(function (w, d, n, s, t) { w[n] = w[n] || []; w[n].push(function () { Ya.Context.AdvManager.render({ blockId: "R-79460-13", renderTo: "yandex_ad_R-79460-13", async: true, onRender: function() { $(window).trigger('yandexBannerLoaded', this); } }); }); t = d.getElementsByTagName("script")[0]; s = d.createElement("script"); s.type = "text/javascript"; s.src = "//an.yandex.ru/system/context .js"; s.async = true; t.parentNode.insertBefore(s, t); })(this, this.document, "yandexContextAsyncCallbacks");

» contentScore=»14683″> If the company did not manage to collect and submit “export” documents to the Federal Tax Service on time, then it will have to pay VAT and penalties. In addition, she will have to submit an updated declaration. We will tell you how to fill it out and other related issues in this article.

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into an export contract with a foreign buyer Hotseason sp. zoo (Poland) for the supply of non-commodity goods in the amount of 10,000 USD.

On March 15, the buyer Hotseason sp. zoo goods were shipped for export: Fans (1,000 pcs.) worth 10,000 USD.

The organization did not collect a package of documents on time (within 180 days) to confirm the 0% VAT rate for export shipments.

On September 11, 181 days from the date of placing the goods under the customs export procedure, the Organization assessed VAT at a rate of 18% and submitted to the Federal Tax Service an updated VAT return for the 1st quarter.

Penalties and taxes have been calculated and paid to the budget until the updated declaration is submitted.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Export of non-commodity goods not confirmed within 180 days | |||||||

| VAT accrual on export proceeds | |||||||

| 11 September | 68.22 | 68.02 | 111 600 | VAT accrual on export proceeds | Confirmation of zero VAT rate - 0% rate not confirmed | ||

| 91.02 | 68.22 | 111 600 | 111 600 | Accounting for accrued VAT on export proceeds as an expense | |||

| — | — | 731 600 | Issuance of SF for shipment (VAT rate 18%) | Invoice issued for sale | |||

| — | — | 111 600 | Reflection of VAT in Additional. sales book sheet for the first quarter | Sales book report - Additional. sheet | |||

| Accrual and payment of VAT penalties to the budget | |||||||

| 11 September | 91.02 | 68.02 | 6 894,40 | Calculation of penalties for VAT | Manual entry - Operation | ||

| 11 September | 68.02 | 51 | 6 894,40 | Payment of VAT penalties to the budget | Debiting from a current account – Tax payment | ||

| Payment of VAT debt to the budget | |||||||

| 11 September | 68.02 | 51 | 111 600 | Payment of VAT to the budget for the first quarter by payment deadlines of April 25, May 25, June 25 | Debiting from a current account – Tax payment | ||

| Submission of an updated VAT return for the 1st quarter. to the Federal Tax Service | |||||||

| 11 September | — | — | 111 600 | Reflection of accrued VAT on unconfirmed export sales | Regulated report VAT Declaration - Section 6 page 030 | ||

How to post unconfirmed VAT in accounting

In accounting, to reflect the export on the date of actual shipment, if the documents have not been collected, you need to make the following entries:

| Debit | Credit | Comments on the operation |

| 90.3 | 68.2 | VAT payable has been calculated (rate 18 or 10%) |

| 99.1.1 | 68.2 | Penalties charged for overdue VAT |

Postings that will reflect the export in accounting, with a full package of necessary documents:

| Debit | Credit | Comments on the operation |

| 41.1 | 60.1 | Items for sale have arrived |

| 19.3 | 60.1 | The amount of input tax is reflected |

| 52 | 62.1 | Received money from buyer |

| 62.1 | 90.1.1 | Shipment of export products has been formed |

| 90.3 | 68.2 | Tax reflected at 0% rate |

| 90.2.1 | 41.1 | The cost of goods sold has been generated |

| 68.2 | 19.3 | The amount of input VAT accepted for deduction |

Note that in Russian accounting, export transactions are reflected in rubles at the current exchange rate of the currency used by the buyer. Recalculation is carried out on the payment date. Currency balances should be revalued at the reporting date. The results of the operation are reflected in account 91 (positive or negative).

