For experienced accountants, the situation when business accounting is carried out in parallel both in branches on a separate balance sheet and in general is not something out of the ordinary: the only condition for maintaining automated accounting in this situation is the use of CORP version 1C: Accounting, since only it supports maintaining regular accounting in separate branches. Such structural units can pay each other’s debts, transfer material assets among themselves, etc. This transfer is formalized as a debt, and the accountant resorts to an advice note - a notification about the completion of a particular monetary or commodity transaction.

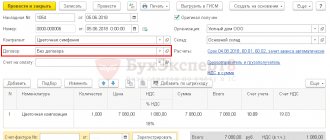

This scheme for processing transactions between branches was developed to eliminate discrepancies in the accounting of disparate structural units for calculations when exchanging data regarding internal movements, and the advice note is a derivative of the accounting certificate. The advice note document in 1C 8.3 creates postings to account 79 “Internal business settlements”.

To display the interaction of structural units of one company, a specific accounting workflow has been implemented, which provides for two types of advice notes:

- Outgoing, drawn up by the sender to register the intention to transfer the accounting object;

- Incoming, issued by the recipient to register the intention to accept the accounting object.

Also, the 1C accounting program provides special documents such as advice notes on the transfer object:

- By OS;

- According to the Ministry of Health;

- According to calculations;

- For other operations.

Let's consider their purpose and order of formation.

What does a memo mean?

The term comes from the Italian word “avviso,” which literally translates to “notice.” In particular, the term is used to refer to an official written notice sent from one person to another for the purpose of informing about the implementation of certain activities (for example, transferring money, sending cargo, etc.).

Within the framework of accounting, an advice note is a notification of various deviations or changes in the status of cash flows, property and assets. The document may contain information about changes in regulations relating to the preparation of accounting documents. In addition, information about:

- account balance;

- entered debit and credit entries;

- opening a letter of credit, etc.

Application of advice note

It is believed that the term “advice” is a banking term, but notifications are used not only by banks, but also in business correspondence between enterprises, as well as in company accounting. In any case (both business and banking practice), the counterparty is notified by means of an advice note about the completion of a financial or commodity transaction.

The bank servicing the company sends it a notification about the receipt of money in the account from the company - the buyer for the purchase of goods under the concluded agreement. They can serve as a payment stamp on the relevant documents - payment orders, checks, etc.

In the absence of a unified form, banks develop their own forms that are convenient for business correspondence. In them, they notify clients about debit and credit entries, balances in cash accounts, opening a letter of credit, and other transactions. The advice note must contain the following mandatory details:

- Document number and date of operation;

- The nature of the operation and the basis for its implementation;

- Amount and account number.

The method of transferring advice is established by correspondent or interbank agreements. Correspondence between enterprises is also carried out.

In addition, an advice note is used to transfer accounting information between separate divisions of one company. For example, when distributing costs among diversified farms united by one large company. In this case, they use the account of intra-farm settlements - No. 79 with the necessary sub-accounts.

The form of the advice note is not established by law. Typically, organizations develop the document themselves. It might look like this:

ADVICE No. 56

dated July 15, 2022

From: Main enterprise

To: Branch No. 2

Financing for payroll

Transfer of the amount of energy costs

Reason: payment orders No. 1542 dated July 15, 2017, No. 1356 dated July 15, 1017.

| the name of the operation | Debit account 79 from account credit (rub.) | Credit account 79 from debit accounts (rub.) | ||||||

| 51 | Total | 20 | Total | |||||

| Financing salary for June 2022 according to payment order No. 1542 dated July 15, 2017 | 35 000 000 | 35 000 000 | ||||||

| Transfer of electricity costs for the period from July 1 to July 15 (pl./por. No. 1356 dated July 15, 2017) | 369 000 | 369 000 | ||||||

| Total | 35 000 000 | 35 000 000 | 369 000 | 369 000 | ||||

The advice note, a sample of which is presented above, is a typical form of intra-company notice, a kind of analogue of an accounting certificate informing divisions, branches and departments of the company about internal movements of funds. For example, in the example presented, the parent company notifies the department about the receipt of money in the current account for the payment of wages and the presentation of expenses for electricity to it.

