The environmental fee was introduced by amendments to Federal Law No. 89-FZ of June 24, 1998 back in 2014. The essence of the law is to introduce extended environmental responsibility for manufacturers and importers, in particular responsibility for waste generated from the operation of goods and packaging.

- General information: environmental fee

- List of goods for disposal

- Product disposal standards

- How to recycle?

- What reporting must be submitted by manufacturers and importers of goods?

- Procedure, forms and deadlines for submitting environmental reporting

- How to report for environmental fees?

- Calculation of the amount of environmental fee

- Environmental fee: Where are the funds sent?

General information: environmental fee

Legal entities and individual entrepreneurs producing goods on the territory of Russia and importing goods from third countries or importing goods from EEC member states are required to ensure compliance with the recycling standards established by the Government of the Russian Federation. Manufacturers and importers of goods ensure the disposal of waste from the use of goods themselves by organizing infrastructure for the collection of such goods or by concluding agreements for the disposal of goods with third parties. This standard can be met during the disposal of not only waste generated from a specific product, but also from a group of similar products in accordance with the list of goods.

List of goods for disposal

The list of goods was approved by Order of the Government of the Russian Federation dated December 28, 2017 No. 2970-r (as amended on June 16, 2018) “On approval of the list of goods, packaging of goods subject to disposal after they have lost their consumer properties.” The order consists of sections:

Section I. Goods, with the exception of packaging of goods, subject to disposal after they have lost their consumer properties, including 46 different groups of goods. Section II. Packaging of goods subject to disposal after it has lost its consumer properties, including 8 packaging groups.

Waste disposal - the use of waste for the production of goods (products), performance of work, provision of services, including the reuse of waste, including the reuse of waste for its intended purpose (recycling), their return to the production cycle after appropriate preparation (regeneration), as well as extraction of useful components for their reuse (recovery).

Whether a product belongs to the list of goods subject to disposal is determined by its name (physical and chemical characteristics) according to OK 034-2014 (CPES 2008). A manufacturer or importer can join an association to implement these standards on the basis of an agreement if he does not want or cannot dispose of waste on his own. In the event of non-fulfillment or partial fulfillment by the association of obligations for waste disposal, which were transferred to it by the manufacturer, importer of goods, the obligations are recognized as not transferred to the extent of the obligations not fulfilled by the association, that is, if the association “under-utilized” waste, the manufacturer/importer will be to blame.

Calculation of environmental fee

An example of filling out an environmental fee declaration in the Rosprirodnadzor program

As an example of generating calculations for environmental fees in electronic form, let’s look at how this is organized in the “Nature User Module” program, which can be downloaded for free on the Rosprirodnadzor website.

1. You need to start working with the module in the same way as with other similar programs - by entering data about your company. This is done on the Registry tab.

NOTE! One program can be used for several payers, entering them into the register one by one. Then in the field on the left you will see a list of all enterprises entered into the register, and navigation will also be possible.

2. After entering information about the enterprise, you can begin creating reports. To do this, go to the “Reports” tab and select the desired report. In our case, “Calculation for environmental fee” is the RES icon.

3. The “Title” tab will be filled in automatically with the data entered in the register. Next, in the report form, you need to go to the “Calculation of environmental fee” tab.

4. Entering data into the calculation is available in 2 ways:

- Manually. Then, on the “Calculation of eco-fee” tab, a table is filled in where all types of manufactured (imported) goods subject to disposal are entered (from the drop-down list, according to the lists approved by the Government of the Russian Federation). In addition to the goods themselves, their quantity is also indicated.

- Automatically. This option is preferable if you have already used the program to submit a report on the total number of finished products for the same period (in our case, 2016). Then, by going to the “Calculation” tab, you can immediately click the “Calculate” button in the upper left corner (see Figure 2). The program will automatically transfer data from the report on the number of products to be recycled into the calculation of the eco-fee for them and perform the calculation of the eco-fee.

5. To upload the completed report, on the “Title” tab, check the “Report closed” checkbox. Then, by clicking the “Upload” icon on the top toolbar, you can upload a report file in xml (xms) format.

By the way!