An exporter who prepared documents at the zero rate late, namely 181 days, must do the following:

- an invoice for unconfirmed exports is recorded in an additional sheet of the purchase ledger;

- reflect the restored VAT by posting: Dt 68.2 Kt 68.Export;

- include the deduction amount in section 6 of the declaration on line 040.

It should be remembered that after filing the report, there will be an overpayment of tax. Her organization has the right to reimburse from the budget.

VAT accrual on export proceeds

Regulatory regulation

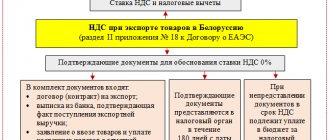

If a package of documents to confirm the export of goods that were purchased starting from 07/01/2016 (Article 165 of the Tax Code of the Russian Federation) is not collected and submitted to the Federal Tax Service within 180 days, then export sales are subject to VAT at a rate of 18 (10)% (Clause 1, Clause 1, Article 164 of the Tax Code of the Russian Federation). In this case, the taxpayer loses the right to a 0% VAT rate.

In this case, the tax base for additional VAT calculation is determined on the day of export sales, i.e. on the date of shipment (paragraph 2, clause 9, article 167 of the Tax Code of the Russian Federation).

It is necessary to “go back” to the shipment period and add additional VAT at the normal rate. Payment of VAT on this sale is overdue. Therefore, it is necessary to calculate and pay VAT penalties, as well as pay additional tax to the budget (Article 75 of the Tax Code of the Russian Federation). Only after this do you submit an updated VAT return, then you can avoid a fine for incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

Accounting in 1C

If export sales are not confirmed within 180 days, then you need to register this event with the Confirmation of zero VAT rate document in the Operations section – Period closure – VAT routine transactions – Create button.

Let's look at the features of filling out the document Confirmation of the zero VAT rate using an example.

Document header

- from – the date on which the period for confirmation of the zero VAT rate expires;

- Item of other expenses – Write-off of VAT on other expenses . The expense item on which accrued VAT is taken into account is selected from the Other income and expenses directory. Type of article in NU – Taxes and fees (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The type of article in NU should be changed for a predefined article manually or a new article with this type in NU should be created.

Tabular part of the document

The tabular part can be filled in automatically with export shipments by clicking the Fill .

Event – 0% rate not confirmed .

The default document is filled in with all export shipments for which the 0% VAT rate has not yet been confirmed. Therefore, unnecessary data must be deleted and only those for which the package of supporting documents has not been collected on time as of the date of the document must be left.

If the export is not confirmed within 180 days, you must:

- additionally charge VAT at the rate of 18 (10)%;

- issue a new invoice with VAT in one copy (clause 22.1 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137). Such SF is not transferred to the buyer.

When posting the document Confirmation of the zero VAT rate with the event 0% rate not confirmed, Invoice issued with the transaction code “01” and with the amount of additional VAT is automatically created

Postings according to the document

The procedure for calculating VAT on unconfirmed export transactions is not clearly regulated. The position of the Ministry of Finance of the Russian Federation is implemented in 1C.

According to Letter of the Ministry of Finance of the Russian Federation dated May 27, 2003 N 16-00-14/177:

- VAT is charged on unconfirmed export sales by posting Dt 68.22 “VAT on exports for reimbursement” Kt 68.02 “Value added tax”;

- accrued VAT is charged to other expenses - Dt 91.02 “Other expenses” Kt 68.22 “VAT on exports for reimbursement”.

If the export is not confirmed within 180 days, two situations are possible in the future:

- previously unconfirmed exports will not be confirmed later than 180 days;

- previously unconfirmed exports will be confirmed later than 180 days.

Let's consider each case in more detail.

