to future periods. How to account for future expenses and what transactions reflect transactions on account 97 - you will find answers to these questions in our article.

What applies to deferred expenses?

Deferred expenses mean the preparatory costs that an organization incurs to generate income in the future. According to legislative norms, the debit of account 97 can reflect expenses for:

- the right to use intellectual property;

- preparatory work (seasonal, mining, start-up and other expenses);

- loan servicing;

- interest accrued on the bill amount.

The basis for reflecting amounts as deferred expenses are primary documents confirming the receipt of income in the future (contract agreement, license agreement, etc.).

Ghost accounts in Russian accounting: 96, 97, 98

We all love to be indignant at “Clerk”. So today I’ll let off some steam. I’ll tell you a story that started 9 years ago and is not going to end. During this time, a new generation of accountants has grown up, who may not know this story, but are probably wondering why there are accounts in the Chart of Accounts whose names do not correspond to the contents.

A long time ago in a Galaxy far, far away In 1998, Russia adopted a very respected document in the field of accounting regulation - the Regulations on Accounting and Financial Reporting in the Russian Federation . They turned to him when there was no separate PBU for accounting for some object. A sort of Yoda among the Jedi - first among equals. After the amendments to it came into force on January 1, 2011, in accordance with Order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n, definitions of expenses and income of future periods were removed from the text of the Regulation.

This was quite expected, since the Concept for the development of accounting and reporting in the Russian Federation for the medium term adopted International Financial Reporting Standards, which identify five elements of financial reporting, as the main instrument for reforming accounting and reporting:

- assets;

- obligations;

- equity;

- income;

- expenses.

The terms “deferred expenses” and “deferred income” do not appear in International Financial Reporting Standards, therefore Russian organizations that prepared financial statements in accordance with international standards were faced with the need to reclassify deferred expenses and income, respectively, into expenses and income, or into assets and liabilities.

Thus, the presence of such accounting categories in Russian accounting was a rudiment that needed to be removed for further integration of domestic accounting standards with international ones. And here the Ministry of Finance did everything right.

But the “cleaning up” of the standards turned out to be incomplete. Accounts 97 “Deferred expenses” and 98 “Deferred income” continue to remain in the Chart of Accounts for accounting financial and economic activities of organizations. These accounts reflect no longer existing accounting objects. I call them ghost accounts. But the main paradox is that these accounts continue to be used for their intended purpose - to reflect the state and changes in expenses and income of future periods.

In order to understand the reasons for this paradox regarding deferred expenses, I will quote the amended clause 65 of the Regulations on Accounting and Financial Reporting in the Russian Federation : “Costs incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type.” Thus, having “killed the hare”, the Ministry of Finance left its “ears” in the form of the opportunity to take into account certain types of costs as deferred expenses, if such a procedure is provided for by accounting regulations. This order still remains for the following types of costs:

- Expenses incurred in connection with upcoming work under construction contracts ( clause 16 of PBU 2/2008 “Accounting for construction contracts” );

- Payments for the granted right to use the results of intellectual activity or means of individualization, made in the form of a fixed one-time payment (clause 39 of PBU 14/2007 “Accounting for intangible assets”);

- Additional expenses on loans and credits, accrued interest on the bill amount, accrued interest and (or) discount on bonds, if the organization in its accounting policy has chosen the option of including them evenly in other expenses (clauses 8, 15, 16 PBU 15/2008 “ Accounting for expenses on loans and credits."

In addition, paragraph 19 of PBU 10/99 “Expenses of the organization” states: “Expenses are recognized in the income statement by their reasonable distribution between reporting periods, when expenses determine the receipt of income over several reporting periods and when the connection between income and expenses cannot be clearly defined or is determined indirectly,” which gives reason to try to establish a broader list of deferred expenses in the organization’s accounting policies.

If we talk about deferred income, the Ministry of Finance treated the “hare” more harshly: clause 81 of the Regulations on Accounting and Financial Reporting in the Russian Federation , which defined deferred income as income received in the reporting period, but relating to the following reporting periods , was completely removed from section III “Basic rules for the preparation and presentation of financial statements.” However, the “rabbit ears”, seemingly cut off at the root, remained in clause 9 of PBU 13/2000 “Accounting for State Aid” , which directly prescribes that targeted funding should be reflected as future income.

Thus, pursuing the good goal of removing controversial categories of expenses and future income from domestic accounting, the Ministry of Finance did not complete the work. And, if in the case of deferred income, this is apparently due to an insufficiently methodical approach to making changes, then in the case of deferred expenses, some intent is visible. But I still don’t understand what exactly it is. Especially considering the long-term tradition of Russian accountants to use account 97 as a “garbage dump”.

