Inventory assets: what is it in accounting

To begin with, let's understand such concepts as inventory (material assets) and inventories (MPI).

In general, these terms are used interchangeably. Is this true and what does it contain? Currently, the concept of inventory has become more widespread, if only because it was used in the terminology of PBU 5/01, which was in force until 2022, which was actually called “Accounting for inventories.” Since 2022, PBU 5/01 has been canceled, and it has been replaced by FSBU 5/2019, the name of which also includes the word “reserves”. To be more precise, that’s exactly what the standard is called.

ConsultantPlus experts spoke about what the new accounting standard has changed in accounting for inventories. Get a free trial access to the system and proceed to recommendations.

According to clause 3 of FSBU 5/2019, reserves include:

- raw materials and materials, fuel, spare parts and components, purchased semi-finished products intended for use in the production of products, performance of work, provision of services - count 10;

- tools, inventory, workwear, special equipment, containers and other similar objects used in the production of products, sale of goods, performance of work, provision of services, except for cases when these objects are considered fixed assets - count 10;

- finished products - score 43;

- goods - account 41;

- work in progress (from 2022) - count 20, etc.

The procedure for accounting for inventories starting from 2022 according to the rules of the new FSBU 5/2019 is described in detail in the Guide from ConsultantPlus. You can view the materials for free by getting trial access to the system.

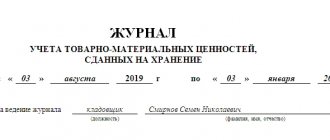

The concept of inventory items is rarely found in legislative acts on accounting. Firstly, it can be found in the title of off-balance sheet account 002 “Inventory and materials accepted for safekeeping.” It follows from the meaning of the name of the account that inventory items are directly goods and materials, because only they can come from suppliers when it comes to current assets. Secondly, in paragraph 3.15 of the Methodological Guidelines for Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49, it is deciphered that inventory and materials include industrial inventories, finished products, goods, and other inventories.

Thus, the concepts of inventory and inventory mean the same classes of assets and are identical.

Write-off of materials for business needs in 1C

Let's look at how to create and fill out this document in the 1C:Enterprise program. As an example, let’s take the write-off of materials for administrative purposes of the organization.

To create a document, you need to go to the “Warehouse” menu tab and follow the link to the document log “Requirements-invoices”.

Then click on “Create” and open a new document, which now needs to be filled out correctly.

Next to the “Create” button you can see the “Copy” button. This button can be used if you need to fill out documents that have the same nomenclature (for example, write off gasoline monthly). In this case, you can simply copy the previous document and make the required corrections to it.

In the window that appears, you must fill in the necessary details and, using the “Select” or “Add” command, select the item for transfer or write-off.

Please note that if the checkbox is not checked in the “Cost accounts” column on the “Materials” tab, then write-off accounts will have to be filled out in a separate tab of the document in accordance with the accounting policy of your enterprise.

When selecting an item (the “Selection” command), by selecting an item group in the left part of the window and clicking on the “Only balances” button, in the right area of the window we can see the available balances for the selected warehouse.

If in the “Settings” tab there is a checkmark in the “Request quantity” column, then when you select an item, a dialog box will be displayed in which you indicate the number of units to add to the document. Then, thanks to the “Move to Document” command, they appear in the tabular section.

By clicking on the “Print” button from the document, you can print out the “Demand-invoice” and “Request-invoice (M-11)” forms.

Key questions when choosing accounting methods for inventory items

There are several key issues regarding the choice of accounting methods for inventory items that need to be fixed in the accounting policy.

Firstly, at what cost will the inventory items be accounted for: immediately at actual prices or using accounting prices.

The choice of accounting option will determine the accounting accounts on which the receipt and availability of inventories in the organization should be recorded: 10, 15, 16. Read more about the use of these accounts in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

Secondly, it is necessary to determine the way to include transportation and procurement costs in the cost of material assets.

All methods are discussed in detail in the article “How to take into account TRP in accounting (nuances)?”

In addition, there are 3 options for writing off inventories as expenses.

For more details on the methods of writing off materials, which are also applicable to other inventories, read the article “The procedure for writing off materials in accounting (nuances).”

It is also necessary to establish a method for writing off expenses for the purchase, storage and sale of inventories in non-trading organizations: monthly in full or in proportion to the goods sold.

Find out how to correctly take into account material expenses in tax accounting when calculating income tax in the Ready-made solution from ConsultantPlus. Get free trial access to the system.

Transfer of materials into operation in 1C 8.3

According to Russian legislation, enterprises are required to provide workers with special clothing* and special equipment (Article 219 of the Labor Code of the Russian Federation) for personal protection when performing work duties. Such low-value property acquired for the purpose of performing work, providing services, carrying out production activities or for administrative needs is classified as inventory.

*Modern workwear also includes corporate workwear, designed to strengthen the corporate spirit within the team, as well as demonstrate the company’s brand to clients. Another type of protective clothing is signal protective clothing, most often used by road workers to warn the driver.

