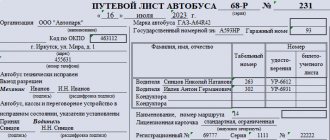

Passenger car waybill form

The template by which all institutions issue a vehicle voucher (form 3) was adopted by decision of the State Statistics Committee No. 78 of November 28, 1997 20 years ago.

Since then, many corrections have been made. The latest amendments were adopted on December 21, 2018 by Order of the Ministry of Transport No. 467, which came into force on March 1, 2019. This Resolution adopted various forms of vouchers for each type of vehicle. At the same time, the enterprise has the right to develop its own voucher form, but it must reflect mandatory requirements, such as:

- The name of the form is “Passenger car waybill”

- Number and date of its discharge.

- Duration of validity of the form. The longest time is one month.

- Details of the vehicle owner. Now it is required to display the OGRN.

- Details of the vehicle driver (full name, driver's license number (DR)).

- Vehicle details (registration number, model).

- Speedometer data on the eve of leaving the route and when returning to the garage.

- Date and time of departure along the route and return to the garage.

- Signature and full name the person who recorded the speedometer readings, with the date and time displayed.

- Date and time of the driver's medical examination before and after the trip.

- Stamp, signature and full name. doctor who performed the medical examination.

- Inspection information with date and time display.

- Signature and full name auto mechanic who examined the vehicle.

- The issued voucher is signed by the dispatcher and the head of the enterprise, or persons appointed by the head.

- If the institution has a seal, the issued form is certified by it.

The permit is issued in one copy and handed to the driver. Upon completion of the task, the driver must return the completed ticket to the responsible employee against signature.

Sample of filling out a waybill used to record the operation of a passenger car

To correctly reflect fuel consumption, organizations need a document containing information about the operation of the vehicle. For example, a waybill. Here is a possible form of a waybill in which an organization enters the information it needs about the operation of a passenger car used for travel of administrative and management personnel.

Situation

ODO "Alpha" uses the LADA Vesta SW Cross 1.6i passenger car (engine power 78 kW) owned by it. XXXX for trips of administrative and management personnel of the organization related to the performance of work duties (hereinafter referred to as the company car).

To record the operation of a company car and control fuel consumption, the organization has approved and used a document called “Passenger Car Waybill.” It is provided for filling it out for a calendar month with detailed information by day. The document, in particular, records information about the time of departure and return of the car, speedometer readings, mileage, fuel movement, serviceability of the car and the driver’s permission to drive, acceptance and delivery of the car by the driver. In accordance with the procedure adopted by the organization for issuing the specified document, when using a car for trips related to the performance of work duties within the city of Minsk, in the column “Route of travel” indicate “throughout the city of Minsk”. The organization keeps cost records for each structural unit. For these purposes, travel notes are made on the travel itinerary about the person who ordered the trip. In the “Customer” column indicate the signature, initials and surname of the person who made the trip, as well as the structural unit in which he works.

On the vehicle in question, by order of the manager, the following were installed for use:

— gasoline consumption rate is 7.8 l/100 km (in an amount equal to that determined by the Ministry of Transport);

— adjustments to this standard under certain operating conditions. In particular, when traveling around Minsk, the rate increases by 15%; at negative air temperatures at the time the car is put on the line, the fuel consumption rate increases by 5%. If boosts are applied simultaneously, they add up.

The organization keeps fuel records in liters with an accuracy of two decimal places.

On November 1, this car was used for business trips around Minsk. When the car was released onto the line, a positive air temperature was recorded.

Explanations for filling

1. Road transportation (both for own needs and under a road transportation contract) is currently carried out without issuing a transport document such as a waybill (paragraph 2, sub-clause 4.5, clause 4 of Decree No. 7; paragraph 2, article 2 , Part 1 Article 35, Paragraph 2 Part 1 Article 40 of Law No. 278-Z). But in order to correctly write off the fuel consumed by a vehicle and take into account the cost of this fuel for tax purposes, the organization must document the operation of the vehicle.

To record the operation of a company car, an organization can, for example, draw up a document called “Passenger car waybill.” She determines its form and order of filling independently. In this case, you can use the form of the waybill, previously mandatory for use when carrying out road transportation of passengers under relevant contracts, and the procedure for filling it out (paragraph 26, part 1, article 1, paragraph 2, article 2, part 1, article 35 of the Law N 278-Z; clause 1 of Instruction No. 25). The organization can also adjust this form (procedure) or develop such a document from scratch.

