In the process of carrying out their activities, companies carry out transactions with liquid assets not only in national, but also in banknotes of foreign countries. In the latter case, it is necessary to take into account all the specifics of such transactions and comply with the norms of current legislation.

Within the framework of this topic, we will talk about what should be understood as transactions in the currencies of other countries, how account 52 works, what standard accounting entries are entered, and also consider one example of reflecting transactions for a designated position.

The essence and definition of transactions in foreign currency

In order to separate the company's funds, expressed in national and foreign banknotes, it is necessary to open appropriate accounts in the so-called authorized commercial banks. All transactions on these accounts will be reflected by the accounting service in 52 positions, which will be discussed further.

If we try to define the concept of “currency transactions,” then they should be understood as actions aimed at fulfilling or otherwise terminating obligations expressed in the currency of another state, as well as using the currency of another state as a means of payment.

Such transactions include:

- actions for the purchase and sale of banknotes of other states;

- use of foreign banknotes as a means of payment;

- fulfillment of foreign economic obligations in Russian rubles;

- import and export of foreign banknotes.

Such transactions occur:

- in case of conversion of monetary resources from one currency to another by business entities and citizens;

- when using foreign banknotes for making payments on the international market.

There are a lot of regulatory documents adopted at different levels of government that regulate the procedure for conducting transactions in foreign currency on the territory of the Russian Federation. One of the key documents in this area is the national law “On Currency Regulation and Control”.

There are a lot of criteria that allow you to classify such operations. If we take the object as a basis, we can distinguish transactions in the national currency of the Russian Federation and foreign currency, as well as transactions with national and foreign securities.

Based on the subjects of this type of transaction, transactions are divided into transactions between residents and non-residents of the Russian Federation.

If we talk about control over transactions with foreign banknotes, it is carried out by agents and government bodies, including the Russian Central Bank and the Ministry of Finance.

As for the accounting of assets and liabilities denominated in foreign currency, this procedure is reflected in a special Regulation approved by the relevant order of the national Ministry of Finance.

Writing off accounts receivable in accounting

In what cases can you write off

Accounting establishes only one explicit criterion for writing off receivables - the expiration of the statute of limitations (clause 77 of order No. 34n dated July 29, 1998). But Order No. 34n allows you to write off other debts that are unrealistic for collection for accounting purposes.

To avoid deviations between the two types of accounting, establish in your accounting policies the same rules for writing off bad receivables that are provided for tax accounting in clause 2 of Art. 266 Tax Code of the Russian Federation.

The procedure for reflecting entries on account 52

Position 50 in the Chart of Accounts exists to summarize information about the availability and movement of monetary resources in foreign currency in the relevant company accounts opened with banks, both on Russian territory and abroad.

The specified position is active. Its debit part shows the funds received into the foreign currency accounts of the business entity. For a loan, you can see the write-off of foreign currency resources from the organization’s accounts.

The company reflects transactions on foreign currency accounts in its accounting on the basis of bank statements and monetary settlement documents attached to them.

In this case, analytics is carried out for each currency account.

Specifics of application of account 52 “Currency accounts”

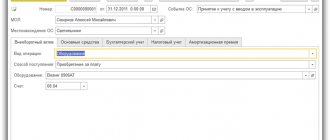

Account 52 - Currency accounts The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) is intended to reflect accounting transactions with non-cash foreign currency funds.

Read about the Chart of Accounts in the article.

Current accounts on which such transactions are carried out can be opened in both Russian and foreign banks. This circumstance determines the allocation of two sub-accounts on account 52, intended for accounting for funds in banks:

- Russian - subaccount 52-1;

- foreign - subaccount 52-2.

The Guide to ConsultantPlus describes in detail the specifics of accounting for foreign currency transactions. If you do not have access to the K+ system, get a trial online access for free.

Just as for ruble accounts, for foreign currency accounts reflected in accounting account 52, the following are required:

- organization of separate analytics not only for banks, but also for each account opened in this bank;

- using bank statements and payment documents attached to them as a basis for carrying out an operation.