Letter of Rosprirodnadzor dated January 26, 2017 No. AS-10-02-36/1417 “On sending information on the disposal of waste from the use of goods and packaging”: At the same time, it should be noted that in the conclusion between the manufacturer, importer of goods and the operator for handling municipal solid waste , regional operator or individual entrepreneur, legal entity engaged in the collection, transportation, processing, disposal of waste (except for municipal solid waste), contracts for the provision of waste disposal services, the parties independently, taking into account the requirements of environmental legislation, determine the terms of the form, subject and content of the agreement and after its conclusion undertake to fulfill the provisions provided for by the agreement in accordance with the Civil Code of the Russian Federation dated November 30, 1994 No. 51-FZ.

Product disposal standards

Recycling standards for each group of goods, group of packaging of goods are established as a percentage of the total quantity of goods released into circulation on the territory of the Russian Federation, expressed in units of mass or units of goods, or packaging of goods, expressed in units of mass of packaging. Manufacturers of packaging are not obliged to recycle it - packaging recycling is carried out by manufacturers of goods in this packaging. If recycling standards are exceeded, then the next year the standards are reduced by this difference. The standard may also be reduced if the packaging is made from recycled materials. Recycling standards are established for groups of goods as a percentage of the total number of released goods, taking into account economic and environmental conditions and are reviewed every 3 years.

Applicants can submit reports in one of three ways:

- Using the free resource user reporting tool “Nature User Module”, posted on the official website of Rosprirodnadzor on the Internet information and telecommunications network;

- Using the “Personal Account” of the natural resource user located on the Internet information and telecommunications network;

- Using other software, if the requirements for the format published on the official website of Rosprirodnadzor are met.

How to recycle?

The recycling obligation is considered fulfilled from the date of submission of reports confirming compliance with recycling standards or from the date of payment of the environmental fee. Waste disposal is confirmed by concluded agreements with third parties (when waste is transferred to them) and recycling acts. Letter of Rosprirodnadzor dated December 15, 2016 N AS-10-01-36/25460 introduced recommended forms of disposal acts.

Note!

Disposal of waste from the use of goods and packaging is a licensed type of activity if the waste is not classified as class V. Federal Law of June 24, 1998 N 89-FZ (as amended on December 25, 2018) “On production and consumption waste” Article 9. Licensing of activities for collection, transportation, processing, disposal, neutralization, disposal of waste of I – IV hazard classes 1. Licensing of activities for the collection, transportation, processing, disposal, neutralization, disposal of waste of hazard classes I - IV is carried out in accordance with the Federal Law of May 4, 2011 N 99-FZ “On licensing of certain types of activities”, taking into account the provisions of this Federal Law.

What is an environmental fee?

In industrial enterprises that produce various products, waste is naturally generated. The legislator has established that responsibility for the disposal of goods that lose their consumer properties over time is assigned, in accordance with Law No. 89-FZ, to manufacturers and importers. Such disposal can be carried out in two ways:

- Directly at the enterprise, or by a specialized recycling company. For this purpose, specialized facilities are equipped.

- By paying a special fee in monetary terms.

An environmental fee is a process of collecting funds that exempts legal entities from mandatory waste disposal. Most business managers prefer to pay a fee, since waste disposal is an extremely complex and time-consuming technological process. The rules for processing various types of waste do not have clearly defined state regulations. To avoid paying serious penalties, it may be better to choose the second option of settlement with the state.

If a company independently disposes of part of the waste, the calculation and payment of the environmental fee is carried out for the share that has not been recycled. In addition, 100% of packaging is counted as waste.

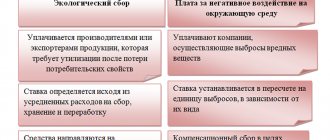

The environmental fee should not be confused with a fiscal payment, which is called a fee for negative impact on the environment (NEI). In addition, the environmental fee does not belong to the category of tax payments. An environmental fee is paid by entities if they do not fulfill their waste disposal obligations.

What reporting must be submitted by manufacturers and importers of goods?

All reporting that must be submitted to manufacturers and importers of goods:

- Declaration of the quantity of goods produced and packaging. The declaration is submitted annually, before April 1 of the year following the reporting period;

- Reporting on compliance with waste disposal standards for these products and packaging. Reporting is submitted annually, before April 1 of the year following the reporting period;

- In case of non-compliance with the standards, the amount of the environmental fee is calculated and its payment.

