To maintain the production process, as well as to increase production levels, a retrofitting process is often used. It is aimed at increasing the functionality of the equipment and tools used in the enterprise. In this regard, the topic of the review will be the modernization of fixed assets in accounting and tax accounting. Employees with this aspect often have problematic situations. Sometimes it is difficult to distinguish a process from a banal repair; it is unclear how exactly to reflect the changes made for reporting. But typical errors can be interpreted as data falsification. And raise unpleasant questions from the Federal Tax Service.

In order to prevent such a development of the situation, we will carefully analyze this procedure from all angles and identify additional equipment, as well as make the necessary changes so that you can create the appropriate postings in the system and software used.

If you want to automate your production processes, you will need quality software, which you can find on the Cleverence website.

Normative base

The necessary points to start with are the essence of the concept and the legal regulation of this area. Let's start with the term. The definition of what modernization of a fixed asset is is the retrofitting, modification, reconstruction of the equipment and tools used in the enterprise.

What does this mean? The item must meet several fundamental conditions.

- To be used for commercial purposes. That is, through it the enterprise receives benefits. An object of art, a painting hanging in the hall (even if it is very expensive) is not such. Although it increases the prestige of the organization in the eyes of clients, it serves as a marketing incentive.

- The item is used for its intended purpose in the production cycle. The simplest example is a machine tool, a conveyor, and so on.

- It is owned by an enterprise, a legal entity. Neither leasing, nor renting, nor the personal property of one of the employees is suitable.

- Some conditions also apply to the equipment itself. Its cost and service life. The first is at least 100 thousand rubles. At the same time, accounting entries for the modernization of fixed assets start from 40 thousand. But this amount has weight only for accounting, not for taxation. Service life – at least 12 years. Otherwise, the item may well be part of the working capital if one turnover is delayed for a long time.

Regarding the legal framework: it is logical to assume that such a moment will be regulated by the Tax Code of the Russian Federation, but the main factors are related to specific articles.

- The value expression is described in Art. 257 of the Tax Code of the Russian Federation, and specifically in paragraph 1.

- At 250 st. The Tax Code of the Russian Federation explains how you can correctly assess the value of a fund if it was received free of charge. There are also no records of its acquisition due to errors or other factors.

- In 256 art. describes all the points that are associated with the calculation of depreciation on equipment.

- Article 257 specifically clarifies how the price for tax legislation of an object increases if it is being modified or reconstructed.

Depreciation during modernization

When carrying out modernization with a period of no more than 12 months, calculate depreciation on the fixed asset. If the modernization of a fixed asset takes more than 12 months, then suspend depreciation on it. In this case, resume depreciation after completion of the modernization. This procedure is established in paragraph 23 of PBU 6/01 and paragraph 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: at what point in accounting should you stop and then resume depreciation on a fixed asset transferred for modernization for a period of more than 12 months?

For accounting purposes, the specific moment of termination and resumption of depreciation on fixed assets transferred for modernization for a period of more than 12 months is not established by law. Therefore, the month from which the accrual of depreciation for accounting purposes for such fixed assets stops and resumes must be established independently by the organization. In this case, possible options could be:

- depreciation is suspended from the 1st day of the month in which the fixed asset was transferred for modernization. And it resumes from the 1st day of the month in which the modernization was completed;

- depreciation is suspended from the 1st day of the month following the month in which the fixed asset was transferred for modernization. And it resumes on the 1st day of the month following the month in which the modernization was completed.

The chosen option for suspending and resuming depreciation for accounting purposes for fixed assets modernized for a period of more than 12 months should be reflected in the organization’s accounting policy for accounting purposes.

Advice: in your accounting policy for accounting purposes, establish the same procedure for stopping and resuming depreciation on fixed assets transferred for modernization for a period of more than 12 months, as in tax accounting.

In this case, temporary differences will not arise in the organization’s accounting, leading to the formation of a deferred tax liability.

Tax accounting for fixed assets

The Federal Tax Service is primarily interested in the cost of funds. Therefore, it is worth paying attention to the correctness of the price factor. You should know that this amount includes not only the size of the bonus for the seller. Also with reconstruction, it is aimed at increasing prices. And if the OS has been modernized, the accounting entries must scrupulously reflect this. After all, a situation is often possible in which an object that does not fall under the description of fixed assets, after modification, reaches the required price group.

