The obligation to use form M-35 to draw up a capitalization act

Recently, the obligation to use many unified forms, including Act M-35, has been abolished. Therefore, today, various forms developed by employees of organizations and subsequently established by the company’s management in the accounting policies can be used as a capitalization act. However, to draw up such an act, the above form is often used, since it is quite convenient to use for the conservative document flow of Russian companies.

Important ! Any changes in the unified form M-35 make the act form independently developed, which does not give the organization the right to indicate the corresponding OKUD code on it, therefore they must be approved and included in the accounting policy by order of the director.

Rules for drawing up an act in form M-35

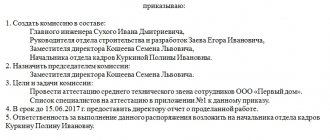

First of all, during the dismantling of a fixed asset, it is necessary to convene a commission, which should include representatives of all parties.

Such a commission identifies materials suitable for reuse from dismantled structures, and also identifies all information related to their accounting. The document contains information about each such material. In this case, new lines are filled in for each item.

The document consists of two sheets on which the tabular part is located. And, as a rule, this space is enough to draw up Act M-35. However, if there is so much “old new” material that there is not enough space in the document, an appendix is drawn up for the act, which is the same table, in which the same details are indicated and the same columns are filled in.

The procedure for drawing up an act of capitalization of goods and materials in form M-35 and its sample

When registering the operation of capitalizing materials obtained as a result of dismantling or disassembling fixed assets, using form M-35, first of all, you must fill out the details of the document header, namely:

- Name of the legal entity that prepared the document;

- Name of customer and contractor organizations;

- Data from appraisers or appraisal organizations.

Important ! In the upper right corner of the act the number of the M-35 form according to OKUD is indicated. If the specified document undergoes changes in the composition of the details, then this code must be removed from there, since such a form will be considered newly created.

Here you need to fill out the tabular part, where the following data should be indicated:

- Date of document execution;

- Type of operation (Code);

- Structural subdivision;

- Kind of activity.

After filling out the above details, the drafters of the capitalization act must fill out the main tabular part. This includes information about the organization’s correspondent account in which this or that material is recorded. This field is filled in by an accountant. It should be noted that for convenience it is divided into two, and they indicate the subaccount and analytical accounting code. Then information is entered about the remaining materials that are in good condition after dismantling, allowing them to be used. For each such product, the item number, information about the unit of measurement, as well as the amount of material obtained after disassembly are indicated. A very important point is to indicate the serviceability coefficient of inventory items; it is this figure that makes it clear how worn out the material resource is and whether it can be used in the future. Among other things, the amount of suitable material transferred for reuse, the price and its full cost are indicated.

The final part of the document summarizes the results: it notes the fact that the goods were accepted into the warehouse, as well as the fact that the goods were received or sent for reuse by the contractor. Members of the commission confirm the information specified in the registration act M-35 with signatures. In this case, the contractor’s representatives sign on the right side, and the customer’s representatives sign on the left side of the document.

You can fill out the act of capitalization of goods and materials in form M-35 here - a sample design.

Introductory part of the act

After the name of the document and its number in the middle of the sheet there are sequential columns in which, when filling out, indicate:

- Name of the compiler's organization.

- Name of the customer organization.

- Contractor company name.

- Name of the appraisal organization or several. Only those who were directly involved in the process of assessing material assets obtained during disassembly are indicated.

Separately on the right in the attached form of the act there is a small table. It already contains the OKUD form number. If at least one column in the act is changed, then this number will need to be removed. This requirement is related to the rules for the use of unified forms of documentation.

In addition to the OKUD code, the attached act has columns for indicating OKPO. In the smaller of the three tables, it is also necessary to fill in the columns: “Date of compilation”, “Operation type code”, “Name of the structural unit” and “Type of activity”. Not all of them are required to be filled out. For example, if there are no structural divisions in the organization, then the entire corresponding column can be left blank. This is not forbidden.

Answers to frequently asked questions

Question N1: Good afternoon! Our organization needed to dismantle the television mast. As a result of disassembly, scrap ferrous metal was left behind. Can form M-35 be the basis for recording such material? Or do we need to register the posting in some other way?

