Accounting for property in organizations of all forms of ownership plays an important role in all areas of activity. Accounting and movement of specialized clothing, footwear and equipment is developed depending on the types of work of the organization’s employees. This can take the form of developed methods of protecting the employee using clothing, shoes, and devices to reduce external influences on the body, designed for a certain period of work. Due to wear and tear during use, the protective functions of these methods of protection decrease, so it is necessary to provide workers with protective equipment in a timely manner. Based on this, the role of accounting in protecting workers is important. One of the primary documents reflecting the accounting of the movement of personal protective equipment is the MB-7 form. Let's consider the need to maintain this document and the procedure for filling it out.

Regulatory regulation of the issuance of personal protective equipment

| Normative act | Scope of regulation |

| Labor Code of the Russian Federation Art. 221 | Providing workers with PPE |

| Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 N 290n | Defines the rules for issuing PPE |

| Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a | Approves form MB-7 |

| Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n | Approves accounting maintenance |

From 01/01/2013, primary documentation forms do not have to be used directly in the form established by law , that is, organizations have the right to independently develop and apply forms that are convenient for themselves, but they must be approved in the organization’s local documents.

Electronic card for recording the issuance of workwear and personal protective equipment - quickly and efficiently

Very often, an occupational safety specialist has questions related to the process of providing employees with workwear and personal protective equipment: how to automate the accounting of the issuance of workwear? How to ensure that each employee is provided with protective clothing on time and in accordance with the required sizes? How to get rid of paperwork? How to organize the maintenance of an electronic card for issuing personal protective equipment?

In accordance with the Labor Code of the Russian Federation, the employer is obliged to provide workers with special clothing, special footwear and other personal protective equipment. In every organization, at every enterprise, the employer is obliged to organize accounting and control over the issuance of personal protective equipment to employees in a timely manner and properly. The issuance of protective clothing to employees and the acceptance of protective clothing from them is registered by an entry in the personal record card for the issuance of personal protective equipment.

Let's take a closer look at what a personal card for recording the issuance of PPE is?

A personal record card for the issuance of personal protective equipment is an approved document used to record and record the fact of setting standards, the fact of issuing and returning protective clothing. The form of the personal card for recording the issuance of PPE is approved by the “Order of the Ministry of Health and Social Development of the Russian Federation” dated June 1, 2009 No. 290n and is uniform and mandatory for everyone.

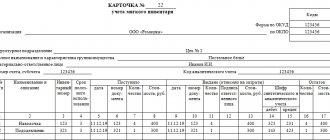

A personal card is filled out for each employee of the organization who needs to be issued protective clothing and personal protective equipment, in accordance with established standard industry standards. The front side of the card stores information about the employee’s data (full name, personnel number, date of employment, size data), information about the name of the point of standard industry standards, information about the established standards for issuing workwear and PPE, information about the quantity and frequency of issuance. The reverse side of the personal card reflects information about the name of the PPE, the date and quantity of the PPE issued and returned, reflects the numbers of certificates or declarations of conformity, and the signatures of the person who received and accepted the PPE.

How to automate and simplify the process of accounting for the issuance of workwear?

Currently, clause 13 of the “Order of the Ministry of Health and Social Development of Russia” dated June 1, 2009 No. 290n establishes that it is possible to keep records of personal cards for issuing protective clothing and personal protective equipment in electronic form.

When maintaining a personal record card for issuing PPE in electronic form, instead of an employee’s signature informing about receipt, information about the issuance document containing the employee’s signature is recorded. This document can be drawn up in the form of a record sheet for the issuance of workwear, summarizing information about the issuance for several employees.

The Occupational Safety and Health program has established a mechanism for maintaining a personal card for overalls and personal protective equipment in electronic form. The Occupational Safety and Health program allows you to create a personal card for each employee by pressing one button, after entering the necessary information in the documents.

