Many organizations use different types of monetary documents. But not all accountants correctly document receipts and disposals. The chart of accounts for analytical accounting provides for subaccount 50.03 “Cash documents”. Each document is reflected in accordance with the type and item of acquisition costs. Keeping records of transactions in 1C: Accounting 8 edition 3.0 has several features.

Monetary documents are divided into several categories:

- paid railway and air tickets;

- fuel coupons;

- vouchers purchased for employees;

- postage and bill stamps;

- other types of monetary documents with characteristic distinctive features.

The list is open. If necessary, the accountant independently replenishes the categories with new types of documents.

Basic job requirements should be taken into account. First of all, secure storage in a safe or cash register must be ensured. In addition, the chosen accounting procedure is necessarily fixed in the accounting policy.

Receipts are reflected in the debit of subaccount 50.03, and disposals are reflected in credit 50.03.

What applies to monetary documents?

Cash documents are paid:

- coupons for petroleum products;

- food stamps;

- health resort vouchers;

- aviation, railway, travel tickets;

- express payment cards for cellular communications and Internet;

- notifications received for postal transfers;

- stamps (including postage stamps, state duty stamps, etc.);

- stamped envelopes.

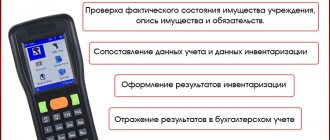

The institution must keep monetary documents accounted for in account 0 201 35 000 “Cash Documents” in the cash register. Accounting for transactions with monetary documents is carried out on separate sheets of the Cash Book (f. 0504514) with the entry “Stock” placed on them, as well as in the Journal for other transactions (f. 0504071) on the basis of documents attached to the cashier’s reports (paragraph 3 p. 170, paragraph 172 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

Analytical accounting of monetary documents is carried out according to their types in the Funds and Settlements Accounting Card (f. 0504051) (clause 171 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

Accounting for travel documents

Expenses for an employee’s travel to the place of business trip and back to the place of permanent work are included in business trip expenses (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation). Travel documents (air and train tickets) can be purchased by an employee sent on a business trip independently. In this case, the employer is obliged to reimburse the employee for these expenses (Article 168 of the Labor Code of the Russian Federation). An organization can also purchase travel documents through specialized transport agencies.

Travel documents are issued on strict reporting forms (clause 2 of the Regulations on the implementation of cash payments and (or) payments using payment cards without the use of cash register equipment, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359). The basis for deducting VAT on the costs of transporting employees to the place of business trip and back is a travel document in which the tax is highlighted as a separate line. Such a ticket or a copy thereof is registered in the purchase book after approval of the employee’s advance report (clause 18 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Often all travel documents are purchased in paperless form (electronic tickets). In this case, strict reporting documents are:

- route receipt of an electronic air ticket (clause 2 of the order of the Ministry of Transport of Russia dated November 8, 2006 No. 134);

- e-railway ticket coupon (clause 2 of Order No. 322 of the Ministry of Transport of Russia dated August 21, 2012).

According to the explanations of the Ministry of Finance of Russia, when purchasing air tickets electronically, the amount of VAT allocated as a separate line in the itinerary receipt of an electronic passenger ticket printed on paper is accepted for deduction (see letters dated January 30, 2015 No. 03-07-11/3522, dated 07/30/2014 No. 03-07-11/37594). In practice, this clarification also applies to the e-railway ticket coupon.

If an employee flies on a business trip by plane, then to confirm the costs of the flight, in addition to the itinerary receipt of the electronic air ticket, a boarding pass is also required. At the same time, the organization has the right to justify the consumption of air transportation services with any other documents that directly or indirectly confirm the fact of use of purchased air tickets (letter of the Ministry of Finance of Russia dated December 18, 2017 No. 03-03-RZ/84409).

If an employee goes on a business trip by rail, then the document confirming his travel expenses will be the control coupon of an electronic travel document (letter of the Ministry of Finance dated April 14, 2014 No. 03-03-07/16777).

No documents evidencing payment for an electronic ticket (for example, a bank card statement) are required to confirm these expenses (letter of the Ministry of Finance of Russia dated December 18, 2017 No. 03-03-RZ/84409).

The current legislation does not contain special rules regulating the procedure for recording electronic travel tickets. The purchase of an electronic travel ticket can be counted as receipt of a monetary document (since the electronic ticket fully meets its criteria) or as an advance payment for transport services (since the services are consumed later). Thus, the procedure for reflecting these transactions in the organization’s accounting records must be reflected in the accounting policy.