2. When creating the form of a waybill for a passenger car and the rules for its registration, you should determine the range of information that will be recorded in it:

1) information about the operation of the vehicle necessary for writing off fuel.

In order to write off fuel, you need documented data on its consumption. In the situation under consideration, such information is reflected in the document “Passenger car waybill”. Fuel consumption during its operational accounting is usually calculated as the difference between the remaining fuel in the car’s tank at the beginning and end of the day plus the amount of fuel filled. It is also reasonable to reflect such initial data for calculating fuel consumption on the waybill.

The cost of fuel spent on the operation of vehicles is written off in accounting as a debit to the accounts of production costs and sales costs from the credit of account 10, depending on the direction of use of these vehicles (Part 1, Clause 83 of Instruction No. 133). How data on the direction of transport use is recorded is determined by the organization independently. In particular, the waybill can reflect information about the driver’s completion of the task (for example, the route, the signature of the person in charge, etc.). The organization determines the degree of detail of the route in this document independently, taking into account the need for such information.

Fuel consumption is normalized. In particular, when taxing profits, costs include the cost of fuel consumed within the norms (subclause 1.2-1 of Article 171 of the Tax Code). Therefore, to control fuel consumption, along with its actual consumption, it is advisable to indicate information about fuel consumption according to the norm, economy or overconsumption.

In addition, it is advisable to reflect information about mileage: fuel consumption standards for a passenger car are generally set per 100 km of run, therefore, to confirm the value of the standard consumption and control the use of fuel, it is necessary to know the distance traveled by the car. If an organization, depending on the operating conditions of the vehicle, adjusts the fuel consumption rate or applies different standards, the mileage is recorded in the context of such conditions. It is logical to record the initial data for calculating mileage, that is, the speedometer readings when the car leaves and returns;

The listed information may be necessary for the organization for purposes other than fuel write-off. For example, information about fuel economy is needed if the organization rewards drivers for saving fuel and energy resources (subclause 1.1, clause 1 of Resolution No. 1124).

2) recording of the driver’s working time.

The employer must organize the recording of the working hours of his employees. Drivers’ working hours are recorded in time sheets and other documents.

Forms of documents for recording the use of working time, as well as the procedure for filling them out, are approved by the organization (Article 133 of the Labor Code, Parts 1 and 2, Clause 20 of the Regulations on Working Time of Drivers).

Certain information can be included in a document used to record the operation of the vehicle. But you can use another document. In the situation under consideration, the driver’s working time is not recorded in the waybill;

3) monitoring the technical condition of the car.

The organization is obliged to monitor the compliance of the technical condition and design of the vehicle it owns with the established requirements. Vehicles whose technical condition does not meet the established requirements are not allowed to participate in road traffic (paragraph 2, part 1, article 34 of Law No. 313-Z, clause 208 of the Traffic Regulations). The specified legal acts do not require documentation of the results of monitoring the technical condition of the vehicle. However, it is advisable to record such results. In the situation under consideration, the organization provided an appropriate mark in the document used to record the operation of the vehicle;

4) information about the driver being monitored to determine whether he is intoxicated or in a state caused by the consumption of narcotic drugs, psychotropic substances, their analogues, toxic or other intoxicating substances (hereinafter referred to as instrument control).

The driver undergoes instrument control before the start of the work shift (the start of transportation if it is carried out over several days). Information about the passage of the said control is recorded (Part 2, Article 34 of Law No. 313-Z, Part 1, Clauses 3 and 5 of Instruction No. 25/28). In the situation under consideration, the organization provided an appropriate mark in the document it developed, “Passenger Car Waybill.”

By decision of the head of the organization, instrument monitoring of intoxication can also be carried out during and after the end of the driver’s work shift (working day) (Part 2, Clause 3 of Instruction No. 25/28).

An organization may enter into the document used to record the operation of the vehicle other information it needs.

3. You should also determine for what period the document in question will be filled out. For example, you can create a separate document every day or fill it out for a certain period (for example, a week, a decade or a month).

For an example of filling out a possible form of a waybill for a company car, see MS-Excel

Read this material in ilex >>** follow the link You will be taken to the paid content of the ilex service

Why is it necessary to create waybills?

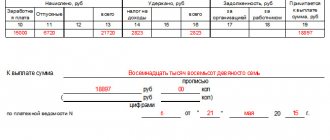

Vouchers are issued to report on the movement of the vehicle, write off consumed fuel, accrue the driver's salary, as well as accrual depreciation and other costs by the company's accounting department.

