It often happens that products stored in a warehouse, or goods offered for sale at a retail outlet, lose their original properties, which entails a decrease in quality and, as a consequence, the price of the product. In the current situation, it is necessary to carry out a complex procedure for changing the value both on the shelves and in accounting. But how to arrange everything correctly? In this article we will answer this question, and also talk about the use of such a document as the act of marking down inventory items in the MX-15 form.

Markdown of inventory items

Markdown of inventory items is a reduction in their previously established value. It occurs as a result of mechanical damage to goods, a decrease in their quality due to improper or prolonged storage, as well as due to a decrease in consumer interest or obsolescence of products.

Important ! It is not enough to simply tell the buyer a lower price than the previously set one. To carry out a markdown, you must go through a rather labor-intensive registration procedure.

Legislative framework of the Russian Federation

valid Editorial from 09.08.1999

detailed information

| Name of document | DECREE of Rosstat dated 08/09/99 N 66 “ON APPROVAL OF UNIFIED FORMS OF PRIMARY ACCOUNTING DOCUMENTATION FOR ACCOUNTING OF PRODUCTS, COMMODITY AND MATERIAL VALUABLES IN STORAGE PLACES” |

| Document type | resolution, instructions |

| Receiving authority | Rosstat |

| Document Number | 66 |

| Acceptance date | 01.01.1970 |

| Revision date | 09.08.1999 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

DECREE of Rosstat dated 08/09/99 N 66 “ON APPROVAL OF UNIFIED FORMS OF PRIMARY ACCOUNTING DOCUMENTATION FOR ACCOUNTING OF PRODUCTS, COMMODITY AND MATERIAL VALUABLES IN STORAGE PLACES”

Unified form N MX-15 ACT ON VALUATION OF COMMODITY - MATERIAL VALUES

Unified form N MX-15

APPROVED

by Resolution of the State Statistics Committee of Russia dated 09.08.99 N 66

| Code | |||||

| OKUD form | 0335015 | ||||

| according to OKPO | |||||

| organization | |||||

| structural subdivision | |||||

| Type of activity according to OKDP | |||||

| Reason for drawing up the act: | order, order | number | |||

| cross out what is unnecessary | date | ||||

| Type of operation | |||||

| I APPROVED | ||

| Supervisor | ||

| job title | ||

| signature | full name | |

| "__" ______________ ____ of the year | ||

| Document Number | Date of preparation | |

| ACT | ||

| ABOUT VALUATION OF COMMODITY MATERIAL VALUES | ||

The act was drawn up by a commission that carried out a markdown of inventory items. Discounted goods and material assets have been relabeled.

Discounted goods and material assets have been relabeled.

Using this sample, print the 1st page of form N MX-15

| Number in order | date | Packing list | Commodity - material assets | Characteristics of commodity and material assets | Unit | Quantity (weight) | |||||||

| receipts of commodity and material assets | release of commodity and material assets | number | date | Name | code | Name | OKI code | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| etc. | |||||||||||||

| Total per page | |||||||||||||

| Total for the act | |||||||||||||

| Total | by page, by act | : | ||||

| cross out what is unnecessary | ||||||

| Number of serial numbers: | with N | by N | ||||

| in words | ||||||

| Quantity in physical terms | ||||||

| in words | ||||||

Using this sample, print the 2nd page of form N MX-15

| Markdown percentage | price, rub. cop. | Price difference, rub. cop. | Amount of markdown, rub. cop. | Reason for markdown | Signs of deterioration in quality | Note | |||

| before markdown | after markdown | Name | code | Name | code | ||||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| etc. | |||||||||

| Markdown amount | rub. | cop. | ||||||

| in words | ||||||||

| All members of the commission are warned of responsibility for signing an act containing data that does not correspond to reality. | ||||||||

| Chairman of the Commission | ||||||||

| job title | signature | full name | ||||||

| Commission members | ||||||||

| job title | signature | full name | ||||||

| job title | signature | full name | ||||||

| Commodity - material assets listed in the act, for the total amount after markdown | ||||||||

| in words | ||||||||

| rub. | cop., | |||||||

| are in my (our) custody. | ||||||||

The procedure for marking down inventory items

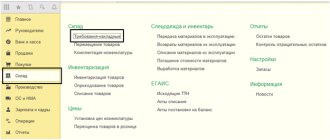

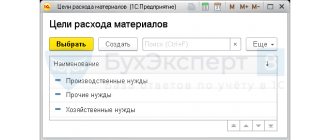

In order to correctly carry out the procedure for marking down goods, you must first correctly draw up the appropriate order. It should include the requirements for markdown and its features. This order must be approved by the company management. Then the management’s order to carry out a markdown of inventory items is brought to the attention of the employees involved in it. Only after this can measures be taken to mark down certain products, including the following actions:

- Carrying out an inventory, which allows you to understand how much goods to be written off are in the warehouse and/or at the point of sale;

- Collection and approval of the composition of a special commission to determine the cost of goods in conditions of market competition;

- Carrying out a procedure to determine the market value of goods subject to discounting;

- Recording of all collected information in a specialized document - depreciation act of goods and materials N MX-15.

