Accounting for material assets

Inventories (MPI) are assets used as raw materials in the production of products, performance of work, provision of services, for resale, for the needs of the organization.

It is also acceptable to use the term “inventory assets”. Accounting for inventories in accounting is regulated by FSBU 5/2019 “Inventories”, approved by Order of the Ministry of Finance dated November 15, 2019 No. 180n.

If the need arises and there are sufficient grounds for inventory, the organization has the right to write off. The reasons for writing off material assets are different:

- release of materials into production;

- sale of materials by the organization to individuals and legal entities;

- write-off of materials that have become unusable after expiration of storage periods;

- write-off of obsolete equipment;

- write-off when shortages, theft or damage are identified, including due to accidents, fires, and natural disasters.

Documentation of these operations is carried out through accounting documents, including the act of writing off the inventories. An organization has the right to develop the form independently or use a unified one approved for public sector organizations (No. 0504230 according to Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n).

Why do you need an act of write-off of fixed assets?

The act of write-off of fixed assets is a primary document that details the process of disposal of fixed assets.

Based on the information presented in the act, the following actions are taken:

- entries are made in the inventory card of the OS being written off;

- The following entries are generated in accounting:

- on write-off of OS;

- reflecting expenses associated with the disposal of fixed assets;

- capitalization of inventories remaining from the disposed fixed assets;

- non-operating income (expenses) are reflected in tax accounting (clause 13 of article 250 of the Tax Code of the Russian Federation, subclause 8 of clause 1 of article 265 of the Tax Code of the Russian Federation).

Read more about how to reflect the write-off of fixed assets in tax accounting in the Ready-made solution from ConsultantPlus. Trial full access to the system can be obtained for free.

There are unified forms of such acts (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). They differ in their scope of application:

- OS-4 – for fixed assets, except for vehicles and fixed assets group;

- OS-4a – for vehicles;

- OS-4b – for the OS group.

Read about the basic rules for reflecting information about written-off fixed assets in forms OS-4, OS-4a, OS-4b in the articles:

- “Unified form No. OS-4 - act on decommissioning of an asset”;

- “Unified form No. OS-4a - form and sample”;

- “Unified form No. OS-4b - form and sample”.

To generate an act of write-off of fixed assets, an organization has the right to use forms of its own design indicating all the required information (clauses 2–4 of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Whether it is necessary to restore VAT when writing off a fixed asset, find out from the ConsultantPlus experts. Get trial access to K+ for free and go to the Ready-made solution.

We will tell you in further examples how to correctly draw up a sample form for the write-off of fixed assets.

Rules for writing off inventory items

Inventory assets mean the following property of the organization:

- raw materials - items, things that are used in production for the manufacture of any product;

- work in progress - products the production of which has not been completed and has not received consumer properties in accordance with its purpose, that is, it is in the production stage;

- finished product is the result of the production process, which is sold without additional costs, having passed all stages of production established in the relevant regulatory documents: regulations, technical instructions;

- inventories - unused property of an organization transferred for storage to warehouses.

The process is initiated by both the person responsible for the safety of valuables and keeping records of them, as well as the chief accountant or manager of the enterprise. In order to carry out write-offs, a special commission is created in the organization, which operates on both a temporary and permanent basis. The composition of such a commission must include persons who are financially responsible for specific assets of the company, specialists in specific equipment, and the chief accountant. The powers of the commission include, inter alia, drawing up a write-off act, a sample of which is presented below.

ConsultantPlus experts have discussed how to write off materials, goods, etc. Use these instructions for free.

Write-off procedure

The procedure consists of 8 stages:

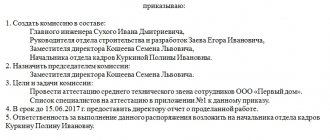

- A commission is created. The head of the organization can also join the commission if he so desires. An order is issued on the creation of the commission. It provides a list of the persons who make up the commission and indicates the need to compile a list of valuables to be written off.

- The commission examines the values themselves, establishes the reasons for write-off: breakdown, damage, natural loss, identifies those responsible and further actions in relation to written-off material assets.

- The commission examines and analyzes documents confirming the state and composition of values: work reports, lists, expense reports, calculations, etc.

- The commission records the volume that needs to be written off, approves the list and sums up the amount and book value.

- All this data is reflected in a document signed by all members of the commission.

- The act is submitted to the manager for approval.

- Accounting makes the necessary entries and notes in accounting, financial and reporting documents.

- The commission exercises control over the destruction of written-off property, if necessary.

If a guilty person is identified, he has the right to be involved in the work of the commission. In this case, a note is made in the act on the procedure for reimbursing the organization’s expenses.

The accounting department records valuables at the actual cost of their acquisition; indirect taxes paid to the supplier are not reflected in the final amount. The write-off method is established in the accounting policy (at the cost of each unit, according to average cost indicators).