The total cost takes into account the finances paid for the purchase, and in addition to them, the costs of delivering the object, if they were incurred by the organization. Installation, configuration and bringing into working condition - all these points are also taken into account.

Operating lifespan after upgrading

Modernization can lead to an increase in the useful life of a fixed asset. In this case, for accounting purposes, the remaining useful life of the modernized fixed asset must be revised (clause 20 of PBU 6/01, clause 60 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). This is what the acceptance committee does when accepting a fixed asset from modernization:

- based on the period during which it is planned to use the fixed asset after modernization for management needs, for the production of products (performance of work, provision of services) and other generation of income;

- based on the period after which the fixed asset is expected to be unsuitable for further use (i.e., physically worn out). This takes into account the mode (number of shifts) and negative operating conditions of the fixed asset, as well as the system (frequency) of repairs.

This follows from paragraph 20 of PBU 6/01.

The acceptance committee may indicate that the modernization did not lead to an increase in useful life in the act in form No. OS-3.

The results of reviewing the useful life in connection with the modernization of a fixed asset are formalized by order of the manager.

Situation: how to calculate depreciation in accounting after modernizing a fixed asset?

The procedure for calculating depreciation after modernization of a fixed asset is not defined by accounting legislation. Paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, provides only an example of calculating depreciation charges using the linear method. So, according to the example, with the linear method, the annual amount of depreciation of a fixed asset after modernization is determined in the following order.

Calculate the annual depreciation rate of fixed assets after modernization using the formula:

| Annual depreciation rate for fixed assets after modernization using the linear method | = | 1 | : | Useful life of a fixed asset after modernization, years | × | 100% |

Then calculate the annual depreciation amount. To do this, use the formula:

| Annual depreciation amount of fixed assets after modernization using the straight-line method | = | Annual depreciation rate for fixed assets after modernization using the linear method | × | Residual value of fixed assets taking into account modernization costs |

The amount of depreciation that must be accrued monthly is 1/12 of the annual amount (paragraph 5, clause 19 of PBU 6/01).

An organization has the right to use this method of calculation even if, as a result of modernization, the useful life of a fixed asset has not changed (remained the same). This is explained by the fact that paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, does not contain conditions on the mandatory increase in useful life as a result of modernization. This means that an organization can calculate depreciation based on the residual value of a fixed asset (taking into account its increase by the amount of modernization costs) and its remaining useful life, regardless of whether this period was extended after modernization or not. Similar explanations are given in the letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144.

If an organization uses other methods of calculating depreciation (the reducing balance method, the method of writing off value by the sum of the numbers of years of useful life, the method of writing off value in proportion to the volume of production (work)), then the annual amount of depreciation charges can be determined in the following order:

- similar to the order given in the example for the linear method;

- independently developed by the organization.

The used option for calculating depreciation on fixed assets after modernization should be fixed in the accounting policy of the organization for accounting purposes.

An example of reflecting depreciation on a fixed asset in accounting after its modernization

Alpha LLC repairs medical equipment. In April 2015, the organization modernized its production equipment, which was put into operation in July 2012.

The initial cost of the equipment is 300,000 rubles. The useful life according to accounting data is 10 years. The method of calculating depreciation is linear. As a result of the modernization, the useful life of the facility increased by 1 year.

Before the modernization of the fixed asset, the annual depreciation rate was 10 percent ((1: 10 years) × 100%). The annual depreciation amount was 30,000 rubles. (RUB 300,000 × 10%). The monthly depreciation amount was 2,500 rubles. (RUB 30,000: 12 months).

RUB 59,000 was spent on equipment modernization. The modernization lasted less than 12 months, so depreciation was not suspended. At the time of completion of the modernization, the actual service life of the equipment was 33 months. Its residual value according to accounting data is equal to: 300,000 rubles. – (33 months × 2500 rub./month) = 217,500 rub.

After modernization, the useful life of the fixed asset was increased by 1 year and amounted to 8.25 years (7.25 + 1).

The annual depreciation rate for equipment after modernization was 12.1212 percent ((1: 8.25 years) × 100%).

The annual amount of depreciation is 33,515 rubles. ((RUB 217,500 + RUB 59,000) × 12.1212%).

The monthly depreciation amount is RUB 2,793. (RUB 33,515: 12 months).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

OS repair

Modernization of fixed assets is a detailed and complex procedure, which definitely should not be confused with adjustment. And such an opportunity happens quite often. Let's look at why.

