BSO is a strict reporting form, analogous to a cash receipt. From July 1, 2019, the BSO can be printed only through the online cash register and the mandatory details of the cash receipt must be indicated in it. This is a requirement of Federal Law 54, the law on the use of cash register equipment.

Strict reporting forms were converted into electronic form so that sales information was transferred from the online cash register to the tax office. This is how the Federal Tax Service sees the company’s income and checks whether the entrepreneur pays taxes correctly.

For operating without an online cash register or trading in violations, the tax office issues a fine. If the BSO does not contain the required details - a fine of 1,500 to 3,000 rubles, for failure to issue a BSO to the buyer - a warning or a fine of 2,000 rubles.

Simplicity

There are no paper contracts required and it is completely legal. We are always nearby, and you are always confident during inspections!

our clients

Our pride is our clients who print strict reporting forms with us. These are real companies that you can check by TIN, and which use BSO-123. You can contact them to find out how they are working with us, for example.

IP Chekova Yulia Vladimirovna

Phone: +7 (988) 173-4454 Taxpayer Identification Number: 302500490860

IP Popov Dmitry Anatolyevich

Phone: +7 (920) 469-8798 Taxpayer Identification Number: 366228183775

IP Galstyan Arkkady Sakunovich

Phone: Taxpayer Identification Number: 691300006094

IP Gulyaeva Alena Sergeevna

Phone: +7 (930) 930-7988 Taxpayer Identification Number: 771538910700

IP Trachuk Vitaly Anatolievich

Phone: +7 (963) 488-6028 Taxpayer Identification Number: 111600056937

IP Rodionov A.V.

Phone: +7 (302) 236-4701 Taxpayer Identification Number: 753401923676

IP Simanova I. A. translation agency "Simtra"

Phone: +7 (904) 980-1990 Taxpayer Identification Number: 666500218402

Here is only a small part, more in the general list.

Blog

- Happy New Year! [ February 5, 2022 15:51 ]

- We're alive! [ February 26, 2022 11:36 ]

- The law on the extension of BSO-123 has been adopted! [ 9 January 2022 09:35 ]

- Happy New Year 2018! [ December 30, 2022 16:48 ]

- BSO-123 remains with you until July 2022 [ November 22, 2017 17:09 ]

Go to Blog

Rules for issuing BSO in 2022

Strict reporting forms can be issued by entrepreneurs who provide household services to the population according to the OKPD 2 and OKVED 2 classifiers. Old-style paper BSOs are valid only when issued together with a cash receipt. If you generate strict reporting forms through an online cash register, it is equivalent to issuing a cash receipt.

Instead of a check, BSO can be issued to individual entrepreneurs without employees who provide services. Such entrepreneurs are exempt from using online cash registers and can issue printed BSOs to customers. The rule is valid until July 1, 2022, from this date entrepreneurs must switch to online cash registers.

Drivers and conductors of public transport work with remote fiscalization. An online cash register with a fiscal drive is located in the office. The tram conductor works with a ticket office without a fiscal drive or with a smartphone on which a special application is installed. When a passenger pays for a ticket, the remote device sends a check to the main ticket office for fiscalization.

If everything is in order, the online cash register, which is located in the office, records the sale on the fiscal drive, in the personal account in the OFD and sends it to the tax office. After the tax office receives the check details, a QR code will appear on the screen of the remote device. The passenger can scan this code to receive an electronic receipt.

Form

An entrepreneur has the right to independently develop the form that will satisfy his requests when conducting operational and economic activities.

In doing so, he must follow a certain list of instructions:

- the form must have a name, a 6-digit number and a unique series;

- if the form belongs to an organization, the name and legal form must be indicated on the document;

- if the form belongs to an individual entrepreneur, you must indicate the full name of the entrepreneur on it;

- location of the permanent executive body;

- individual tax number of an organization or entrepreneur;

- type of service or name of product;

- cost of a unit of service or product in monetary terms;

- amount of payment;

- date of calculation and preparation of the document;

- full name and position of the person responsible for the transaction and the correctness of execution, his personal signature and seal;

- other details that the entrepreneur or organization has the right to put on the document;

Samples for individual entrepreneurs and LLCs

Production of strict reporting forms

Strict reporting forms can be ordered from a printing house or generated using an online cash register or an automated system.

Typographic printing method

Currently, only individual entrepreneurs without employees who provide services to the public, as well as entrepreneurs and organizations legally exempt from using cash register systems, can issue printing BSOs to clients. The rest are required to print forms using a specialized automated system or online cash register, or abandon them and switch to online checks.

A list of areas of activity whose representatives are exempt from using cash registers can be found in.

This is the least expensive manufacturing method. An entrepreneur can use forms for various types of activities, which in most cases are available in the printing house, or develop his own (with a tear-off spine or regular). The main condition when developing your own forms is the presence of the required details:

- name of the form, identification number (series and number);

- name and form of organization or full name for individual entrepreneurs;

- address;

- TIN;

- type of service provided;

- its cost;

- amount of payment;

- date of document preparation;

- position, full name, signature of the employee who performed the transaction, seal of the organization or individual entrepreneur;

- other details that can be added to the document indicating the specifics of the activity.

