Which organizations use the statement?

This type of statement can be used in a variety of institutions: state and non-state. Most often it is used in educational institutions, scientific and medical centers. Sometimes this document can also be found in commercial companies, since it is convenient in that it contains all the necessary information for accounting for a certain group of inventory items.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

What are the conditions for full financial liability?

The employee may be held financially liable for the full amount of damage caused.

It consists in his obligation to compensate the direct actual damage caused to the employer in full. The employee may compensate the employer for the full amount of damage caused, in particular in the following cases:

- if the employee is charged with financial liability in full for damage caused to the employer during the performance of the employee’s job duties;

- shortage of valuables entrusted to the employee on the basis of a special written agreement or received by him under a one-time document;

- intentional infliction of damage.

In order to impose on an employee the obligation to compensate for the damage caused in full, a written agreement on full individual or collective financial responsibility must be concluded with him.

An agreement on full financial liability can be concluded with a cashier, courier, delivery driver, seller, storekeeper and other employee servicing goods.

The online service “Correct Agreement”, which is part of the taker, will help you correctly draw up an agreement with the courier and delivery driver.

With the help of service, you can create your own liability agreement by changing the standard form of the agreement, taking into account the specifics of your activity.

More information about the berator service “Correct Agreement”

But an agreement on full individual or collective financial liability can be concluded not with all employees, but only with those whose positions are indicated in the List of works and categories of employees with whom these agreements can be concluded, approved by Resolution of the Ministry of Labor dated December 31, 2002 No. 85.

Previously on the topic:

The employee caused material damage to the employer: how to recover?

Additional work with financial responsibility: how to apply?

Full financial responsibility during the performance of vacation duties: is it possible?

Liability agreement: when to conclude?

What materials are included in the document

Not all materials used in the activities of the organization are subject to reflection in this type of documentation. Only those items that are used to carry out work to achieve the goals and solve the professional tasks of the institution and whose price per unit does not exceed three thousand rubles should be included here. In particular, these are office supplies (office paper, pens, markers, pencils, hole punches), office equipment, consumables and replacement accessories, etc.

The regulatory legal acts of the institution must necessarily indicate the category of inventory items recorded on the statement, with a detailed description of them.

Write-off procedure

Regardless of the reasons why there is a need to formalize the write-off of materials, you first need to convene a team of specialists who will act as a commission. They will be the ones who will decide whether a write-off is really necessary. The employees responsible for the materials in question must be present here. Often these are financially responsible persons. Often the commission includes heads of structural divisions, accountants and other managers. A specially created group must familiarize itself with the materials, their technical condition, defects, malfunctions and damage. Having recorded all the characteristics, authorized persons sign the act, thereby confirming their consent to write-off.

( Video : “The nuances of writing off materials”)

Quite often in large corporations, the write-off procedure is carried out according to clear instructions that are developed specifically for these purposes. You need to understand that there must be good reasons for writing off materials. Moreover, they must be documented. Without this, the write-off procedure does not even begin. Often additional documents are attached to confirm the need to write off materials:

- Reports on products produced for a specific period;

- Documents confirming the fact of consumption of materials above the planned norm;

- Reports from responsible employees on the use of materials;

- Other accounting and financial documentation.

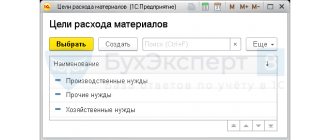

Reasons for writing off materials in the act

After the materials are written off, the financial condition of the company changes. Naturally, such a business transaction must be documented. One of the main points in the drafted act is to indicate the reasons why there was a need to write off materials. Naturally, the reasons must be adequate and compelling:

- transfer to a unit;

- damage to materials;

- the expiration date has expired;

- use of materials for equipment repair;

- sale;

- change in original characteristics.

This is not a complete list of reasons why it may be necessary to prepare this document. Often the reasons are determined by the characteristics of the material. For example, soft materials often fail due to natural wear and tear.

It is also worth noting that the created commission is obliged not only to confirm the legality of the write-off, but also to perform some other work. For example, specialists inspect materials to determine their cost. If they were damaged, the persons responsible for this are identified. Then the specialists must correctly draw up the write-off act and submit it to the head of the organization.

Why do you need a statement?

A statement is a reporting document on the basis of which an organization carries out accounting, write-off of material assets and fixed assets worth up to three thousand rubles.

The main advantage of this document is that its formation does not require convening a special commission (as in the case of writing off goods and materials with a higher value).