Retrofitting is aimed at improving current equipment. It becomes more functional, more powerful, performs a larger volume of work, begins to operate in previously unsuitable industries, and so on. That is, it has become more profitable, brings in more money, because it produces faster and more volume, and touches on new opportunities.

Repair has no such purpose. It is necessary only to restore lost performance. And the legislation does not provide us with a clear definition of this procedure. At the same time, it is not entirely clear if a part or module of the unit failed and was replaced with a new one, which is younger and more innovative. As a result, he began to work better than ever. What is this? Improvement or repair? After all, the replacement was made only due to the failure of the old module. But it’s impossible to install the same one, or it’s simply illogical, because it’s outdated. It's either not on the market or it's too dysfunctional compared to the new ones.

In this case, is it necessary to modernize fixed assets or is it sufficient to arrange repairs? In fact, this is a flaw. Therefore, it is quite possible to prescribe the adjustment. And what is noteworthy is that the costs incurred in this area will not increase the cost. Which is beneficial for tax reporting for very prosaic reasons.

But getting too carried away with this technique is highly not recommended. Otherwise, Federal Tax Service officers may well perceive criminal intent and classify it as “evasion.”

Modernization and reconstruction of fixed assets

Chapter from the book “Annual Report edited by Vasilyev Yu.A -2006”,

Accounting

From January 1, 2006, the cost of work on modernization and reconstruction of the operating system is taken into account in a new way. So, if before changes were made to the accounting standard for accounting for fixed assets, the organization, at its discretion, increased the initial cost by the amount of improvements, then after the specified date it does not have such a right. Clause 27 of PBU 6/01 establishes that the costs of modernization and reconstruction of an OS facility after their completion increase the initial cost of such an object if, as a result of modernization and reconstruction, the initially adopted standard performance indicators improve (increase) (useful life, power, quality of use and etc.) OS object.

Clause 20 of PBU 6/01 determines that the useful life (SPI) of a modernized (reconstructed) fixed asset is either revised or not revised depending on whether the facility’s performance indicators improve or not. If the indicators have improved, then a revision of the SPI of the asset is mandatory. However, this does not mean that the organization is obliged to increase this period. As a result of the analysis (revision), the SPI of the modernized (reconstructed) facility may not change, for example, if the purpose of the reconstruction was to significantly increase the capacity of the facility or improve the quality of its use.

Example. The company installed a manipulator on the truck. Due to the fact that after installing the manipulator, the technical characteristics of the car have improved (it has become possible to load and transport large cargo), the costs of installing it are related to retrofitting and increase the initial cost of the car. The installed device does not extend the service life of the vehicle, so in accounting it was decided not to increase its service life .

Tax accounting

For profit tax purposes, as in accounting, an organization increases the initial cost of an asset by the amount of expenses for its modernization (clause 2 of Article 257 of the Tax Code of the Russian Federation ). At the same time, according to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation , a taxpayer has the right to increase the SPI of an asset if, after the reconstruction (modernization) of this asset, its useful life has increased. An increase in the useful life of an asset can be carried out within the time limits established for the depreciation group in which such asset was previously included .

Thus, in both accounting and tax accounting, SPI may or may not increase.

The useful life of the asset has not changed

Accounting. According to the explanations of financiers (see, for example, Letter of the Ministry of Finance of the Russian Federation dated June 23, 2004 No. 07-02-14/144 ) in this case, the annual amount of depreciation charges is recalculated based on the residual value of the object, increased by the costs of modernization and reconstruction, and the remaining SPI. Consequently, in accounting there is an increase in the annual amount of depreciation.

Tax accounting . For tax purposes, depreciation amounts are calculated in accordance with clause 4 of Art. 259 of the Tax Code of the Russian Federation on the basis of the depreciation rate determined for accepting an asset for tax accounting. Consequently, if the SPI does not change, then the depreciation rate remains the same ( letters of the Ministry of Finance of the Russian Federation dated March 2, 2006 No. 03-03-04/1/168 , Federal Tax Service of the Russian Federation dated March 14, 2005 No. 02-1-07/23 ).