Also on such forms are the name and INN of the printing house, order number and year, and circulation.

Sample of filling out the required details

Instructions for recording printed forms of strict reporting

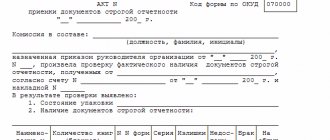

Forms from the printing house are accepted by the manager or employee with whom the liability agreement is concluded. After recalculation and verification of identification numbers, the head and members of the commission approved by the order sign the BSO acceptance certificate.

Make sure that BSO accounting instructions are developed. Strict reporting forms must be stored in a safe or metal cabinet; their issuance is recorded in the accounting book.

Sample of filling out the BSO accounting book

The sheets of the accounting book are numbered and stitched, the signature of the head and the seal of the organization are affixed.

Documents confirming payment in cash are drawn up as follows. Each time you accept cash, an employee of the organization fills out a form: gives the tear-off part to the client and leaves the spine. If you use the permanent option, you need to make a copy of the form. Subsequently, the spines and copies are packed in a bag and stored for 5 years. After this time, the reporting documents are disposed of, which is confirmed by the BSO write-off act.

BSO sample with spine

BSO sample without tear-off spine

BSO produced using online cash registers or automated systems

Strict reporting forms can be generated using an online cash register or an automated BSO system - a device that looks like a cash register, but with less functionality and cost. For most entrepreneurs, this is now the only option, because... They can no longer use printed BSOs as a document confirming payment by card or cash.

This method is more expensive than the printing method, but has a number of advantages:

- there is no need to fill out, store and maintain BSO records. All information is stored in a secure system for five years, after which the forms are written off and the corresponding act is drawn up;

- You don’t need to come up with the form yourself. The system automatically selects it by type of business activity, fills out and displays the form with all the required details in print or electronically;

- the automated system does not require registration with the Federal Tax Service;

- the likelihood of imposing a fine for errors when filling out and accounting for BSO is minimized, since the entire process is automated.

Such forms are printed automatically when performing a transaction via cash register. In addition, you can configure the system in such a way that the BSO will be sent to the client by email or mobile phone number. There are two nuances. If the client asks to do this before settlement, then if technically possible, the seller is obliged to satisfy the request. If the request was received after the payment was made, then there is no need to send an electronic copy, since the paper copy has already been printed.

Please note that the electronic form received and printed by the client is equivalent to the form printed on the cash register.

Sample of BSO printed through an automated system

Where can I get the forms?

There are various methods for producing strict reporting forms, but the most widely used method is printing. Any printing house has the right to fulfill an order, but it must comply with a number of conditions. The document must contain basic information about the company that produced the form. The printing house puts down the series and number of each form independently.

An entrepreneur or organization can create a series of forms on their own, choosing the digital or letter combination that meets the company’s needs. If forms are ordered from different printing houses, you can add the letter of the printing house to the series of the form.

In this case, you should adhere to the rule: new order - new series. This will ensure the absolute uniqueness of each form, where the series will constantly change, and the form number will become its serial number.

There is another option for making forms. You can print them yourself on a special cash register. However, you do not need to register it with the tax service. It is worth understanding that a strict reporting form produced on a household printer will not be valid.

How to fill it out?

- The form must be filled out manually, clearly and legibly. It is prohibited to make corrections to the document, in which case it becomes invalid. If an error was made when filling out, the form is crossed out. After this, the document must be attached to the form book.

- When filling out a document, you must create at least one copy. Modern forms contain two sheets: one tear-off sheet, which the client receives, and the second, the information on which is transferred by copying, remains in the organization.

The software must:

- Have protection from unauthorized access.

- Store all transactions for at least five years.

- Keep the unique number and series of the form.

Type of form

Previously, it was allowed to use BSO only for certain services for which unified forms were developed. These include: receipts, travel tickets, subscriptions, coupons, work orders, and so on. For certain types of activities, special forms still exist. However, for the majority they can be developed by organizations and entrepreneurs themselves.

The standard strict reporting form consists of two parts. One of them is issued to the buyer, and the second remains with the seller and is subject to accounting.

So who determines?

When ordering the production of tickets, sales receipts, receipts or any other types of strict reporting forms, their series is determined by the entrepreneur himself. Traditionally, most people choose the starting standard option AA as the most logical. In the future, you need to make sure that the numbers do not start repeating and change the series in time.

However, in our printing house, they will definitely advise you and will not allow re-issuance of existing forms, so you can rely on us.

The numbers of the forms are assigned by the printing house automatically. Usually the first form has the number 000001

, and the rest are numbered in order, starting from this number.

Please note that although the AA

for the first circulation and is recommended as the most logical, the law does not oblige you to adhere to this particular option. From the point of view of legislation, only the uniqueness of the forms is important, but how it is achieved within the framework of the described formats is not so important.

Therefore, you can assign any other series, for example, your initials. Just remember that when you reach the 999999th form you will need to use your imagination again.