In the banking industry, a credit memo is a document created on the basis of an agreement between banks that gives the client the right to cash documents in another branch or bank that does not service his cash accounts. The credit memo contains instructions on the deadlines for accepting checks, maximum amounts, as well as sample signatures of the client (or his authorized persons) and the company's seal.

Types of advice notes

There are several classifications of advice notes. So, depending on who the notification is sent to, several groups of advice notes are distinguished:

- Between structural divisions of the same company

In this case, the advice note is a document in the form of an accounting certificate, the purpose of which is to record the transfer of information about business transactions between departments that have a separate balance sheet.

- Between different counterparties

Purchase and sale transactions imply that the seller and buyer must notify each other about all stages of the fulfillment of their obligations - and this happens precisely with the help of an advice note. Thus, the seller is obliged to notify the buyer about the readiness of the consignment of goods for shipment and its exact cost. In turn, the buyer is obliged to send a response notification to the seller, which will reflect information about the debiting of money from his personal account to the seller’s account as payment for the purchased goods.

In the event that negotiations are ongoing between several enterprises regarding the quality, quantity and monetary value of services (delivered products), then we can talk about direct and return advice notes:

- A direct memo does not imply a response to the sent request from the second party. The company has the right to send a request to counterparties to change the parameters of the product or cost, but this does not mean that the counterparty, in turn, must accept these conditions or respond to the request.

- A return note, on the contrary, implies a response to the notification sent (agreement or disagreement to the stated conditions, as well as one’s own options for action). A return memo can also act as confirmation of the completion of a financial transaction and the absence of any claims by counterparties against each other.

Depending on the debt, the advice note may be:

- Credit – drawn up by the buyer of the goods in order to confirm the debt to the seller.

- Debit – drawn up by the seller in order to notify the buyer about existing monetary obligations and requirements for their repayment.

In addition, the advice note can be electronic and then certified by an electronic signature, as well as by postal one. With the development of information technology, electronic advice notes have begun to be used much more often, but one must remember that they will only be valid if an electronic signature is required.

Varieties and classifications

There are several classifications of such notifications, the first is divided into:

- Debit – indicate data regarding the funds spent.

- Credit – information about funds received.

The division into direct and reverse has already been mentioned. The first type is sent by the counterparty, the second is sent to him in response as confirmation of the end of the transaction. Such a response comes only if the conditions satisfy the second party.

For advice notes for settlements

A settlement note is drawn up, most often, when there is a debt or disagreement between the parties regarding the total cost of delivery, agreement on a new price due to quantitative or qualitative discrepancies, and also when one of the parties has submitted a complaint.

If any aspect of the relationship between counterparties affects monetary issues, it makes sense to draw up an advice note for settlements, which must include:

- amount to be determined;

- postings for settlements made (debit or credit);

- date and essence of the transaction;

- proposed or completed actions (notification of readiness for shipment, demand to repay a debt or deliver a shortage);

- applications proving the correctness of the compiler or supporting the information presented.

Important! Advice notes drawn up for an external addressee are printed in 2 copies. If the document is published by one of the divisions/branches, then there should be three copies (one for the parent organization).

Example of a payment advice note

For advice notes on fixed assets

An advice on fixed assets can be compared with an act of acceptance and transfer (internal movement) of objects. However, due to some features, the advice note is considered a more flexible tool, suitable for different purposes. So with the help of this paper you can reflect:

- the fact of transfer of an asset between branches (the document must contain a list of objects and signatures of the releasing and receiving person);

- entering initial balances (at the start of working with new accounting software);

- “closing” during the construction of a new facility (with the help of this document you can formalize data received directly from the contractors if the work is carried out by the enterprise’s own resources).