The statement itself is not particularly complicated, but, nevertheless, its preparation should be taken extremely carefully and seriously, since during control actions carried out by supervisory authorities, it is such documentation that is checked first. Identification of even the slightest inaccuracies in the completed form in comparison with information from other papers is fraught with the imposition of an administrative fine on management and financially responsible employees.

Statement or act

The write-off of inventory items in organizations of this type can also be formalized by an alternative document - an act on the write-off of inventories, the form of which is also approved by the above-mentioned order of the Ministry of Finance. But unlike a statement, the materials on which are written off at a time, write-offs based on an act require the adoption of an appropriate decision by a special commission.

The act itself, according to the principle of its completion, is similar to the statement for writing off inventory items. But in accordance with the specifics of the document, it additionally contains the conclusion of the commission that makes the decision to write off materiel. It is not the general director who signs the act, but the members of the commission and its chairman.

One way or another, each institution must independently approve the list of cases in which one or another document is used.

Traditionally, such information is fixed in the accounting policies of the organization. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make a statement

The list of issuance of material assets for the needs of the institution refers to the primary documentation used mainly, as mentioned above, in state budgetary organizations. That is why its unified form is used, developed relatively recently - in 2015 (the previously valid form was no longer valid) and filled out in a certain order

The statement can be made in “live” form or in printed form, but in the second case it must be printed (for approval). If the statement is made on paper, the remaining empty lines should be crossed out; if in electronic format, then the empty lines must be deleted (to avoid all kinds of manipulations with the document)

It is formed in one original copy, which is initially compiled in the department for issuing inventory items, and then transferred to the accounting department.

Information about the finished statement must be entered into a special accounting document - a journal, and then handed over to the responsible employee for storage. The storage period for the statement is determined either by the accounting policy of the institution or by the laws governing the creation of this type of documentation. After the statement loses its significance, it can be disposed of (subject to the procedure also established by law).

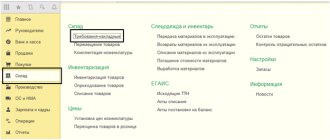

Statement of issue of material assets

The form for the statement of issuance of material assets for the needs of institutions was approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. This form is suitable for cases of transfer of material assets for economic, scientific and educational needs, that is, formally it is an analogue of a demand invoice.

It should also be noted that until 2015, an earlier version of the form was used (the statement of issuance of material assets for the needs of the institution in the previous version was approved by order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n). But in fact, it was no different from the form that is relevant today.

Sample statement

- On the right, at the top of the statement, several lines are reserved for the signature of the head of the institution.

- Below is the date of formation of the statement, the name of the organization (full) and the structural unit in which it was issued.

- Next, enter information about the financially responsible person: it is enough to indicate here his last name, first name and patronymic.

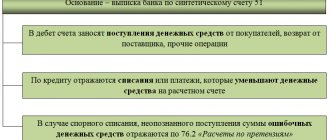

- Then comes the main section. It begins with accounting records of the postings of inventory items entered on the form.

- Below, the chief accountant and the employee who issued the goods and materials according to this statement put their signatures; the document is dated again.

- The second part of the form contains the actual information about inventory items, formatted in the form of a table.

- The full name of the employee who received them is entered in the first column, and he also signs at the end of the corresponding line.

- The vertical columns contain data about the objects to be accounted for (their name and code) and the unit of measurement (also in the form of name and code).

- After the statement is completed, its results are summed up: the issued quantity of each item of materials, as well as their cost per piece and the total cost for all columns.

Filling procedure

Here are step-by-step instructions for filling out the report using the example of a children's institution canteen.

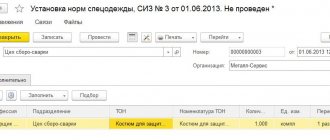

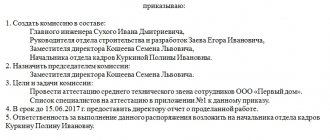

Step 1. Fill in the number and date, name of the organization, structural unit, OKPO code, INN and KPP of the institution, financially responsible person, members of the commission for the receipt and disposal of assets, details of the order on the basis of which the commission operates.

Step 2. The commission, in the presence (in our case) of the canteen manager, checks the condition of the valuables and certifies them with signatures. Makes a decision on the need to exclude from the list of valuables items that do not meet the requirements for them.

Step 3. After all the necessary fields have been formed, the last sheet is filled out with the signature of the chairman and members of the commission. The commission includes the administrative staff of the organization, accounting workers, and other specialists.

Issued in two copies. One of them is transferred to the appropriate service in order to reflect the data in accounting. The second remains with the financially responsible person as a document confirming the disposal of the material.

This is what a sample act for writing off inventory items looks like in 2022: