Document flow for writing off materials for construction and installation work

Let's consider the procedure for drawing up a document according to form No. M-29, approved by the Instructions.

In Section I of the report “Standard requirements for materials and volumes of work performed,” columns 2, 4, 5, 6, 8 are filled in by the construction organization’s technical department before the start of construction of the facility, and column 9 - only for transitional objects at the beginning of the year.

Column 2 “Name of types of work, structural elements and materials” is filled out as follows. First, the type of construction and installation work is recorded (excavation work, stone work, flooring, etc.), then the name of the structural element with a list of materials required for its implementation.

Column 4 “Unit of measurement” indicates the units of measurement of the structural element and the materials required for its implementation.

Column 5 “Justification of production standards for the consumption of materials” records the numbers of tables, paragraphs and the abbreviated name of the collections of production standards that this construction organization uses in its work.

In column 6 “Rates of material consumption per unit of measurement of work (structural element)”, based on the relevant collections of production standards, the rates of material consumption per unit of measurement of construction and installation work are indicated.

Column 8 “Scope of work and standard requirements for materials for the entire facility” is filled out as follows. For each type of work (structural element), the physical volume of construction and installation work is shown, provided for by the working drawings for the entire facility under construction, and for each type of materials - its standard requirement (limit) for the corresponding type of work (structural element), which is calculated by multiplying the norm material consumption (column 6) for the corresponding volume of construction and installation work (structural element) given in column 8.

If the construction of a facility has been ongoing for more than one year, then in column 9 “Including the volume of work actually completed at the beginning of the reporting year” for each unfinished type of work (structural element) from the total volume of work for the entire facility under construction (the column identifies the volume of construction and installation work , actually completed in previous years.

Columns 10 to 21 are filled in by the work contractor directly during construction of the facility. They reflect the volume of work performed for each type (structural element) for the corresponding reporting month and the standard consumption of each type of materials, calculated as the product of the standard consumption of materials (column 6) by the volume of work performed for the month.

As noted above, data on the volume of work actually performed is determined on the basis of a log of work performed, compiled according to form No. KS-6a.

After the end of the reporting month, for each type of material, the total standard consumption for all work according to production standards is determined and recorded on the corresponding total lines of Section I, which is then transferred to columns 5, 9, etc. section II.

If an overestimation of the volume of work performed is detected in Form No. M-29, the volume of work performed for the period in which the overestimation was detected must be corrected and, accordingly, the consumption of materials for the volume of work performed must be clarified. Materials previously written off for work must be reported to the financially responsible persons.

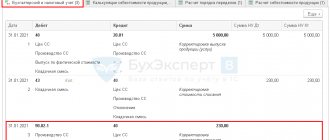

Section II of the report “Comparison of the actual consumption of basic materials with the consumption determined by production standards” indicates the amount of materials consumed for each reporting month according to production standards, and the actual savings or overconsumption of materials and the amount of materials allowed to be written off to the cost of construction and installation work .

If the construction of the facility has been ongoing for more than one year, then in Section II the data from the “Total since the beginning of construction” columns of Section II of the report for the previous year is transferred to the “Total at the beginning of the year” columns.

If the object is being built for the first year, then dashes are added in the report in the “Total at the beginning of the year” columns.

The consumption of materials for the reporting month, calculated according to production standards (for filling out columns 5, 9, 13, etc.), is taken from the final data of Section I of the report on the relevant materials.

The actual consumption of each type of materials for the month is shown in section II of the report in form No. M-29 for the entire facility based on primary expenditure documents.

The amount of materials consumed, indicated in the report on Form No. M-29, must correspond to the amount of materials given in the material report.

Savings or overconsumption of materials for each month are determined as the difference between actual consumption and consumption calculated according to production standards, and is recorded in columns 7, 11, etc. In this case, savings are shown with a minus sign (–), and overspending is shown with a plus sign (+).

For each case of excessive consumption of materials, the foreman provides a written explanation in the prescribed form (Appendix No. 3 to the Instructions), which is attached to the report.

The report in form No. M-29 is confirmed by the signature of the site manager (foreman), after which it is submitted to the technical department and accounting department of the construction organization for verification.

The technical department checks in the report the correctness of the foreman’s determination of the consumption of basic materials according to the standards for the volume of work performed and the foreman’s explanation of the reasons for the overconsumption of materials, if the overconsumption occurred in the reporting period, and the accounting department checks the correctness of the data on the actual consumption of materials. The results of the inspection are certified by the signatures of the persons performing the inspection.