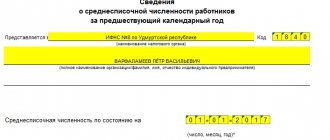

The declaration on released goods and packaging is drawn up in accordance with the Regulations on the declaration by manufacturers and importers of goods subject to disposal of the quantity of finished goods released into circulation on the territory of the Russian Federation during the previous calendar year, including packaging, approved by the Decree of the Government of the Russian Federation dated December 24, 2015 N 1417.

If a product is produced in the Russian Federation and exported, it is not indicated in the declaration. Manufacturers of goods include information about goods in the declaration based on primary accounting documents. Importers of goods - on the basis of customs documents. The declaration is filled out for each product name, the quantity is indicated in kilograms. If you registered a legal entity (or individual entrepreneur) during the year, then the declaration is filled out from the date of registration until the end of the year. At the same time, Rosprirodnadzor may request, during the verification of the authenticity of the declaration, certified copies of the documents on the basis of which it was compiled. The declaration is submitted by April of the year following the reporting year.

Related reporting

As mentioned earlier, the manufacturer also needs to take care of reporting. It is sent no later than April 1 of the current year. The following reporting will be required:

- Declaration of the volume of products produced. It must indicate the volume of manufactured or imported products, as well as packaging.

- Report on the implementation of processing standards. If some of the goods have been disposed of, Rosprirodnadzor must also be notified about this.

Reporting can be transmitted in electronic format. There is no need to accompany it with a paper document. If it is sent in paper form, you must also send a copy of the document on electronic media. Until April 15, the entrepreneur is required to submit a calculation of the ES amount. It is drawn up according to the form approved by order of Rosprirodnadzor dated August 22, 2016 No. 488.

It is recommended to submit reports through the appropriate system. A document is drawn up in it, all parameters are checked. After this, he is sent to the RPN.

IMPORTANT! The date of reporting will be considered the day it is sent via the Internet.

Manufacturers of goods submit reports to the RPN authority at the place of registration. Companies importing products must send them directly to Rosprirodnadzor.

ATTENTION! The official website of Rosprirodnadzor lists services where you can compile reports completely free of charge.

Procedure, forms and deadlines for submitting environmental reporting

The procedure, forms and deadlines for submitting reports on compliance with recycling standards are established on the basis of Decree of the Government of the Russian Federation of December 8, 2015 N 1342 (as amended on October 17, 2018) “On approval of the Rules for the submission by manufacturers of goods, importers of goods of reporting on compliance with standards for recycling waste from the use of goods " Disposal reporting is submitted by April 1 for the past year.

Reporting, like declarations, is submitted by manufacturers of goods to the territorial office of Rosprirodnadzor, and by importers to the central office of Rosprirodnadzor. As supporting documents, Rosprirodnadzor has the right to request copies of agreements between the manufacturer and the third party that disposed of its waste or, if the manufacturer disposes of waste independently, copies of disposal acts. An agreement can be concluded not only with the operator and regional operator, but also with an individual entrepreneur or legal entity engaged in the collection, transportation, processing, and disposal of waste (with the exception of municipal solid waste).

Procedure and deadline for payment of ES

The procedure for submitting reports depends on who the payer is:

- If you are a manufacturer of goods or packaging: transfers to the budget are sent to the account of the territorial body of Rosprirodnadzor at the place of state registration;

- If you are an importer of goods or packaging (or a manufacturer and importer): funds are transferred to the central office of Rosprirodnadzor in Moscow.

Codes, payment details, forms of payment orders are presented on the websites of the territorial bodies of Rosprirodnadzor and the central office of Rosprirodnadzor in the “Details” section.

Payment is made in the currency of the Russian Federation.

It is possible to submit reports in paper and electronic form in XML format (via the RPN receiving gateway or reporting system). If the reporting is submitted in paper form, the document is certified by a seal, the pages are stitched and numbered. An inventory must be attached to the document. A copy on digital media is included with the declaration. Documents are submitted in a single copy in person or by post with acknowledgment of receipt. The receipt mark is the date of acceptance of the document by the supervisory authority or the day of mailing.

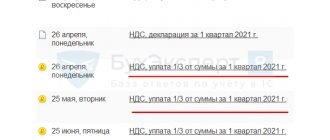

Deadlines for submitting reports and paying environmental fees:

- Until April 1 of the year: declaration on the volume of goods released and a report on compliance with recycling standards;

- Until April 15 of the year: calculation of the fee amount and payment of the fee.

Note: the year of filing is considered to be the year following the reporting year. In other words, the declaration and reporting for 2022 must be submitted before April 1, 2022.