Answer: Hello! Materials obtained as a result of dismantling fixed assets that are not real estate should be formalized with a demand invoice in form M-11. Form M-35 is used when capitalizing inventory items remaining after the dismantling of buildings and structures. In your case, it is advisable to convert the document into a demand invoice in form M-11 or use your own form developed at the enterprise.

Question N2: Good afternoon! The contractor and I had a dispute about who was required to fill out the M-35 form, due to which the materials obtained as a result of dismantling the building were not properly processed. Please allow it.

Answer: Hello! It was already said earlier that filling out the posting act is the work of a specially assembled commission, which includes both the customer’s employees and the contractor’s employees. To prepare the document, assemble a commission that will consist of at least three people and let it evaluate the received material, on the basis of which it will fill out Act M-35.

act on receipt of materials

All companies are required to document transactions involving the movement of material assets in appropriate forms.

The act on the capitalization of material assets is used to account for inventory items that were received as a result of the liquidation of fixed assets, but are suitable for further use in the operation of the enterprise.

In such cases, the established form M-35 is used. The company's loss is reduced by the cost of material assets that were obtained as a result of dismantling and dismantling structures and buildings.

The act is drawn up by a commission, the composition of which is formed taking into account representatives of the customer and the contractor, in triplicate. The form can be filled out manually or using computer technology.

The act indicates such data as the number, names of the customer and contractor organizations, as well as the name of the involved appraisal companies. The date of preparation of the document, the code of the type of operation, the name of the unit and its type of activity are indicated.

A special column records information about the material value and its characteristics (name, size, code, grade), item number, unit of measurement and quantity obtained during dismantling of structures or buildings. The utility coefficient of inventory items from the total quantity is indicated.

In the designated column, the quantity and price per unit of material assets is written down and the total amount of materials that are transferred to the contractor for reuse is entered.

At the end of the act, all members of the commission sign with a description of the position. The act is certified by the seals of the companies. Two copies of the act remain with the customer company, the third is transferred to the contractor. The customer attaches the document to the contractor's invoice.

Form form No. M-35. Act on the recording of material assets received during the dismantling and dismantling of buildings and structures

The form of the Act on the capitalization of material assets received during the dismantling and dismantling of buildings and structures in form No. M-35 is used to register the capitalization of material assets received during the dismantling and dismantling of buildings and structures suitable for use in the production of work.

The act is drawn up in triplicate by a commission consisting of representatives of the customer and contractor, and signed by representatives of the customer and contractor.

The first and second copies of the act remain with the customer, the third - with the contractor. The customer, in turn, attaches the first copy of the act to the submitted invoice for payment to the contractor.

Form M-35. Act on the posting of material assets

The act of recording material assets in form M-35 is used to document inventory and materials received during the demolition and dismantling of buildings and structures. Through it, they can be classified as the organization’s fixed assets and used in its economic activities.

The document must be drawn up by a specially created commission. Moreover, there must be at least three people in total. Naturally, it should include both representatives of the customer and representatives of the contractor. The presence of signatures of representatives is in the interests of each organization. Without them, the act will not have legal force.

How many copies will be required?

Form M-35 is issued in triplicate. The first one remains with the contractor. The remaining two go to the customer. The customer attaches one of the original documents to the invoice.

In principle, the number of copies of the act created is not limited in any way. If three or more parties take part in the process, then it would be more logical to sign the document in four copies at once, etc.

Is this form required?

Since 2013, all unified forms have lost paramount importance. They remained mandatory for use only in exceptional cases provided for by law. But the M-35 form does not apply to these exceptions. An act on the recording of material assets after the demolition of a building can be drawn up in any form convenient for the organization.

The only fundamental point remains the nuance that any form created personally must be entered into the company’s accounting policy by a separate order from the manager. Therefore, if such a process occurs for the first time in a company, it is necessary to ensure that by the time of signing the act is already listed in the accounting policies as a developed document.

Moreover, you can use both a unified and your own form of the form. The slightest changes and additions to the unified form make it independently developed.

In the attached form and sample act in the upper right corner there is information that the form was adopted by Resolution of the State Statistics Committee No. 71 A of October 30, 1997.

At that time it was mandatory for use in all companies.

As you can see, it has not lost its popularity to this day due to its ease of use and the conservatism of the Russian document management system and regulatory authorities.