Let's consider the algorithm for creating an electronic personal card in the Occupational Safety and Health program:

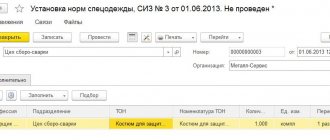

1. At the first stage, it is necessary to fill out the document “Establishing standards for workwear, PPE,” which helps us register the fact of establishing standards for issuing workwear, PPE. The program provides the ability to set standards for departments, for professions, for individual workplaces, for specific employees, for harmful factors and for hazardous substances. When choosing a profession and a TON item, the program itself will indicate the frequency and required quantity for issue, and also indicate the wear period and the “Assign” status.

2. Next, you need to fill out the document “Establishing the needs for workwear, PPE” . This document helps us automatically generate a list of employees and a list of necessary workwear, in accordance with previously established standards. The “Fill” - “Fill in accordance with all standards” button allows employees to quickly and conveniently fill out the tabular part.

3. The next step, subject to the availability of PPE in warehouses, issuance can be issued. To do this, we will fill out the document “Issue of workwear, PPE” , which reflects the fact of issue of workwear and PPE for use to an employee, department, or workplace. The tabular part “Workwear and PPE” can be filled out automatically (using the menu commands of the “Fill” button above the tabular part of the document) according to the needs of individuals. persons, for an employee, for employees in a department.

After filling out the document, you can easily print out the “Registration Sheet for the Issue of Workwear MB-7” , the number and date of which will be reflected in the electronic personal card for issuing PPE, in the column “signature of the recipient”; the employee only has to sign the record sheet for the workwear.

4. The last, final stage is the formation of an electronic personal card for the employee, all data is transferred to it automatically.

Scheme of the business process of providing employees with special clothing and personal protective equipment, implemented in the Occupational Safety and Health software product for 1C: Enterprise 8:

The transition to electronic accounting of workwear and maintenance of electronic personal issuance cards contributes to:

- minimizing the time spent on filling out, entering data, and maintaining personal cards for issuing personal protective equipment;

- reducing the likelihood of errors in the process of planning and issuing workwear;

- the emergence of the possibility of operational planning for the quantity and type of PPE range for any given period;

- a significant reduction in the costs of carrying out measures to implement procedures in the field of labor protection, by reducing unnecessary stocks of workwear;

- a significant reduction in fines from supervisory organizations for violations in the field of labor protection.

Managing and maintaining the process of providing employees with workwear should not cause problems; set a goal to minimize paper document management, move to automating the accounting process, automating the process of issuing workwear, and the Occupational Safety and Health program will help you with this!

Kristina Tyurina

Use of Form N MB-7 in an organization

A statement in form N MB-7 is necessary to correctly reflect in accounting the movement of these items in the enterprise through their issuance for individual use by employees.

Due to the fact that at the regulatory level it is mandatory and necessary to provide specialized protective equipment to employees, which are provided by the employer depending on the harmfulness and danger of the organization’s activity (there are free standards for issuing), it is necessary to ensure correct accounting of their movement.

Tax accounting of workwear

The cost of workwear belonging to the first and second categories is included in material costs at a time as they are put into operation (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Please note : As a result of accounting for the second category of workwear, a temporary difference arises, because in accounting, the cost of such workwear is written off gradually (in a linear manner), and in tax accounting, the write-off is performed at a time (material expenses).

The third category of workwear is reflected as part of depreciable property.

General requirements for filling out the MB-7 form

Form MB-7 is a table filled out by the responsible person. Like all primary documentation, such an accounting statement must comply with the general procedure for preparing primary documentation in accordance with Article 9 of the Federal Law of December 6, 2011 N 402-FZ :

- name of the form (in full)

- start date of statement compilation

- name of the organization and structural unit where the document was drawn up

- information reflected in the document

- quantities and units of measurement

- position, signature, transcript of the person (materially responsible) responsible for registration

- position, signature, transcript of the head of the department where the document was compiled

All cells are required to be filled out. If there is no data in individual cells, then a dash is added.

Special requirements for filling out the MB-7 form

Form MB-7 is used at the enterprise mainly when processing accounting data in an automated form.