Option No. 1. Export will not be confirmed later than 180

The document generates transactions:

- Dt 68.22 Kt 68.02 – VAT is charged on export proceeds;

- Dt 91.02 Kt 68.22 – VAT accrued on export proceeds is included in expenses.

Posting data is generated automatically when posting a document.

If the zero VAT rate is not confirmed within 180 days and is not confirmed later, then VAT accrued on unconfirmed export sales is reflected in the income tax return as indirect expenses. PDF

Sheet 02 Appendix No. 2:

- page 040 “Indirect costs – total”; page 041 incl. “amounts of taxes and fees...”.

Option No. 2. Export will be confirmed later than 180 days

If the taxpayer is confident that supporting documents will be collected later, then posting Dt 91.02 Kt 68.22 must be removed from the document movements by checking the Manual adjustment .

It is also necessary to remove movements from the VAT register for the sale of 0% .

This is done so that later, when confirming the VAT rate of 0% later than 180 days, the document Confirmation of the zero VAT rate .

To edit you should:

- Dt Kt button to go to the movements of the document Confirmation of the zero VAT rate ;

- enable Manual adjustment mode ;

- on the Accounting and Tax Accounting , delete the posting Dt 91.02 Kt 68.22.

After that, go to the VAT tab on sales of 0% and delete the movement in the register.

Additional sheet in the sales book

Unconfirmed export sales are reflected in an additional sheet of the Sales Book during the export shipment period. In our example - in the 1st quarter.

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

In order to display data from an additional sheet of the sales book, you need to configure the report using the Show settings .

Let's consider the formation of an additional sheet of the sales book from the adjustment period.

In our example, export sales were in the 1st quarter, the confirmation period of 180 days expired in the 3rd quarter. We create an additional sheet of the sales book from the adjustment period, i.e. from the 3rd quarter.

- Period – 3rd quarter, i.e. the period in which the adjustment was made;

- Settings : checkbox Generate additional sheets and select analytics for the adjusted period from the drop-down list;

- For convenience, you can also check the box Display only additional sheets .

For non-commodity goods purchased and sold starting from July 1, 2016, it is not necessary to restore the deduction of input VAT if export sales are not confirmed (clause 3 of Article 172 of the Tax Code of the Russian Federation).

Documenting

If the export is not confirmed within 180 days, then an invoice with the calculated VAT amount is issued in one copy only for yourself. There is no need to hand over the document to the buyer.

The Invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137.

This form can be printed using the Invoices from the document Confirmation of the zero VAT rate . PDF

What to do if the export of goods is not documented?

If the export of goods according to the Federal Customs Service of the Russian Federation is not confirmed, then only then will the application of the tax rate of 0% VAT be considered unconfirmed. Let's look at the issue in more detail with Natalya Vakhromova, an expert at the GARANT Legal Consulting Service.

The organization exported non-commodity goods to Mongolia in April 2022. A copy of the construction and installation work and declaration for the goods was sent to the customs point through which the goods should have been exported in order to receive a mark on the export of the goods, but a message was received that there was no information about the export. The organization usually submits customs declaration registers in electronic form to confirm the zero VAT rate.

What documents are needed to confirm the export of non-commodity goods to Mongolia? What to do if the export is not confirmed? Who should be listed as the buyer on the invoice? How to receive a refund from the buyer for VAT (20%) and penalties paid?

In this case, there are prerequisites for recognizing the export of goods as unconfirmed.

In this case, the organization must calculate VAT at a rate of 20% on the date of shipment of goods, draw up an invoice in one copy and register it in the sales book for the tax period in which the goods were shipped for export by filling out an additional sheet to the sales book, pay calculated VAT and corresponding penalties, submit an updated declaration.

The Mongolian buyer must be indicated as the buyer on the invoice.