After checking the report and the foreman’s explanatory note about the reasons for the cost overrun, the construction organization’s manager approves the report and indicates (in columns 8, 12, etc.) the amount of materials to be written off as construction and installation costs.

In cases where the amount of basic materials actually spent on construction and installation works is less than the amount calculated according to the standards, the amount of actually consumed materials is approved for writing off as the cost of construction and installation work.

If the amount of basic materials actually spent on the production of construction and installation work is greater than the amount calculated according to the standards, and the overconsumption of materials is technically justified or caused by production necessity (for example, overconsumption of metal when forced to replace reinforcement with large diameters due to the lack of reinforcement of the required dimensions), then the cost of construction and installation work, the amount of materials allowed for write-off by the head of the construction organization is written off.

Technically unjustified excess consumption of materials (for example, due to violations of labor or production discipline) is not written off as the cost of construction and installation works.

If the amount of basic materials actually spent on construction and installation work exceeds the amount allowed for write-off, then the head of the construction organization, on the foreman’s explanatory note about the reasons for the overexpenditure, indicates to which accounting accounts the cost of these materials should be attributed: to account 76 (sub-account “Calculations for claims”). or to account 94 “Shortages and losses from damage to material assets”, if no decision has been made to recover from the perpetrators.

Based on the manager’s decision, indicated on the foreman’s explanatory note, the accounting department makes appropriate corrections to the data on the actual consumption of materials in the material report.

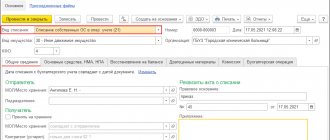

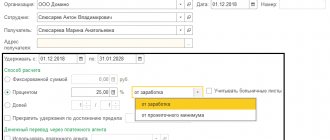

Write-off of materials in 1C 8.3: setting up material accounting

- Go to the Enterprise and find the submenu “Methods of inventory valuation (BU)”;

- Add a line indicating the account and valuation method.

If you still have questions about writing off TMZ and OS, call the managers of First Bit. First Bit clients have a free consultation line. Consultation Line experts will find errors if there are any, tell you how to correct them, and help collect reports.

Important! This setting can only be done if accounting for goods has not yet begun, or otherwise you will have to remove from processing all documents with the movement of goods on the selected accounts. But it is worth considering that if you change the method of valuing inventories and re-post documents for the period, the amounts in the balance sheet may change, primarily at cost and on the inventory accounts themselves.

Do not forget about some of the features that are characteristic of this configuration of 1C version 8.3, namely:

- Enterprises using the general regime can choose any assessment method. For example, if you want to value based on the cost per unit per material, then choose the FIFO method;

- Enterprises using the simplified tax system most often choose FIFO. If an enterprise operates according to a simplified system of 15%, then in 1C version 8.3 this line will be the default, and the ability to select an estimate based on average cost will be removed altogether. This is due to the peculiarities of accounting under the simplified taxation system.

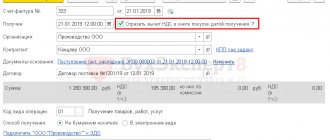

How materials are written off through 1C: Accounting for Kazakhstan version 3.0

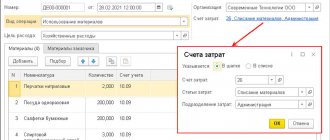

Before writing off, you will need to post and fill out the “Demand-invoice” document or Write-off of Inventory. It can be found in two ways, namely:

- Submenu “Warehouse” -> Requirement-invoices;

- Submenu “Production” -> Requirement-invoices;

- Next you need to create a new document;

- Select in the document header “Warehouse” from which the material will be written off;

- The “Add” button will allow you to create an entry in the tabular part of the document. For convenience, you can use the “Selection” button, it will allow you to view all remaining materials and their quantity.

The screenshot below shows the screen of the form that appears when you click the “Selection” button. To make it convenient for you to work and see only those positions for which there are physical balances, make the “Remains Only” button active.

You just need to select all the items that need to be written off, and they will automatically go to the “Selected Items” section. Then click the “Move to Document” button.

The items you have selected will be displayed in the tabular part of the document for writing off the goods.

Don’t forget to fill out the “Cost Division”, “Cost Item” and “Item Group” sections.