With this procedure for calculating depreciation in tax accounting, it is impossible to write off the entire cost of the fixed asset during the remaining fixed income period. Officials point out that in the situation under consideration, the organization continues to charge depreciation and include these amounts in expenses taken into account when calculating income tax until the cost of the fixed assets is completely written off or the object is disposed of from the fixed assets ( letters of the Ministry of Finance of the Russian Federation No. 03-03-04/ 1/168 , dated March 13, 2006 No. 03-03-04/1/216 ).

Please note : the presented position contradicts the Tax Code, according to paragraph 1 of Art. 258 of which, if there is no increase in the useful life of the object, when calculating depreciation, the taxpayer takes into account the remaining useful life. In other words, for such cases, the Tax Code of the Russian Federation prescribes a special procedure, according to which the amount of depreciation charges can be calculated based on the residual value of the object and the remaining SPI. However, such an approach (due to explanations from tax authorities and financiers) will cause disputes with the inspection authorities, so the taxpayer must be prepared for the interpretation of the legislation set out in the mentioned letters.

Example. In January 2006, the company modernized the operating system with a useful life of 180 months.

(15 years). At the time of modernization, the useful life was 132 months. (11 years), the initial cost of the object is 110,000 rubles. Modernization costs amounted to 80,000 rubles. The method of calculating depreciation is linear. The useful life of the facility did not change as a result of modernization. There were no differences in the calculation of depreciation for accounting and tax purposes before modernization. Tax accounting . Since the SPI of the object has not changed after modernization, then, according to the explanations of financiers, given, for example, in Letter dated 03/02/06 No. 03-03-04/1/168 , the depreciation rate for tax purposes has not changed and is 0.555% (1/ 180 months x 100%) ( clause 4 of article 259 of the Tax Code of the Russian Federation ).Before modernization, the monthly amount of depreciation charges was 611 rubles. (RUB 110,000 x 0.555%).

Using the norm of clause 1.1 of Art. 259 of the Tax Code of the Russian Federation , the accountant will immediately include in the expenses of the reporting period 10% of modernization costs in the amount of 8,000 rubles. (RUB 80,000 x 10%), and the remaining RUB 72,000. (80,000 - 8,000) will be attributed to the increase in the initial cost of the operating system, which will be 182,000 rubles. (110,000 + 72,000). Consequently, the monthly amount of depreciation after modernization will be equal to 1,010 rubles. (RUB 182,000 x 0.555%).

Accounting . Before modernization, the monthly amount of depreciation charges was 611 rubles. (RUB 110,000/180 months) ( clause 19 of PBU 6/01 ), that is, it did not differ from the tax one.

In accordance with PBU 6/01, the organization cannot take advantage of the depreciation bonus and is obliged to increase the cost of the object by the entire amount of modernization costs. To calculate the new depreciation amount, the residual value of fixed assets is RUB 80,667. (110,000 rubles - (110,000 rubles/180 months x 48 months)) - we increase by the amount of modernization expenses and at the same time take into account the remaining SPI - 132 months. The new monthly amount of depreciation charges will be 1,217 rubles. ((80,667 + 80,000) rub./132 months).

The period for writing off the cost of fixed assets as tax expenses will be approximately 151 months ((182,000 rubles - 611 rubles x 48 months) / 1,010 rubles), that is, 19 months (151 - 132) more than in accounting.

Since the new monthly depreciation amounts will be different in accounting and tax accounting, temporary differences will arise according to PBU 18/02 .

In accounting, the accountant will reflect these transactions as follows:

Contents of operation Debit Credit Sum, rub.

In January 2006 (in the month of completion of modernization)

The costs of modernization are attributed to the increase in the cost of the fixed asset 01 08 80 000 Deferred tax liability (DTL) has been accrued for the amount of bonus depreciation <*>

(RUB 8,000 x 24%)68 77 1 920 Monthly from February 2006 to January 2017 (during the remaining useful life)

Depreciation calculated according to accounting rules 20, (23, 25, 26, 44) 02 1 217 From February 2006 to March 2009 A decrease in IT is reflected

((1,217 - 1,010) rub. x 24%)77 68 50 In April 2009 The balance of ONO <**> has been repaid 77 68 20 The deferred tax asset (DTA) is reflected

((1,217 - 1,010) x 24% - 20 rubles)09 68 30 From May 2009 to January 2022 OTA was accrued from the difference between accounting and tax depreciation

((1,217 - 1,010) rub. x 24%)09 68 50 Monthly from February 2022 A decrease in IT is reflected

(RUB 1,010 x 24%) <***>68 09 242 <*> Due to the fact that in accounting the costs of bonus depreciation in the amount of 8,000 rubles.