Composition of the markdown act MX-15. Sample and example of filling

An act of markdown of goods is a document reflecting a decrease in the value of goods for one reason or another. It can be compiled using the form developed by the organization’s own employees, however, it is much more convenient to use the form of the existing form of Act N MX-15. You can download it by following this link.

Form MX-15 consists of two parts, each of which is presented on separate sheets.

The first part is the title page. It requires the following information:

- Full name of the organization;

- Company addresses: legal and actual;

- Reason for carrying out the markdown procedure.

Also on the title page there is a place for approval of this act MX-15 by the head of the organization upon completion of the markdown procedure. Until this moment it should remain empty.

The second part - the second and third pages of the MX-15 form are devoted to the product itself, subject to markdown. They indicate its characteristics and appearance. You must also provide the following information here:

- By what percentage of the cost is the markdown made;

- The initial cost of the goods and the final price;

- The difference between the initial and final cost;

- The reason for the markdown.

A sample of filling out this act can be downloaded by following this link.

Markdown of goods. Consider the nuances

In the process of trading companies, situations often arise when a product ceases to be in demand or loses its consumer properties and has to be discounted. But this procedure has a number of nuances. To figure this out, we analyzed legal norms, arbitration practice, and explanations from financiers. Accounting of transactions

The specific accounting procedure for markdowns depends on what method of valuing goods is recorded in the store’s accounting policy - at purchase or at sales prices.

GOODS ARE ACCOUNTED AT PURCHASE PRICES

Let's assume that they decided to mark down the product due to a decrease in demand, and the amount of the markdown is within the limits of the trade markup.

In this case, the selling price of goods will only decrease. Therefore, the markdown is not accompanied by any additional accounting entries. EXAMPLE 1

In April 2010, the Melissa department store purchased a batch of blouses (100 pieces) at a price of 1,900 rubles.

Initially, the selling price was set at 3,540 rubles. (including VAT). At this price, 80 blouses were sold during April. However, subsequently the demand decreased significantly, and in June 2010 the company’s management decided to discount the blouses and set the retail price for the remaining ones at 2,360 rubles. (including VAT). At this price in June 2010, two blouses were sold. The accounting policy stipulates that goods are accounted for at purchase prices. To simplify the example, “input” VAT on purchased goods is not considered. A department store accountant makes entries like this. In April 2010: DEBIT 41 CREDIT 60

- 190,000 rubles.

(1900 rubles/piece x 100 pieces) - blouses have been capitalized; DEBIT 50 CREDIT 90 subaccount “Revenue”

- 283,200 rubles.

(RUB 3,540/piece x 80 pieces) - revenue from the sale of blouses is reflected; DEBIT 90 subaccount “Cost of sales” CREDIT 41

- 152,000 rub.

(RUB 1,900/piece x 80 pieces) - the purchase price of the blouses sold was written off; DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “Calculations for VAT”

- 43,200 rubles.

(RUB 283,200 x 18%: 118%) - VAT is charged on goods sold. In June 2010: DEBIT 50 CREDIT 90 subaccount “Revenue”

- 4720 rubles.

(RUB 2,360/piece x 2 pieces) - revenue from the sale of discounted blouses is reflected (at the new selling price); DEBIT 90 subaccount “Cost of sales” CREDIT 41

- 3800 rub.

(RUB 1,900/piece x 2 pieces) - the purchase price of the blouses sold was written off; DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “Calculations for VAT”

- 720 rubles.

(RUB 4,720 x 18%: 118%) — VAT is charged on goods sold. In practice, situations are possible when the amount of markdown on goods exceeds the trade markup. This will happen, for example, if the current market value of goods (at which they can be sold) is lower than the actual cost. However, it is impossible to change the cost at which inventories are recorded (clause 12 of PBU 5/01). Therefore, in such cases, the company should create a reserve to reduce the value of valuables. The procedure for this is as follows. On December 31, the firm identifies items that can be sold at a price below their actual cost. On the same day, the difference between the purchase price of goods, at which they are listed on account 41, and their current market value is determined. A reserve is created for the amount of this difference to reduce the cost of goods, and an entry is made in accounting: DEBIT 91 subaccount “Other expenses” CREDIT 14

- the creation of a reserve to reduce the cost of goods is reflected.