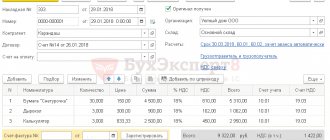

“Cost division” and “Item group” become available only in documents in which the following values are set in the system parameter:

“Keep cost records by department” - “Use several item groups.”

Even if you are engaged in accounting in a small organization, create a “General nomenclature group” item in your reference book and select it so that problems do not arise at the end of the month when closing.

In large companies, maintaining this bookmark allows you to receive all the necessary reports quickly and without problems, and therefore quickly close the month.

A cost unit can be a site, a separate store, a workshop, or anything for which a cost control amount needs to be collected.

All product groups are associated with various types of products that the company produces. For example, if different workshops produce the same products, then you should specify a single product group in order to see the total amount of costs.

However, if you want to see the amount of revenue and the amount of costs separately for different types of products, for example, chocolates and caramels, then specify different product groups.

When indicating a cost item, you need to focus on the tax code. For example, be sure to indicate the items “Labor expenses” and “Material costs”. These lists can be expanded, it all depends on the needs of a particular enterprise.

Once you have specified all the parameters, you need to click the “Close and Post” button. After this you can view all transactions.

In the future, when keeping records, if you need to make a similar invoice and write off inventory items, you can not create it again, but simply copy it using the standard tools that are available in the 1C program.

Process Tools

The next basis is a combination of an algorithm, legislation and relevant knowledge.

The algorithm implies 3 ways of implementation:

- At the cost of one unit of a material resource - convenient for writing off at the purchase price of especially valuable goods.

- By average cost - most suitable for a large assortment of material inventories, it looks like the arithmetic average between the number of units and their total cost.

- FIFO method - takes into account resources, starting with the earliest acquisitions, but in reverse order, the first to “go” are those special materials that are listed as the last to appear. Also in Russia, an alternative to FIFO is used - LIFO. Here the order of liquidation is normal, chronological.

Thus, the current rules for writing off materials in construction are based, first of all, on the correct determination of the cost of raw materials. The actual cost is calculated including:

- initial value (price);

- transportation costs;

- payment for services (consultants, intermediaries, etc.);

- customs expenses.

One write-off method is selected; it will have to be applied throughout the entire reporting period.

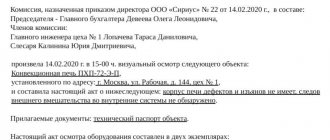

Who is responsible?

The first question is who is responsible for writing off construction materials during production. The answer is specially appointed employees directly involved in the sale of commodity and material assets. For 2022, these are: engineers, representatives of the accounting staff, production site managers, financially responsible persons. Their task, supplementing the composition of the construction technical department (production and technical department), is to control the use of materials resources calculated by cost estimating engineers.

The list of appointees is approved by the director of the enterprise, simultaneously describing the functions of each and indicating the need for the final documents to be signed by the chief engineer and the head of the technical and technical department.

Separately, accountants are assigned the following responsibilities:

- ensure that the consumption and overconsumption of materials in construction does not exceed acceptable standards;

- suppress attempts to write off working raw materials without proper grounds, for example, under the guise of a mythical loss;

- recognize and eliminate cases of higher quality construction materials being included in the list of write-off resources than were actually used;

- draw up write-off documentation.

The more professionally the document flow and write-off of construction materials is organized in the accounting department or its replacement body, the easier it is to monitor the material base in production, to protect the business from theft and rise in cost.

Consequences of overspending or shortages

It happens that the final reporting on special materials shows a discrepancy between income and expenses. Here, the main person at the site should draw up an explanatory note based on the corresponding M29, and attach to it an act on the write-off of materials in construction in the prescribed form. The act is carried out and approved by a special commission.

The result of studying the act with an explanatory note is two scenarios:

- it is established that the discrepancy is associated with theft, dishonest performance of duties (damage, loss) - the management of the enterprise must involve regulatory authorities to confirm what happened;

- overexpenditures (shortages) are recognized as valid - management has the right to give the go-ahead to remove them from the balance sheet.

In general, the head of the entire construction campaign is responsible for the correct registration of the movement of building materials and their waste. So it is in his interests to competently organize proper accounting and identify the true culprits of the losses.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 697) (Moscow) +7 (ext. 281) (St. Petersburg) +8 (ext. 198) (Russia) It's fast and free!