Features of accounting on account 52 are due to the fact that:

- a foreign currency account opened in a Russian bank is actually represented by two accounts: transit (in which the funds are kept until the recipient submits documents identifying the payment to the credit institution) and current;

- According to accounting rules, accounting transactions must be reflected in ruble equivalent, and this requires: keeping records in parallel in two currencies (foreign and rubles);

- mandatory recalculation of currency balances on the date of the transaction and on the reporting date;

At the same time, you should remember that there is a ban (clause 1 of Article 9 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ) on carrying out currency transactions between residents of the Russian Federation (with some exceptions). However, this does not mean that account 52 will show only settlements with non-residents and the results of recalculation of the ruble equivalent of foreign currency amounts.

Read about the rules that govern currency transactions in the Russian Federation in the publication “Currency transactions: concept, types, classifications.”

Typical wiring

Typical transactions showing the availability and movement of funds in the company’s foreign currency accounts look like this:

1) Dt 52

Kt 50 – crediting cash in foreign currency to a transit bank account;

2) Dt 52

Kt 51 – conversion of funds into foreign banknotes and their crediting;

3) Dt 52

Kt 55 – transfer of foreign banknotes from a special account to a foreign currency account;

4) Dt 52

Kt 60 – return of advance funds to the company’s foreign currency account;

5) Dt 52

Kt 62 – crediting to the transit account of proceeds for shipped products under an export contract;

6) Dt 52

Kt 67 – crediting a long-term loan or loan to the company’s foreign currency account.

Posting examples

Here are typical transactions for account 52.

The receipt of non-cash foreign currency, depending on the source of funds, can be reflected as follows (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Dt 52 – Kt:

- 62 “Settlements with buyers and customers”;

- 60 “Settlements with suppliers and contractors”;

- 57 “Translations on the way”;

- 66 “Calculations for short-term loans and borrowings”, etc.

Accordingly, the withdrawal of money from account 52 is recorded with the following entries:

Dt 60/62/66/57, etc. – Kt 52

Accounting is kept in rubles, so foreign exchange transactions are reflected simultaneously in the currency of settlements and in rubles (clause 20 of PBU 3/2006). In this case, the recalculation is done at the rate of the Central Bank of the Russian Federation on the date of the operation (clause 5 of PBU 3/2006). In addition, foreign currency account balances are recalculated at the end of each month (clause 7 of PBU 3/2006).

As a result of recalculation, exchange rate differences arise. They are reflected like this:

Dt 52 – Kt 91 “Other income and expenses”

Or

Dt 91 – Kt 52

In the balance sheet, the ruble debit balance of account 52, recalculated at the Bank of Russia exchange rate as of the reporting date, is reflected in line 1250 “Cash and cash equivalents” (Order of the Ministry of Finance dated July 2, 2010 No. 66n).

Case Study

Let's imagine that a certain company received foreign exchange earnings in the amount of $13,000.0. In addition, one of the founders made a contribution to the authorized capital, the amount of which amounted to USD 7,000.0.

At the time of crediting resources, the rate was 55.0 rubles per 1 US dollar. Then the company decided to sell $3,500.0. At the time of withdrawal of funds from the account, the rate rose to 57.0 rubles, and upon sale it was equal to 56.0 rubles. For the transactions performed, the bank's commission amounted to 50.0 US dollars.

In this situation, the accounting department made the following entries:

1) Dt 52

Kt 62 – 13,000.0 US dollars / 715,000.0 rubles, crediting of funds;

2) Dt 52

Kt 75 – 7,000.0 US dollars / 385,000.0 rubles, founder’s contribution;

3) Dt 57

Kt 52 – USD 3,500.0 / RUR 199,500.0, sale of foreign currency;

4) Dt 92

Kt 52 – USD 3,500.0 / RUB 196,000.0, sale of foreign currency;

5) Dt 51

Kt 91 - 3,500.0 US dollars / 196,000.0 rubles, crediting funds from the sale of currency;

6) Dt 91

Kt 52 – 50.0 US dollars / 2,850.0 rubles, service fee written off;

7) Dt 91

Kt 57 – RUB 3,500.0, taking into account exchange rate differences.

Accounting for currency transactions on account 52 using an example with postings

Let's consider an example of selling foreign currency.

Let’s say that VESNA LLC, as of January 9, 2017, has 2,000.00 US dollars in its current currency account, purchased on December 27, 2016. On 01/09/2017, the organization instructed the authorized bank to sell 1,000.00 US dollars. On January 10, 2017, the bank bought US dollars at the rate of 57.00 rubles per US dollar and transferred the proceeds from the sale of foreign currency to the organization.

The dollar exchange rate set by the Central Bank of the Russian Federation was:

- as of December 27, 2016 – 60.9084 rubles per US dollar;

- as of 01/09/2017 – 60.6569 rubles per US dollar;

- as of January 10, 2017 – 59.8961 rubles per US dollar.

To reflect the currency transaction in accounting, the following entries were generated:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 57.22 | 52 | 60 656,90 | Listed foreign currency for sale (USD 1,000.00 * 60.6569) | Application for the sale of foreign currency. Bank statement. |

| 91.02 | 52 | 251,50 | The exchange rate difference is reflected (USD 1,000.00 * (60.9084 – 60.6569)) | |

| 91.01 | 57.22 | 760,80 | The amount of currency revaluation is reflected (USD 1,000.00 * (60.6569 – 59.8961)) | Bank statement. |

| 51 | 91.01 | 57 000,00 | Proceeds from the sale of foreign currency were credited to the current account (USD 1,000.00 * 57.00) | |

| 91.02 | 51 | 59 896,10 | The value of the sold currency is reflected on the date of write-off (USD 1,000.00 * 59.8961) | |

| 91.02 | 57.22 | 2 896,10 | The difference between the exchange rate for selling currency to the bank and the Central Bank rate is reflected (59,896.10 - 57,000.00) | |

| — | NOT.04 | 57 000,00 | Reflected revenue from the sale of currency | |

| HE.01.9 | — | 60 656,90 | The value of the sold currency is reflected at the exchange rate on the date of write-off |

Score 91

Lesson Topic 91 Account “Other income and expenses”

The debit of the account reflects other expenses. Other income is reflected on the loan.

Sub-accounts can be opened to account 91 “Other income and expenses”:

91-1 “Other income” - Income is reflected in this subaccount.

91-2 “Other expenses” - Expenses are reflected in this subaccount.

91-9 “Balance of other income and expenses” - This sub-account is needed to calculate profit or loss from other activities.

In short, this account is used to record income and expenses not related to core activities.

Analytical accounting for account 91 “Other income and expenses” is carried out for each type of other income and expenses. At the same time, the construction of analytical accounting for other income and expenses related to the same financial and business transaction should ensure the ability to identify the financial result for each operation

Account 91 reflects income and expenses not related to the normal activities of the organization:

- Interest payable and interest receivable.

- Fines to be received and paid.

- Rental income (If the main activity is not rental).

- Income and expenses from disposal of fixed assets.

- Dividends receivable.

Let's look at standard wiring:

- Debit 76 Credit 91-5000 rub. -Income from rental property is reflected.

- Debit 91 Credit 02.10-3200 rub. -Reflects the costs of leasing the fixed asset.

- Debit 91 Credit 52- 1500 rub. A negative exchange rate difference in the foreign currency account is reflected.

- Debit 52 Credit 91- 3000 rub. A positive exchange rate difference in the foreign currency account is reflected.

- Debit 91 Credit 10 -1500 Actual cost of materials sold written off

- Debit 62.76 Credit 91- 15,000 rub. Reflects revenue from services and works sold that are not the main activities of the enterprise.

- Debit 91/09 Credit 99 16800 rub. -(All credit amounts - All debit amounts) Profit from other activities is calculated and reflected. If the amount turns out to be - (Minus) then it is a loss.

Account 91 is very similar to account 90 “Sales”, if you understand account 90, then it will not be difficult to understand account 91. (Read account 90 in my previous lessons)

Let's consider the counting scheme (airplane) for count 91 using the previous examples:

Account 91, No balance at the end of the period. Expenses and VAT are reflected in Debit. Income is reflected in Credit. The revolutions are counted in the same way as in the count of 90.

To summarize: account 91 is intended to account for the process of selling property and services, which is not the main one. Data on account 91 is reflected in the statement of financial results in the lines of other income, expenses, interest receivable, interest payable.