In addition, if the driver of a service vehicle is detained by a traffic police officer, the permit is the basis for the legality of departure and confirmation of the right to drive the vehicle. If there is no voucher, the driver will be fined in accordance with Art. 12.13 Code of Administrative Offenses of the Russian Federation.

To report on fuel consumed, materials are required certifying the refueling and the nature of the route. If fuel is refueled using fuel cards, this is reflected in the supplier’s documents.

If fuel payments are made in cash, then accounting is carried out using gas station receipts and driver reports. When a vehicle is connected to electronic control, which provides monitoring of the route and consumption of fuel and lubricants, reports from this system are used to write it off (Letter of the Ministry of Finance No. 03-30-06/1/354 dated June 16, 2011).

Types of waybills for trucks

Depending on what indicators are used to record vehicle operation, there are two types of waybills - 4-C and 4-P.

Form 4-P

Waybill 4-P is used in cases where the operation of transport is recorded on the basis of recording the time of its operation. This document is filled out when the fee for using a car is calculated based on time rates.

For example, when a vehicle transports goods, and payment is made not for the tonnage transported, but for the time the vehicle is in operation. However, there is a limitation in its application. Such a waybill can be issued if cargo is delivered to no more than two destinations per day.

Form 4-C

This form 4-C is most often used to document the operation of vehicles. It allows you to take into account the piecework indicators of vehicle use.

This waybill is used by carriers who charge per ton-kilometer.

Required details on the voucher

The waybill is considered a strict accounting form, therefore it is required to display data regulated by the legislative norms of the Russian Federation. If an institution wishes to develop its own form, it is necessary to take into account the provisions for its design.

- The title side of each travel form must display:

- Date of validity of the voucher. If the voucher is issued not for a day, but for a certain period, you must write it as follows (for example, 07/22/2019 - 07/26/2019).

- Number and series of the document. The number must be unique. Series are assigned during the production of forms in the printing house.

- Details of the company and its stamp (name, address, contact details, OKUD and OKPO codes).

- Vehicle details (model, make, vehicle license plate). If the vehicle is rented, you must display the details of the rental agreement.

- Driver details (full name, number and category of driver's license, type of license, if any).

- Route, displaying the final destination, the driver’s departure and return times.

- Signature of the dispatcher who issued the order to the driver.

- Signature of a car mechanic, displaying information:

- about the serviceability of the vehicle at the beginning and completion of the task;

- speedometer values;

- about refueling fuel and lubricants and its balance;

- about the brand of fuel;

- about fuel consumption, displaying standard and actual consumption.

- information about honey examination of the driver and technical inspection (MOT) of the vehicle.

The fact that a car mechanic is obliged to ensure control of vehicle maintenance on the eve of each route has been regulated by the Ministry of Transport of the Russian Federation since 2014. However, the required details did not exist in the voucher, which allowed enterprises to fail to comply with the established requirement with impunity. Currently, this property has become mandatory. It is required to display information about the owner of the vehicle, indicating the OGRN, IP - OGRIP. It is no longer necessary to put a stamp on unified forms (form 3) that have been approved. Enterprises that develop their travel forms are required to include all the required details in accordance with Order of the Ministry of Transport No. 467 dated December 21, 2018.

It should also be noted that all medical examinations of drivers on the eve of the trip are recorded in a specialized journal. The need for a medical examination of drivers is established by order of the head of the enterprise. In addition, a medical examination after returning from a flight is mandatory for drivers carrying out passenger transportation or transporting dangerous goods.

Pre-flight inspection includes:

- Listening to the driver's complaints.

- Visual inspection.

- Checking temperature, pressure, pulse.

- Testing for alcohol with a breathalyzer.

- Definition of taking psychotropic substances.

Based on the results of the examination, the doctor issues a conclusion and allows departure by signing a voucher, displaying the date and time of the examination.

- Mandatory details on the back page of the voucher:

- Serial number of the record. Each route must be displayed under a unique number.

- Customer code.

- Route, showing the departure point and destination.

- Departure and return times.

- The distance traveled is entered in the “Completed” field.

- Driver's signature.

The travel form is always presented in one copy.