Credit and debit memo

A credit memo establishes the existence of a debt to the seller (counterparty) and its amount. It is formed by the buyer himself and is actually an order to credit funds.

In response to the advice note, the seller provides the buyer with an invoice, which is subsequently subject to cancellation (if the buyer returns the entire batch of purchased goods to the seller) or downward adjustment (if the buyer returns part of the batch).

In the case of delivery of undeclared goods or products of poor quality, a credit memo can serve as a sales document drawn up on the basis of a claim, as a waiver of payment. In this case, accounts receivable will be reduced.

As for the debit memo, it is used to notify the counterparty of the company's rights to demand the fulfillment of financial obligations. In effect, a debit memo acts as an instruction to debit funds upon completion of a transaction. In turn, a debit memo can be:

- official notification that the financial transaction has been completed;

- notification that the recipient of the advice note has a debt.

Notice! The debit memo is used extremely rarely in the practice of Russian companies (invoices are its replacement). It is mandatory only if the transaction has international status.

Credit memo in banking

Speaking about various banking services, here the credit memo has different grounds. An agreement signed between a number of banking institutions is taken into account. This document, whose basis and availability provides the client with the opportunity to cash an existing check at a bank branch or a completely different institution that does not service this account.

Thus, in the banking industry, a credit memo is a document developed on the basis of an agreement between financial institutions, which provides the consumer with the right to cash financial documents in other branches or banks that are not involved in maintaining his current and cash accounts. Such a notification requires compliance with some nuances:

- Issuing a credit memo involves mentioning in a special form the options for checks, as well as the total amount available for acceptance as payment by employees of a banking structure or other branch.

- The advice note must have clear information about what period of time is allocated for accepting checks.

- A credit memo requires a sample signature of the client representing the person, as well as a sample stamp.

We can conclude that the credit memo should contain information about the time limits for accepting checks, maximum funds, along with samples of the company seal and client signature. If the consumer provides all necessary authority for any credit memo transactions to employees of the banking entity, the bank itself must have in its possession sample signatures of the selected employees.

A credit memo in accounting used in transactions between partners has completely different characteristics. When a purchase is completed, an invoice is created by the retail outlet, and a memo is created by its client, certifying the presence of a certain debt to the buyer.

When the client returns the received batch of products or part of it back to the retail outlet, the invoice is canceled or adjustments are made in favor of reducing the payment. A credit memo is also used for this.

If we consider the transfer of counterfeit or low-quality products to the client, here the notification can act as a full-fledged sales document and be developed with the help of a claim or complaint, including refusal to pay. The result is a general decrease in accounts receivable.

Issuing an advice note

There is no unified form for issuing advice notes, so each company independently develops and installs it for itself, and then (which is very important) enshrines it in its accounting policies. However, there are mandatory points that must strictly be reflected in the notice. These include:

- document number and date of its preparation;

- content of the settlement transaction;

- reasons for the operation;

- amount and account number;

- transaction amount or sales income;

- information about the sender and recipient (including details).

If the advice note is sent to a third-party company, then additional documentation will need to be attached to it (payment orders, rights to assets and everything that relates to the essence of the transferred object).

When transferring financial assets (liabilities), the addressee receives an advice note issued in duplicate. One of them is kept in the accounting department and acts as confirmation of the legality of the financial transaction with the recipient, and the second (with appropriate notes on receipt) is returned to the sender.

The advice note is issued in triplicate if it is used for intra-business transactions carried out within the same company between its structural divisions. In this case, the first copy remains in the accounting department, the second copy (with receipt notes) is returned to the sender, and the third is sent to the main office (head division), from where all subsequent actions of the divisions are coordinated.

Explanation of the concept of “advice note”, examples

In order to minimize the level of labor costs, a consolidated variation of such official notices is often used. They reflect several settlement transactions performed at once. If bank settlement transactions have the status of an international transaction, it is necessary to resort to the use of a debit memo. This term implies an order to a foreign trade organization carried out in the prescribed form.