This form must be filled out in 2 copies by the person who is materially responsible (MRO) , for example, in the person of the storekeeper of a structural unit, while 1 completed copy of the form is provided to the accounting department by the person responsible for the movement of the IBP, the second, as a fact of the accuracy of the information, remains with MOL.

Special equipment, clothing and shoes belong to the group of low-value and wearable items, which, like all property of the enterprise, are subject to inventory. Depending on the field of activity, the employee is obliged to follow special requirements, rules, instructions of occupational safety and health, that is, if he needs to use the provided personal protective equipment in his work.

By virtue of Art. 21 of the Labor Code of the Russian Federation, the employee is obliged to comply with labor protection and occupational safety requirements.

Ministry of Labor and Social Protection of the Russian Federation P.S. Sergeev

The procedure for filling out the table of form MB-7

The basic information of the form is presented in the table, where the following information is entered in order:

- serial number of issue (in chronological order)

- Full name of the employee

- employee personnel number

- identification characteristics of personal protective equipment

- Name

- nomenclature number

- unit

- code

- name of the unit of measurement

- number of items issued for each item

- date of entry (transfer) into operation

- PPE service period

- confirmation of receipt or delivery of PPE with the employee’s signature

Important! When an employee receives special protective equipment, financial responsibility is transferred to him for the period of operation. If an employee refuses to receive PPE, the employer may face disciplinary action.

An example of the design of a table of the MB-7 form

| Number in order | Full Name | Personnel Number | Working clothes, safety shoes and safety devices | Unit | Quantity | Date of entry into service | Life time | Signature on receipt (delivery) | ||

| Name | item number | code | Name | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1 | Bakeev R.R. | 111 | Mittens | 012345 | 001 | PC | 1 | 01.06.2022 | 2 | Bakeev |

| 2 | Akhmerov V.V. | 123 | Mittens | 012345 | 001 | PC | 1 | 01.06.2022 | 2 | Akhmerov |

Accounting for workwear, safety footwear and special devices

In accounting, the movement of personal protective equipment is reflected in the debit of account 10 “Materials” (in this case, the sub-account “Special equipment and special clothing” is opened) and the credit of production cost accounts (accounts 20, 23, 25, etc.) at the actual cost (expenses) for its production, calculated on the basis of the cost calculation method used at the enterprise for the corresponding type of product.

Write-offs are made in accordance with the Accounting Policy adopted by the organization.

Accounting for workwear

The procedure for maintaining accounting records of workwear is determined by the Methodological Guidelines for the accounting of special tools, special devices, special equipment and special clothing (approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n) (hereinafter referred to as the Guidelines).

Depending on the cost and useful life, workwear can be divided into three categories:

- First category : workwear with a useful life of less than 12 months.

- Second category : workwear with a useful life of more than 12 months, not included in fixed assets according to the cost criterion in accordance with PBU 6/01 “Accounting for fixed assets” (paragraph 4, clause 5 of PBU 6/01) and the accounting policy of the enterprise.

- Third category : workwear included in fixed assets (useful life of more than 12 months, costing more than 40,000 rubles).

Workwear belonging to the first category is taken into account as part of inventories, regardless of cost (clause 2 of the Guidelines).

At the same time, it can be written off to cost accounting accounts at a time in order to reduce the labor intensity of accounting work (clause 21 of the Methodological Instructions). Workwear, which belongs to the second category, is taken into account as part of inventories, but cannot be written off at a time to cost accounts. Its cost is repaid in a straight-line manner based on the useful life stipulated in the standard industry standards for the free issuance of workwear, as well as in the rules for providing workers with workwear (clause 26 of the Guidelines).

To ensure control over the safety of workwear after its commissioning, it is recorded on an off-balance sheet account (clause 23 of the Guidelines). In the 1C: Accounting 8 program, for these purposes, the off-balance sheet account MTs.02 “Working clothes in operation” is used.

Workwear, which belongs to the third category, is accounted for in the manner used for accounting for fixed assets.