( Video : “Registration of a waybill”)

Truck waybill. Standard interdepartmental form No. 1

Approved by order of the Central Administration of Ukraine under the Council of Ministers of the USSR dated December 14, 1972 N 816

Standard interdepartmental form N 1 ———————————— Approved by the Central Administration of the USSR on December 14, 1972 N 816 Place for the stamp ¦TRAIN SHEET N _____ ¦ ¦TRUCK ¦ ¦ ¦ ¦»__» ________ ____ g.¦ ————————————+ ¦The car is technically sound. ¦ ¦Brand ¦Chauffeur _______________¦Speedometer readings upon departure ¦Motor vehicle __¦vehicle _______¦ (last name, first name, ¦from the garage ______ km ¦________________¦ ¦ patronymic) ¦ ¦ (name, ¦Garage N _______¦Loader _____________¦I authorize departure: mechanic ¦________________¦Government N ¦ (last name, first name,¦ ¦ address) ¦__________________¦ patronymic) ¦The car is technically ¦ ¦Trailer N _________¦ ¦in good condition received: ¦Telephone N ______¦ (single-axle,¦Column number _______¦driver ¦ ¦ two-axle)¦ ¦ +—————-+——————+———————+— ¦ TASK TO THE DRIVER ¦ Dispensing fuel (fuel) +—————————— ——————————+—————————- ¦In whose dis- ¦Place ¦ Place ¦Dis- ¦Name¦Number ¦Quantity ¦ ¦l, kg¦Signature¦ ¦order ¦ taking¦delivery¦standing-¦ cargo ¦riders ¦cargo, pcs.,+————-+——+——-+ ¦ ¦cargo ¦cargo ¦nie, ¦ ¦s ¦weight, t ¦Remaining measurement¦ ¦ ¦ ¦ ¦ ¦ ¦km ¦ ¦loaded¦ ¦when leaving ¦ ¦ ¦ +———-+——+———+——+———+——+————+ +——+—— -+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ Issued by: ¦ ¦ ¦ +———-+——+———+——+———+——+————+ ————-+——+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———-+——+———+——+———+——+——— —+————-+——+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———-+——+———+——+———+——+— ———+————-+——+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦Remaining measurement¦ ¦ ¦ +———-+——+———+——+———+ ——+————+upon +——+——-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦return ¦ ¦ ¦ +———-+——+———+——+———+— —+————+————-+——+——— ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———-+——+———+——+———+——+ ————+The driver handed over the car ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———-+——+———+——+———+——+————+The car was received at ___ o’clock. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦___ min. +———-+——+———+——+———+——+————+Speedometer reading when returning to the garage _____ km +———-+ ——+———+——+———+——+————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦Mechanic +———-+——+———+——+——— +——+————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———-+——+———+——+———+——+————+ ¦Time to leave the garage : ¦Return time to the garage ¦ ¦ according to schedule at ___ hour. ___ min.¦ at ____ hour. ___ min. ¦ ¦ actually at ___ o'clock. ___ min.¦ ¦ ¦ ¦ ¦ ¦ Dispatcher ¦ Dispatcher ¦ +———————————+—————————+ ¦Delays, downtime, visits to the garage and other marks _ ¦ ¦______________________________________________________________¦ ¦_______________________________________________________________¦ ————————————————————— Back side of form N 1 COMPLETING THE TASK ——————————————— —————————————————————— ¦N¦ Filled out by the driver on the basis of shipping documents ¦ Filled out ¦Class¦ ¦ +—————————— —————————————————+ in the motor vehicle fleet “cargo” “e” group- “code” place “place” N and date “designated- “code” loaded, t “time” pros-¦time¦request-+———————+ ¦ ¦z¦zo- ¦for- ¦from- ¦as- ¦commodity - ¦vanie¦gru-+————+pri- ¦ at the same time, mileage, done, dvla-kaz-rights-otherwise-transport-cargo, for everything-including being-under-being-under-km-tonno - ¦ ¦ to ¦division¦ of ¦documentation¦ ¦ ¦th ¦under ¦ag- ¦under ¦kilometers¦ ¦ ¦and¦ ¦ ¦ ¦ment or ¦ ¦ ¦ ¦ at - ¦ load- ¦ unload-¦ load-+———+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦note-¦ ¦ ¦ ¦chains ¦unloading¦in a way ¦unloading¦ which ¦with ¦without ¦all-¦in ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ra or ¦ ¦ ¦ ¦ +——+——+——+——+gr-¦gr-¦go ¦t.ch. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦weighing- ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ m ¦ for ¦ ¦ on ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦nia <*> ¦ ¦ ¦ ¦ ¦а ¦and ¦а ¦and ¦а ¦and ¦а ¦and ¦ ¦ ¦ ¦pri- ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦с.¦н.¦с.¦н.¦ s.¦n.¦s.¦n.¦ ¦ ¦ ¦tsepah¦ ¦ +-+—-+—-+——+——+———-+——+—-+—-+——- +—+—+—+—+—+—+—+—+—-+—-+—-+——+——+ ¦ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9¦10¦11¦12¦13¦14¦15¦16¦17¦ 18¦ 19¦ 20¦ 21¦ 22¦ +-+—-+—-+——+——+———-+—— +—-+—-+——-+—+—+—+—+—+—+—+—+—-+—-+—-+——+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +-+—-+—-+——+——+———-+——+—-+—-+——-+— +—+—+—+—+—+—+—+—-+—-+—-+——+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +-+—-+—-+—+——+———-+——+—-+—-+——-+—+—+—+—+—+—+— +—+—-+—-+—-+——+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +-+—-+—- +——+——+———-+——+—-+—-+——-+—+—+—+—+—+—+—+—+—-+—-+—-+ ——+——+ ¦ ¦ ¦, etc. to the end (ruling through 14 points) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ L-+—-+—-+——+——+———-+——+—-+—-+——- +—+—+—+—+—+—+—+—+—-+—-+—-+——+—— Driver The recording was checked by the dispatcher (responsible person) Garage number ——— Code ——— Type — —— car ¦ ¦ brand ¦ ¦ trailer ¦ ¦ —————+——+——-T+—-T-+———-+——+T———————————— ——————————————- ¦ Number of hours ¦ Number ¦ Mileage, ¦ Transported ¦ Done ¦ Expense ¦ Payroll ¦ Types of work ¦ Co- ¦ Price ¦ +——————— ———+rider km ¦ cargo, t ¦ tonne — ¦fuel +——————————+ and payment ¦li- +———-+ ¦in ¦in ¦in ¦ including ¦ from ¦ ¦ ¦kilometers¦ (fuel- ¦ta- ¦ type of payment ¦ ¦ches-¦sho- ¦cargo-¦ ¦on-¦mov-¦pro-+————-T-+gru- ¦ ¦ ¦ ¦ th), l, kg¦bel-+———————T-+ ¦your ¦feru¦chiku ¦ ¦ry-¦hard- ¦standing¦under ¦on ¦ ¦zom +———+——— -+———-+———-+ny N¦piecework ¦__________¦and+———-+—-+—-+——+ ¦de ¦nii ¦ ¦pog- ¦technique-¦ ¦ ¦about -¦in that¦everything-¦in that¦everything-¦in that¦ by ¦fak-¦ ¦(cipher ___)¦(cipher ___)¦t¦For tone-¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦in simple ¦ ¦ ¦number¦of¦of¦of¦of ¦number¦norm¦- ¦ +———-+———-+about¦no- +—+—-+—-+——+ ¦ ¦ ¦ ¦and ¦unis- ¦ ¦ ¦ ¦s ¦ ¦on ¦ ¦on ¦ ¦ches-¦ ¦sum-¦if-¦sum-¦if-¦g¦kilo- ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦disg- ¦ right- ¦ ¦ ¦ ¦gr- ¦ ¦pri- ¦ ¦pri- ¦ ¦ki ¦ ¦ma ¦honest-¦ma ¦honest-¦o¦meters +—+—-+—-+——+ ¦ ¦ ¦ ¦ tight¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ in ¦ ¦ in ¦ ¦ (by ¦ ¦ ¦ ¦ ¦ +—+—-+—-+——+——+-+— —+—+——+—-+——+—-+——+——+—-+ ¦ ¦hours¦ ¦hours¦ ¦class +—+—-+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+—-+——+—-+——+-+load) ¦ ¦ ¦ ¦ ¦ —-+—-+—-+——+—— +-+——+—+——+—-+——+—-+——+——+—-+sho- ¦ ¦ ¦ ¦ ¦ +——-+—+—-+—-+— —+ ¦fera ¦ ¦ ¦ ¦ ¦ ¦For ¦ ¦ ¦ ¦ ¦ Accountant (accountant) +——+—-+——+—-+——+-+tons +—+—-+—-+—— + ¦load-¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦chika ¦ ¦ ¦ ¦ ¦ ¦ +—+—-+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——-+—+—-+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦Others ¦ ¦ ¦ ¦ ¦ ——+—-+——+—-+——+-+ + —+—-+—-+——+ Taxi driver ¦ ¦ ¦ ¦ ¦ ¦ ———+—+—-+—-+—— M.P. ——————————- <*> Documents are attached to the waybill. Note. When paying for vehicles by the hour, the customer certifies the following data in the waybill in the “Task Completion” section: time of arrival and departure of the vehicle, number of kilometers driven (according to speedometer readings) during the time of work with the customer, number of hours of use of the vehicle by the customer; the driver fills in the columns: N of the trip, cargo owner, place of departure, place of destination, name of the cargo.