The procedure for sending advice notes is determined by correspondent agreements or a drawn up cooperation agreement with the client. The written notice is presented in the form of a form, which indicates a lot of important data, including the name of the sender and recipient, account number and its amount, the nature of the transaction being performed, and the date.

Advice is used not only to notify various organizations that are competitors or partners of the company. Quite often, it serves to control intra-business calculations carried out by various departments within the same organization. In this case, these divisions must have an independent balance sheet. Along with this, the acceptance and transfer of financial obligations, results and costs between the head office and one of the ordinary divisions is issued in separate advice notes.

When carrying out the procedure for transferring financial assets or liabilities, the addressee receives an official notification letter in two copies.

- One of them acts as a document confirming the legality of the financial transaction and remains in the accounting department.

- The corresponding signatures and seals are placed on the second copy, as a result of which the letter is sent to the address of its sender.

If the advice note is used for intra-business settlements carried out within one organization, then there should be three copies.

- The first of them, as in any other case, is the basis for reflecting financial transactions in accounting.

- Another version of the document is then sent to the address of its sender after all the necessary seals and signatures have already been supplied.

- The third copy of the advice note is transferred to the head office, from where, in fact, all subsequent actions of the individual department are coordinated. In the future, it will be used to make the necessary amendments to analytical accounting.

Relationships between counterparties

One company notifies the second that goods have been shipped and services have been provided. Based on this information, the counterparty sends an order to debit funds from its current account.

Advice on OS

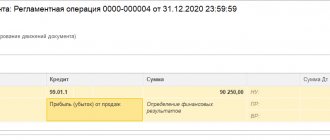

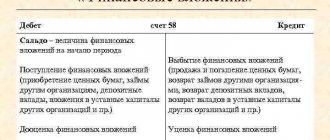

A note on fixed assets is used to record the movement of funds between departments and divisions within one company. All these operations are reflected in the subaccounts of account 79, which regulates settlements between departments that are on a separate balance sheet.

The fact of moving money to the department is recorded by an outgoing advice note on the operating system. If the document is generated in an accounting program, then when you select an OS object, the tabular part of the advice note will be filled in automatically based on the inventory number and cost. There will also be an automatic adjustment in accounting: the transfer of the original cost and depreciation will be reflected in account 79.

The fact of receipt of funds from the department, in turn, is recorded by an incoming advice note on the operating system, which is issued in the accounting program on the basis of the received outgoing advice note. In this case, all details about the transferred OS object will need to be entered manually.

Direct and reverse advice notes

Modern banks use various advice notes to effectively notify their clients. Financial institutions report through notifications about debit and credit entries in current accounts, balances of own or borrowed funds, opening of letters of credit, invoicing and other financial news. Such financial notices often require a response, which can be a return memo from the accounting department. What is it?

A return notification means that the other party has accepted the direct memo, reviewed the information in it, and prepared a response. A return memo does not necessarily mean full consent to carry out an accounting or financial transaction; sometimes it simply contains information that the information received has been taken into account, but the financial entry cannot be completed for one reason or another.

For example, a reduction in selling prices for some categories of goods in the current financial month is impossible, since the buyer has not fulfilled the terms of the contract necessary to provide a discount. Or the supplier side refuses to accept the return of goods on the basis that the return limit has already been met, and a new operation to accept unsold goods is possible only in the next reporting period.

Sometimes return notifications contain a proposal to revise the terms of the contract or draw up an additional agreement to it indicating the controversial points. If the parties reach an agreement, the direct notice is considered agreed upon and a formal response is drawn up. After this, changes are made in accounting according to the data presented. The result of the exchange can be an agreed and signed act of reconciliation of mutual settlements.

Advice on calculations

The main function of a settlement advice note is to move receivables and payables acquired with the participation of external counterparties between divisions of the company. At the same time, in one notification you can immediately report both types of debts under different agreements.