Justification for the position:

When shipping goods for export from the territory of the Russian Federation, the selling organization will be subject to VAT taxation (clause 1, clause 1, article 146, clause 2, clause 1, article 147 of the Tax Code of the Russian Federation). When exporting goods from the territory of the Russian Federation in the customs export procedure, VAT is not paid (clause 1, clause 2, article 151 of the Tax Code of the Russian Federation), since clause. 1 clause 1 art. 164 of the Tax Code of the Russian Federation stipulates that for goods exported under the customs export regime, a tax rate of 0% is applied, provided that the documents provided for in Art. 165 Tax Code of the Russian Federation.

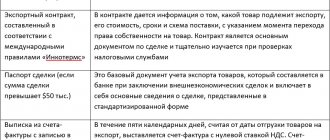

To confirm the validity of applying the VAT tax rate of 0%, the following are submitted to the tax authorities (clause 1 of Article 165 of the Tax Code of the Russian Federation):

1) a contract (copy of the contract) of the taxpayer with a foreign person for the supply of goods outside the customs territory of the EAEU (clause 1, clause 1, article 165 of the Tax Code of the Russian Federation);

2) a customs declaration (its copy) with marks of the Russian customs authority that released the goods in the export procedure, and the Russian customs authority of the place of departure through which the goods were exported from the territory of the Russian Federation and other territories under its jurisdiction (clause 3 p. 1 Article 165 of the Tax Code of the Russian Federation). When exporting goods in the customs procedure of export across the border of the Russian Federation with a member state of the EAEU (for example, Kazakhstan, Kyrgyzstan, Belarus), where customs clearance is cancelled, a customs declaration (a copy thereof) with marks from the customs authority of the Russian Federation that carried out the customs clearance is submitted to third countries the specified export of goods (paragraph 3, paragraph 3, paragraph 1, Article 165 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 19, 2017 N 03-07-13/1/45813).

In addition, it is also possible to submit registers of the specified customs declarations (full customs declarations) in electronic form, indicating in them the registration numbers of the relevant declarations instead of copies of declarations (clauses 15, 16 of Article 165 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 21. 2018 N 03-07-08/93433). [email protected] can be used. Sections I and II of Appendix No. 15 to the said Order establish the Procedure for filling out the register.

The tax authority conducting a desk tax audit has the right to request from the organization documents, information from which is included in the registers. In this case, copies of documents must be submitted within 30 calendar days from the date of receipt of the relevant request. Moreover, copies of the requested customs declarations, information from which is included in the registers submitted electronically to the tax authority, can be submitted to the tax authorities without the corresponding marks of the Russian customs authorities of the place of departure (paragraphs 15, 17 of paragraph 15 of Article 165 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated 10/26/2018 N ED-4-2/20995, Ministry of Finance of Russia dated 11/05/2019 N 03-07-08/84885).

In the case under consideration, the organization submits registers of customs declarations to the tax authority. Therefore, at the request of the tax authority, copies of customs declarations can be submitted without the Russian customs authority marking the place of departure through which the goods were exported (clause 2 of the letter of the Federal Tax Service of Russia dated 01.08.2019 N AS-4-15/15211).

Note that the register of contracts is not mentioned in paragraph 15 of Art. 165 of the Tax Code of the Russian Federation, but its form has not been approved. Therefore, foreign economic agreements (contracts) are submitted in the usual manner (in paper form or in the form of a scanned image in the format approved by order of the Federal Tax Service of Russia dated January 18, 2017 N ММВ-7-6 / [ email protected] ).

From 10/01/2018, to confirm the validity of applying a 0% tax rate when selling goods that are not supplies (clause 8, clause 1, article 164 of the Tax Code of the Russian Federation), submit copies of transport and shipping documents and (or) other documents with border stamps customs authorities confirming the export of goods outside the territory of the Russian Federation are not required (letter of the Ministry of Finance of Russia dated 08/09/2018 N 03-07-14/56316).

However, the tax authority may request copies of transport, shipping and (or) other documents confirming the export of exported goods outside the customs territory of the EAEU. In this case, these documents must be submitted within 30 calendar days from the date of receipt of the relevant request, taking into account the specifics established by clause 1.2 of Art. 165 Tax Code of the Russian Federation.

