Is there a special form for the acceptance certificate for completed work, and where can I download it?

The acceptance certificate for completed work is the final document with which the parties to the contract (you can download the 2020 sample for free in this article) approve the completion of the work upon completion.

In addition to the final acts, interim acts can be drawn up. Read about them in the article “Certificate of Interim Acceptance of Completed Work - Sample” .

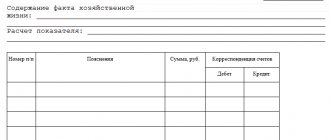

There is no special form for the act of acceptance and transfer of the result of work (with the exception of activities in which it is necessary to draw up an act in the KS-2 form, which we will discuss below). When concluding a contract, the partners (customer and contractor) develop and agree on the form or sample of the work completion certificate themselves. Moreover, it is important for an accountant that it contains those details that are established by law for the primary document. That is, the details from Art. 9 of the law of December 6, 2011 No. 402-FZ. After all, based on the certificate of completion of work, the contractor company will record revenue, and the customer will record expenses. In particular, the acceptance certificate for completed work must contain:

- Name;

- date of compilation;

- name of the person who prepared the document (contractor);

- characteristics of the work, including its types, unit of measurement (if any) and cost indicators;

- positions and signatures of persons carrying out delivery and acceptance.

For more information about correcting primary documents, see the article “How to make corrections to primary documents.”

You can view the acceptance certificate for completed work on our website using the link below:

Sample filling

.

.

The form of the certificate of work performed is not prescribed by law, so an organization can develop its own form to fill out and use.

In order to correctly (and in as much detail as possible) draw up the act, you must indicate the following points:

- The serial number of this document for its registration in the accounting department.

- Date of document creation.

- Number of the contract according to which the work completion certificate is drawn up.

- Deadlines for completing the agreed work.

- Volumes of work performed.

- Total cost of work (including mandatory VAT).

- The invoice number that is provided to the customer to pay for the work (service) performed.

- Full name of the customer and contractor, according to the constituent documents.

- Stamp of the seal of both interested organizations.

- Signatures of the contractor and the customer, or persons authorized to sign.

.

.

When is the KS-2 form applied?

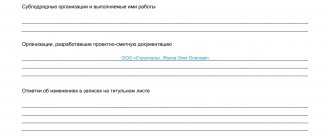

The unified form KS-2 is used in capital construction. The current legislation does not provide for the mandatory use of unified forms, including such documents as the act of acceptance and transfer of the result of work in the KS-2 form. However, in practice, the implementation of construction and installation work for industrial, housing, civil and other purposes is formalized by an act in the KS-2 form, which, if necessary, is modified to suit the needs of the organization. The basis for its preparation is the journal of work performed (form No. KS-6a). And the act itself is used to generate a certificate of the cost of work performed and expenses (form No. KS-3).

A sample act of acceptance of completed work in form KS-2 and explanations for its preparation can be found in the article .

Is it necessary to use forms KS-2 and KS-3 when accepting/transferring repair work performed under a construction contract if a UPD is drawn up? You will find an expert answer to this question in ConsultantPlus. Trial access to the legal system is free.

What is the certificate of services rendered used for?

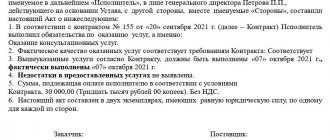

After the supplier has fulfilled its obligations under the contract, the customer accepts the fulfilled obligations under the contract. The customer’s specialists check the delivered volumes with the terms of the government contract and analyze the quality of the services provided. If the services are provided in full and properly, then the parties draw up and sign a certificate of work performed or services rendered.

The act stipulates the deadlines allotted for the completion of work in accordance with the government contract. If the deadlines are violated, then penalties are prescribed; if the services are provided on time, this is noted in the report. This primary register confirms the quality and completeness of the work performed. By preparing the final documentation, the parties agree on the results of the purchase. For example, a signed certificate of completion of work for consulting services means that all obligations under the contract have been fulfilled, the customer has no claims against the supplier, and the supplier has no claims against the customer.

The parties sign the deed document if:

- all conditions stipulated by the order documents and included in the contract are fulfilled in full;

- the contractor delivered, and the customer accepted, the services provided, which are the subject of public procurement;

- the parties have no mutual claims against each other.