Advice for settlements can also be incoming and outgoing. They must include the following information:

- type of debt (accounts payable and receivable);

- information about the sender and recipient;

- contract numbers;

- amounts.

Important! If the debt is transferred in foreign currency, then an appropriate adjustment will need to be made in the accounting program.

Advice form

According to these rules for preparing financial statements, the current sample advice note in the accounting department has all the details of an official document. The notification must include:

- date of document preparation;

- outgoing number;

- information about the recipient;

- information about the sender;

- details of both counterparties;

- essence of the notice.

When contacting a bank or government agency, the advice must be certified by a seal. Other documents may be attached to the form as supporting documents. Among them may be:

- copies of payment orders;

- duplicates of memorial orders;

- other.

Sometimes accompanying documents themselves can be advice notes: for example, copies of payment orders can be sufficient grounds for making changes to the final balance of mutual settlements.

Based on the notification provided, a debit or credit memo is generated. What does this mean in accounting? A credit memo is an alert created based on an agreement with customers. A credit memo reduces accounts receivable in financial accounting. A debit memo is an alert created based on the posting of an additional debit entry. A debit memo increases the accounts receivable in the financial accounting of an organization.

Form of memo document in accounting department

As noted earlier, there is no generally accepted form for the advice document, so each organization develops it at its own discretion.

In general, an advice note in accounting looks like a special form on which information such as the advice note number, date of execution of the document, nature of the transaction, transaction amount or income from the sale of goods, account number, details of the sender and recipient are indicated.

It is also necessary to remember that an advice note can be replaced with payment orders or other settlement and accounting documentation.

How is an advice note used?

It is generally accepted that an advice note is a bank notification of mutual settlements, but such notifications are also used in business communication between enterprises and for accounting needs. One way or another, the bank servicing the company sends the organization a notice of mutual settlements and transfer of funds to the account from the client legal entity that purchased the products on the basis of a certified agreement.

Payment advice for companies is available in two versions. To begin with, it is an interaction between two different partners. A purchase and sale transaction involves notifying the seller of the volume of goods released, written off from the warehouse, and the transfer of the agreed cost to be paid by the client. The buyer is notified of the transfer of money from his current account to the seller’s account, which becomes payment for the purchased products.

When more than two parties participate in the transfer of funds, the accounting department of one of the parties issues a direct advice note, where a request for a response notice is possible. This is carried out by the accounting department of the second party within the stated time frame and becomes confirmation of the completion of the transaction, as well as the satisfaction of all participants.

The second version of the advice note in accounting involves cooperation between the structures of a single company. In this situation, the notification acts as a derivative version of a certificate from the accounting department. Through documentation, various structures of the organization exchange information about the movement of money.

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Advice: forms and samples

- Marked form of an irrevocable documentary letter of credit (advice for the beneficiary)

- Marked form of an irrevocable documentary letter of credit (advice for the advising bank)

- Marked form of irrevocable documentary letter of credit (advice for beneficiary) (English)

- Marked form of an irrevocable documentary letter of credit (advice for the advising bank) (English)

- Advice for acceptance and transfer in the order of intra-business calculations of property, costs, obligations and financial results

- Advice on the transfer of premises from the seller’s balance to the buyer’s balance

- Advice for settlements between a separate division and the parent organization

- Form of irrevocable documentary letter of credit (advice for the beneficiary)

- Form of irrevocable documentary letter of credit (advice for the beneficiary) (reverse side)

- Form of irrevocable documentary letter of credit (advice for the advising bank). Option 2

- Form of irrevocable documentary letter of credit (advice for the beneficiary) (English)

- Form of irrevocable documentary letter of credit (advice for beneficiary) (reverse side) (English)

- Form of irrevocable documentary letter of credit (advice for the advising bank) (English)

- Form of irrevocable documentary letter of credit (advice for the advising bank)

Advice in accounting