What is a cash book

The cash book (Form N KO-4) is used by all legal entities to record receipts and issue cash to the organization at the cash desk. Its form was approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88, however, currently its use for doing business is not mandatory since January 1, 2013, as a form of the primary accounting document contained in albums of unified forms. Therefore, each entrepreneur can independently develop and apply his own form of such a document, while complying with the established requirements for its completion. We will talk about the requirements and the form that have been developed for these purposes, since their use makes it possible to make accounting for cash transactions simpler and more convenient.

How to properly maintain a cash book in 2022

At each enterprise, by order of the manager, a special employee must be appointed responsible for the cash register. If the state allows, then this is a separate cashier; if not, then, as a rule, this is the chief accountant. It is this person who must keep records of all transactions and the cash book. In any case, the chief accountant controls the process. The cash book itself is a journal if maintained in paper form, or a separate section of the accounting program if maintained electronically. Both methods are allowed, so let’s look at each method of maintaining a cash book in more detail.

First, let's look at the responsibilities of a cashier, since they do not depend on the method of maintaining the cash book and have a certain algorithm that looks like this:

- At the beginning of a new shift, the cashier must open the day, that is, make an entry with the date and amount of the balance in the cash register. This amount should always be equal to the balance at the end of the previous working day. Such operations may not be daily, so it is necessary to open a shift and make an entry in the cash book only on the day on which the movement of funds occurred. On other days, the balance is simply transferred.

- Each operation for issuing or receiving cash must be formalized by a cash receipt order (PKO) or an expenditure cash order (RKO). The cashier prepares these documents, assigns them numbers and makes a record of each of them.

- At the end of the shift, the cashier sums up the day's income and expenses, makes appropriate entries in the cash book and displays the balance. The recordings made during the day are certified by the signature of the performer with a decoding of the last name, first name and patronymic. After which the cash book is submitted to the chief accountant for verification and approval.

This procedure is provided for each shift. These are only general requirements for maintaining a book; the basic procedure is slightly different, depending on the organization of the process.

Separately, it is necessary to note the requirements for storing the cash book. All cash registers, cash registers, tear sheets, various checks and the magazine itself must be kept in the company for 5 years. After the expiration of this period, the documentation should be destroyed in accordance with the established procedure.

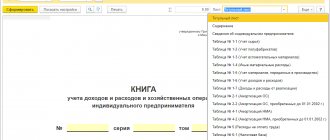

How to fill out a cash book: sample electronic form

The easiest way is to organize the maintenance of a cash book in an accounting program, which reflects all accounting in the organization. This function, for example, is available in 1C and other programs. In this case, the form is generated and filled out directly on the computer, the order of making entries does not change: it is necessary to enter information about each PKO or RKO. At the end of the day, the cashier must summarize, display the account balance and print out the sheets of the cash book for the day in two copies. All documents must be submitted for verification by the chief accountant, who verifies the data in the primary documents with the data in the registers and certifies them with his signature. Corrections and edits are not permitted.

Every year, and if the cash register turnover in the organization is daily, then quarterly, the printed sheets of the cash book must be formed into a journal and stitched. The last page must indicate the total number of sheets and bear the signature of the head of the organization, the chief accountant and an imprint of the company’s round seal, if any. In addition, you can maintain a cash book entirely electronically. In this case, all records must be certified by electronic signatures of authorized persons, and information and its editing must be protected from unauthorized access using additional technical means

How to flash a cash book printed from 1c

However, such a design makes it possible to easily replace sheets in the book, and therefore does not meet with enthusiasm from inspectors. So, the sheets must be folded in an even stack so that the book has an orderly appearance. The holes are made on the left side strictly vertically.

Then thread or twine is pulled through the holes twice so that the ends are on the wrong side. An example of how to sew a cash book can be seen in the photo above. The ends of the threads are tied with a strong knot several times so that everything is held securely.

How to fasten what is sewn In the Word program or any other analogue, a sticker is created on the wrong side of the book. The contents of the sticker should be as follows: “the sheets in the pack are numbered, laced, signed and sealed.” The line below contains a description of the position and signatures of the authorized person and the chief accountant.

Madina, correct firmware is like a book: at the top is what happened before (January 1), below is what happened later (December 31). As I understand it, your book was printed from a computer, which means you need to make at least 3 holes on each page in order to make stitching convenient. I do this with a hole punch - quickly and without much effort. I print two pieces of paper on A4 format - the one that is sewn into the cash register and the one to which I attach PKO and RKO, so I make 3 holes, and if you print 1 page on A4 format, it is more convenient to make 4 holes with a hole punch. Next, sew in such a way that the ends of the threads remain in the center (in the middle hole, if there are three of them, or the entrance is in one of the middle ones, the exit is in another of the middle ones, if you have 4 holes). You tie the threads and glue a piece of paper on top (it is also printed in 1C), stating that there are so many sheets stitched in the cash book. Today, most enterprises and individual entrepreneurs are required to use non-cash payments in their payments. But with certain limits it is also possible to make payments in cash. In this case, it is necessary to draw up a fairly large number of various documents.