How to report for environmental fees?

In January 2022, the Ministry of Natural Resources issued a letter explaining the issue of reporting and payment of fees for 2022. This letter stated, in particular, […] Reporting, declaration and calculation of the amount of environmental fees (in case of failure to achieve recycling standards) in 2022 were submitted for the 2017 reporting year (using recycling standards established for 2017 by order of the Government of the Russian Federation December 4, 2015 N 2491-r). When submitting a declaration in 2022 for the reporting year 2018, it indicates the number of goods released into circulation on the territory of the Russian Federation, packaging of goods sold for domestic consumption on the territory of the Russian Federation for 2022. In 2022, for the reporting year 2022, reporting is compiled on the basis of data on the number of goods released into circulation on the territory of the Russian Federation, packaging of goods sold for domestic consumption on the territory of the Russian Federation for 2022, and recycling standards established for 2018 by Decree N 2971- R. In 2022, for the reporting year 2022, the calculation of the amount of the environmental fee is formed on the basis of data on the number of goods released into circulation on the territory of the Russian Federation, packaging of goods sold for domestic consumption on the territory of the Russian Federation for 2022, using recycling standards established for 2022 Decree No. 2971-r, and environmental fee rates approved by Resolution No. 284 (as amended by Decree of the Government of the Russian Federation of October 31, 2022 No. 1293). We note that the new approach to using in reporting and in calculating the amount of environmental collection of data on goods (packaging of goods), released into circulation on the territory of the Russian Federation, goods sold for domestic consumption on the territory of the Russian Federation for the year preceding the reporting period, has been applied since the reporting period for 2022. To calculate the amount of the environmental fee both for 2022 and for 2022, use the same values of the mass of goods, the mass of packaging of goods put into circulation on the territory of the Russian Federation, sold for domestic consumption on the territory of the Russian Federation for 2022, and payment of environmental fees for 2022 do not relieve manufacturers of goods and importers of goods from the obligation to pay an environmental fee for 2022 in 2022 if they fail to comply with recycling standards during 2018. Thus, when preparing reports for the 2018 reporting year by manufacturers and importers of goods, associations, as well as calculating the amount of environmental fees (in case of failure to achieve recycling standards), it is necessary to use data from the declaration for 2022 and recycling standards for 2018 established by Order N 2971- R. […]

The letter dated 02/22/2019 confirmed this interpretation of the provisions of the regulations:

[…] In accordance with paragraph 9 of Decree No. 1417 and paragraph 9 of Regulation No. 1342, the reporting period for submitting declarations and reporting is recognized as a calendar year. Based on clause 5 of Article 2 of the Federal Law of June 3, 2011 No. 107 “On the Calculation of Time,” a calendar year is considered to be the period of time from January 1 to December 31, lasting three hundred sixty-five or three hundred sixty-six (leap year) calendar days. According to paragraph 10 of Resolution No. 1417, the declaration is submitted annually, before April 1 of the year following the reporting period. The rules for collecting environmental fees were approved by Decree of the Government of the Russian Federation dated October 8, 2015 No. 1073 “On the procedure for collecting environmental fees.” Thus, in 2022, importers and manufacturers of goods, reporting for 2022, indicate in the declaration, reporting, and calculation of the environmental fee the number of goods released into circulation on the territory of the Russian Federation in 2017, applying waste disposal standards from the use of goods in 2022, established by the order Government of the Russian Federation dated December 28, 2017 No. 2971-r.

Thus, due to the “new approach” to reporting, it was not entirely clear how to report in April 2022. If the manufacturer/importer reported last April for goods produced in 2022 and waste from them disposed of in the same 2017, does this mean that they will have to take these indicators into account again and pay twice for the same thing? As of April 2019, we were waiting for additional clarification on this issue from Rosprirodnadzor or the Ministry of Natural Resources.

Payment of environmental tax separately for goods and packaging

From Law No. 89-FZ and the Rules it now follows that the environmental fee must be paid (clause 2 of the Rules):

- in relation to goods and packaging as finished goods - manufacturers and importers of goods;

- in relation to packaging as a raw material (for packaging other goods) - manufacturers and importers of goods in this packaging.

Previously, this was not clearly stated in the regulations. However, Rosprirodnadzor, in a letter dated February 20, 2017 No. OD-06-02-32/3380, gave explanations that are now enshrined in law.