(RUB 80,000 x 10%) are not taken into account, the organization must reflect the taxable temporary difference (RUB 8,000) and the corresponding deferred tax liability (DT). As the taxable temporary difference decreases or is completely repaid (when depreciation is calculated in accounting), IT will be repaid. <**> After 3 years 2 months IT will be repaid in the amount of 1,900 rubles. (50 rubles x 38 months). Next month (April 2009) the organization will write off the remaining 20 rubles. IT, and also recognizes in accounting (due to the excess of accounting depreciation over tax) a deductible temporary difference and the corresponding deferred tax asset (DTA). Further, the amount IT will be 50 rubles.<***> As of February 1, 2022, the amount of IT accounted for in account 09 will be 4,680 rubles. (30 rubles + (50 rubles x 93 months)) and is subject to reduction as depreciation is calculated in tax accounting monthly in the amount of 242 rubles. (RUB 1,010 x 24%).

The useful life of an object of fixed assets has increased.

As already noted, according to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation , you can increase the SPI (within the limits established for the depreciation group in which the object was previously included) of an asset after the date of its commissioning if, after reconstruction (modernization, technical re-equipment) of the asset, an increase in its useful life occurred .

In accounting, in accordance with clause 4 of PBU 6/01 SPI, this is the period during which the use of an asset brings economic benefits (income) to the organization. Paragraph 60 of the Guidelines for accounting for fixed assets provides an example of calculating new depreciation.

In accounting and tax accounting, the new useful life of an object is determined on the basis of Classification of OS No. 1 within the depreciation group to which the fixed asset belongs.

Example. The company modernized a fixed asset with a useful life of 120 months.

(10 years) (sixth depreciation group). By the time of modernization, the SPI was 48 months. (4 years), the initial cost of the object is 110,000 rubles. Modernization costs amounted to 80,000 rubles. The method of calculating depreciation is linear. As a result of modernization, the useful life of the facility was revised and increased to 180 months. (15 years) (within the sixth depreciation group). Tax accounting . The depreciation rate in tax accounting before modernization was 0.833% (1/120 month x 100%), after it was 0.555% (1/180 month x 100%). Before the modernization work was completed, the monthly amount of depreciation charges amounted to 917 rubles. (RUB 110,000 x 0.834%).In accordance with clause 1.1 of Art. 259 of the Tax Code of the Russian Federation 10% of modernization costs in the amount of 8,000 rubles. (RUB 80,000 x 10%) is immediately included in the expenses of the reporting period. For the remaining 72,000 rubles. (80,000 - 8,000) we increase the cost of the OS, which as a result will amount to 182,000 rubles. (110,000 + 72,000). Accordingly, the monthly amount of depreciation charges will be equal to 1,010 rubles. (RUB 182,000 x 0.555%).

Accounting . Before modernization, the monthly amount of depreciation charges was 917 rubles. (110,000 rubles/10 years/12 months), accordingly, the monthly amount of depreciation deductions did not differ from the tax one.

To calculate the new depreciation amount for accounting purposes, we take the residual value of the fixed assets - 44,000 rubles. (RUB 110,000 - (RUB 110,000 /10 years x 6 years)), we increase it by modernization costs and take into account the remainder of the revised useful life - 9 years (15 - 6). The monthly amount of depreciation charges will be 1,148 rubles. ((44,000 + 80,000) rub./9 years/12 months).

1.8.3.

Modernization, reconstruction of fully depreciated fixed assets As indicated by the Ministry of Finance in No. 04-02-05/3/65 dated 04.08.03 , the procedure for calculating depreciation also applies if the reconstruction is carried out on an object with an expired useful life. Accounting rules allow an organization to increase the useful life of an object and charge depreciation on it based on the new useful life, taking into account its increase. Therefore, in order to determine the monthly amount of depreciation, the costs of modernization (reconstruction) must be divided by the new useful life established by the organization independently.

In tax accounting, according to Letter of the Ministry of Finance of the Russian Federation No. 04-02-05/3/65, there are two options for calculating depreciation for a modernized fixed asset, the residual value of which is zero.

