Why is the KM-6 form needed?

Certificate form KM-6 is the main reporting document of the cashier. It indicates the revenue received and is handed over to the manager along with the revenue. If the proceeds are given to collectors, then a corresponding note is required in the certificate-report.

In the work of inspection bodies, such certificates play a very important role. It is on their basis that a conclusion is made about the completeness of revenue reflection. In addition, information from the KM-6 certificate is used to fill out a summary report. This report includes data on the status of cash register meters and the income of the enterprise.

Features of the help report

The cashier-operator's certificate-report has several characteristic features:

- the KM-6 form, approved by the State Statistics Committee of the Russian Federation in 1998, is unified;

- errors when filling out, as well as deviations from the generally accepted format, may result in a fine during the work of inspection bodies;

- KM-6 must be filled out daily (or at the end of each shift), and simultaneous filling out of certificates for 2 or more days/shifts is not allowed;

- The document must be submitted simultaneously with the proceeds - either to the chief cashier of the company or to the bank;

- The certificate must be kept for exactly 5 years, after which it loses its value.

Important! Column 4 is filled in only when using outdated cash register equipment. If modern devices have been installed in the organization over the past 12 years, then this section should be left blank.

Cash book

Filling out the cash book, numbering and filing sheets in it are carried out according to the approved form. This document (Form KO-4) must begin in January of each calendar year. It records all cash transactions. You can buy a cash book in a store; it is a magazine with horizontal sheets with printed columns.

Even before filling out, all sheets of the journal must be numbered, stitched and their quantity certified with a stamp and seal on the last page of the document. The document can be signed by the head of the company (organization) or the chief accountant.

The corresponding entries in the book are made manually in chronological order, according to the days of cash payments.

In the case when the document is maintained in electronic form, the form for each calculation (operation) must be printed and filed in the book. With this option for maintaining a book, the chronological sequence of filing documents must also be observed.

If the cash book that was purchased in the store ended before the end of the year, it is allowed to create a new document. Its design and maintenance are similar to those described above.

It should be taken into account that the KO-4 form provides for the presence of two parts in the cash book. One of them is a loose-leaf sheet, and the other is a cashier’s report form. Therefore, entries in such a book must be made with a ballpoint pen using a carbon copy, because the copied copy will be the cashier’s report.

General filling rules

In order to avoid mistakes when entering information into the KM-6 form, you must follow the general rules:

The first line of the report should contain the name, address (legal or actual - it doesn’t matter, the main thing is that it is the same in all reports) and telephone number of the enterprise. If there is a separate division, then its name must also be indicated.

If the KM-6 form is filled out by an individual entrepreneur, then he must indicate all the necessary information in the same order. This is a common mistake - many individual entrepreneurs believe that they can deviate from the unified form, because they work for themselves. The document must indicate the name, registration number and number of the CCP manufacturer. You must indicate the exact date of completion and certificate number. Revenue must be reported in numerical form and in words. The signature of the author of the certificate report is a required element.

Important! If the proceeds are not handed over to the company’s chief cashier, but to the bank, then this must be noted in the report.

Is it necessary for online checkouts?

Explanations of the tax authority dated September 26, 2016 No. ED-4-20/ [email protected] in connection with the use of online cash registers allows legal entities to refuse to maintain a certificate report; all information about transactions performed on cash registers is stored in the taxpayer’s personal account.

If no cash transactions were carried out throughout the working day (shift), then a certificate report is not issued.

Payment is displayed in the KM-6 form:

- In cash;

- bank cards.

Non-cash transfers to the company's current account are not recorded in the report.

Sample certificate. Filling example

To learn more about the KM-6 form, download a free sample. It is in *.doc format and contains the correct form of help without factual errors or inaccuracies. This sample can be used not only to study the features of the certificate report, but also for the specific work of a cashier.

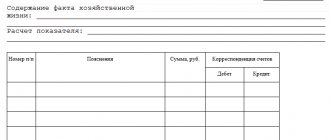

The cashier-operator's certificate-report is divided into 3 parts - line, tabular and final. For convenience, we will divide it into 3 parts and an example of filling it out so that the reader can quickly find exactly what interests him.

So, an example of entering information into the line part of KM-6:

- In the “Organization” field enter the name of the enterprise, its address, and contact telephone number.

- The identification number of the enterprise where the cashier works is entered in the TIN field.

- The “Structural division” field does not need to be touched if this division does not exist in the company.

- In the “Cash register equipment” field, information about cash register models is entered.

- In the “Number” field – the number of the cash register. This information, as well as the information for point 3, can be obtained from the senior cashier or read in the cash register documentation.

- The “Application program” field remains empty if such a program is not used.

- In the “Cashier” field, enter the cashier’s last name and initials. If a certificate is created for 2 or more sectors that have several cashiers, then the field remains empty.

- The number of the current Z-report is entered in the “Change” field. This is not shown in the sample, but it typically starts with the letter "Z". For example, "Z 0040".

