BALDINA Svetlana Vyacheslavovna

CEO

All questions

| Your expert MUKHIN Mikhail Sergeevich The head of the company Human rights protection Choose another |

| Your expert VOLODINA Elena Vikentievna Budget accounting Choose another |

| Your expert KULIKOV Alexey Alexandrovich Taxes and law Choose another |

| Your expert MOROZOVA Irina Vladimirovna Wage Choose another |

| Your expert KONOPLYANNIK Tatyana Mikhailovna Accounting and taxes Choose another |

| Your expert DYATLOVA Elena Mikhailovna Lecturer-expert Accounting and taxes Choose another |

| Subscribe to news: |

| Unsubscribe from news: |

New topics on the forum

03/03/2022 15:34 paid material not received Good afternoon! Tell me where I can find paid materials, in particular new templates... More details...

03/02/2022 20:30 Help draw up a petition for missing the deadline for submitting a VAT return Mikhail Sergeevich, help draw up a petition for reducing the “punishment” for missing the deadline for submitting a VAT return for the 3rd quarter of 2022. We ourselves don’t understand how this happened. We prepared a declaration... Read more...

02/28/2022 16:54 Application of FSBU 25 Good afternoon! Is it necessary to apply FSBU 25/2018 in relation to a land lease agreement if the subject of the agreement states: “The site is provided for administrative use... Read more...

02/26/2022 05:36 codes for 6NDFL Good evening. The LLC pays employees working remotely compensation for expenses in accordance with the Labor Code. The amount of compensation is specified in the employment contract. Are paid amounts of compensation subject to personal income tax... Read more...

02/25/2022 15:30 Transition to FSBU 6/2020 in the 1C program. Elena Mikhailovna, hello! The 1C program makes adjustments to the book value of fixed assets during the prospective transition to FSBU 6/2020 with transactions dated December 31, 2021. As a result, the book value of fixed assets is ... More details...

All topics

How to fill out form No. KS-2?

As we have already noted, in practice, participants in construction contracts use unified forms No. KS-2 and No. KS-3, which are approved by Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100.

The column “Contract agreement (contract)” indicates the number of the contract agreement concluded between the customer organization (or general contractor) and the contractor organization (subcontractor), as well as the date of its signing in the format DD.MM.YYYY.

The column “Reporting period from to” indicates the dates of the period for which the contractor reports to the customer.

In the column “Estimated (negotiated) cost in accordance with the contract (subcontract)” the total amount under the contract in rubles is indicated (entry of amounts in other currencies is not acceptable).

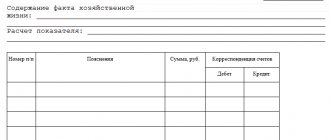

Next, a table consisting of columns is filled in.

Column 1 “Sequence number” indicates the serial number of the material or work in this table.

Column 2 “Item number according to the estimate” indicates the number of the material or work in the estimate.

Column 3 “Name of work” indicates the name of the work corresponding to the name in the estimate.

Column 4 “Unit price number” indicates codes from the collections of Federal unit prices for construction, special construction and repair and construction work.

If, under a work contract, the cost of construction or repair work entrusted to the contractor is determined by the fixed price agreed upon in the contract and payments for work performed and costs are made within the specified fixed contract price, then in columns 4 “Unit price number” and 7 “Work completed; price per unit, rub.” a dash is inserted (Letter of Rosstat of the Russian Federation dated May 31, 2005 No. 01-02-9/381).

In column 5 “Unit of measurement” the name of the measure of work or materials is written, for example, sq. m, pcs., t, etc.

Column 6 “Work completed, quantity” indicates the number of those units of measurement that are written in column 5 (in this case, indicating the percentage of work completed is unacceptable).

In column 7 “Work completed, price per unit” prices are set based on the mentioned collections of unit prices. If the price of contract work is fixed by contract, this column is filled in with a dash.

Column 8 “Work completed, cost, rub.” filled in in any case: either with the amount from the contract, or with the estimated amount based on unit prices.

Download a sample of completed form No. KS-2 .

New answers on the forum

03/03/2022 16:05 paid material not received Hello, Galina Takhirovna Go to your personal account on our website Then the publishing house (on the left on a blue background), then methodological publications, find the desired publication, under the text there is a yellow... Read more...

03/01/2022 13:47 Transition to FSBU 6/2020 in the 1C program. Lyudmila Vyacheslavovna, good afternoon. I don’t know about the changes in the 1C program, the postings should be generated on December 31, 2021, but after the reporting for 2022 is generated. Prospective transition to FSBU 6... Read more...

03/01/2022 13:36 Natalya Igorevna, good afternoon Sorry, I don’t remember the circumstances of the original question, so I can’t answer the continuation. From the description of the situation, I did not understand the essence of the operation... Read more...