One of the most important is the cash book.

- Important points

- How to sew a cash book for the year

It includes a fairly large amount of information. The need for its implementation is established by legislative bodies. If possible, you should familiarize yourself with the procedure in advance.

A cash book must be used in enterprises where cash payments are made. The document reflects an extensive list of data. It is required to follow the format of its compilation. Special regulatory documents reflect the main points related to the drafting procedure.

Cash book: sample manual filling and filling requirements

Maintaining a cash book in 2022 begins with numbering and stitching its sheets. The ends of the lacing at the back of the journal must be sealed with a paper strip on which you must indicate the number of sheets, the start date of maintaining the cash book and the end date. To certify the record, the chief accountant and the head of the organization must sign, and a seal, if available, must be affixed. It should look like this:

On the title page of the cash book you must indicate the name of the organization and the period for which the document was opened. All entries must be made only with blue or black ballpoint pen or ink.

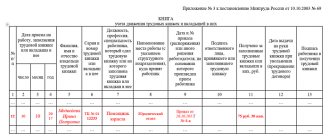

Each sheet is divided into two parts:

- one remains in the book;

- the second is detachable and is stored together with the RKO and PKO registers.

To fill out the sheet, the cashier places carbon paper so that the entry in pen is on the sheet that remains in the document. The entries must be completely identical, but you cannot sign a carbon copy. Therefore, at the end of the day, the cashier must sign on each copy of the cash book. All records about cash settlements and cash settlements are entered line by line in the appropriate columns, indicating the details of the person who deposited or received the money. Income and expense are entered in different columns. If one sheet is not enough to reflect all transactions for one day, the cashier must fill out the “transfer” line, which records the total amount of money received and spent at that moment. The next sheet of the cash book begins with the same amounts.

At the end of the day, you should sum up the results and indicate the total turnover at the cash register for the day and withdraw the remaining cash at the end of the day. If the cash register included amounts intended for the payment of wages or benefits according to the payroll or payroll, the cashier must allocate them in the line “including wages, social payments and scholarships.” After all the entries have been made, they are checked against the primary documents and certified by the chief accountant.

A correctly completed cash book sheet for the day looks like this:

Procedure for preparing a handwritten document

The paper version is an A4 brochure, which is printed on a printer or in a printing house and is handwritten. The sheets must be numbered and stitched. It must correspond to form KO-04. You need to know how to stitch together a cash book for the year. The process of numbering and maintaining electronic and paper format differs from the classic version used in office work.

Important! The pages are numbered, duplicating the number in two copies. The first page is the original, the second is a copy. A copy is filled out using carbon paper and submitted to the accounting department for reporting. To detach the second page, a cutting line is provided.

It is more convenient to do the stitching at the bottom of the page. The edges of the thread are brought out from behind onto the last sheet, secured with a knot, a paper seal and a seal. The seal is placed in such a way that it partially covers the book page and the seal. Nearby indicate the number of pages and put the signature of the manager or chief accountant.

Administrative responsibility

Violation of the rules for maintaining a cash book or its absence is an administrative offense; liability for it is provided for in Article 15.1 of the Code of Administrative Offenses of the Russian Federation, as for violation of the handling of cash. For such an offense, the Federal Tax Service may impose an administrative fine:

- in the amount of 40 thousand to 50 thousand rubles for the organization itself;

- in the amount of 4 thousand to 5 thousand rubles per manager or chief accountant.

Cash book, form in Word

in Excel

What is the document for?

A cash book is prepared for all persons who have a cash register. This requirement applies to individual entrepreneurs, including those working under the simplified tax system. Form KO-04 was approved in 1998 by the Decree of the State Statistics Committee of the Russian Federation. A paper form and an electronic cash book are acceptable; the electronic version form can be maintained in Word and Excel with mandatory protection from unauthorized access. It is run by the cashier (operator), but the chief accountant controls the correct filling. The correctness of maintenance is systematically checked by regulatory authorities.

In large companies, maintaining a cash book is necessary in each division, provided that each of them is listed on a separate balance sheet. One copy of the document is created for one department. Copies of the book and originals of primary documents for it are provided to the main office (management company). Information about the remaining money is taken into account when drawing up balance sheets and reporting for the enterprise as a whole. Let's look below at how to stitch together a cash book for the year.