A reserve is created for each unit of inventory listed in accounting. At the end of the year, the cost of discounted goods is shown in the balance sheet minus the created reserve (the balance of account 14 is not reflected separately in the balance sheet liability). This procedure is provided for in paragraph 25 of PBU 5/01. Subsequently, as the goods for which a reserve was created for a decrease in value are sold (or as their market price increases), the following entry is made: DEBIT 14 CREDIT 91 subaccount “Other income”

- the amount of the reserve for a decrease in the value of goods is written off. Let’s say that during the inventory it turned out that the product has completely or partially lost its original qualities. As a result, its selling price is set at a level below the actual cost. In such a situation, in our opinion, it is advisable to reflect the markdown as losses from damage. The algorithm of actions will be as follows: - write off the purchase price of goods from the credit of account 41 to the debit of account 94 “Shortages and losses from damage to valuables”; — capitalize goods at the price of possible sale (lower than the actual cost) on the debit of account 41 in correspondence with the credit of account 94; - write off the debit balance of account 94 to other expenses (posting to the debit of account 91 in correspondence with the credit of account 94).

GOODS ARE ACCOUNTED AT SALES PRICES

If the markdown does not exceed the amount of the trade margin, then the accountant makes a reversing entry in the debit of account 41 in correspondence with the credit of account 42 “Trade margin”.

EXAMPLE 2

Let's use the conditions of example 1, but assume that goods are recorded at sales prices.

With this option, the trade accountant needs to make the following entries. In April 2010: DEBIT 41 CREDIT 60

- 190,000 rubles.

(1900 rubles/piece x 100 pieces) - purchased blouses are capitalized; DEBIT 41 CREDIT 42

- 164,000 rub.

((3540 rubles/piece - 1900 rubles/piece) x 100 pieces) - reflects the trade margin on purchased blouses; DEBIT 50 CREDIT 90 subaccount “Revenue”

- 283,200 rubles.

(RUB 3,540/piece x 80 pieces) - revenue from the sale of goods is reflected; DEBIT 90 subaccount “Cost of sales” CREDIT 41

- 283,200 rub.

— sold goods are written off (at sales price); DEBIT 90 subaccount “Cost of sales” CREDIT 42

- 131,200 rub.

((3540 rubles/piece - 1900 rubles/piece) x 80 pieces) - the trade margin on goods sold has been reversed; DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “Calculations for VAT”

- 43,200 rubles.

— VAT is charged on goods sold. In June 2010: DEBIT 41 CREDIT 42

- 23,600 rubles.

((3540 rub/piece - 2360 rub/piece) x 20 pieces) - the trade margin on the remaining blouses when they are marked down has been reversed (reduced); DEBIT 50 CREDIT 90 subaccount “Revenue”

- 4720 rub.

(RUB 2,360/piece x 2 pieces) - revenue from the sale of discounted blouses is reflected (at the new selling price); DEBIT 90 subaccount “Cost of sales” CREDIT 41

- 4720 rub.

— sold goods are written off (at sales price); DEBIT 90 subaccount “Cost of sales” CREDIT 42

- 920 rub.

((2360 rubles/piece - 1900 rubles/piece) x 2 pieces) - the realized trade margin was reversed; DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “Calculations for VAT”

- 720 rubles.

— VAT is charged on goods sold. If the amount of the markdown exceeds the trade margin (that is, the selling price of the goods becomes lower than their actual cost), then you first need to reverse the entire amount of the trade margin: DEBIT 41 CREDIT 42

- the trade margin on discounted goods is reversed.

Further, we believe that an accountant can apply a technique that allows one to avoid using account 14. The fact is that the idea of valuing goods at sales prices is as follows: the balance of account 41 should always correspond to the value of the balance of goods at sales prices. And this is impossible if the accountant does not write off the remaining amount of the markdown (above the previously applied markup). Therefore, from our point of view, the difference between the actual cost of goods and their new sales value must be shown as follows: DEBIT 91 subaccount “Other expenses” CREDIT 41

- reflects the markdown of goods in excess of the trade margin. If we approach the situation formally, such an entry violates the requirements of paragraph 12 of PBU 5/01 (prohibiting changes in the actual cost of goods). However, if the established accounting rules do not reliably reflect the property status and financial results of the organization, the accountant may not apply these rules with appropriate justification. This conclusion follows from paragraph 4 of Article 13 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. Therefore, this option for reflecting transactions must be provided for in the accounting policies of a trading company. And also subsequently disclose this fact in an explanatory note when preparing annual reports.

Features of tax accounting

In tax accounting there are no concepts of “trade margin”, “accounting for goods at sales value”, “markdown of goods”.