First option . The SPI established earlier coincides with the maximum possible useful life. Financiers believe that in this case, a new fixed asset is actually created with changed characteristics, which provide for the establishment of a new useful life, based on the provisions of Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. Moreover, the initial cost in this case is formed from the amounts spent on reconstruction of fixed assets.

In the Letter of the Ministry of Finance of the Russian Federation dated November 1, 2005 No. 03-03-04/1/329, this topic was continued. In it, officials gave a response to the taxpayer’s request, the essence of which is as follows. The company modernized the press, the useful life of which ended in 1987 ( ! ). In this case, the taxpayer writes, according to Letter of the Ministry of Finance of the Russian Federation No. 04-02-05/3/65, a new useful life must be established for the object based on Classification OS No. 1 , that is, 121 months. At the same time, it is known that the object will not last for such a period. How should an organization, for tax purposes, reflect the creation of a new fixed assets object and establish a private property tax taking into account the actual physical condition of the object? Officials pointed to the need to apply OS Classification No. 1 and emphasized that independently, based on the technical conditions and recommendations of manufacturing organizations, the taxpayer can establish SPI only for those types of OS that are not indicated in depreciation groups.

Meanwhile, there are other explanations. Thus, in the Letter of the Ministry of Finance of the Russian Federation dated 03/02/06 No. 03-03-04/1/168, it is recommended to increase the initial cost of the fixed asset for the amount of modernization costs and depreciate it in the future according to the standards that were initially determined when this object was put into operation . In other words, the amount of modernization costs will practically be amortized. A similar position (regarding the procedure for writing off reconstruction costs) is set out in Letter of the Ministry of Finance of the Russian Federation dated March 13, 2006 No. 03-03-04/1/216. In our opinion, the accountant should be guided by these later recommendations from officials.

Second option . The SPI determined earlier is less than the maximum possible useful life established for this depreciation group. In this case, after modernization, the useful life can be increased; accordingly, the monthly depreciation amount will be determined as follows:

(Initial cost of the fixed asset + Modernization costs) / Useful life, taking into account the increase

Example. The LLC modernized an asset included in the fifth depreciation group, for which at the time of its commissioning the useful life was set at 85 months.

Based on Classification of OS No. 1, the fifth depreciation group includes property with a useful life of over 7 to 10 years inclusive, that is, over 84 to 120 months inclusive. Thus, in the event of modernization of this facility, the SPI can be revised, since the maximum possible period of use in this case is 120 months.

Modernization, reconstruction of fixed assets with an initial cost of up to 10,000 rubles

Property with an original cost of less than RUB 10,000. is subject to inclusion in material expenses in full as it is put into operation ( clause 3, clause 1, article 254 of the Tax Code of the Russian Federation ), that is, it does not apply to fixed assets for tax purposes. How to take into account the costs of reconstruction (modernization) of objects worth up to 10,000 rubles in tax accounting? It would seem that if the cost of the object is included in the expenses at a time, then the costs of reconstruction (modernization) can be immediately taken into account as expenses. However, both the Ministry of Finance and the tax authorities propose a different accounting procedure.

The Letter of the Ministry of Finance of the Russian Federation dated 06/09/04 No. 03-02-05/3/50 recommends taking into account the costs of reconstruction (modernization) depending on their size. If the costs of reconstruction (modernization) are less than 10,000 rubles, then these costs are included in the expenses at a time.

If the cost of reconstruction (modernization) is 10,000 rubles. and more, then in this case, according to the Ministry of Finance, in accordance with the requirements of paragraph 1 of Art. 256 and paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, an object of depreciable property is formed with an initial cost equal to the amount of costs for reconstruction (modernization). The Ministry of Finance once again confirmed this point of view in Letter dated 04/05/05 No. 03-03-01-04/1/169 . In accordance with paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, the initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and on other similar grounds. Consequently, if the cost of reconstruction (modernization) amounted to 10,000 rubles. or more, and there is no residual value for tax purposes, then it is necessary to form a new initial cost of the asset, consisting of the costs incurred for reconstruction (modernization). In this case, the SPI of the fixed asset is determined anew in accordance with clause 1 of Art. 258 Tax Code of the Russian Federation .

For accounting purposes, you can act similarly (expenses up to 20,000 rubles are written off at a time, and expenses in an amount exceeding this limit will form the cost of the fixed asset).