Peculiarities for the preparation of copies of transport and shipping and (or) other documents when exporting exported goods by road, clause 1.2 of Art. 165 of the Tax Code of the Russian Federation does not contain, nor does it contain a requirement for the presence on documents of a mark of the customs authority of the place of departure through which the goods were exported from the territory of the Russian Federation. As follows from a direct reading of clause 1.2 of Art. 165 of the Tax Code of the Russian Federation, the only requirement is that the submitted documents must confirm the fact of export of goods outside the customs territory of the EAEU.

We have not come across any explanations from the authorized bodies on the form in which, after October 1, 2018, transport and shipping documents must be submitted when exporting exported goods by road.

Pursuant to the provisions of Art. 93 of the EAEU Labor Code, by Decision of the Board of the Eurasian Economic Commission dated 02/07/2018 N 25, the Procedure for confirmation by the customs authorities of the EAEU member states of the actual export of goods from the customs territory of the Union (hereinafter referred to as the Procedure, applied from 02/01/2019) was approved.

From the provisions of paragraphs. 14-20 of the Procedure it follows that confirmation of the actual export of goods from the customs territory of the EAEU (hereinafter referred to as the Confirmation) is generated by the customs authority of the place of departure in electronic form, and this Confirmation is stored in the information system of the central customs authority of the Member State whose customs authority released the goods.

In this case, the declarant or his authorized person (customs broker) may request Confirmation. Why should you contact the customs authority that released the goods with a reasoned appeal submitted in the form of an electronic document or a document on paper in any form. From pp. 35-42 of the Procedure, it can be concluded that the Confirmation is sent to the declarant or his authorized person in written or electronic form.

Taking into account the above, we believe that an organization in the situation under consideration can submit to the tax authority copies of international consignment notes (CMR), in which a place located outside the customs territory of the EAEU is indicated as the point of destination (arrival) of goods, without marks from the customs authority of the place departures. In our opinion, the export of goods can be confirmed by an electronic Confirmation printed on paper, which does not contradict clause 1.2 of Art. 165 of the Tax Code of the Russian Federation (for additional information, see the definition of the Supreme Court of the Russian Federation dated May 19, 2016 N 304-KG16-1137).

Documents (copies thereof), registers necessary to confirm the legality of applying the zero VAT rate must be submitted to the tax authority simultaneously with the tax return no later than 180 calendar days, counting from the date of placing the goods under the customs export procedure (clause 9 , 10 Article 165 of the Tax Code of the Russian Federation).

In the case where the taxpayer submits registers of customs declarations along with the VAT return, the following must be taken into account.

According to paragraph 21 of clause 15 of Art. 165 of the Tax Code of the Russian Federation, if the export of goods in the customs procedure for export outside the EAEU according to documents submitted by the taxpayer (copy of the contract and register) is not confirmed by information received from the Federal Customs Service of the Russian Federation in the manner established by clause 17 of Art. 165 of the Tax Code of the Russian Federation, the taxpayer is informed about this. The taxpayer has the right, within 15 calendar days from the date of receipt of the tax authority’s message, to provide the necessary explanations and any documents he has confirming the export of the specified goods.

If the export of goods in the customs procedure of export outside the territory of the EAEU is not confirmed by information (information) received from the Federal Customs Service of the Russian Federation at the request of the tax authority, then the validity of applying the 0% VAT rate in relation to transactions for the sale of goods in the relevant part is considered unconfirmed. Moreover, such a request from the Federal Tax Service of the Russian Federation to the Federal Customs Service of the Russian Federation must include explanations and documents if they were submitted by the taxpayer to the tax authority in accordance with paragraph 21 of clause 15 of Art. 165 of the Tax Code of the Russian Federation (paragraph 22 of clause 15 of Article 165 of the Tax Code of the Russian Federation).