Example 2

| An employee of Confetprom LLC was sent on a business trip to Ufa from 04/09/2018 to 04/11/2018 (for 3 days). The daily allowance, according to the organization’s regulations on business trips, is 700 rubles. RUB 9,000 was transferred to the employee’s personal account for the report. A round-trip e-ticket was purchased by the organization through a transport agency. The cost of an air ticket on the route Moscow - Ufa - Moscow is 10,574 rubles. The amount of VAT (10%) is highlighted on the ticket as a separate line and amounts to 930 rubles. The cost of the service fee charged by the transport agency is 295 rubles. (including VAT 18%). In accordance with the accounting policy of the organization, electronic travel tickets are accounted for as monetary documents. Upon returning from a business trip, the reporting person submits an advance report, to which he attaches documents, including a boarding pass and documents from the hotel service provider (in the amount of RUB 7,000 excluding VAT). |

The transfer of funds to the employee's personal account, confirmed by a bank statement, is reflected in the document Write-off from current account with the transaction type Transfer to an accountable person. In the Recipient field, the accountable person is indicated, which is selected from the Individuals directory.

After posting the document Write-off from the current account, an accounting entry is generated:

Debit 71.01 Credit 51 - for the amount of funds issued for the report (9,000 rubles).

Settlements with the transagency can be made on account 76.05 using the following documents:

- Debiting from a current account with the transaction type Payment to supplier - to register payment;

- Receipt of monetary documents with the transaction type Receipt from the supplier - upon receipt of monetary documents;

- Receipt (act, invoice) with transaction type Services - to reflect expenses for transagency services.

In this case, the agreement with the transagency should look like:

- With the supplier - in the documents Write-off from the current account with the transaction type Payment to the supplier and Receipt (act, invoice);

- Other - in the documents Receipt of monetary documents and Write-off from the current account with the transaction type Other settlements with counterparties.

Thus, settlements with the transagency in Example 2 are carried out under two contracts with different types.

Payment to the transagency is registered by the document Debit from the current account with the transaction type Payment to the supplier (under an agreement with the type With supplier). After posting the document, an accounting entry will be generated:

Debit 76.05 Credit 51 - for the cost of air tickets, taking into account the service fee charged (RUB 10,869).

After posting the standard document Receipt (act, invoice) with the transaction type Services, the following entries are entered into the accounting register:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (295 rubles). The offset is carried out between the settlement documents Receipt (act, invoice) and Write-off from the current account; Debit 26 Credit 76.05 - for the cost of transagency services excluding VAT (250 rubles); Debit 19.04 Credit 76.05 - for the cost of VAT (45 rubles).

The purchase of an electronic ticket is reflected in the document Receipt of monetary documents with the transaction type Receipt from the supplier. In Example 2, the monetary document has the form Tickets. When posting a document, the following entry is entered into the accounting register:

Debit 50.03 Credit 76.05 - for the amount of the ticket received (RUB 10,574) in the amount of 1 piece.

Under an agreement with the type Other, the advance payment does not offset. To offset an advance payment to a supplier (under an agreement with the type With supplier), you can use the document Adjustment of debt with the transaction type Debt write-off, after which the posting will be generated:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (RUB 10,574). The offset is performed between the settlement documents Receipt of cash documents and Write-off from the current account. After completing this operation, the account 76.05 is closed.

The issuance of an electronic ticket to an accountable person is documented in the document Issuance of monetary documents with the transaction type Issue to an accountable person and is reflected by the posting:

Debit 71.01 Credit 50.03 - for the amount of the monetary document issued to the employee for reporting (RUB 10,574) in the amount of 1 piece.

Upon returning from a business trip, the reporting person submits an advance report. To include business trip expenses in expenses and account for input VAT, an Advance Report document is created. On the Advances tab, use the Add button to specify the following documents:

- Issuance of monetary documents, according to which the accountable person received a travel document;

- A debit from the current account, according to which funds were transferred to the employee’s bank card.

Information about business trip expenses (travel, accommodation and daily allowance) is reflected on the Other tab. This tab is filled out in accordance with the documents submitted by the accountable person. The following data is indicated in the fields (Fig. 5):

Rice. 5. Tabular part on the “Other” tab of the “Advance report” document

| Field | Data |

| "Document (expense)" | Enter information about primary documents |

| "Nomenclature" | The element corresponding to the flow rate is selected from the “Nomenclature” directory |

| "Amount", "VAT" | The amount and tax rate for the document are indicated, the “Total” field is calculated automatically |

| "Provider" | The counterparty is selected from the directory of the same name (for daily allowances this field is not filled in) |

| "SF" and "BSO" | Flags are set to register an electronic ticket as a strict reporting form. In this case, the “Invoice Details” field will be filled in automatically using the number and date of the BSO from the “Document (expense)” field. After executing the “Write” command, a link to the created “Invoice (strict reporting form)” document is automatically added to the “Invoice Details” field of the “Advance Report” document. |

| "Cost Account/Division" | Indicate the accounting expense account, the debit of which will include business trip expenses (for example, 26 “General business expenses”). If records are kept by division, the corresponding division is indicated |

| "Subconto" | The analytics for the cost account are indicated (for account 26 cost item “Travel expenses”) |

| “NU Cost Account” and “NU Subconto” | By default, they are filled in according to accounting data. They can be edited if necessary |

| "VAT invoice" | By default, account 19.04 “VAT on purchased services” is installed (if necessary, you can select a different VAT account) |