Accounting for the costs of preparatory work for the reconstruction of fixed assets

In Letter dated 01.08.06 No. 03-03-04/2/185, the Ministry of Finance indicated that preparatory work for the reconstruction of the OS cannot be taken into account until they are included in the design estimate cost of the reconstruction. If such work requires the conclusion of additional contracts and obtaining separate permits, then the costs for them should be taken into account separately.

See the full contents of the book on the website www.audar-press.ru

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Reconstruction

This concept is understood as a set of measures aimed at changing the technical condition of material assets. And it is also sometimes confused with repair. After all, due to the installation of new elements, it is often similar to the designated term.

The main difference lies on the surface. Reconstruction is carried out only in relation to technically sound working equipment. It turns out to be a fine line. Either simply wait until the equipment you are using breaks down and use repairs, or incur costs by introducing new technologies right away.

In fact, everything is so rosy. There will be no increase in the cost of fixed assets, and there will be no need to make corresponding entries. But a lot of other difficulties will arise. Only the part that has failed can be repaired. This means that a high-quality update of all systems is still not provided. In addition, waiting until the object simply ceases to be serviceable is simply economically unprofitable.

Plus, reconstruction most often refers to major repairs. An example is a change in the number of storeys of a building. And even during the renovation, this will be a combination of two procedures, so you will still have to register. And if you delay the process too much, you can get a serious fine for violating safety conditions.

Modernization

This is the same reconstruction, only based on working with mechanisms. Typically, machines, machines, and production assets fall under this category. And the point of the process is to improve the technical component by replacing elements with newer ones. This is the basis, but no one excludes the possibility of remaking the entire mechanism, and not just replacing elements.

And if we talk about OS modernization, accounting entries record only such a replacement with a high-quality and new analogue.

The law provides for qualitative improvement. Accordingly, replacement with exactly the same element does not apply here. In other words, if you replaced the engine of the machine with the same one that was installed, then the work will change. A new unit will perform better than a worn-out but functional one. But if you replace it with another model, which is decades away from its outdated analogue, then there will be a significant improvement.

Retrofitting

These funds are not reflected in accounting, their residual value is equal to zero. Obviously, when changes are made, their price aspect should increase. This is also provided for by the Tax Code, but only within the depreciation group.

How is equipment modernization reflected in accounting - postings

All of the above costs are accurately reflected in accounting. Let's move on to specifics. By debit, tangible assets are recorded in “investments in non-current assets”. Which is obvious, since we have already indicated that these objects last at least over 12 months. For loans, the list is much longer. “Depreciation of OS” – that goes without saying. But also “settlements with the supplier”. That is, the actual cost of acquisition. And also “materials”, i.e. our new parts and modules. And “settlements with personnel.” After all, the process itself usually costs serious investments. The company's own employees are involved in this or outsourcing comes into play. And at the same time, when the modifications are carried out by your own employees, do not forget about the calculations for “social. provision."

Accounting for modernization costs

The costs of modernizing fixed assets are taken into account in account 08 “Investments in non-current assets” (clause 42 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). To ensure the possibility of obtaining data on types of capital investments, it is advisable to open a subaccount “Modernization Expenses” for account 08.

The costs of modernizing fixed assets using economic methods are:

- from the cost of consumables;

- from employee salaries, deductions from it, etc.

Reflect the costs of carrying out modernization on your own by posting:

Debit 08 subaccount “Modernization expenses” Credit 10 (16, 23, 68, 69, 70...)

– the costs of modernization are taken into account.

If an organization is modernizing fixed assets with the involvement of a contractor, then reflect his remuneration by posting:

Debit 08 subaccount “Modernization expenses” Credit 60

– the costs of modernizing fixed assets carried out by contract are taken into account.

Upon completion of the modernization, the costs recorded on account 08 can be included in the initial cost of the fixed asset or taken into account separately on account 01 (03). This is stated in paragraph 2 of paragraph 42 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

When including the costs of modernization in the initial cost of a fixed asset, make the following entry:

Debit 01 (03) Credit 08 subaccount “Modernization expenses”

– the initial cost of the fixed asset was increased by the amount of modernization costs.