In practice, difficulties may arise when paying a fee in relation to the packaging of goods. For example, a manufacturer of glass containers can supply it to retail stores and beverage manufacturers.

In such a situation, it is necessary to keep separate records of containers, because:

- in the first case, such containers are finished goods, and the glass container manufacturer is responsible for its disposal and payment of fees (if recycling is not carried out),

- in the second case, this responsibility rests with the manufacturer of the drinks in the specified container.

A new norm has appeared in the Rules. It concerns manufacturers of goods, which are then sold to persons who manufacture special wheeled vehicles (chassis) and trailers for them. The list of such vehicles is approved by Decree of the Government of the Russian Federation dated December 26, 2013 No. 1291. Manufacturers of these goods must pay an environmental fee only in relation to their packaging (clause 2.1 of the Rules).

The provision that there is no need to pay an environmental tax on goods and packaging that are exported from Russia has remained unchanged (clause 9 of the Rules).

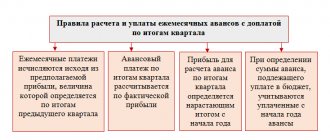

Environmental fee: calculation of the amount

If recycling standards are not met or not fully met, you need to calculate the amount of the environmental fee and submit the calculation to Rosprirodnadzor before April 15 of the year following the reporting year. The environmental fee refers to non-tax revenues of the federal budget. For packaging, it is paid by the manufacturer of the product in the package, and if the product is not ready for consumption, then the fee is paid only for packaging. Collection rates are established by Decree of the Government of the Russian Federation dated 04/09/2016 N 284 “On establishing collection rates for each group of goods, group of packaging of goods, waste from the use of which is subject to disposal, paid by manufacturers of goods, importers of goods who do not ensure independent disposal of waste from the use of goods (environmental fee).” Rates are set in rubles per ton of waste and are formed for each group of goods and packaging, varying from 2025 rubles / ton of lead batteries (“Group N 38”) to 33,476 rubles / ton for Group N 37 “Primary elements and batteries of primary elements” and Groups N 39 “Rechargeable batteries”

According to Parts 5 and 6 of Article 24.5 of Federal Law No. 7-FZ: 5. The environmental fee rate is based on the average cost of collection, transportation, processing and disposal of a single product or unit of mass of a product that has lost its consumer properties. The environmental fee rate may include the specific cost of creating infrastructure facilities intended for these purposes. Environmental tax rates for each group of goods, group of packaging of goods, waste from the use of which are subject to disposal, are established by the Government of the Russian Federation. 6. The environmental fee is calculated by multiplying the environmental fee rate by the weight of the product or by the number of units of the product (depending on the type of product) or by the weight of the product packaging put into circulation on the territory of the Russian Federation, and by the recycling standard expressed in relative units.

The procedure for collecting environmental fees is established by the Government of the Russian Federation through Resolution No. 1073 dated October 8, 2015 (as amended on August 23, 2018) “On the procedure for collecting environmental fees.” Order of Rosprirodnadzor dated August 22, 2016 N 488 approved the form for calculating the amount of environmental fees. This form includes:

Section 1. General information about the manufacturer, importer of finished goods, including packaging of such goods Section 2. Calculation of the amount of environmental fees

When calculating the fee, an indicator of the number of goods (finished goods/packaging) put into circulation on the territory of the Russian Federation is used, which must be taken from the declaration on the number of finished goods put into circulation on the territory of the Russian Federation for the previous calendar year, including packaging, subject to disposal. The total quantity to be disposed of is included in the calculation in accordance with the specified quantity from the reporting on compliance with waste disposal standards from the use of goods subject to disposal after they have lost their consumer properties. The amount of the environmental fee for finished goods and the amount of the fee for packaging are determined by summing the values for groups of goods, including packaging, subject to disposal. The total amount is determined by summing the amount of the fee for finished goods and the amount of the fee for packaging.

If the product is packaged in packaging produced by a third-party organization, you need to request information about its production and composition at the stage of declaring the quantity of goods in order to find out what proportion of the packaging is recycled materials, which will allow you to use a reduction factor in the calculation.

The following documents are attached to the completed form for calculating the environmental fee: a) copies of payment documents confirming payment of the environmental fee; b) a document confirming the authority of the payer’s representative to carry out actions on behalf of the payer.

Who is the payment administrator?