The write-off method approved in local regulatory documents does not change during operation. Sometimes the act is drawn up in the presence of third-party organizations: with the participation of sanitary or fire inspectors.

Order template

The template is not unified, therefore the organization has the right to develop its own template, including additional details and provisions in accordance with current legislation.

Although the company itself has the right to develop forms of orders and other documents, we must not forget that they must be approved in the internal accounting policies of the organization and comply with it. This document approves the forms of primary documentation at the enterprise for accounting purposes.

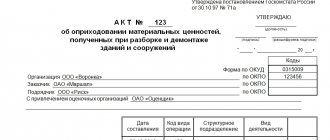

Form of the act

Companies have the right to use OKUD forms 0504230 and 0504143, which are used by state and municipal institutions.

Form OKUD 0504143, sample act for write-off of inventory items

Form 0504230, act of write-off of material assets

IMPORTANT!

The form, compiled independently, must meet the requirements of the primary accounting document.

Primary accounting documents must include the mandatory details established by the Federal Law “On Accounting”:

- Name;

- date of compilation;

- name of company;

- content of a business transaction;

- meter of business transactions in physical and monetary terms;

- the name of the officials responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons and their transcripts.

The organization has the right to independently add details to the write-off document that reflect its specifics. A form that meets the specified requirements is approved by the accounting policy of the organization.

The act is signed by members of the commission headed by the chairman. It necessarily includes an accounting employee and a financially responsible person.

Subtleties of filling

Purpose of materials consumption

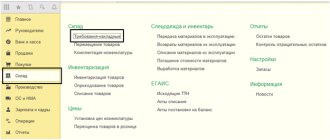

Request-invoice

– Purpose of expense

(document header)

What are goods and materials used for, for example:

- Household needs,

- Production needs,

- Other needs.

Commission

Request-invoice –

link Commission

(bottom left)

Manager's details

are inserted from the Organizations card (Main - Settings - Organizations - Signatures):

1C “remembers” the last Commission

and in the following document

Request-invoice inserts it automatically:

- The full name and position from line No. 1

is inserted into the

Chairman of the Commission

if 2 or more lines are filled in; - if one line

, then only the signatory is displayed in the printed form, and the lines

Chairman of the Commission

and

Members of the Commission are NOT filled in ; - The individual entrepreneur

signs the Act

himself

, so he does not need to fill out the composition of the commission.

More details:

- Write-off of material assets in 1C Accounting 8.3

- Average write-off of materials for general business needs

- Writing off gratuitously received valuables as expenses in accounting and tax accounting

- Linear write-off of material costs

- Write-off (transfer into operation) of business equipment as part of distribution costs

- Accounting and analytical accounting of materials: legislation and 1C

Amounts

The total indicators depend on the Accounting policies and settings in 1C (Main - Settings - Accounting policies - Methods for estimating inventories):

Method of assessing MPZ: Average

Administration – Program settings – Posting documents – Calculations are performed:

- At the end of the month;

- When carrying out documents.

- Option When closing the month

:

planned prices

.

They must first be filled in in the document item

prices ; - if planned prices are not maintained in 1C, then there will be no amounts in the Act - the cost price will be filled in at zero

.

:

- The write-off report contains the cost at the time of write-off ( moving average cost

);

);

- this is

NOT an error

.

In 1C, the disposal of materials is carried out at a sliding

cost

: for the calculation, the cost of materials and the quantity at the time of their disposal are taken.

At the end of the month, the rolling cost is adjusted to the weighted average

: balances at the beginning of the month and all receipts for the month are taken into account.

Cost adjustments will be made only if there are revenues

within a month

after

their

disposal

.

See also:

- [05/30/2019 entry] BP support seminar for April-May

- Write-off of material assets in 1C Accounting 8.3

- Average write-off of materials for general business needs

- Writing off gratuitously received valuables as expenses in accounting and tax accounting

- Linear write-off of material costs

- Write-off (transfer into operation) of business equipment as part of distribution costs

- Accounting and analytical accounting of materials: legislation and 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Document Receipt (act, invoice) transaction type Services (act) Document Receipt (act, invoice) transaction type Services (act) allows you to issue…

- The moment of writing off a bad debt due to the expiration of the statute of limitations You do not have access to view To gain access: Complete a commercial...

- The certificate for last year’s services was drawn up in 2022 - what is the VAT rate? The Ministry of Finance considered a situation where the actual provision of services occurred at the end...

- How to set up Sales (act, invoice) + invoices issued in one journal...

Filling out the act

Let's look at filling out the document step by step.

Step 1. Fill in the information of the manager and the date of approval of the document.

Step 2. Place and date of compilation. The date of drawing up the act is the date of write-off of inventories and recognition of expenses. The organization has the right to draw up an act once at the end of the month and include in it the vacation of inventories for the entire month. It must be prepared in a timely manner, otherwise there is a risk of non-recognition of expenses.