Important! Next comes an intermediate field in which you need to enter the serial number of the reference report, the date of preparation, the start time of work on the report and the end time of work. These data cannot be ignored.

The tabular part of the certificate must be filled out as follows:

- Column 4 should also be left blank if modern cash register technology is used (since 2004).

- In column 5 enter the amount at the beginning of the day or shift. This amount can be found in the cashier-operator’s journal, in column 9. It was left there by the cashier who worked the previous shift. This amount is also in the morning X-report, in the GROSS TOTAL line.

- In column 6 enter the amount from the GROSS TOTAL line of the Z-report.

- In column 7 - the amount from the “Shift Total” line of the Z-report. If returns occurred during the day/shift, then you need to enter the shift total minus the returns.

- Column 8 should be left blank if there were no returns. If they were, then you need to enter the amount from the “Returns” line of the Z-report.

- In column 9, the cashier enters his last name.

- The cashier signs in column 10.

The sums of columns 7 and 8 are entered in the “Total” field.

Important! Empty columns can be crossed out. Cashiers often cross them out so that the inspection authorities know for sure that the document is completed completely and the cashier has not forgotten anything.

The final part of the certificate is completed as follows:

- The line “Total...” requires you to enter the proceeds in words.

- The line “Accepted...” should be left blank. It is necessary when a receipt order is issued for a report. In practice this rarely happens.

- The line “Delivered to the bank” contains information about the bank only if the report is handed over to the collector. If the proceeds and certificate are given to the chief cashier, then this line should be left blank.

- There is also no particular point in filling out the “Receipt No.” line, because it refers to the “Accepted...” line.

Next, you need to leave signatures and transcripts of the signatures of the operator, senior cashier and head of the enterprise.

X-report: formation and why it is needed

At the end of the article we will talk about the X-report. It is not so much needed by the tax service as by the owner of the organization or individual entrepreneur.

This document is necessary to track the receipt of revenue and obtain detailed information about sales. The owner of the cash register can personally determine when and in what quantity to check the indicators of this report, since no restrictions are set. In addition to the above functions, staff can ensure that the date printed on the check is correct, as well as check the details of the organization.

It is thanks to this report that individual entrepreneurs and organizations can promptly learn about certain errors, which gives them a chance to avoid punishment from the tax service.

Now let’s take a closer look at why the X-report is useful and what you can learn from it:

- The amount of cash in a certain period of time;

- Date and time of receipt printing;

- The total amount of money at the end of the shift;

- Number of sales made;

- Payment method for each item separately (cash or card);

- Number and total amount of returns;

- Total number of checks per shift.

It should also be remembered that none of the staff has the opportunity to obtain an X-report for the previous shift. Among other things, this type of reporting makes it possible to find out a lot of additional information:

- The performance of each cashier individually (by analyzing the number of customers served and total revenue);

- Number of remaining goods;

- Cash balance in cash register.

Z-report: is it necessary?

With the advent of the latest equipment and online cash registers, the need for a Z-report has disappeared. Therefore, now we can say with confidence that no one uses this type of reporting, since it is not displayed on the current generation cash register. They stopped using it at the beginning of 2022. And especially for those who are interested in what the Z-report was intended for, we have prepared a small list of its purposes:

- Complete reset and update of parameters;

- Display of revenue for a particular shift;

- Data on the return of funds and goods;

In addition, the Federal Tax Service used these reports for reconciliation with accounting data.

Closing a shift and disabling the online cash register

Thanks to the shift closure report, all data is automatically sent to the federal tax service. It is with the help of this function that KKM owners no longer need to print documentation and personally submit it to the Federal Tax Service. Now every entrepreneur can decide for himself whether he should spend time queuing at the tax office to submit a report or carry out the process using the latest generation online cash register.

The shift closing report independently archives all cash transactions and also saves them on the fiscal drive. Like the Z-report, this type includes information about revenue and refunds, and allows you to find out the address of the organization. Among other things, now owners of a cash register have the opportunity to find out the number of transactions performed during the entire shift.

If you do not want to receive fines for incorrect use of the cash register, you should close your shift on time. For violating the rule, the organization will be forced to pay a fine of 5-10 thousand rubles, individual entrepreneurs - up to 3 thousand rubles.

The most important advantage of a cash register: there is no need to store documentation in printed form, because all information is collected on the fiscal drive. KKM owners do not have to worry about printing reports.

Common mistakes when filling out

Newbie cashiers sometimes make the ridiculous mistake of entering their own TIN instead of the company’s TIN. Of course this is wrong. The identification number must always belong to the company.

Columns 5 and 6 of the main table should not be confused. Column 5 contains the GROSS TOTAL of the X-report, and column 6 - the GROSS TOTAL of the Z-report. It can't be the other way around. This mistake is often made due to inattention.

Other errors are due to inattention when entering numerical values. For example, you can confuse the date or make a mistake when entering the amount. Such errors are unacceptable, so the cashier should check everything properly.

Important! If there are typos in the KM-6 form itself, then no one will punish the cashier for them. A fine can only be issued for errors in the information that the cashier-operator personally entered.