Home • Blog • Online cash registers and 54-FZ • How to deregister a cash register with the tax authorities

November 16, 2021

702

To deregister a cash register, it is enough to correctly fill out the appropriate application and send it to the Federal Tax Service. The document can be presented during a personal visit to the tax office or sent electronically through the website nalog.ru or your personal office of the OFD. Its form, as well as the procedure for filling it out, are approved by the authorized body. The basics of the procedure are set out in Art. 4.2 Federal Law-54. Below we will discuss how to deregister a cash register with the tax office.

Causes

The online cash register must be deregistered from the tax office directly by its owner. That is, to the person to whom it is documented and who was involved in registering the device. But in some cases, the Federal Tax Service handles the procedure without the participation of the businessman.

The owner deregisters the cash register on the following grounds:

- the cash register becomes the property of another person, which often happens in the case of sale, lease or other similar consequences;

- the online cash register is lost or stolen;

- The CCP has lost its functionality as a result of a breakdown and cannot be repaired.

Situations forcing tax authorities to deregister a cash register without the participation of a businessman:

- non-compliance of the device with established requirements, as a result of which its use is contrary to legal norms;

- the period of validity of the FN ended more than a month ago, and the owner of the cash register did not replace the drive in a timely manner;

- the business entity ceased its activities, which was recorded in the state registers of individual entrepreneurs or legal entities.

When a cash register is deregistered unilaterally, the owner is notified of this by mail or online (a notification is sent through the user's personal account on the Federal Tax Service website).

If the fiscal drive fails, while the functionality of the cash register is maintained, as evidenced by the normal operation of another FN installed in the device, deregistration of the cash register is not expected. A damaged drive must be replaced, followed by re-registration of the cash register.

Situations when a cash register is deregistered

In the current law, officials have provided not only the procedure for registering control equipment, but also an algorithm for removing it. Thus, it will be necessary to carry out the procedure for deregistering the cash register with the tax office in the following cases:

- The device was sold to another person. For example, a company sold a cash register to a third-party businessman. In this case, the business buyer is obliged to independently register the cash register with the Federal Tax Service.

- The depreciation period has expired. All equipment, including cash registers, has an individual useful life. When the SPI ends, the CCM cannot be used. Consequently, the company will have to deregister the cash register with the tax office in the month following the end of the SPI.

- The entity has officially ceased operations. In other words, we are not talking about a temporary suspension of business, but about the official removal of an individual entrepreneur or legal entity from fiscal accounting, during which a corresponding entry is made in the state register.

- The device is faulty, outdated, broken, stolen. The decision to replace old equipment with new ones may have other reasons. However, in such a situation, before registering a new cash register, register the deregistration of the cash register with the tax authorities.

Next, we’ll look at step-by-step instructions on how to deregister a cash register machine with the tax office.

How to deregister an online cash register owner

Let's look at how to deregister an online cash register. The action algorithm is as follows:

- 1. Formation of the corresponding application for the purpose of sending it to the Federal Tax Service. The application is submitted in paper or electronic form. The regulatory authority has not established strict rules regarding the form of this document.

- 2. Creating a report on closing a financial fund. The drive is not used at another cash register, so it is considered already “used material”. Data from the report on closing the FN archive is submitted to the tax office along with the application. Exceptions are cases when it is impossible to remove the report (the drive is lost or out of order).

- 3. Receiving a card about deregistration of the device.

Each stage is discussed in more detail below.

How to deregister a cash register through your personal account

To begin, log into your personal account on the tax website and open the “Cash Accounting” section.

Next, select the cash register that you want to close and click the “Deregister” button.

An application for deregistration of the cash register with the tax office will open. Fill in the date and time of closing the financial fund, the number of the fiscal document and the fiscal attribute. After this, click the “Sign and Send” button - the application will be certified with a digital signature.

After these steps, you will see that the request to deregister the online cash register has been added.

Filing an application

The first stage of deregistration of a cash register is the formation of a corresponding application. As mentioned above, it can be in electronic or paper form.

The application can be submitted:

- through your personal account on the Federal Tax Service website;

- upon a personal visit to the nearest branch of the Federal Tax Service;

- in your OFD personal account.

To certify an electronic document, an electronic digital signature is used, which was issued to the owner of the cash register or his authorized representative.

Submitting an application in your personal account on the Federal Tax Service website

Since May 29, 2017, Federal Tax Service Order No. ММВ-7-20/ [email protected] , approving the application form.

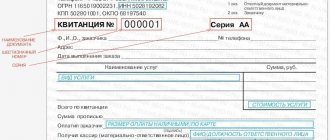

The application shall indicate the following information:

- name of the company (as in the constituent documents) or full name. Individual entrepreneur, if he is the owner of the cash register;

- TIN;

- CCT model;

- number assigned to the equipment at the manufacturer’s plant;

- reason for deregistration of equipment.

The application includes a section where data from the report on closing the financial fund is indicated. It is filled in after the corresponding procedure has been completed.

Paper application form

Applications for deregistration of the cash register with the tax office can be found here (KND form 1110062).

If the reason for deregistration of the cash register is its transfer to another owner, the application is generated within 1 business day from the moment the transaction is concluded. The same period is given if the fact of theft or loss of the device is discovered. If there is a breakdown of the cash register or financial register, an application for deregistration is submitted within the next 5 working days.

Deadlines for filing an application with the tax authority

As a rule, this issue is left to the discretion of the entrepreneur himself. However, in a number of cases, 54-FZ obliges you to meet the deadline:

— upon transfer of the device — 1 business day;

- in case of theft or loss - 1 business day from the moment of discovery of the relevant fact;

— in case of breakdown of the FN — 5 working days.

If an examination of a faulty FN reveals the possibility of reading its data, it will be necessary to additionally send it no later than 60 days from the date of filing the application. The easiest way to do this is to personally contact any tax authority. The inspection must have special USB adapters that allow you to retrieve fiscal documents.

An individual entrepreneur can also copy fiscal documents from the FN to an electronic medium independently. To do this, you need a cash register and the “FN reader” program or similar. You can send the archive to the tax office through the individual entrepreneur’s personal account on the tax office’s website in the “Cash Accounting” section.