Dividends are the portion of profits that a company distributes to shareholders in the form of dividends.

To pay dividends, the company must receive net profit, which it distributes among shareholders. Whether and in what amount it will be distributed is decided by the company's management and shareholders. When a decision is made, the company issues a press release. It indicates the amount and date of closure of the register - the “cut-off date”.

If the company made a loss, then you should not count on dividends. But there are exceptions: sometimes the top management of a company may decide to pay dividends from retained earnings from previous years or even borrow to please its shareholders. In addition, the company can pay dividends not only from net profit, but also from EBITDA or free cash flow, depending on its dividend policy.

Dividends are a right, not an obligation, of the issuer. However, cases of refusal to comply with a publicly stated dividend policy among large companies are quite rare, despite the dividend policy. This undermines investor confidence and damages reputation and stock prices.

Dividend policy is the policy of a joint stock company in the field of distribution of company profits, that is, the distribution of dividends among shareholders. The dividend policy is formed by the board of directors. Depending on the company's goals and current/forecast situation, company profits may be reinvested, written off as retained earnings, or paid out as dividends.

Dividend payments

Payment of dividends is carried out in cash by bank transfer by transferring dividends to bank accounts within the time limits established by the Federal Law “On Joint Stock Companies”. In accordance with the amendments made to this law, the deadline for paying dividends now depends on the type of person registered in the register of shareholders: the deadline for paying dividends to a nominee holder and trustee registered in the register of shareholders is carried out within 10 working days, to others registered in the register shareholders to persons - no later than 25 working days from the date on which persons entitled to receive dividends are determined.

Useful information and no spam

Join us and get new ideas on the stock market!

Consequences of failure to pay dividends on time

Both laws provide the same procedure for situations of non-payment of dividends on time. They can be claimed by the participant within 3 years (or 5 years if this is stated in the charter) from the date:

- making a decision on payment to the JSC (clause 9 of Article 42 of Law No. 208-FZ).

- completion of the 60-day period in the LLC (Clause 4, Article 28 of Law No. 14-FZ).

If dividends are unclaimed at the end of these periods, they are returned to profit and claims for them are no longer accepted.

The legislation does not provide for any sanctions for exceeding the deadline for paying dividends. The consequences may be that the participants go to court demanding the payment of not only dividends, but also interest for the delay in their transfer. If it is proven that the JSC that accrued the dividends opposes their payment, then a fine is possible under Art. 15.20 of the Code of Administrative Offenses of the Russian Federation in the amount of:

- from 20,000 to 30,000 rub. for officials;

- from 500,000 to 700,000 rubles. for legal entities.

For information on the rules for reporting dividends in the 6-NDFL report, read the material “How to correctly reflect dividends in the 6-NDFL form?”

Who is entitled to dividends?

The right to receive dividends is granted to persons who were owners of shares of the corresponding category (type) or persons who exercised rights under these shares on the date of compilation of the list of persons entitled to receive income (“the date of closure of the register for income”).

The closing date of the register for receiving income on the company's shares is determined by the General Meeting of Shareholders of the company and is set in the interval: 10 days before the meeting - 20 days after the meeting.

A register is a list of shareholders of a company with information about the number of shares they own. Fixation is needed because someone is constantly buying and selling shares on the stock exchange.

If you know it in advance, you can buy shares in time and quickly receive dividends. But often shares rise in price as soon as a company approves its dividend, so it's better to buy shares even earlier.

Frequency and documents

A joint stock company has the right to decide to pay dividends four times a year: the first quarter, half a year, 9 months and a year.

The company does not have the right to make a decision on the payment of dividends in the cases listed in Article 43 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”:

- until full payment of the entire authorized capital;

- until all shares are repurchased;

- if on the day the decision to pay dividends is made the company meets the signs of bankruptcy or these signs appear in the company as a result of the payment of dividends. In this case, the head of the company must, within 10 days, inform the persons who have the right to initiate the convening of an extraordinary general meeting of shareholders;

- if on the day the decision to pay dividends is made, the value of the net assets is less or will become less after the payment of dividends of the amount of the authorized capital, reserve fund and the excess of the liquidation value of preferred shares over their par value.

The General Meeting of Shareholders may decide to pay both annual and interim dividends.

The annual general meeting of shareholders is held annually within the time limits established by the charter, but no earlier than two and no later than six months after the end of the year.