02/26/2022 09:28 codes for 6NDFL Amounts of compensation for expenses of remote workers for the use of equipment owned or leased by them, software and hardware, information security tools and other means, expenses... Read more...

02/25/2022 15:49 Personal income tax of citizens of the Republic of Belarus Citizens of Belarus are required to submit an income tax return annually no later than March 31 if they received income subject to taxation in the reporting calendar year. Based on... Read more...

All answers

Filling KS-3

How to fill out KS-3

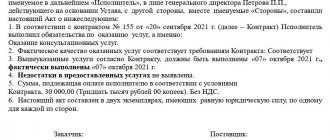

Order a certificate KS-3 A certificate in form KS-3 is filled out periodically, usually no more than once a month, in accordance with the contract, until the work is completed and/or equipment is delivered. Moreover, if during the entire period of work under the contract there were more than two reporting periods (percentages), then columns 4 “from the beginning of the work” and 5 “from the beginning of the year” are filled in with an accrual total in each subsequent certificate, after the first.

Procedure for filling out KS-3

You can use the following general procedure for filling out a certificate in form KS-3 .

In some cases, the customer asks to decipher the cost of work into the cost before indexing and indexed, indicate indices for construction and installation work, construction work, commissioning, design and survey work and others, indicate the full details of the Investor, Customer, General Contractor, Contractor, indicate additional data or supplement the standard format, but general the order does not change .

- Find out if there is an “investor” for your property. If it is not there, remove the “Investor:” field from the form.

- Indicate the contract number and date.

- Indicate the serial number of the certificate. If KS-3 is being filled out for the first time for this object (first percentage), then indicate No. 1. For each subsequent certificate, the following numbers are used in order. As a rule, a new numbering begins with the new year.

- Indicate the date of compilation.

- Write down the reporting period. It is desirable that the reporting period corresponds to a month, for example, from September 1 to September 30. But it is also desirable that the end date of the reporting period corresponds to the date of compilation (clause 4).

Accounting departments of different customers have different opinions about the dates in KS-3. 1. For some, it is important that the reporting periods of KS-3 certificates correspond to months, even if the date of preparation does not fall at the end of the month. For example: KS-3 No. 1 dated 09/27/2016 and the reporting period from 09/01/2016 to 09/30/2016, KS-3 No. 2 can be drawn up on 10/19/2016 and the reporting period for it will begin from the end of the previous one, i.e. from 10/01/2016, and will continue until 10/31/2016. 2. For others, it is important that the KS-3 certificates cover all calendar days, and the end date of the reporting period corresponds to the date of preparation, even if the reporting period is rolling over months. For example: KS-3 No. 1 of 09/27/2016 and the reporting period from 09/01/2016 to 09/27/2016, KS-3 No. 2 of 10/19/2016 and the reporting period from 09/27/2016 to 10/19/2016. 3. Still others do not attach importance to the correspondence of the end of the period with the date of preparation of the certificate and the transition between months. Also, often the dates for the possible interest period are specified in the contract, for example “no later than the 25th day of the reporting month”

- In column 2, indicate the type of work and the object, for example, “Construction and installation work on the object “Construction of a non-residential facility, Moscow”, in accordance with the contract

- In column 6, write down the cost of work performed during the reporting period, in accordance with the act/acts of KS-2

- Columns 4 and 5 are filled in cumulatively, depending on the funds already disbursed, respectively, from the beginning of the work and from the beginning of the year.

- In the signature section, enter the positions and surnames of the I.O. signatories.

Above you can download blank forms and samples of filling out a certificate in the KS-3 form for filling out yourself or order it from us.

Reviews and wishes

02/16/2022 10:39 Seminar “Annual report, accounting policies and taxation 2022 in business and non-profit organizations” February 15, 2022 Good afternoon, Dear Colleagues! Let me express my deep gratitude to you for a wonderful seminar! Such seminars are very supportive and give confidence that everything can be sorted out…. Read more…

12/15/2021 21:41 Review of the seminar 12/14/2021 Thank you very much Selezneva GA for such an interesting seminar. I especially remember the story with the fish. Everything was very interesting, the presentations were presented in detail, the time flew by quickly and unnoticed. About... Read more...