HOW THE FINANCIAL RESULT IS FORMED

Trading companies determine the financial result (profit or loss) according to the universal rule set forth in subparagraph 3 of paragraph 1 of Article 268 of the Tax Code of the Russian Federation. Namely: when selling purchased goods, income from the sale is reduced by the cost of their acquisition (determined by one of the four permitted valuation methods), as well as by the amount of expenses directly related to the sale. This means that if a product was discounted, but its sale price still remained higher than the purchase price, a profit from the sale will be generated in tax accounting. If, as a result of the markdown, the selling price of the goods has become lower than the amount of expenses for its acquisition, then the company receives a loss. It is recognized in tax accounting in accordance with paragraph 2 of Article 268 of the Tax Code of the Russian Federation.

MARKET PRICES FOR GOODS

We must not forget about the provisions of Article 40 of the Tax Code of the Russian Federation. Thus, if the actual price deviates from the price level used by the company for identical (homogeneous) goods by more than 20 percent, controllers have the right to charge additional taxes. They will calculate them based on market prices. However, this does not mean that the tax authorities will be able to make additional assessments in any case (it may turn out that the actual prices that the company uses correspond to market prices). Indeed, paragraph 3 of Article 40 of the Tax Code of the Russian Federation specifies that when determining the market price, discounts caused by: seasonal and other fluctuations in consumer demand for goods must be taken into account; loss of quality or other consumer properties of goods; expiration (approximation of the expiration date) of the shelf life or sale of goods. All these three factors can be the reason not only for the announcement of sales and discounts on certain goods, but also the basis for their markdown.

What about “input” VAT?

There is no need to restore the “input” tax previously accepted for deduction when marking down goods. If the sales price reduced by the amount of the markdown exceeds the actual cost of goods, then no questions arise at all. But even in cases where the product is ultimately sold at a price lower than its purchase price, the entire amount of “input” tax should be considered legally accepted for deduction. After all, the deduction is made on the basis of the supplier’s invoice when goods are accepted for registration - regardless of the exact price at which this product is subsequently resold to end customers. And among the grounds for VAT restoration (listed in clause 3 of Article 170 of the Tax Code of the Russian Federation), markdown of goods (sale below the purchase price) does not appear.

The article was published in the journal “Accounting in Trade” No. 6, June 2010.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Rules and procedure for drawing up a depreciation act

The act is drawn up by the financially responsible person in the presence of a specially created commission in two copies. One of them is transferred to the accounting department, so it must be supported by inventory documentation.

The financially responsible person in charge of the markdown procedure keeps the second copy.

In this case, both copies must first be completed by the organization’s management.

Important ! It is necessary to mark down a product before it is sold at a reduced price, and not after that.

What is an act of damage

This is a document recording the fact of damage to goods as a result of careless handling of the property of the enterprise. At the same time, in the process of drawing up the document, the reasons that led to the damage do not play a role.

Such a document is drawn up in various situations:

- As a result of damage, dents, cracks and breakages;

- The occurrence of damage as a result of flooding of the premises when office furniture is damaged;

- The occurrence of damage as a result of careless intentional or accidental handling of the employee’s property.

A document is required for official written confirmation of property damage. In addition, this document is the basis for applying penalties to the culprit of the incident.

When and by whom is the document generated?

An act is drawn up upon the occurrence of damage by the responsible person who is charged with such actions. In addition, there must be a person as a witness to the fact of the occurrence of damage, as well as a specialist who can confirm the extent of damage to the mechanism.

It follows that the document is prepared by an authorized commission at the time of damage.

Form, structure and highlights

The paper does not have a unified form, so the enterprise has the right to draw it up according to the chosen sample, and it is necessary that when forming it the following structure is observed:

- The header of the document is the date and place of preparation, the number and title of the act, the details of the enterprise.

- The main part is the essence of the damage caused, its nature, as well as the number and name of the damaged values, the approximate amount of damage:

- When creating a document for several types of property, it is better to use a table;

- In addition, it is necessary to indicate information about the culprit of the incident, his data, position, information about the cause of the damage;

- If there is no specific person who caused the damage, this fact must be indicated.

- Next, you should indicate the commission’s conclusions and recommendations.

- If supporting documents exist, their availability must be indicated.

- The document must contain the signatures of the originator, the participants in the process and the culprit; if you refuse to sign, you must draw up an act to this effect.

This is interesting: How to organize a pawnshop business: drawing up a competent business plan

Form for property damage report.

It is permissible to form a document on a blank sheet of paper or company letterhead, then there is no need to form a header, fill it out by hand with a ballpoint pen, or create it on a computer.

The procedure for marking down goods when a defect is discovered.

The document is drawn up in 2 copies, one is intended for accounting, since the damage needs to be written off, and the second is handed over to the person responsible for the incident.

If private property is damaged, the act is formed in the same order and under the same circumstances, with representatives of the housing and communal services or the Ministry of Emergency Situations acting as a commission.

Important: drawing up must take place within the first 12 hours after the flooding; if authorized persons do not appear during this period, you must draw up the document yourself in the presence of neighbors and the person at fault.