The decision to pay interim dividends can be made within three months after the end of the reporting period.

Decisions made by shareholders are documented in the minutes of the general meeting. A list of persons entitled to dividends is attached to the protocol.

The protocol must indicate:

- place, date and time of the general meeting;

- surnames of the chairman and secretary of the meeting;

- the total number of votes held by shareholders and the number of votes held by shareholders participating in the meeting;

- agenda and decisions adopted at the meeting.

How to find out the size of dividends?

The board of directors, depending on the company's dividend policy, makes its recommendations on the size of dividends once or several times a year. However, this does not mean that the company is absolutely obliged to decide on the payment of interim dividends. The size of dividends per share of different types may differ, it all depends on the company's dividend policy. In addition, it determines the closing date of the register (the so-called dividend cut-off) - the date on which you must own shares in order to receive dividends. All dividend dates for Russian and American companies are also located in the cards ]in the dividends tab[/anchor].

Next, the amount of dividends and the decision on their payment are approved by the meeting of shareholders. Such meetings are annual (annual general meeting of shareholders - AGM) and extraordinary (extraordinary general meeting of shareholders - EGM). At the same time, the amount of dividends cannot be more than recommended by the Supervisory Board (directors).

Example:

The cut-off for Detsky Mir shares is May 27, 2022, so you need to buy shares 2 business days before that - on Thursday, May 23, 2019, or earlier.

Typically, after the cut-off date, shares become cheaper by the amount of the dividend paid per share.

Dividends in advance

If your company operates with stable profits, you don’t have to wait until the end of the year and pay dividends quarterly. This becomes especially relevant in light of new amendments to the Tax Code.

From January 2005, the personal income tax on dividends will increase to 9 percent (Law No. 95-FZ of July 29, 2004). But you still have the opportunity to save owners money. To do this, you need to pay interim dividends based on the results of 9 months of 2004 and charge 6 percent of personal income tax. Then only fourth quarter dividends will fall under the newly introduced additional 3 percent.

You have the right

Firms are allowed to pay interim dividends. For joint stock companies, this opportunity is enshrined in paragraph 2 of Article 42 of the Federal Law of December 26, 1995 No. 208-FZ. And for limited liability companies - in paragraph 1 of Article 28 of the Federal Law of February 8, 1998 No. 14-FZ.

If the charter provides for the payment of dividends only at the end of the year, this does not deprive the company of the right to accrue interim payments based on the results of three quarters. But we will have to at least formally hold an extraordinary meeting of shareholders. The board of directors must present to the meeting a recommended amount of net profit that shareholders will share.

To recommend any profit, it must first be calculated. This is where difficulties may arise.

Minor inconveniences

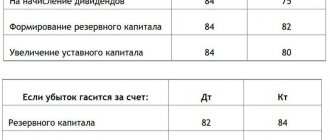

The thing is that the accounting rules do not provide an algorithm for calculating interim net profit. Net profit here is determined only by the results of work for the year. When reforming the balance sheet, the accumulated annual total is written off from the debit of account 99 “Profits and losses” to the credit of account 84 “Retained earnings (uncovered loss)”. In quarterly reporting, interim profit is not reflected in account 84. But the entry for interim dividends is made from this account:

Debit 84 subaccount “Profit subject to distribution” Credit 75 subaccount “Calculations for payment of income”

– dividends were paid for 9 months of 2004.

It turns out that the accountant accrues dividends in advance, having calculated the preliminary profit “on the knee”.

Let's look at the procedure for paying interim dividends using an example.

Example

Alexey Ivanov is the sole founder of Passiv LLC. Therefore, he unilaterally decided to pay dividends based on the results of three quarters (Article 39 of the Law “On Limited Liability Companies”).

Profit for 9 months amounted to 300,000 rubles. Ivanov ordered in writing that 75 percent of profits be used to pay dividends.

The Passiv accountant made the following entries:

Debit 84 Credit 75-2

– 225,000 rub. (RUB 300,000 x 75%) – dividends were accrued to Ivanov;

Debit 75-2 Credit 68

– 13,500 rub. (RUB 225,000 x 6%) – tax was withheld from Ivanov’s income;

Debit 75-2 Credit 50

– 211,500 rub. (225,000 – 13,500) – dividends were paid to Ivanov.