12/15/2021 20:40 Thank you for the seminar 12/14/2021 Thank you for the useful seminar, for the very competent lecturers. Read more…

10/17/2021 08:29 Seminar 10/14/2021 Good afternoon! The seminar held on October 14, 2021 was wonderful and eventful. But. Question. At Mikhail Sergeevich’s seminar, it was said that your website has templates for responses to the tax office. CAN'T FIND ANYTHING... Read more…

10.15.2021 13:46 Seminar 10.14.2021 Thank you very much!!! Very useful information! Read more…

Guest book

Blog

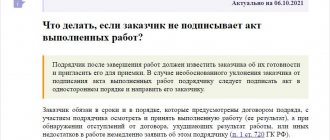

The delivery and acceptance of the work result is formalized by an act signed by both parties to the construction contract - the contractor and the customer (clause 4 of Article 753 of the Civil Code of the Russian Federation). Federal Law No. 402-FZ of December 6, 2011 “On Accounting” establishes that primary accounting documents are drawn up when a fact of economic life is committed. The forms of primary accounting documents, in accordance with paragraph 4 of Article 9 of this law, are approved by the head of the company.

KS-2 is used for acceptance of completed contract construction and installation work for industrial, residential, civil and other purposes. The act is drawn up on the basis of the data from the Logbook of work performed in the KS-6 form in the required number of copies. The act is signed by authorized representatives of the parties.

Based on the data in the Certificate of Acceptance of Work Completed, a Certificate of Cost of Work Completed and Expenses is filled out in Form KS-3.

Related course

Advanced accountant

Find out more

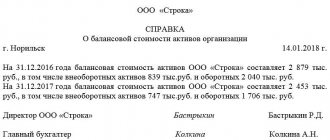

For settlements with the customer for work performed, a certificate of the cost of work performed and expenses in the KS-3 form is used.

A certificate in form KS-3 is drawn up for construction and installation work performed in the reporting period, major repairs of buildings and structures, and other contract work and is presented by the subcontractor to the general contractor, and by the general contractor to the customer (developer).

The cost of work performed and expenses includes the cost of construction and installation work, which are included in the estimate.

In KS - 3, the cost of work and expenses is indicated on an accrual basis from the beginning of the work, including the reporting period; cumulative total from the beginning of the year and for the reporting period.

All work is reflected in the construction as a whole, and for each stage.

The amounts in the certificate are reflected with the allocation of VAT amounts.

The contractor may submit free-form acts to the customer instead of standardized forms. / “Accounting encyclopedia “Profirosta” 08/15/2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

Comments

01/14/2021 16:56 RE: Map of the day January 15, 2022: SZV-M, SZV-TD, salary contributions and taxes - according to new details! Good afternoon. Thanks a lot! Sincerely, Tatyana Borisovna Fedorova Chief Accountant Read more…

01/14/2021 10:47 Thank you! Thanks a lot! Read more…

04/03/2020 16:50 Many thanks to you and your colleagues for prompt notification and commenting. Hello, Svetlana Vyacheslavovna! Many thanks to you and your colleagues for promptly notifying and commenting on the constantly changing situation. And especially for attention to the problems of SMEs and priests... Read more...

04/03/2020 13:54 We also have wishes to expand the affected activities Hello! We very much support your proposals for amendments, we began to think through independent steps in this direction, and your newsletter turned out to be very timely. We are a medical organization... Read more...

03/31/2020 14:37 Comments on the news 03/31/2020 Svetlana Vyacheslavovna, thank you. Wonderful to see and hear. Thank you very much again! Read more…

All comments

Conversations

15.02.2017 16:54 I practically live at work, but the salary is getting smaller... Apparently they started deducting for accommodation... Read more...

02/15/2017 14:14 Fire at the tax office Call to the fire department: - Guys, are you very busy? - No, we’re sitting, playing dominoes... - Well, finish the game and get ready slowly, the tax office is on fire... Read more...

01/19/2012 15:24 Ballad about the average number of employees I threw away frivolity, I got up early today - I handed over the average number to the tax office. Having scratched the hard stubble on my face, I open the discreet door, having smoked on the roof… Read more…

03/05/2011 12:01 “Why empty-handed?” Now she is the chief accountant in a small budget institution, but in the 90s she worked in the tax office. This is an incident from my inspection life. There was a notice on the door of our office that in order to register you must... Read more...

12/28/2010 16:09 Red reversal The boss comes to the chief accountant and sees that he has an almost empty bottle of vodka on his desk. He says: “How can you? Drunk at work! And you’re also drinking white stuff!” What does the chief accountant need... Read more...

All entries

Certificate of acceptance of completed work KS-2 and certificate of cost of work KS-3

KS-2 and KS-3 are two documents that are an integral part of the work of an estimator in any area of construction.

The decoding of KS-2 and KS-3 and what type of documentation they are can be understood by referring to the structure of both documents. Currently, there are a fairly large number of samples of filling KS-2 and KS-3. However, it should be noted that for each individual object, this type of documentation most often includes some individual features characteristic only of the object.

In this regard, the question of what is KS-2 and KS-3 will be considered in this article only from the point of view of general aspects. It should be noted that the decoding of KS-2 and KS-3, and what it is in construction, can be obtained from open sources of information or from a variety of methodological documents.