The delivery date has changed

According to the latest amendments to the legislation of the Russian Federation, it is not allowed to issue one ticket for multiple routes on different working days. The new rules state that the travel form must be issued the day before:

- each departure - if the flight is longer than a working day;

- the beginning of the first trip - if the scope of the task is less than a day and the driver receives one or many tasks.

The form in which the validity period of the form is displayed on the ticket depends on the duration of the route. If its duration is no more than a work shift, the duration of the voucher is displayed as one date. If the duration of the route is more than one shift, the “validity period” column displays the start date of the route and the date of its completion.

Validity

Until March 1, 2019, it was possible to issue a voucher for both one day and a full month. After the amendments reflected in Order No. 467, the voucher is issued on the eve of each shift or assignment. The driver is given a ticket on the eve of departure. The standard form allows you to change the duration of the voucher, since the flight may be delayed, and traveling without a voucher is a violation.

At the end of the validity period of the issued voucher, the form is returned to the responsible employee against signature and then sent to the accounting department for revision.

How to issue a waybill for a passenger car

The rules for issuing a passenger vehicle voucher (form No. 3) were adopted by order of the Ministry of Transport of the Russian Federation dated No. 152 on September 18, 2008.

Registration is carried out, for the most part, by dispatchers. At enterprises where there is no such service on staff, and the passenger vehicle is the boss’s personal car, the permit can be filled out by the boss himself or an employee appointed by order. If filling out vouchers is entrusted to the driver (this is not prohibited), he is obliged to fill out the vehicle mileage based on instrument readings. Form No. 3 can be issued for passenger vehicles, both in motor transport enterprises and in ordinary institutions. The design features of this form are reflected in Rosstat letter No. IU-09-22/257 dated 02/03/2005, where it is noted that each travel form is stamped with an enterprise stamp (not a seal). You are also required to comply with other standards for filling out vouchers.

( Video : “How to fill out travel forms correctly”)

It is required to record instrument readings both on the eve of leaving and when returning to the garage. The fuel sensor, speedometer and other devices are subject to accounting.

Provisions for filling out vouchers:

- An auto mechanic is required to inspect the vehicle's maintenance, having entered his/her report on the form on the eve of departure.

- A medical professional is required to check the driver’s health, displaying the date and time, a personal signature, and also writing down the phrase that the driver “had a medical examination on the eve of departure with permission to work.”

The issued form is completed as follows:

- In the upper left section of the form fill out:

- Movement start date.

- Name of the company that owns the vehicle.

- Information about the driver.

- Vehicle details.

- Time to leave the garage.

- Time to return to the garage.

- Medical examination information.

- Medical details employee who carried out the inspection.

- In the right section of the form enter:

- Codes from the company's constituent materials.

- Ticket number.

- Mileage.

- Information about the auto mechanic performing vehicle maintenance.

- Type of fuel.

- Volume of fuel and lubricants filling.

- In the lower section of the form the following is indicated:

- Signature of a mechanic confirming the serviceability of the vehicle.

- Driver's signature.

Waybill for a passenger car (Sample of filling)