The payment administrator is Rosprirodnadzor. The amount can be calculated using software or on paper. The date of submission of the calculation of the amount of the environmental fee in electronic form is considered to be the date of its sending via the Internet to Rosprirodnadzor; on paper, the date is considered to be the mark of Rosprirodnadzor on its receipt indicating the date stamped on paper, or the date of mailing. The payment administrator can draw up an act of monitoring the correctness of calculation of the amount of the environmental fee, the completeness and timeliness of its payment when these facts are identified. The act is sent to the payer within 3 days, but the payer can, within 10 days, send to the administrator copies of documents confirming the validity of the calculation, payment of the fee, as well as explanations of the reasons for the discrepancy in the information provided by the payer.

15(3). The control report indicates:

a) facts of errors made when performing calculations and contradictions (inconsistencies) between the information contained in the calculation of the amount of the environmental fee and the information available to the administrator of the environmental fee and (or) received by him in the prescribed manner when declaring goods and packaging of goods, when reporting on standards and when monitoring compliance with established recycling standards, as well as federal state environmental supervision;

b) facts of non-payment, incomplete payment or untimely payment of the environmental fee;

c) the fact of overestimation of the amount of calculated and (or) paid environmental fees;

d) the requirement to submit to the administrator of the environmental fee, within 10 working days from the date of receipt of such a requirement, reasonable explanations regarding the calculation of the amount of the environmental fee, and (or) making corrections to it to eliminate the facts specified in subparagraph “a” of this paragraph, by introducing changes in the calculation of the amount of the environmental fee, which are re-sent to the administrator of the environmental fee, and (or) repayment of debt on the environmental fee if the facts specified in subparagraph “b” of this paragraph are revealed.

If the payer cannot justify the correctness of the calculations, the amount of the fee may be recovered in court. In addition, it is possible to credit the collection amounts to future payments or return the fee upon application after drawing up a report of a joint reconciliation of the calculations of the amount of the environmental fee. The application can be submitted by the payer or his representative to the administrator within 3 years from the date of the last payment (collection) of the environmental fee, attaching the following documents:

a) allowing to determine the payment (collection) of an environmental fee in an amount that exceeds the amount of the environmental fee subject to payment, as well as erroneous payment (collection) of an environmental fee;

b) confirming the authority of the person who signed the application or a certified copy of the specified document;

c) confirming the authority to carry out actions on behalf of the payer, if the application specified in paragraph 19 of these Rules is submitted by a representative of the payer.

In case of non-payment, partial payment of the fee and (or) failure to submit a calculation of the amount of the fee by the payer within the established time frame, the administrator sends the payer a request for voluntary repayment of the debt and submission of a calculation of the amount of the environmental fee, 15 days are allotted for this, after which collection begins in court .

The period for voluntary repayment of debt on payment of the fee has been reduced

If the payer does not pay the environmental fee or does not pay it in full, the Rosprirodnadzor body will send a demand to pay off the debt on a voluntary basis.

This must be done within 15 calendar days. After this period, the regulatory authorities will collect the debt through the court (clause 25 of the Rules). If the court rules in favor of Rosprirodnadzor, you will need to pay not only the arrears, but also reimburse the agency’s legal expenses (Article 110 of the Arbitration Procedure Code of the Russian Federation).

Before the changes were made, the period for voluntary repayment of debt was longer - 30 calendar days.

We note that the legislation of the Russian Federation does not currently provide for special rules providing for liability for non-payment of fees and failure to submit reports.

At the same time, according to information on the websites of regional departments of Rosprirodnadzor, payers who have not submitted a calculation of the amounts of environmental fees may be brought to administrative liability under one of the following articles of the Code of Administrative Offenses of the Russian Federation:

- Article 8.5 of the Code of Administrative Offenses of the Russian Federation “Concealment or distortion of environmental information.” It provides for a fine against officials and individual entrepreneurs in the amount of 3,000 to 6,000 rubles; in relation to organizations - from 20,000 to 80,000 rubles;

- Article 19.7 of the Code of Administrative Offenses of the Russian Federation “Failure to provide information (information).” This article provides for a fine against officials and entrepreneurs in the amount of 300 to 500 rubles; for organizations - from 3,000 to 5,000 rubles.

As for liability for non-payment (incomplete payment) of the environmental fee, there are no penalties for this offense.

Nevertheless, the Rosprirodnadzor body has the right to collect the debt registered with the payer.