If the organization receives a loss in the fourth quarter, income tax on “early” dividends will need to be recalculated. Indeed, in this situation, part of the previously made payments will no longer be considered dividends, since the annual profit was not enough for them. On this part you will have to pay personal income tax at a rate of 13 percent.

N. Kalokhina, PB expert Material provided by the magazine “Practical Accounting”, No. 9, 2004.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Is this a dividend gap?

When the last day on which one could be included in the register for dividends passes, the price of the share, as a rule, falls by the amount of these dividends.

For example, the last day to be included in the Company register for dividends will be September 16. The closing price of the “Company” on September 16, 2019 will be 616 rubles. With dividends of 25.5 rubles. per share, the dividend gap will be approximately equal to the size of the dividend. Thus, the share price on September 19 from the opening of the market will fall to 590.5 rubles.

The money seems to be leaving the company, since it will soon be paid to the shareholders included in the register. Therefore, those who buy shares later, without the right to dividends, will want a discount on the amount of dividends. Yesterday's owners do not lose anything: their shares have fallen in price, but they received dividends.

The price of a stock does not always fall precisely due to the amount of dividends: sometimes it recovers the fall quite quickly. But there is such a pattern, and it must be taken into account.

How quickly does a stock close its dividend gap?

It all depends on the state of the market and future profit prospects. If the market believes that dividends will rise next time, then the stock remains attractive and can quickly close the gap. If the last time there were large dividends and a deterioration in profits is expected in the future, then an unclosed gap may hang for a long time.

The Supreme Court had to remind that dividend arrears relate to “registered” requirements

In the dispute over the payment of dividends by a bankrupt, the Supreme Court recalled that the issue of legal qualification is not resolved either by the rules of prejudice, much less by the rules on the generally binding nature of judicial acts (Determination of June 11, 2022 No. 305-ES20-16 in case No. A41-15768/ 2017).

Three authorities considered the “registration” requirement to be current

JSC Central Design Bureau of Oil Equipment has arrears in paying dividends for 2003–2014. to its shareholder PJSC Gazprom. In February 2016, they entered into an agreement in which they determined the procedure and timing of debt repayment: by the end of September 2022, Gazprom was to receive the entire amount in eight tranches. However, in March 2022, the Arbitration Court of the Moscow Region initiated bankruptcy proceedings for the design bureau and in October 2022 declared it insolvent.

The debtor was supposed to make three more payments in favor of Gazprom, but the bankruptcy trustee and the shareholder could not agree on the priority of satisfying these demands. The position of the manager was that the claims are not subject to inclusion in the register, since they arise from Gazprom’s participation in the debtor’s authorized capital, and are not current, since the obligations to pay dividends arose before the initiation of bankruptcy proceedings. The shareholder insisted that the debt is a current payment, since its repayment period came after the date the court accepted the application and initiated bankruptcy proceedings for the bureau.

The bankruptcy trustee appealed to the Moscow Region CA with a statement to resolve these disagreements. The first instance supported Gazprom's position, the appeal and the district court agreed with it. They proceeded from the fact that, according to the previously adopted determination of the Moscow Region AS dated January 11, 2022, similar demands of Gazprom arising from the same agreement dated February 17, 2016 were qualified as current payments. By virtue of Art. 16 and 69 of the Arbitration Procedure Code of the Russian Federation on the mandatory and prejudicial nature of judicial acts, similar debt on controversial points is subject to the same qualification, the courts decided.

The bankruptcy trustee filed a cassation appeal with the RF Supreme Court. According to the manager, repayment of debt on dividends is possible only after satisfying the claims of bankruptcy creditors. He also noted that the disputed claims cannot be attributed to current payments, since the corresponding obligation of the debtor arose before the initiation of his bankruptcy proceedings, and the agreement dated February 17, 2016 is not a novelty.

The Supreme Court pointed out the inadmissibility of reference to prejudice in legal qualification

Having studied the arguments of the parties, the Judicial Collegium for Economic Disputes of the RF Armed Forces noted that the dispute essentially boils down to resolving the issue of the priority of satisfying Gazprom’s demands on the design bureau.

The court recalled that, by virtue of Art. 134 of the Bankruptcy Law, the claims of creditors for current payments are first repaid, i.e. for obligations related to legal relations that arose after the initiation of bankruptcy proceedings (Clause 1, Article 5 of the Bankruptcy Law). Then, in the manner established in Art. 134 priority requirements of registered creditors are satisfied, i.e. claims from obligations arising before the initiation of bankruptcy proceedings. After this, calculations are made for the restitution claims of creditors who committed abuses in invalid transactions, as well as for the claims of creditors submitted after the closure of the register. And only then, at the expense of the debtor’s property remaining after completion of settlements with creditors in accordance with Art. 148 of the Bankruptcy Law, the claims of its founders (participants) for obligations arising from such participation are extinguished, the Economic College indicated.

“Due to the ban on the payment of dividends when introducing the monitoring procedure established in paragraph 1 of Art. 63 of the Bankruptcy Law, this debt cannot in any way be current,” she emphasized. In addition, the Supreme Court added, in accordance with Art. 2 of the Bankruptcy Law, the requirement to pay dividends is not a requirement of the bankruptcy creditor. “The debt under this claim must be satisfied after the claims of “late” creditors and restitution claims for invalid transactions have been satisfied. Under such circumstances, the date of conclusion of the debt payment agreement does not matter for the substance of the separate dispute under consideration,” the RF Supreme Court concluded.

Regarding Gazprom’s argument to recognize a similar claim as current in an earlier decision of the Moscow Region Arbitration Court, the Court indicated that such a decision is not a sufficient basis for a different classification of dividend payment debt. The issue of legal qualification cannot be resolved according to the rules of prejudice, and even more so according to the rules of the generally binding nature of judicial acts, the Economic Collegium emphasized.

“Indeed, the assessment given by the court to the circumstances that were established in the previously considered court case is subject to consideration in the subsequent case. However, the court is not bound by the previous assessment and, having reached different conclusions, must indicate the relevant motives,” she said. This approach is reflected in paragraph 2 of the Resolution of the Plenum of the Supreme Arbitration Court of July 23, 2009 No. 57 on some procedural issues in the practice of considering cases related to non-fulfillment or improper fulfillment of contractual obligations, as well as in paragraph 4 of the joint Resolution of the Plenum of the Supreme Court and the Supreme Arbitration Court No. 10/ 22 about some issues that arise in judicial practice when resolving disputes related to the protection of property rights and other property rights.

On this basis, the Supreme Court overturned the acts of lower authorities and recognized the claim of PJSC Gazprom as subject to satisfaction after the claims of “late” creditors were repaid (clause 4 of Article 142 of the Bankruptcy Law).

Lawyers commented on the position of the Court

Lawyer, partner of Tenzor Consulting Group Anton Makeychuk noted that the determination of the Supreme Court concerns not so much the legal qualification of the requirements as the assessment of the prejudice of judicial acts. “The Supreme Court indicated that, despite the existence of an agreement to pay the debt, it is necessary to look at the original nature of the obligation,” the expert explained. In general, he added, this position could be traced back in the Resolution of the Plenum of the Supreme Arbitration Court of July 23, 2009 No. 63 on current payments, according to which a claim that arose before the initiation of bankruptcy proceedings and was subject to inclusion in the register cannot subsequently acquire the status of current.

“The debt payment agreement can hardly be considered an innovation, but this logic directly applies to the present case. It is not even about the creditor's register claim, but about the shareholder's claim, which must be satisfied last. Moreover, there is a direct legislative prohibition on the payment of dividends after the introduction of supervision. The courts, apparently, would have correctly determined the legal nature of the claim of PJSC Gazprom, but the mistake was the incorrect application of the prejudicial judicial act, which at one time recognized the specified debt as current,” the lawyer believes.

In his opinion, the Supreme Court correctly indicated that the court is not bound by the previous assessment and, having come to different conclusions, must indicate the corresponding motives. “This position was also expressed in the Determination of the Constitutional Court No. 2528-O/2014, according to which Part 2 of Art. 69 of the APC exempts from proving the factual circumstances of the case, but does not exclude the possibility of their different legal assessment depending on the nature of the particular dispute,” noted Anton Makeychuk. At the same time, he emphasized, a similar interpretation of this norm could be traced back in the Resolution of the Presidium of the Supreme Arbitration Court of June 15, 2004 No. 2045/04 in case No. A40-30884/03-84-351.

“Thus, the Supreme Court did not develop a new position in the commented definition, but once again focused on uniformity in the application and interpretation of the law by courts, correcting the mistakes of lower courts,” the expert concluded.