________OJSC "Alfa"_______ (name of the carrier (stamp (seal))) Waybill of a passenger company car N 00058 for the period from “02” to “08” ___ May___ 2012 Car __Ford Mondeo 2.0___ Registration plate _____5568 KX-7_____ (make ) Driver _____Korotkov S.I._____ Driver's license __KM 156892__ (last name, initials) ————————————————————————————————— ——————————————————————— ¦ ¦ ¦ Indications ¦ ¦ ¦ Car ¦ Upon return ¦ ¦ ¦ ¦ ¦ Time (h, min) ¦ speedometer ¦ ¦ Movement fuel ¦ technically ¦ car ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ serviceable ¦ ¦ Driver ¦ Signature ¦ ¦ +———————+—————+ +———————————— ——————+——————+——————+ according to ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ balance ¦ filled ¦ fuel consumption, l ¦ ¦ ¦ ¦ ¦ condition ¦ persons, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ fuel, l ¦ fuel ¦ ¦ ¦ ¦ ¦ ¦health responsible-¦ ¦ Date ¦ ¦ ¦ ¦ ¦ ¦Mileage,+—————+————— —+———————+ departure ¦ ¦ ¦ accepted ¦administration ¦ ¦ (number,¦ ¦ ¦ ¦ ¦ ¦ km ¦ ¦ ¦ ¦ signature ¦ ¦ ¦ ¦ allowed ¦ accepted ¦ passed ¦ (signature ¦ allowed ¦ for ¦ ¦ month) ¦ ¦return-¦ in ¦ at ¦ at ¦ ¦ ¦ ¦ ¦ (stamp) ¦ ¦ ¦savings¦ (signature ¦(signature¦(signature¦ (stamp) ¦ (signature ¦ formal- ¦ ¦ ¦ departure¦ order¦departure¦return-¦ ¦ ¦ with ¦ quantity- ¦ authorization- ¦ ¦ ¦ (+), ¦ (stamp) ¦ driver- ¦ driver- ¦authorized-¦ (stamp) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ upon ¦return-¦quality,¦accepted¦ by ¦actually¦re- ¦authorized¦ ¦ body) ¦authorized ¦travel¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦departure¦ (date and ¦ ¦ (-) ¦ faces ¦ ¦ ¦ ¦ persons ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ number ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ gas station receipt)¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +— —-+——+——-+——+——+——-+——-+——+——-+——-+———+——+——+———+— ——+———+———+———+———-+———+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ 13 ¦ 14 ¦ 15 ¦ 16 ¦ 17 ¦ 18 ¦ 19 ¦ 20 ¦ +——-+——+——-+——+——+——-+——-+——+——-+—— -+———+——+——+———+———+———+———+———+———-+———+ ¦ May 2 ¦ 8:15 ¦ 16 :30 ¦ 8:15 ¦ 1256 ¦ 1400 ¦ 144 ¦ 43 ¦ 30 ¦ — ¦ ¦ 13 ¦ 13 ¦ — ¦ Ilyin ¦Korotkov¦Korotkov¦ Ilyin ¦ Petrov ¦Korotkov¦ +——-+——+——-+ ——+——+——-+——-+——+——-+——-+———+——+——+———+———+———+——— +———+———-+———+ ¦ 3 May ¦ 8:30 ¦ 17:00 ¦ 8:30 ¦ 1400 ¦ 1580 ¦ 180 ¦ 30 ¦ 14 ¦ — ¦ ¦ 16 ¦ 16 ¦ — ¦ Ilyin ¦Korotkov¦Korotkov¦ Ilyin ¦ Petrov ¦ ¦ +——-+——+——-+——+——+——-+——-+——+——-+——-+——— +——+——+———+———+———+———+———+———-+———+ ¦ 4 May ¦ 8:15 ¦ 17:00 ¦ 8: 45¦ 1580¦ 1690¦ 110¦ 14¦ 20¦ 17¦Cas. check ¦ 10 ¦ 11 ¦ — 1 ¦ Ilyin ¦Korotkov¦Korotkov¦ Ilyin ¦ Petrov ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ 359842 ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +— —-+——+ ——-+——+——+——-+——-+——+——-+——-+———+——+——+———+———+——— +———+———+———-+———+ ¦ 7 May ¦ 8:15 ¦ 17:00 ¦ 8:45 ¦ 1690 ¦ 1880 ¦ 190 ¦ 20 ¦ 33 ¦ 30 ¦ Cas. check ¦ 17 ¦ 17 ¦ — ¦ Ilyin ¦Korotkov¦Korotkov¦ Ilyin ¦ Petrov ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ 456852 ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——- +——+— —-+——+——+——-+——-+——+——-+——-+———+——+——+———+———+———+ ———+———+———-+———+ ¦ 8 May ¦ 9:00 ¦ 18:00 ¦ 9:00 ¦ 1880 ¦ 1980 ¦ 100 ¦ 33 ¦ 25 ¦ — ¦ ¦ 9 ¦ 8 ¦ 1 ¦ Ilyin ¦Korotkov¦Korotkov¦ Ilyin ¦ Petrov ¦ ¦ +——-+——+——-+——+——+——-+——-+——+——-+——-+ ———+——+——+———+———+———+———+———+———-+———+ ¦Total for the period from 02 ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ until May 08, 2012 ¦43:15 ¦ x ¦ x ¦ 724 ¦ x ¦ x ¦ 47 ¦ x ¦ 65 ¦ 65 ¦ — ¦ x ¦ x ¦ x ¦ x ¦ x ¦ x ¦ ————————+——+——+——-+——-+——+——-+——-+———+——+—— +———+———+———+———+———+———-+——— For calculations: Linear fuel consumption rate - __7.8__ l/100 km Fuel consumption at the rate for ____ (period) Increase for Minsk - _15_% (8.97 l/100 km) mileage in Minsk - _724_ km; mileage outside the city - _0_ km; fuel consumption (city): 724 / 100 * 8.97 = 64.9 l; fuel consumption (outside the city): 0 l; Total fuel consumption is normal: 64.9 liters. ————————————————————————————————————— ¦ Completing the task ¦ +———————— ————————————————————————————-+ ¦ Date ¦Route¦ Total ¦ including: ¦Customer (name, surname, ¦ Other ¦ ¦ (date, +——————+mileage, +————————+ initials of the person in charge ¦ information ¦ ¦ month) ¦ from ¦ where ¦ km ¦ within the city ¦ outside the city ¦ customer, signature, stamp (seal)¦ ¦ +———+————+——+———+———-+————+———————————-+—— ——-+ ¦ 21 ¦ 22 ¦ 23 ¦ 24 ¦ 25 ¦ 26 ¦ 27 ¦ 28 ¦ +———+————+——+———+———-+————+—— —————————-+————-+ ¦ May 2 ¦around the city ¦ ¦ 144 ¦ 144 ¦ ¦deputy director Kuprin V.V. ¦ ¦ +———+————+ ——+———+———-+————+———————————-+————-+ ¦ 3 May ¦ around the city ¦ ¦ 180 ¦ 180 ¦ director Savitsky A.I. ¦ ¦ +———+————+——+———+———-+————+———————————-+——— —-+ ¦ 4 May ¦ around the city ¦ ¦ 110 ¦ 110 ¦ ¦ director Savitsky A.I. ¦ ¦ +———+————+——+———+———-+———— +———————————-+————-+ ¦ 7 May ¦ around the city ¦ ¦ 190 ¦ 190 ¦ ¦ deputy director Kuprin V.V. ¦ ¦ +———+—— ——+——+———+———-+————+———————————-+————-+ ¦ 8 May ¦ around the city ¦ ¦ 100 ¦ 100 ¦ ¦Director Savitsky A.I. ¦ ¦ ———+————+——+———+———-+————+———————————-+—————