That is, if inconsistencies are detected, the tax authority first requests the organization to provide explanations and documents and only then sends a request to the Federal Customs Service of the Russian Federation and compares the data. And if the export of goods according to the Federal Customs Service of the Russian Federation is not confirmed, then only then will the application of the 0% tax rate in the relevant part be considered unconfirmed.

From the above it follows that in the situation under consideration, before the expiration of 180 calendar days, counting from the date of placing the goods under the customs export procedure, together with the VAT declaration, the organization should submit to the tax authority only a copy of the contract with the Mongolian buyer and a register of customs declarations in electronic form. In this case, you must have with you either Confirmation or customs authorities’ marks on the CMR about the actual export of goods (clause 15 of Procedure No. 1327, see also letter of the Ministry of Finance of Russia dated November 5, 2019 No. 03-07-08/84885).

As follows from the question, at the request of the organization, the Federal Customs Service of the Russian Federation does not confirm the actual export of goods outside the EAEU. We believe that the tax authority received (or will receive) similar data in accordance with clause 17, paragraph 22 of clause 15 of Art. 165 Tax Code of the Russian Federation. That is, we can say that the legality of applying a 0% tax rate when exporting the goods in question is not confirmed.

If, after 180 calendar days, counting from the date of placing the goods under the customs export procedure, the required package of documents has not been collected, the moment of determining the tax base is determined on the date of shipment of the goods (paragraph 2, clause 9, article 167, clause 1, clause 1, art. 167 of the Tax Code of the Russian Federation). In this case, VAT is calculated at the rates provided for in paragraphs. 2 and 3 tbsp. 164 of the Tax Code of the Russian Federation (10% or 20%) (paragraph 2 of clause 9 of Article 165 of the Tax Code of the Russian Federation), and is subject to payment to the budget for the tax period in which the date of shipment of goods falls.

Also, the organization should draw up a single copy of an invoice containing the amount of VAT (at a rate of 20%) to be paid to the budget, register it in the sales book for the tax period in which the goods were shipped for export by filling out an additional sheet to the sales book (clause 22.1, 3 of the Rules for maintaining the sales book), submit an updated declaration (letter of the Ministry of Finance of Russia dated September 2, 2016 N 03-07-13/1/51480), pay the calculated VAT and the corresponding penalties (letter of the Ministry of Finance of Russia dated July 28. 2006 N 03-04-15/140).

There are no specific features for the preparation of such invoices. It is necessary to indicate the Mongolian buyer as the buyer (clauses “and” clause 1 of the Rules for filling out the invoice). In this case, it is permissible to put a dash on line 6b “TIN/KPP of the buyer” of the invoice (for additional information, see letters of the Ministry of Finance of Russia dated 04/01/2014 N 03-07-09/14382, dated 05/25/2011 N 03-07-09/14).

If the organization subsequently confirms the legality of applying the 0% rate (confirms export outside the EAEU), it will be able to deduct the amount of tax previously calculated for unconfirmed exports at a rate of 20% for 3 years after the end of the tax period on which the day falls shipment of goods (paragraph 2, paragraph 9, article 165, paragraph 10, article 171, paragraph 2, paragraph 3, article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 02/03/2015 N 03-07-08/4181). For information on the procedure for reporting transactions in the VAT return, see letters from the Federal Tax Service of Russia dated July 30, 2018 N SD-4-3/14652, dated December 29, 2018 N SD-4-3/ [email protected]

Moreover, if there are concerns that the export of goods outside the EAEU will not be confirmed, then the amount of VAT paid at your own expense can be taken into account for profit tax purposes as part of other expenses associated with production and sales on the basis of paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation during the tax assessment period (when the 180-day period has expired from the date of placing goods under the customs export procedure) (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 27, 2015 N 03-03-06/ 1/42961, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/09/2013 N 15047/12).

Payment of VAT on unconfirmed exports at the expense of the buyer is not provided for by the Tax Code of the Russian Federation.

Paid penalties are not taken into account for profit tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation).