Step 3. We indicate the number and date of the order to appoint a commission and the reason. When moving internally, the organization issues materials to its departments without specifying the destination. In this case, the materials themselves are considered subordinate to the department that received them, and their value is assigned to expenses when they are actually spent on manufacturing products or performing work according to the materials consumption report.

Step 4. We fill out a table indicating the name of the materials, the price and the reason for writing off the materials. In the write-off act, it is necessary to indicate the full name of the inventory, including brand, grade, batch, article, etc. to justify the accounting of expenses and the possibility of their identification in accounting. To do this, it is advisable to add data by date of receipt. Erroneous write-off of another brand or grade of materials leads to misgrading or refusal to accept expenses. It is not necessary to indicate the cost, as it may differ in accounting and tax accounting. But if the cost matches, then the act will additionally confirm the amount of expenses.

Step 5. We summarize the number and amount of write-off.

Step 6. The document must be signed by members of the entire commission responsible for the release and receipt of materials, persons who authorized such release and ensure internal control in the organization.

Basis for compilation

The grounds for drawing up the act are as follows:

- an inventory was carried out, during which it became clear that some of the accounting objects needed to be disposed of;

- initiative of persons responsible for the use of values (PRO).

The specified reason for writing off materials in the write-off act depends on what material assets are supposed to be written off. For example, the disposal of soft equipment is due to the wear and tear of the item. Office supplies are transferred according to a statement from the MOL to the direct user according to the statement for issuing valuables for the needs of the institution (form 0504210). The dishes are entered in accordance with the table book (form code 0504044). In case of destruction of inventory items, approved documents must be attached.

Responsible persons are members of the commission for the receipt and disposal of assets. They are appointed by order of the head of the institution.

Specifics of write-off for production

The need to write-off from warehouse to production arises for enterprises that are engaged in production activities. Such an act must reflect the following information:

- Date of completion;

- information about the sender of the document (name of the structural unit and its type of activity);

- information about the recipients (also the name of the specific structural unit and the type of its activity);

- why the property is written off, the purpose of this action (for example, for the production of accessories);

- the name of the property being written off, allowing it to be identified, indicating the item number;

- unit of measurement of materials being written off;

- the amount of materials written off, that is, released into production;

- price.

The company has the right to either develop a form for this act independently or decide to use unified forms. In the latter case, the following standardized forms are used to confirm the transfer of materials to production:

- limit intake card in form M-8 in the event that materials are transferred systematically and the organization has approved standards and plans for their consumption. Also, in such circumstances, use a materials accounting card in form M-17;

- invoice in form M-11 if the materials are transferred to a division of the company that is not geographically separate.

Reflection in accounting

After drawing up an act confirming that material assets are recognized as written off, the accountant needs to make the following entries:

| Debit | Credit | Operation description |

| 20 | 10 | Release into production |

| 23 (25, 26) | 10 | Write-off for auxiliary production or for business needs |

| 94 | 10 | Applicable in case of damage or theft of goods and materials |

| 99 | 10 | Used when disposal of inventories due to natural disasters |

| 91.2 | 10 | Reflection of gratuitous transfer of materials |

When generating account data and registering inventory movement transactions, data from the act is used.

Storage and liability

Members of the commission are responsible for the correctness of the inspection of inventory items, the validity of recognizing the need for write-off (based on damage to property due to wear and tear or damage, loss or loss, etc.). The commission is also responsible for the correct preparation of documentation: not only the act, but also other forms. Company employees do not have the right to write off inventories or other property of the organization without properly established grounds. Otherwise, the person financially responsible for the safety of property may be held liable within the limits established by his agreement on individual financial responsibility.

The write-off act is drawn up in two copies and stored both in the accounting department (in the archives of the organization) and with the financially responsible person. The minimum shelf life is 5 years.

Correct and timely drawing up of the act will save the organization and financially responsible persons from problems during inspections.

Sample statement

- On the right, at the top of the statement, several lines are reserved for the signature of the head of the institution.

- Below is the date of formation of the statement, the name of the organization (full) and the structural unit in which it was issued.

- Next, enter information about the financially responsible person: it is enough to indicate here his last name, first name and patronymic.

- Then comes the main section. It begins with accounting records of the postings of inventory items entered on the form.

- Below, the chief accountant and the employee who issued the goods and materials according to this statement put their signatures; the document is dated again.

- The second part of the form contains the actual information about inventory items, formatted in the form of a table.

- The full name of the employee who received them is entered in the first column, and he also signs at the end of the corresponding line.

- The vertical columns contain data about the objects to be accounted for (their name and code) and the unit of measurement (also in the form of name and code).

- After the statement is completed, its results are summed up: the issued quantity of each item of materials, as well as their cost per piece and the total cost for all columns.