The situation around account 96 “Reserves for future expenses” looks even stranger. The same order of the Ministry of Finance dated December 24, 2010 No. 186n invalidated clause 72 of the Regulations on accounting and financial reporting in the Russian Federation , which contained a list of reserves for future expenses, and also allowed their creation in order to evenly include future expenses in costs production or circulation of the reporting period.

The FSB (PBU) makes no mention of these reserves. Thus, this accounting category, unlike expenses and income of future periods, has been completely abolished. However, in the Chart of Accounts for accounting financial and economic activities of organizations, account 96 “Reserves for future expenses” still remains, moreover, it is actively used. This account isn't even a ghost - it's a swindler posing as a ghost for selfish reasons. The fact is that, according to clause 8 of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets,” the account for reserves for future expenses must reflect estimated liabilities, that is, the organization’s liabilities with an uncertain amount and (or) deadline. Why not just rename the account to avoid confusion and adjust the instructions for it? Unclear.

For 9 years, the situation has not improved, and the accounting reform has reached a new level - I have written about this more than once on Klerke.ru. Therefore, it is unlikely that we will wait for changes to the Chart of Accounts and PBUs that I have listed. Rather, the unfinished categories will die out with the introduction of new FSBUs and a new Chart of Accounts, rumors about which are regularly heard.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Typical transactions for account 97

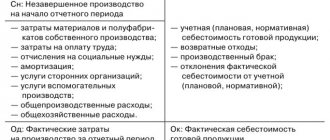

Amounts of expenses of future periods are accumulated according to Dt 97, write-off of expenses and their reduction are reflected according to Kt 97.

Expenses to be reflected in account 97 can be recognized as expenses incurred by the organization for the repair of fixed assets and intangible assets:

| Dt | CT | Description | Document |

| 97 | () | The share of general production (general business) expenses for the repair of fixed assets/intangible equipment as part of deferred expenses | Accounting certificate-calculation |

| 97 | , 69 | The amount of wages and social contributions of workers involved in the repair of fixed assets/intangible equipment as part of deferred expenses | Payroll |

| 97 | 20, | Share of main (auxiliary) production during repair of fixed assets/intangible equipment as part of deferred expenses | Accounting certificate-calculation |

| 20, | 97 | Expenses for repair of OS/intangible equipment as part of production cost | Certificate of completion |

Goods, materials, and finished products can be written off as deferred expenses:

| Dt | CT | Description | Document |

| 97 | 10 | Materials included in deferred expenses | Sales Invoice |

| 97 | 41 | Goods included in deferred expenses | Sales Invoice |

| 97 | GP as part of deferred expenses | Sales Invoice |

Using account 97 in accounting in 2018

As directly stated in paragraph 16 of PBU 2/2008, deferred expenses include those expenses that were incurred to provide planned work or expected services. To take them into account, accounting account 97 is used for this. Upon recognition of revenue for tax and accounting purposes, they will be written off to determine the financial result.

Let's look at examples of what future expenses can be attributed to account 97:

- an operation for the purchase of building materials that have not yet been used;

- rent paid in advance;

- those related to preparation for seasonal work;

- expenses for the development of new production facilities;

- costs for the reclamation of agricultural land, which will be included in the cost of cultivated products for many years to come;

- irregular repairs of fixed assets during the year, if the enterprise has not created an appropriate reserve for this type of expenditure;

- in agriculture - these are the costs of constructing temporary non-capital structures for production purposes;

- procurement of agricultural products for the purpose of their subsequent processing in the off-season.

In addition to the costs listed above, account 97 deferred expenses in 2022 also reflects the licensee’s costs of paying a fixed one-time payment for the right to use intangible assets (clause 39 of PBU 14/2007). Subsequently, these expenses will be written off in equal parts over the term of the contract.

Deferred expenses when obtaining a software license

One of the most common transactions on account 97 is the reflection of deferred expenses associated with the conclusion of license agreements for the use of software.

Let's consider an example: in August 2015, Molniya LLC entered into a license agreement with Computer Service JSC. Under the agreement, Molniya LLC receives the rights to use the software for a period of 3 years. The cost of the contract is a one-time payment in the amount of RUB 342,500.

The following entries were made in the accounting of Molniya LLC:

| Dt | CT | Description | Sum | Document |

| Funds were transferred in favor of Computer Service LLC as payment under the license agreement | RUB 342,500 | Payment order | ||

| 97 | The cost of the contract is included in deferred expenses | RUB 342,500 | License agreement | |

| 012 | The software is accounted for on an off-balance sheet account | RUB 342,500 | License agreement | |

| 20 (, 44…) | 97 | Monthly write-off of expenses for using the software (RUB 342,500 / 36 months) | RUB 9,514 | License agreement |