ConsultantPlus experts discussed what to do if the customer does not sign the work completion certificate. Use these instructions for free.

If any of these conditions are not met (the services are not provided in full or of inadequate quality), then the customer has the right not to accept the work and not to sign the register. In such situations, a recording document is drawn up, which indicates all items that do not allow acceptance. The protocol also specifies the period within which it is necessary to eliminate the identified violations.

A well-drafted protocol of disagreements is a kind of guarantee for the customer. If the organization applies to the judicial authorities for further proceedings, the record of violations and the unsigned act will become evidence of improper fulfillment of obligations on the part of the supplier.

The form is drawn up in two copies: one copy remains with the customer organization, the other with the supplier.

Where to find a sample contract for 2022

A contract with an individual of the 2022 model (or a civil contract) is quite often used by businessmen if it is necessary to hire an employee to perform a certain amount of work, but there is no need to conclude an employment contract with him.

When concluding a GPC agreement with a “physicist”, do not forget about the risks of his retraining for labor. Explanations from ConsultantPlus experts, for example, an analytical review of recent judicial practice, will help you minimize these risks. If you do not already have access to this legal system, a full access trial is available for free.

Particular attention should be paid when drawing up a contract with a foreign citizen of the 2022 model - it is important to take into account all the nuances. To make the task easier, we present you with a form for such a document.

Look for the nuances of a contract with an individual in the article “Civil contract with an individual.”

Read about the specifics of taxing payments to individuals under contract agreements with insurance premiums in the articles “Contract agreement and insurance premiums: nuances of taxation” and “Insurance premiums under the GPA”.

These types of agreements are also widely in demand among entrepreneurs; you can download samples of them by clicking on the link:

- contract for the provision of services, sample 2022;

- construction contract sample 2022.

Certificate of completed work for individual entrepreneurs without VAT

If a participant in a transaction operates under a taxation system without VAT, this point is specified in the act. Otherwise, the document is no different from the document if an individual entrepreneur pays value added tax.

Important! It is necessary to clarify in the text that the individual entrepreneur operates without VAT, and also in the column where the tax amount is written down, indicate this in one of the following formulations:

without VAT;

NDS is not appearing;

without tax (VAT).

According to the text of the act, in order to avoid questions from tax authorities, other inspection bodies and the customer directly, it is best to clarify on what basis the individual entrepreneur does not pay value added tax.

Results

The acceptance certificate for completed work does not have a legally established form; it can be developed by the organization independently, in compliance with the requirements for primary documents.

In construction, as a work acceptance certificate, as a rule, an act of form KS-2 is used, which, if necessary, includes details to reflect additional information.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rules for drawing up an act

The act of provision of services does not have a standard, unified sample that is mandatory for use, so it can be drawn up in any form, based on the needs of the company, or according to a template developed by the company (if the second option is chosen, then the form of the act must be fixed in the accounting policy of the organization ).

When preparing a document, you must adhere to certain rules and regulations. In particular, the act must include:

- information about both parties to the contract,

- information about the contract under which the work was carried out,

- Services list,

- date

- cost of services provided.

If any additional documents are attached to the act (this can be not only printed papers, but also photographs, checks, receipts, etc.), they must be indicated in a separate paragraph.

Reasoned refusal to sign the work completion certificate

If, upon acceptance of the work, the customer discovers defects or poor-quality execution, a refusal to sign the work completion certificate is drawn up. The refusal must be motivated, otherwise this act will not have legal force, therefore:

- details of the customer and contractor are indicated;

- information about the accepted agreements is written down (subject of the transaction, details of the contract);

- shortcomings and defects, poor quality workmanship are described in detail. To do this, it is recommended to attach photographs, documents evidencing these facts, indicating the losses incurred, etc.;

- links to clauses of the contract that describe the necessary work. Links to legislation, regulations;

- information about the employee or commission who accepted the work.

The sample remains with the compiler, the second copy is sent to the contractor. The refusal is a document independent of the work completion certificate. In the text, it is important to describe everything in detail, otherwise the refusal may be considered unmotivated, and the customer will still have to pay for the contractor’s losses due to the refusal to accept the finished work.

Acts can be drawn up both in printed form and in handwritten form. To do this, simply download and print the papers in Word or Excel format. To create your own samples or use existing ones, download blank templates.

If you have any questions, ask them to the lawyer on duty in the chat.