Lawyer, Lidings partner Alexander Popelyuk noted that sometimes disputes reach the Supreme Court, which had no chance of being resolved the way seven lower judges were able to do it. “But practice shows that this is not the case. Indeed, the issue of including a shareholder’s request for dividend payment in the register is not at all difficult. Such requirements go “beyond the register”, i.e. are satisfied after the claims of “late” creditors and restitution claims for invalid transactions are repaid,” the expert supported the position of the Supreme Court.

The difficulty in this case, according to the lawyer, was caused by the fact that the creditor referred to the date of the agreement on the payment of the debt and the presence of another court ruling, by which similar claims were recognized as current. “This sometimes happens when an illegal judicial act remains in force either by mistake or due to the inaction of other creditors and is used by an obstinate creditor as a model for uniform application in other disputes with its participation. This is what happened in this case,” explained Alexander Popelyuk.

The Supreme Court indicated that an error made in one dispute should not be repeated further, especially since such a judicial act is not prejudicial for the purposes of considering a new claim, the expert emphasized. “The date of conclusion of the agreement also does not matter, since the status of the shareholder’s demands does not cease to be corporate,” summed up Alexander Popelyuk.

What dividend yield will I receive?

Dividend yield of shares is the ratio of the amount of dividends for the year per share to the market price of the share, expressed as a percentage.

Yield = Dividend per share / current share price

Accordingly, the more profitable you buy shares, the greater the profitability you will receive in the future. To do this, it is most convenient to look at information on Russian and American dividends in the dividend calendar.

The procedure for distributing profits received in previous periods

The payment of dividends from retained earnings of previous years is practically no different from the distribution of current year profits.

The only difference is that the participants already know in advance that there is profit and it can be distributed among the participants.

A meeting of participants is held and a protocol is drawn up, or a decision if there is only one founder. They reinforce the desire of the owners to receive their share of dividends.

The next day after payment, personal income tax or income tax must be transferred to the budget.

Taxation of dividends

Income received on the securities market (from dividends and increases in market value) is taxed at a rate of 13%, with the exception of payments on state and municipal bonds, which are not taxed.

Dividends from foreign companies are also subject to tax. If you invest in U.S. securities on the St. Petersburg Exchange or through an overseas broker, sign Form W-8BEN. It shows that you are not a US resident. Without it, the tax on dividends is 30%, and with it - 13%. At the same time, 10% of them are automatically withheld, and you yourself will only have to pay 3%.

Collection of taxes on dividend payments

It should be noted right away that taxes must be transferred the next day after receiving dividends.

If the amount of income is paid to an individual, then personal income tax is transferred to the budget. The tax rate is 13% for Russian citizens and 15% for non-residents.

Payments to founders - organizations are subject to income tax. In most cases, the tax rate is 13% for Russian organizations and 15% for foreign companies.

It should be borne in mind that when receiving dividends, income tax is paid by organizations that are subject to both general and simplified taxation systems.

Buyback and dividends

Buyback or buyback is a procedure for the issuing company to repurchase its shares at the expense of its own or borrowed funds. The company can buy shares either directly from the market (from the stock exchange) or directly from shareholders.

After the shares are on the company’s balance sheet, it can redeem them (Lukoil is currently doing this), thereby reducing their number in circulation and increasing the net profit of the remaining securities, or use them for:

● Payments and/or exchanges in transactions to acquire other companies;

● Remuneration for top managers and/or employees;

● Sales back “to the market” after their value has increased.

The company buys back its own shares in order to:

● Improve the ratio of the market price of a share and earnings per share;

● Get rid of excess liquidity and capital dilution due to the issue of new securities;

● Receive benefits when calculating tax on dividends;

● Reduce the risk of a hostile takeover.

Reducing the number of shares in circulation increases earnings per share, even without overall growth in company profits, as well as dividend yield. Companies' demand for their own shares can also lead to an increase in stock prices, which is perceived positively by investors. Buyback announcements tend to keep shares from declining significantly.

Dividend approach

Classic passive income - dividends from shares. Many investors, when choosing such a strategy, make the same mistake - they try to select securities with the highest yield. Focusing only on this indicator, good options are rejected.

But companies whose capitalization is falling can show high dividend yields. Then the investor will earn on dividends, but lose due to falling stock prices.

Look for promising companies with consistent earnings growth, high profitability and low debt load.