When posting the Advance Report document, the following transactions are generated:

Debit 26 Credit 71.01 - for the cost of an air ticket excluding VAT (9,644 rubles); Debit 19.04 Credit 71.01 - for the amount of VAT (930 rubles); Debit 26 Credit 71.01 - for the cost of living (RUB 7,000); Debit 26 Credit 71.01 - for the amount of daily allowance (RUB 2,100).

The deduction of VAT on an electronic air ticket will be reflected by the date of the advance report if the Reflect the deduction of VAT in the purchase book by the date of receipt in the form of an Invoice document (strict reporting form) is checked.

If the flag is cleared, the deduction can be reflected in the document Formation of purchase ledger entries.

To view the status of settlements with an accountable person, you can use the report Turnover balance sheet for account 71.01 “Settlements with accountable persons”.

In the balance sheet for account 71.01, the credit balance is 100 rubles. This means that the organization must pay the overspending of funds to the accountable person (in cash from the cash register or by transfer to the employee’s bank card).

Coupons for fuel and lubricants

Under the agreement, a certain amount of gasoline of the appropriate brand is paid, and the institution receives coupons with which drivers will refuel cars at the gas station. The received coupons on the basis of the supplier’s shipping documents (waybill, invoice, etc.) are received as monetary documents at the institution’s cash desk, and in the receipt order you must indicate the brand of gasoline, the series and numbers of these coupons, the denomination of the coupons in liters and the cost coupon in rubles (based on the cost of gasoline specified in the contract and invoice).

As a rule, for control purposes, a special accounting book is opened in which the movement of coupons is recorded.

The fuel received using coupons is accounted for as the institution’s inventory after the submission of an advance report by the accountable person with supporting documents from the gas station that sold the fuel in exchange for the coupon.

- Coupons for fuel and lubricants were received at the cash desk of the institution Dt 0 201 35 510 Kt 0 302 34 730

- Coupons issued from the cash register to the accountable person Dt 0 208 34 560 Kt 0 201 35 610

- The accountable person submitted an advance report on used coupons Dt 0 105 33 340 Kt 0 208 34 660

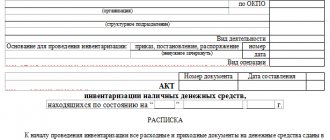

Filling out the cash register: sample

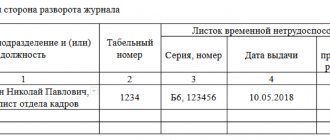

On the title cover, regardless of whether a self-developed or recommended journal form for registering receipts and expenditures is used, there must be the name of the organization, its structural unit where the cash desk is located, and the name of the form itself. In addition, you need to write the date when maintaining the form began, and the details of the person responsible for it (position and full name). It will look like this:

Inside the form, it is necessary to provide columns to indicate the following information for each cash order:

- order number and date of its preparation;

- amount of expense or income;

- a note indicating a brief purpose of the amount of money issued or received.

Numbers for incoming and outgoing orders must be assigned separately for each of these types of cash papers. Continuous numbering of income and expenses is not allowed.

Postage stamps and stamped envelopes

Postal services also remain widespread and in demand. The organization of postal shipments is impossible without purchasing stamps and marked envelopes, which, according to Instruction No. 157n, must be taken into account as monetary documents and, as necessary, issued for reporting to the persons responsible for sending correspondence. The supporting document for the advance report may be a register of sent correspondence, and in case of damage, a damaged envelope attached to the report.

- Receipt of stamps and marked envelopes to the institution's cash desk Dt 0 201 35 510 Kt 0 302 21 730; 0 208 21 660

- Issuance of stamps and marked envelopes for reporting Dt 0 208 21 560 Kt 0 201 35 610

Main

Cash documents are a type of material assets that accompanies the movement of funds. Accounted for in account 50.3 at the cost of acquisition, stored in the cash register, according to the rules for storing cash. The movement of monetary documents is documented using standard cash documents, with the mark “stock” on them. The concepts of “monetary documents” and “strict reporting forms” are different in a broad sense. Strict reporting forms can serve as confirmation of already paid monetary documents, however, not all BSO can be monetary documents.