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Accrual and payment of VAT penalties to the budget

The organization independently establishes in its accounting policies the procedure for recording the amounts of accrued penalties.

In our example, we will adhere to the position of the Ministry of Finance of the Russian Federation and attribute accrued VAT penalties to other expenses by posting Dt 91.02 Kt 68.02 (Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875).

Penalties are calculated by organizations relative to the period of delay:

Up to 30 days:

Starting from day 31:

The current refinancing rate can be viewed on the website of the Central Bank of the Russian Federation.

See also Penalty Calculator

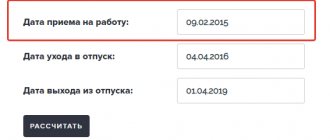

Calculation of penalties according to example

The deadline for paying VAT is no later than the 25th day of each of the three months following the expired tax period (clause 1 of Article 174 of the Tax Code of the Russian Federation). Therefore, VAT penalties are calculated on every 25th day of the payment deadline. In our example, penalties for the 1st quarter and tax payment deadlines are April 25, May 25, June 25.

The taxpayer independently decides from what day to accrue penalties for late payment of VAT on unconfirmed export sales. There are two positions - penalties are charged:

- from the 26th day of the month following the quarter in which there was an unconfirmed export sale - the position of the Federal Tax Service (Letter of the Ministry of Finance of the Russian Federation dated July 28, 2006 N 03-04-15/140);

- from 181 days from the date of implementation - judicial practice (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 16, 2006 N 15326/05, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 7, 2010 N A43-40137/2009).

If the export is confirmed later than 180 days, then the paid penalties are not refundable. Only the amount of VAT paid on unconfirmed exports can be returned or offset against future payments (paragraph 2, paragraph 9, article 165 of the Tax Code of the Russian Federation, paragraph 2, article 173 of the Tax Code of the Russian Federation).

The accrual of penalties is documented in the Transaction document in the Transactions – Accounting – Transactions entered manually section.

The tabular part is filled in with the following entries:

Debit – account 91.02 “Other expenses”;

- Subconto 1 – expense item Penalties, fines, sanctions transferred to the budget : item type Other non-operating income (expenses) ;

- checkbox Accepted for tax registration not placed;

Credit - account 68.02 “Value added tax”;

- Subconto 1 – type of payment to the budget Penalties: additionally accrued / paid (independently) ; Amount – the amount of penalties according to the calculation.

The payment of VAT penalties to the budget is reflected in the document Write-off from the current account transaction type Payment of tax in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using an example.

The document must be completed as follows:

- Transaction type – Tax payment ;

- Type of obligation - Penalty ;

- link Reflection in accounting : Debit account - 68.02 “Value added tax”;

- Types of payments to the budget (funds) - Penalties: additionally accrued / paid (independently) .

Postings according to the document

Tax consequences of export VAT

Tax on proceeds from export transactions is calculated in the usual manner. The organization includes it in the tax base and reduces it by the amount of input VAT, using the right of paragraph 1 of Article 171 of the Tax Code of the Russian Federation.

When determining the tax base for export transactions, it is necessary to follow the regulations established by Article 167 of the Tax Code of the Russian Federation. Namely, the moment of revenue recognition no later than the last day of the quarter in which documents were collected to confirm the preferential VAT rate.

If the organization is late, you will need:

- calculate tax and penalties;

- pay the arrears to the budget;

- draw up a declaration and include Section 6 in it.

In this case, the date of shipment of the products serves as the moment for determining the tax base.

Note! For organizations that operate on a simplified system, there is no requirement to confirm a zero rate. Exemption from the obligation to declare an export transaction is confirmed by letter of the Ministry of Finance No. 03-11-11/2022 dated January 19, 2017.

Payment of VAT debt to the budget

Additional payment of VAT to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using an example.

The document must be completed as follows:

- Transaction type – Tax payment ;

- Tax – VAT ;

- Type of liability - Tax ;

- Link Reflection in accounting : Debit account - 68.02 “Value added tax”;

- Types of payments to the budget (funds) - Tax (contributions): accrued / paid .