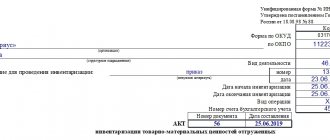

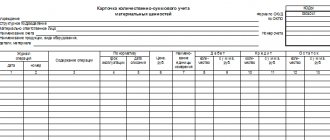

Materials accounting occupies an important place in the activities of the enterprise. Inventory materials are taken into account with an active synthetic 10th account, on which, depending on the types of materials, the corresponding sub-accounts are opened.

Writing off materials in accounting is a strictly regulated and specific process, depending on the type of inventory. Usually, when preparing documents for the write-off of materials, it is assumed that the released materials will immediately be used for their intended purpose, which means they are accompanied by postings - on the credit 10 of the account and the debit 20, 25, 26, 44, etc. Such materials include raw materials (account 10.01), semi-finished products (account 10.02), fuel (account 10.03), containers (account 10.04), spare parts (account 10.05), construction (account 10.08) and other (account 10.06) materials. But there is a group of materials - low-value and wearable items, which must be written off at the time of commissioning or taken into account evenly in expenses (if their service life exceeds 12 months).

A similar write-off procedure applies to such a group of inventories as inventory and household supplies - this is part of the organization’s material reserves used as means of labor for no more than 12 months or the normal operating cycle, if it exceeds 12 months (inventory, tools, etc. ). These include various tools, instruments and devices whose service life exceeds 12 months, but in terms of cost they are not the main asset. In such a situation, they are taken into account as inventories, and a special procedure for transferring them into operation is also provided for them.

Let's look at the steps to write off inventories using the program. The first step is to reflect the issue through “Transfer of materials for operation” in the “Warehouse-Workwear and equipment” menu.

Fig. 1 Submenu “Warehouse” in the program “1C: Accounting”

As already mentioned, our materials are listed in special account 10.10 - “Working clothing and special equipment in the warehouse.” Having generated the balance sheet for the account, we see that the balance sheet includes reflective vests - quantity 10 pieces and insulated suits - quantity 15 pieces.

Fig.2 “Reversal” according to 10.10

We will reflect their transfer into operation. To do this, create a document of the same name by clicking “Create” in the document log.

Fig.3 Creating a document

Let's fill in the header of the document - organization, location of materials, warehouse - where they will be transferred, and using the selection button, add the nomenclature. Next, we indicate the quantity and financially responsible person, and fill in the purpose of operation. Here we prescribe the method of extinguishing the cost and displaying expenses, as well as the useful life (in months).

Fig.4 Filling out the transfer document

The service life of the materials in question is established by the norms of the Labor Code of the Russian Federation. They depend on the specialty of the employee, climatic conditions, and the activities of the organization. For example, a jacket and trousers with insulated lining and special inserts in the form of membranes are issued for three years, after which they must be replaced, and winter boots are issued once every four years. Clothing without a membrane, but with lining, is changed once every two years, boots are issued for two and a half years.

Free expert consultation

Anna Vikulina

Head of 1C support department

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

Based on the cost and established service life of the workwear taken into account in the MPZ, it can be divided into:

- First group: useful life less than a year, regardless of cost with a one-time write-off;

- The second group: a period of more than a year is not included in the operating system according to the cost criterion, so the cost is paid off in a linear way, starting from the term.

This must be taken into account when filling out information about the intended use. So, our reflective vest has been used for less than 12 months, so we note that it is written off as the first group.

Fig.5 Example of filling out a document

The cost of the second group is written off over the entire useful life in equal shares, but at the same time in the NU it is written off immediately, so a temporary difference arises.

Fig.6 Example of filling out a document

Another extinguishing option, but applicable only to special equipment - based on the volume of products (works, services) in equal proportions. It involves the monthly entry of the “Material Production” document.

Fig.7 Proportional method

The Expense Reflection Method field reflects the accounting setting.

Fig.8 Window for creating a “Method of reflecting expenses”

Fig. 9 Methods of reflecting expenses

Next, we post the document and check the generated transactions - the “Show transactions and other document movements” button. From here you can print the “Issue Statement” and the “Request Invoice”.

Fig. 10 Completed “Transfer of materials to production”

Postings will be generated on balance sheet accounts 10.10 and 10.11, as well as in the debit of off-balance sheet accounts of the MC accounting. At the same time, the cost of the reflective vest was paid off when it was put into operation (Dt. 26 Kt. 10.11).

Fig. 11 Posting a transfer document

But repayment of the cost of workwear according to the display method (for us it is Dt 26 Kt 10.11.1) will only be in tax accounting. The consequence of this will be a temporary difference in the data of NU and accounting.

Fig.12 Wiring

The temporary difference will be recognized in the first month of repayment of the cost of workwear and will then be written off (repaid) over the useful life of the workwear, in equal installments at the end of the month.