The document consists of several separate elements:

- Hats.

- Two tables in the main part.

- Conclusions in the form of a conclusion to the second table and signatures of the members of the convened commission.

At the top there is a little space left for the visa of the head of the organization, who certifies the paper. After filling out the document, his signature with a transcript and position should appear in the required columns. If the organization has a seal, then its imprint is placed here.

After the name of the document and its number in the middle of the sheet there are sequential columns in which, when filling out, indicate:

- Name of the compiler's organization.

- Name of the customer organization.

- Contractor company name.

- Name of the appraisal organization or several. Only those who were directly involved in the process of assessing material assets obtained during disassembly are indicated.

Separately on the right in the attached form of the act there is a small table. It already contains the OKUD form number. If at least one column in the act is changed, then this number will need to be removed. This requirement is related to the rules for the use of unified forms of documentation.

In addition to the OKUD code, the attached act has columns for indicating OKPO.

In the smaller of the three tables, it is also necessary to fill in the columns: “Date of compilation”, “Operation type code”, “Name of the structural unit” and “Type of activity”. Not all of them are required to be filled out.

For example, if there are no structural divisions in the organization, then the entire corresponding column can be left blank. This is not forbidden.

For convenience, the description of material assets obtained during the dismantling of buildings and structures is presented in the form of a lengthy table with separately labeled columns. They should include information regarding:

- Corresponding account. This column is divided into two: the first part indicates the subaccount, and the second - the analytical accounting code. This data is filled in by the accountant.

- The nature of the remaining material assets. Their name, variety or brand are indicated, as well as, if the organization has adopted such a system, the nomenclature number.

- Units of measurement of goods and materials, its code.

- The quantities of the specified material resource.

- The suitability coefficient of the material obtained during disassembly.

- How much of the material received was transferred to another company for reuse.

- Prices and total amount of materials that are transferred to the organization.

The table is placed on two sheets. In the vast majority of cases, this space is sufficient for a detailed description of the categories of material assets obtained during analysis. And also their quantities and prices.

At the end of the table, the results are summed up, and it is also indicated that the inventory items have been accepted, are subject to capitalization, and that some of them (or all) are transferred to the contractor for reuse.

As a sign that the data indicated in the table is correct, all members of the commission put their signatures at the end of the act. If necessary, the participants in the process leave notes and draw up applications.

Moreover, the contractor’s representatives sign on the right side, and the customer’s representatives sign on the left. Both sides of the conclusion of the act on the posting of material assets in form M-35 must be completed. Without this, the document will not have legal force.

Acceptance and write-off of materials: we prepare documents

We thank Elena Sergeevna Shatalova, chief accountant of Technolux Metal LLC, Moscow, for the proposed topic.

Now it is not necessary to use unified primary forms, including those provided for accounting for materials and their movement. Therefore, organizations are slowly beginning to reshape Goskomstat forms to suit themselves. And on this wave, accountants are once again asking the question: what document will be the basis for accepting materials for accounting and writing them off as expenses?

Speaking about materials, we will consider production materials and raw materials, and office materials, for example, stationery.

Documenting the arrival of materials to the organization

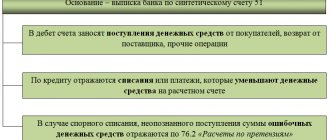

The posting of materials implies not only their physical receipt by the financially responsible employee of the organization (for example, a storekeeper), but also their reflection on the accounting accounts (as a rule, this is a debit posting to account 10 “Materials”).

There are several options for documentation, and they often depend on the situation that arises when receiving materials, as well as on the structure of the organization and the internal document flow system adopted in it.

Receipt order according to form No. M-4. It is used if there are no comments on the quality and range of materials. Only the form No. M-4 is quite large. Therefore, you can easily remove from it some details that are not related to the mandatory details of the primary document and clause 2 of Art. 9 of the Law of December 6, 2011 No. 402-FZ (hereinafter referred to as the Accounting Law):

- numbers of forms according to OKUD and OKPO;

- passport number (it makes sense to leave it only if you are bringing materials containing precious stones and metals);

- information about the insurance company;

- column with the unit of measurement code.

Stamp on the invoice

Source: https://gladweb.ru/dom-i-semyya/akt-na-oprihodovanie-materialov/