Postings according to the document

The situation when a VAT refund arises

VAT payable to the budget is the difference between calculated and “input” VAT. There are different tax rates: 0, 10 and 20%. Most transactions are taxed at the highest rate.

When selling goods in Russia, VAT is usually not refundable, since VAT on the sales price always exceeds “input” VAT.

For example, Alpha LLC sells plastic pipes. Price - 120 rubles, including VAT - 20 rubles. For production, Alpha purchases granulated plastic at a price of 60 rubles, including VAT - 10 rubles. The tax payable will be:

20 - 10 = 10 rubles - the amount of VAT payable.

In addition, situations with VAT refunds from the budget attract the attention of the tax authorities. Read more about this in our article about the safe share of VAT deductions.

But in the case of exports, the situation changes. In our example, Alpha LLC, selling pipes abroad, would charge VAT at a rate of 0%, that is, 0 rubles. But the “input” VAT for raw materials remains the same. This means that Alpha can return 10 rubles of tax from the budget.

If you want to learn more about export VAT, read our article “VAT on exports”.

The right to VAT refund is regulated by Art. 176 of the Tax Code of the Russian Federation. Refunds follow standard rules, which we described in the article “VAT Refund for Legal Entities.” Follow the following order.

Submission of an updated VAT return for the 1st quarter. to the Federal Tax Service

VAT accrued on unconfirmed export sales is reflected in the updated declaration for the shipment period. In our example, in the 1st quarter.

When converting revenue from foreign currency into rubles, to calculate the tax base for VAT, only the exchange rate of the Central Bank of the Russian Federation on the date of shipment of goods is used (clause 3 of Article 153 of the Tax Code of the Russian Federation).

The VAT return must be submitted to the Federal Tax Service no later than the 25th day of the month following the quarter in which the deadline for collecting supporting documents expired.

Reporting

If the zero rate is not confirmed, you must provide an updated VAT return for the shipment period.

In Section 6 “Calculation of the tax amount...the justification for applying a tax rate of 0 percent for which is not documented”: PDF

- page 010 – transaction code 1011410 “Sale of goods exported under the customs export procedure...”;

- line 020 – tax base for VAT;

- line 030 – amount of accrued VAT.

In Section 9 Appendix No. 1 “Information from additional. sales book sheets":

- registration of an invoice issued when calculating VAT on unconfirmed export sales, transaction type code “01”.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Registration of receipt and sale of goods

After enabling the checkboxes in the Receipt of goods and services documents, the “VAT Accounting Method” column appears. In our case, we select the “Blocked until 0% confirmation” option (Fig. 2). The choice of this method is the main feature when registering the receipt of goods intended for resale for export.

Fig.2

Don’t forget to register the supplier’s invoice and check the postings of the invoice (Fig. 3).

Fig.3

When purchasing a product from a supplier, we pay not only for the product itself, but also pay tax (VAT), which we have the right to claim for deduction in the future (i.e., reduce the amount of VAT on sales that we pay to the budget). In our case, “hereinafter” means “upon confirmation of the zero rate.”

Fig.4

VAT is still blocked in all registers (Fig. 4).

We register in 1C the sale of goods with a zero rate (Fig. 5).

Fig.5

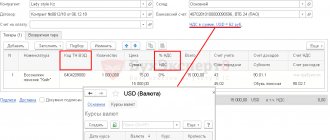

You must select a currency in the contract. In this example, calculations are carried out in USD (Fig. 6), the price in the invoice is also indicated in foreign currency.

Fig.6

Generating VAT purchase book entries at zero VAT rate

It is by register movements that the program analyzes the state of VAT accounting. If you now create a purchase book, the required entry will automatically appear in it (Fig. 11).

Fig.11

The transactions generated in 1C by the document “Creating purchase book entries (0%)” show that the VAT we paid when purchasing goods intended for export was successfully deducted.

Fig.12