A COMMENT

This form is given as an example and was developed on the basis of the form of a waybill for a passenger car given in the Letter of the Ministry of Transport and Communications of the Republic of Belarus dated November 8, 2011 and taking into account the provisions of Decree of the President of the Republic of Belarus dated March 15, 2011 N 114. It can be used as a basis for the development of a similar form, taking into account the specifics of the organization’s activities.

Document storage order

Submitted vouchers are stored for at least 5 years (Order of the Ministry of Transport of the Russian Federation No. 152 of September 18, 2008).

Responsibility for the safety of the forms rests with:

- To the head of the institution.

- For officials (responsible for the operation of the vehicle).

The following may check vouchers:

- Traffic police officers.

- Federal Tax Service.

- GIT workers.

In the absence of vouchers, a fine of 200 rubles may be imposed for each unissued voucher (Article 12.13 of the Administrative Code).

Which form to use

There are three forms of waybills recommended by the state. These are 4-P, 4-S and 4-M. 4-P is used for time-based wages, 4-C for piecework, and 4-M for intercity transportation. There are practically no differences in filling out these forms.

The forms were approved by Decree of the State Statistics Committee of November 28, 1997 No. 78, and ceased to be mandatory for use from the beginning of 2013. To date, these forms do not contain all the details necessary for the waybill, but they can be added taking into account the requirements specified in the Order of the Ministry of Transport dated September 11, 2020 No. 368 (it replaced the previously valid order No. 152 dated September 18, 2008, establishing the procedure for filling out waybills and a list of their details).

Responsibility for the absence of a waybill

The legislation of the Russian Federation does not allow driving a passenger vehicle without a permit.

For leaving without this form, a fine of 500 rubles is imposed. Sometimes you can limit yourself to a warning. Also, a driver may be subject to an administrative fine for filling out a ticket incorrectly. The legislation of the Russian Federation regulates the following fines:

- If the driver does not have a vehicle travel form, he will be fined 500 rubles or given a warning.

- If an official of the institution does not have a vehicle travel form, the fine is equal to 20 thousand rubles.

- For an institution, such a fine can be imposed up to 100,000 rubles.

- In some circumstances, all penalties may be imposed at the same time.

- The individual entrepreneur is fully responsible for this violation, even if he is not a legal entity. face. The fine for traveling without a voucher for an individual entrepreneur can reach up to 100,000 rubles.