Material write-off act: right or obligation

Federal Law No. 402-FZ (“On Accounting”) requires that all operations of a business entity be documented with appropriate primary documents. And the act of writing off materials

is just one of these documents. However, it is not always drawn up: in accordance with the order of the Ministry of Finance No. 119N dated December 28, 2001. the act in question is generated if, when releasing materials from a conditional (or real) warehouse, the purpose is not indicated.

On the other hand, the write-off act is documentary evidence of a decrease in taxable profit. Therefore, it is unlikely that the Federal Tax Service will allow such an act to be drawn up at the first opportunity. According to paragraph 98 of the methodological instructions of the same Ministry of Finance, the procedure for drawing up a write-off act is determined by the accounting policy of the organization itself and is approved by order of the head. The act must indicate:

- name of goods and materials;

- quantity;

- unit price and cost of each item.

Business entities, as a rule, issue write-off acts once a month. But Federal Tax Service specialists sometimes disagree with this, and they have to defend their case in court.

That is why the 1C:Accounting 8 software package has a different practice - a write-off act is drawn up for each inventory disposal act. This approach avoids litigation.

Let's look at this document in more detail.

Algorithm for writing off goods in 1C

1. One way is to draw up an act in the form TORG-16 “Act on write-off of goods.” 2. In accounting, an initial write-off should be made and reflected in account 94 “Shortages and losses from damage to valuables.” 3. After this, determine the reasons and those responsible (if any). These results determine which accounting accounts to assign costs to: 20 “Main production”; 25 “General production expenses”; 26 “General business expenses”; 44 “Sales expenses”, when the write-off amount does not exceed the limits of natural loss, or is included in other expenses of the organization; 91.02 “Other expenses” when the shortage occurred due to theft and the culprit was identified; 73.02 “Calculations for compensation for material damage” - write-offs are made to this account if the costs were assigned to the person responsible for the shortage. In PP 1C, goods are written off automatically; registration takes place according to the document of the same name in the “Warehouse” section. You will have to fill in the required data manually, or using the “Inventory” document located in the same “Warehouse” block. If the organization has undergone an inventory, then its results must be documented in the “Inventory” document.

You must select a warehouse and indicate the responsible person. It is not difficult to create an inventory commission and fill out the necessary columns from the directory of individuals. If you need to print out the inventory list on paper, you must enter the time during which the inventory took place, as well as the basis document and reason. “Inventory of goods” is filled out based on the data on the balances of goods in the warehouse that are registered in accounting. The quantity and amount of goods, actual and accounting, will match automatically. If the actual data is changed, the result will be a variance. When there is a negative value in the “Deviation” column, this is an indicator that the actual amount/quantity is less, therefore, it is necessary to write off. This is the process of writing off goods. Based on the “Inventory” data, a “Write-off of goods” is generated, information is entered into the table automatically.

When the write-off has taken place, we recommend checking the generated transactions. The posting should be visible to the debit of account 94 and the credit of the goods or material accounting account. It is also necessary to check whether the accounting record has been formed in terms of quantity and amount. Now from the section “Write-off of goods” you can print the finished Write-off Act, form TORG-16.

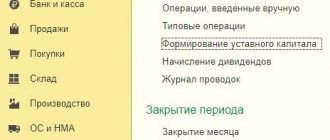

Let us repeat that as soon as the organization has decided on the reasons for the write-off, the shortage (which is duly registered) is written off to the expense account, at the expense of the person at fault, or to other expenses of the organization. In PP 1C itself, everything is registered using the “Operation entered manually” from the “Operations” section. To check whether the write-off of goods is reflected correctly, you should create a balance sheet. After reconciling the balances on the goods accounting account, close account 94.

This is what writing off a product looks like in practice. Everything is quite clear and you can figure it out on your own, but if you have any questions, contact MasterSoft!

Act on write-off of materials in 1C form

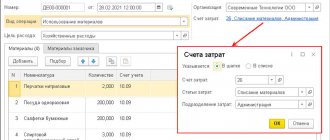

In the “1C: Accounting 8” software package, the document in question is named in the menu as “Requirement-invoice” and can be found in the root directory “Warehouse” or “Production”.

Before the corresponding form was approved by the Ministry of Finance, users were forced to work with a non-unified (non-standardized) form, manually transferring data from other sources there.

However, these documents are not enough. And before the introduction of the new functionality, users had to additionally fill out an act for writing off materials: manually copy the data into the appropriate non-unified form. Starting from version 3.0.69 in 1C:Accounting 8, a printed form of the act for writing off materials (proposed) is available from the document Requirement-invoice (button Print - Act for writing off materials)

Taking into account the fact that the form of the act for writing off materials must be approved by the head of the enterprise, it is included in the list of accounting policy documents (Menu: Main - Accounting Policy - Print). To approve the form of the document in question, you can either print out the corresponding order on changes in the accounting policy and a set of appendices to it, or issue a separate order to include the act in question in the list of documents being generated.