Fig. 13 Issue record sheet (MB-7)

Fig. 14 Request-invoice (M-11)

Having generated the balance sheet for account 10.11.1 “Workwear in use,” we see that the “Reflective vest” was written off upon issue (there is no balance at the end of the month), and the insulated suit is listed as the financially responsible person.

Fig. 15 SALT for account 10.11.1

In the same way as special clothing, special equipment, equipment and household supplies are transferred.

Fig. 16 Bookmarks in the transfer document

As we can see, this is the same document, but other tabs corresponding to the materials are filled in.

Accounting for inventory items as an example

purchased 50 meters of fabric for the production of curtains in the amount of 120,000 rubles (including VAT 20,000 rubles). There were 25 finished curtains. cost - 5000 rubles. each. The enterprise maintains quantitative and total accounting of inventory items. The accountant recorded the following entries in accounting:

Dt 10 Kt 60 - 100,000 rub. — 50 m fabric arrived;

Dt 19 Kt 60 - 20,000 rub. — VAT;

Dt 20 Kt 10 - 100,000 rub. — 50 m of fabric was transferred to the sewing workshop;

Dt 43 Kt 20 - 125,000 rub. — 25 pieces produced. curtains

Sold a batch of 6 pieces. in the amount of 42,000 rubles. (including VAT RUB 7,000)

Dt 62 Kt 90 - 42,000 rub. — sold 6 curtains;

Dt 90 Kt 68 - 7,000 VAT on sales;

Dt 90 Kt 43 - 30,000 rub. — written off cost of 6 pcs. (125,000 / 25 × 6)

The company also purchased a batch of curtains ready for sale in the amount of 30 pieces. in the amount of 90,000 rubles. (including VAT RUB 15,000).

Dt 41 Kt 60 - 75,000 rub. — 30 pieces arrived. curtains;

Dt 19 Kt 60 - 15,000 rub. — VAT.

Sold 4 pcs. in the amount of 16,500 rubles. (including VAT RUB 2,750)

Dt 62 Kt 90 - 16,500 - sales 4 pcs. curtains;

Dt 90 Kt 68 - 2,750 - VAT;

Dt 90 Kt 41 - 10,000 rub. — the cost of 4 curtains was written off (75,000 / 30 × 4)

Read about the specifics of inventory accounting in trade here.

Regulations for accounting of material assets at an enterprise

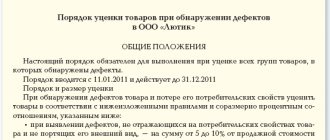

The development of internal regulations is an important point for the effective establishment of processes at the enterprise, the implementation and compliance of internal controls, as well as the prevention of shortages and errors in accounting data. Note that the inventory accounting regulations describe the procedure for employees and document flow to complete a certain operation. And what accounting methods were chosen is described in the accounting policy; in addition, separate clarifying internal acts are possible. Let us describe the main points that can be disclosed in the regulations for accounting for inventories:

- Receipt of goods and materials at the warehouse:

- placing an order/purchase application;

- checking the order for compliance with the budget, plan or other standards;

- order approval;

- acceptance of inventories to the warehouse by the warehouseman, including a description of the process of checking incoming documents from contractors, the purchased inventories themselves;

- reflection by the storekeeper of data in the warehouse accounting system;

- transfer of primary documents to the accounting department;

- reconciliation of warehouse and accounting records;

- identification of shortages, uninvoiced supplies, etc.

- Release of materials from warehouse to production:

- filling out a request for a warehouse;

- approval of this request;

- registration of internal movement;

- reconciliation of warehouse accounting, workshop accounting and accounting data;

- accounting for the movement of materials in accounting.

- Acceptance of finished products to the warehouse.

- Shipment of finished products from the warehouse:

- execution of an agreement with the buyer;

- receiving an order from the buyer and approving it;

- preparation of primary documents for shipment;

- reflection by the warehouseman of shipment data in the warehouse accounting system;

- actions of the security service when exporting finished products from the territory of the enterprise;

- control of payment for finished products, etc.

We have provided an approximate list of topics that may be covered in the regulations, since they are created taking into account the specifics of the internal processes of an individual enterprise.

Results

Accounting for inventory at an enterprise requires the development of a methodology specially selected for a specific case. This methodology is reflected both in the accounting policy and in the internal regulations for working with inventory items. In our article, we examined the main issues that should be disclosed in these documents.

Sources: FSBU 5/2019, approved. by order of the Ministry of Finance of Russia dated November 15, 2019 N 180n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings to inventory items

Materials are accounted for in account 10, which has subaccounts depending on their type (materials, semi-finished products, fuels and lubricants, inventory, others, etc.). In its accounting policy, the organization must establish how it will reflect accounting: simply at actual cost or at accounting prices (in this case, it is necessary to use accounts 15 and).

In order to write off materials, they also choose their own method in the accounting policy. There are three of them:

- at average cost;

- at cost of inventories;

- FIFO.

Materials are released into production or for general business needs. Situations are also possible when surpluses are sold, and defects, losses or shortages are written off.