Example for writing off personal protective equipment

To perform a labor function during the summer period, employee A.A. Andreev. issued 04/01/2022:

- light jacket - 1 piece, service life 18 months, cost 5,000 rubles.

- gloves - 1 pc., service life 6 months, cost 300 rubles.

And accepted for storage at the winter workwear warehouse on 04/01/2022:

- insulated jacket - 1 pc., service life 18 months (used for 4 months: December-March), cost 9,000 rubles.

- fur gloves - 1 pc., service life 6 months, cost 300 rubles.

Due to the specialization of the organization, subaccounts were opened on account 10: Special clothing in warehouse and Special clothing in use. The following transactions will be made in the organization:

| Debit | Credit | Operation | Amount, rub. |

| 10 / “Special clothing in use” | 10 / "Special clothing in stock" | Special clothing issued | 5300 |

| 10 / "Special clothing in stock" | 10 / “Special clothing in use” | Workwear put into storage | 9300 |

| 25 | 10 / “Special clothing in use” | The cost of the insulated jacket was partially written off | 2000 |

Transfer of special clothing into service

Reflect the transfer of the kit to the new employee with the document Transfer of materials into operation in the Warehouse . The document Consumption of materials (request-invoice) is not suitable for this, because it does not allow issuing workwear from an off-balance sheet account.

Fill in the document header:

- Location - the department in which the employee is registered;

- warehouse - in this case it does not affect the result, since records are not kept for warehouses.

On the Workwear , specify:

- transferred set;

- its quantity;

- the employee receiving the kit;

- the account on which the workwear was reflected in the organization’s accounting using the document Transaction entered manually (in our example, MTs.02 “Workwear in use”).

In the form of the column Purpose of use , indicate:

- Order of use - For a fixed period ;

- Useful life is the remaining SPI taking into account the use by the dismissed employee (in our example - 15 months).

method for reflecting expenses - in this case it does not affect the result, since the expenses have already been taken into account.

the Purpose of use of workwear checkbox must be checked to indicate the period of use in the issue document.

More details: Duration of use in “Purpose of use”

Postings according to the document

The document generates transactions:

- Kt MTs.02 - write-off of workwear from an off-balance sheet account;

- Dt MTs.02 - workwear is reflected in the operation of the new employee on the balance sheet.

Control

The useful life of workwear is counted from the date of the reissue document.

Check the reflection of transactions in the Turnover balance sheet report for account MTs.02 (section Reports ).

The overalls must belong to the new employee.

See also:

- Accounting for workwear from 2021

- Acquisition of low-value objects with a useful life of more than 12 months

- Accounting for non-essential assets in accounting and tax accounting

- Write-off of inventories and non-essential assets

- Inventory of workwear and equipment from 2021

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Transferring a work book to an employee - should it be done through the cash register and what to do with VAT? The Ministry of Finance reminded employers of the need to charge VAT when issuing...

- Receipt of workwear and its transfer into operation until 2021. Accounting for workwear in 1C 8.3 is fully automated. Let's take a closer look at each...

- Payment for part of the night hours at a different rate...

- Transfer to another employer...

Answers to common questions

Question No. 1 : How to formalize the issuance of special clothing that was rendered unusable by an employee through his own fault?

Answer : If an employee, who is obliged to treat his workwear with care, as well as all the property of the organization, has intentionally rendered it unusable, then it is necessary to contact the manager, and a commission is appointed that decides to write off the cost to the employee, but during the investigation it is necessary provide an available spare kit. If the investigation does not establish intentional damage, but poor quality, then the cost of PPE is not written off to the employee.

Question No. 2 : Is it possible to issue workwear to an employee for the summer and winter periods without taking it into storage?

Answer : Working clothes, as a rule, require special storage conditions. Therefore, some types of clothing cannot be given to employees for storage at home, as well as for washing or cleaning. Features of storage and care of special devices are regulated by GOSTs for protective equipment. And the movement of clothing is reflected in the MB-7 form and the personal card of the employee for issuing special equipment