Directions for spending goods and materials

Paragraph 2, Article 9 of Law No. 402-FZ states that the mandatory details and data that the primary document must contain include:

- number and date;

- information about the business entity (in particular, its tax identification number and address);

- indicator of natural measurement of the fact of economic activity (it is necessary to indicate the units of measurement);

- cost expression of the fact of economic activity for each of their positions.

However, the “Request-Invoice” document also contains the “Purpose of Expense” field, which is required to be filled out (because without this, the document will not be created and cannot be sent for printing). Law No. 402-FZ does not say anything about this column and there are no requirements for filling it out.

However, there is a reference to the fact of the use of inventory items. In the same order of the Ministry of Finance No. 119N dated December 28, 2001. It is noted that the goals and objectives of a business transaction when it is carried out and accepted for accounting must be clear and economically justified.

By the way, the lack of economic significance of a transaction is one of the reasons for blocking a transaction on a bank account in accordance with Law No. 115-FZ. (This is a direct analogy).

In this regard, filling out the “Purposes of the operation” field is not only advisable, but also mandatory, if we take into account that writing off inventory items from the warehouse entails a reduction in the income tax base.

Example: let’s say an organization carries out repair and construction work. If a significant amount of inventory and materials are written off from the warehouse without indicating what exactly they were spent on (indication of the object, etc.), then when checking financial and economic activities by the Federal Tax Service, impersonal inventory items that are not assigned to specific projects may be recognized as unlawfully reducing the basis for income tax. The tax amount may be recalculated, and penalties will be imposed on the taxpayer.

The meaning of the column “Purpose of expense” is to get rid of impersonality in any of its manifestations: it is very simple to draw up “inappropriate” documents for the supposed acquisition of goods and materials, and then write them off beautifully and “correctly” according to the act. However, if these “left” write-offs relate to a specific object, then it will be possible to very simply check and make sure that no costs were incurred. If the purpose is not specified, then such write-offs can be “spread” throughout the entire financial and economic activity of the enterprise. This is the reason for the presence of this field.

Example: when considering a dispute on this topic in court between the Federal Tax Service and a business entity, the latter lost and was forced to assess additional income tax (Resolution 15 of the Arbitration Court of Appeal dated 05/07/2009 No. 15AP-1477/2009 in case No. A53-19371/2008) .

Write-off of materials to an off-balance sheet account

An organization can take into account not only other people's material assets on its balance sheet, but also its own. An example would be low-value property, household supplies and inventory that are used for more than 1 year, costing less than the limit for accepting an object for accounting as fixed assets (the organization sets this limit independently in its accounting policy, but it cannot be more than 40,000 rubles in accordance with p. 5 PBU 6/01).

ATTENTION! From 2022, PBU 6/01 will no longer be used. It will be replaced by FSBU 6/2020, according to which the taxpayer will be able to set the accounting limit independently. It is possible to apply the Federal Accounting Standards already now, having consolidated new provisions in the accounting policies.

Find out what else will change in asset accounting in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

If the service life of the OS for any reason is less than 12 months, it is taken into account in inventories (clause 3 of FSBU 5/2019). Such inventory items are accepted for accounting at actual cost, which recognizes the amount of the organization's actual costs for the acquisition, with the exception of refundable taxes. The actual cost also includes an estimated liability for the estimated costs of disposal of material assets (clauses 9 - 12 of FSBU 5/2019).

Such materials are written off as expenses at a time. But due to the long period of use, it is necessary to organize control over their safety (clause 8 of FSBU 5/2019). For this purpose, you can create a list of household supplies and equipment in use, or you can keep off-balance sheet accounting. In the Chart of Accounts, approved. By order No. 94n, there is no special account for these purposes, so the organization can develop an off-balance sheet account independently and approve the chosen procedure for writing off low-value materials in the accounting policy.

If you use the 1C:Enterprise computer program for accounting, then in the chart of accounts of this program, special off-balance sheet accounts are provided for accounting for low-value materials written off the balance sheet:

If the company decides to take into account the low value off the balance sheet, then the postings will be as follows:

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 29, 44 | 10 | Released from inventory warehouse |

| Off-balance sheet account “Inventory and household supplies” | Inventory and materials transferred into operation are registered | |

| Off-balance sheet account “Inventory and household supplies” | Inventory written off |

Such inventory items are written off from the off-balance sheet account:

- after they are completely worn out, an MB-8 act or another document is drawn up, developed taking into account the requirements for mandatory details (clause 2 of article 9 of law No. 402-FZ);

- sale, gratuitous transfer and other disposal.