In this case, reflect the costs of modernization in the primary documents for accounting for fixed assets. For example, in an act in form No. OS-3 and in an inventory card for accounting for fixed assets in form No. OS-6 (No. OS-6a) or in an inventory book in form No. OS-6b (intended for small enterprises). This is stated in the instructions approved by the State Statistics Committee of Russia dated January 21, 2003 No. 7. If it is difficult to reflect information about the modernization carried out in the old card, open a new one instead (clause 40 of the Methodological instructions approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

When accounting separately, write off the costs of modernization to a separate subaccount to account 01 (03). For example, subaccount “Expenses for modernization of fixed assets”:

Debit 01 (03) subaccount “Costs on modernization of fixed assets” Credit 08 subaccount “Costs on modernization”

– the costs of modernizing fixed assets are written off to account 01 (03).

In this case, for the amount of expenses incurred, open a separate inventory card, for example, according to form No. OS-6. This is stated in paragraph 2 of paragraph 42 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Dismantling

Modernization of the operating system in accounting (AC) means an increase in its price. And dismantling is a kind of reverse procedure. When one large model is disassembled into its component parts. The reasons are different. But most often it is simply the absence of need. The company may no longer cover some areas, or its target turnover has decreased, and it simply cannot sell the entire volume of products produced.

Separated modules become of little value. Or OS also remain if the original object had a very high cost. But in cases where the price aspect has decreased slightly and the equipment can, in principle, be used for its intended purpose and this is exactly what happens - then its price aspect simply decreases. And accordingly, it is recalculated, the accounting document records this. The original price is reduced to the current price based on market value.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

How to modernize a fixed asset (OS) in 1C 8.3

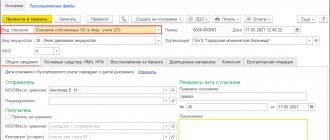

From theory to practice. Now we will look at how the process works using an actual example. First, let's take some basic information. Let's say we need to improve the server to increase data storage capacity, as well as improve the comfort of processing customer requests. And what is important is speed.

For these purposes, first of all, an additional SSD drive is purchased. It also meets the declared speed, and due to its large volume, its market price reaches 36 thousand rubles. Straight depreciation without premiums will be used. Moreover, such a purchase will increase the basic service life of the entire server by 8 months, with the initial one being 48.

Let's see how the costs of modernizing fixed assets will be accounted for; an example will show everything in detail.

Purchasing materials

First, we formalize the purchase itself. And we register it using a regular invoice.

Next, we fill in all the key points of the documentation necessary for further work.

We will need to register the invoice.

We send materials

Now we already have all the resources to start the procedure. But it is necessary to transfer them to the appropriate professionals who will carry out the installation work.

There is no need to register the materials themselves. Based on the information already entered, the column will be filled out without our participation. There is no need to make edits.

And at the final stage of working with the material, we fill out an invoice. Pay attention to the choice of article; in this example, the option is obvious. But there are ambiguous cases when an entire module is supplemented, which itself can serve as a separate OS.

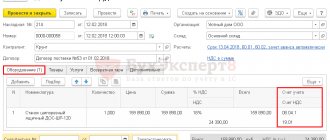

Fixation of works

Now we need to fill out the invoice for the activities of installation professionals. And in the case of a hard drive, in principle, this is not the most voluminous article. But when constructive changes are made to an entire building, the size will be completely different.

We enter information on the current act.

OS price increase

All expenses incurred directly affect the cost factor of the entire server. And this growth is direct; accordingly, we just need to add up all the minuses and add to the total cost.

We also include information about the increase in the final operational life.

Depreciation

It must be remembered that this indicator is included only from the next month. But not after 30 days, but from the first day. Take this aspect into account.

In this case, all the described procedures are performed strictly on 1C 8.3.

Accounting

The costs of modernizing fixed assets change (increase) their initial cost in accounting (clause 14 of PBU 6/01).

The organization is obliged to keep records of fixed assets according to the degree of their use:

- in operation;

- in stock (reserve);

- on modernization, etc.

This is stated in paragraph 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting for fixed assets by degree of use can be carried out with or without reflection on account 01 (03). Thus, during long-term modernization, it is advisable to account for fixed assets in a separate sub-account “Fixed assets for modernization”. This approach is consistent with paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Debit 01 (03) subaccount “Fixed assets for modernization” Credit 01 (03) subaccount “Fixed assets in operation”

– fixed assets were transferred for modernization.

After completing the upgrade, make the following wiring:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 01 (03) subaccount “Fixed assets for modernization”

– a fixed asset adopted from modernization.

See also about entries in accounting for repairs of fixed assets