Valuation of goods and materials

The acquisition of inventory items is always associated with their clear assessment - the value indicated in the invoice is taken into account. But after the goods are already stored in a warehouse (including in a conditional warehouse), its value may change. With the regular purchase of homogeneous goods and materials, it becomes very difficult to understand which materials from which particular batch are being consumed at the moment. Therefore, modern Russian accounting provides 2 ways to form the cost of accounting for goods in a warehouse:

- by average (weighted);

- FIFO (first-in-first-out).

In the case of accounting at average cost, the write-off act indicates the price that is the current average. That is, if after write-off this product was purchased again at some new price, then its average cost will change.

The FIFO method implies that, first of all, those goods that were purchased earlier are written off (with a guide to the chronology of processing invoices). In this case, when writing off the same item, the act may contain several expense items at once - each with its own price.

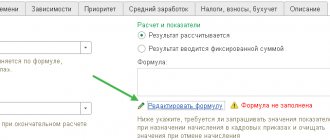

In the 1C:Accounting 8 software package, the method of accounting for valuables in a warehouse is determined in the “Accounting Policy” register. And then the price values for written-off inventory items will be entered into the act form automatically. However, when selecting the “average” rating, additional clarifying settings will be required:

- The “Calculations” option is set to the “When posting documents” position.

The average price in this case is determined by the moving average (cost) at the time the act is formed.

- The “Calculations” option is set to “When closing the month”.

The average price here is set discretely at the end of the month. And the average price indicator is adjusted to the weighted average.

And of course, you should not be surprised that the prices indicated in the write-off act at the average cost may differ from the actual prices for the purchase of inventory items.

Writing off software in accounting: acquiring exclusive rights

If a company has acquired exclusive rights to use software, then the program is usually recognized as an intangible asset. In this case, the asset is recorded on the account. 04, its value is written off through depreciation over the period of the useful life established by the company, i.e. the process is essentially similar to the disposal of a fixed asset.

The acquisition of an exclusive right to software is reflected in accounting as follows:

| Operations | D/t | K/t |

| Software costs | 08 | 60 (76) |

| Putting the software into operation | 04 | 08 |

| Writing off the cost of purchasing software through monthly depreciation over its useful life | 20, 25, 26, 44 | 05 |

Example

A company operating on OSNO, in August 2022, under an alienation agreement, acquired exclusive rights to accounting software worth 420,000 rubles, while paying a state fee for registering rights to the software in the amount of 20,000 rubles. The validity period of the exclusive right is 5 years. The method for calculating depreciation of intangible assets is linear.

| Operations | D/t | K/t | Sum |

| Cost of software under contract | 08 | 60 | 420 000 |

| Payment of state duty | 08 | 76 | 20 000 |

| Putting the software into operation | 04 | 08 | 440 000 |

| Monthly depreciation charges from September 2022 to August 2023 (440,000 / 60 months) | 26 | 05 | 7333,33 |

By September 2023, the cost of the software will be completely written off as expenses.

Signing an act for writing off materials in 1C

If you look closely at the essence of such a document as the act of writing off materials, then its high economic significance for the entire financial and economic activity of the enterprise becomes obvious.

Let’s assume this scenario: some dishonest employee of an enterprise’s warehouse can register several “wrong” incoming invoices for goods allegedly shipped by some “one-day” company for pre-delivery. The invoices enter the accounting system, and the company has accounts payable to these “one-day” companies. And then invoices are issued for payment for these supposedly accepted materials, and even if they are not paid, it remains possible to recover payment for them in court.

The only “tail” that definitely needs to be removed (and this is the task of the swindler) is the very presence of purchased materials in the warehouse. After all, there are none, which means that during the same trial his scam will be fully proven. And here write-off acts come to his aid... If only it were possible to sign them so simply.

In addition, write-off is always a decrease in the company’s assets, and this is already reflected in the capital of the entire business. Is it any wonder that in the 1C:Accounting 8 software package increased attention is paid to signing the materials write-off act.

- Signature by a sole entity.

This is, as a rule, an individual entrepreneur - only one signature is required here.

- Signing by the commission.

If such an act is already formed by a legal entity (for example, an LLC), then both the General Director and the chief accountant (and this is a commission) must sign. You will need to fill out the column “Composition of the commission” and its lines “Chairman of the commission” (this is automatically the first line) and “Members of the commission”.

In this case, the full name of the head of the organization and the chief accountant will be automatically entered from the signature card, but all other names will need to be entered manually.

If any of the responsible persons is on vacation, then you will need to generate an order to replace this official with another, transferring all rights to him. Signatures are an important element in drawing up a write-off act, since if such a document is signed by a person who does not have the necessary authority, then the act can be declared invalid, and additional income tax will need to be assessed (with penalties).

However, if it is initially difficult to determine whose names should be on the act, then you can leave this section blank and fill it out manually after printing.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter