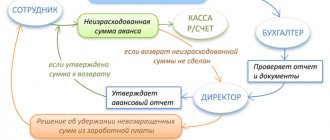

Why do you need an advance report?

An advance report is a prerequisite for the procedure for issuing money. The employee reports on expenses made within the prescribed period using a special reporting form. Its main goal is complete control over financial expenses in a budget organization. With the help of this document, the movement of spent funds issued to fulfill the needs of the institution is checked and the expenses incurred are written off.

Who is the accountable person

Accountable funds are issued by the manager to the employee of the enterprise for general production or general business expenses. The employee reports for the amounts disbursed on time through an advance report. An employee, having received funds for the needs of the enterprise, is an accountable person.

IMPORTANT!

Advances are issued not only to employees of the enterprise, but also to freelance employees who have entered into civil law contracts with the employer (clause 5 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014).

Accountable funds are transferred to responsible employees not only in cash, but also to a bank card by wire transfer (letter of the Ministry of Finance of the Russian Federation No. 03-11-11/42288 dated 08/25/2014).

The employer determines the circle of accountable employees in a special order. Employees agree with the appointment. The management order approves the list of responsible employees who receive accountable funds.

All accountable persons are required to report on expenses incurred, attaching supporting documentation, and provide advance reports to the accounting department on time.

General rules

There is no single, legally regulated formal type. The accountant has the right to draw up an advance report using the unified form No. AO-1 or develop a personal form, approving it by order.

Documentation is maintained both in paper and electronic form. If the institution provides for completion in electronic form, then the JSC is signed electronically by each of the participants in the accountable process.

There are a number of generally accepted rules for filling out (Decree of the State Statistics Committee No. 55 of 01.08.2001):

- The report is generated within a three-day period from the expiration of the period for which accountable funds were issued (it must be determined by order or regulation), the employee’s return from a business trip or the employee’s departure from sick leave, provided that the specified day of return of the accountable account fell during the period of incapacity for work.

- If the deadline for returning the advance money is violated, the employer applies sanctions to the employee, including financial ones.

- The accountant provides full assistance to the accountable person in filling out.

- The document, completed and executed in accordance with all rules, is signed by the head of the organization.

- The reporting is accompanied by primary documentation confirming the expenses incurred (receipts, tickets, statements, invoices).

Advance report in 1C 8.3 Accounting.

Primary documents accepted for the report. With updates as of July 1, 2022.

What documents can be used for the report?

1. Cash receipts. From July 1, 2022, all sellers, including individual entrepreneurs, are required to issue checks or send them via email. Therefore, an online receipt or a receipt printed at the register must be requested for any purchase. An electronic check is just as suitable and legally binding as a printed one. In this case, it is important to indicate “electronic check” in the expense report. If an advance was issued for fuel, then a waybill must be attached to the receipt.

2. Payment receipts, if for some reason the seller does not issue checks, indicating the details and signature of the seller.

3. Travel documents.

3.1 It is important to include a boarding pass with your plane ticket, otherwise the Organization may lose expenses, and the employee’s personal income tax will be withheld.

3.2 If the employee traveled by train, the ticket issued at the ticket office must be attached to the report. If the ticket is electronic, then it must have a mark indicating that registration has been completed. Without a mark, the electronic receipt is not valid.

3.3 If an employee used taxi services and ordered through the application, then you must request an electronic receipt there and ask the driver for a receipt with his signature. Sometimes a Taxi Service Organization may offer to deliver a signed receipt to your Organization's address. To confirm the purpose of the trip, you need to ask the employee from the application to print out the same route that the ordered car followed.

4. Accommodation bills (on a business trip).

5. Invoices, delivery notes.

Without the presentation of such documents, the report is not valid.

Step-by-step creation of a report in the 1C 8.3 Accounting program.

Upon expiration of the stipulated period, the employee prepares the documents for the report and draws up the report independently in Form AO-1 within three days. The accountant checks the documents and, if everything is in order, starts processing the documents in the 1C program.

In some Organizations, it is customary for an employee to bring only primary documents to the accounting department and not worry about drawing up the report itself. And the accountant generates the report itself in the 1C program, based on primary documents from the employee, prints it out from the 1C program and the finished document is signed by the accountable person, the accountant and, then, the manager.

Step-by-step creation of a report in the 1C Accounting 8.3 program:

1. Sequentially open the tabs: “Bank and cash desk” - “Advance reports” - “Create”

2. We indicate (fill out the document):

2.1 Number and date: filled in automatically. You can also change it.

2.2 Organization: the field is filled in automatically or selected if the program contains data for several enterprises.

2.3 Accountable person: select and list.

2.4 Warehouse: indicate if goods and materials were purchased. You can specify "main"

3. “Advances” tab. Click “add” and select “cash withdrawal” or “debit from current account” in the window that appears (depending on how the employee received the advance money), then select the required document from the list for which the report is provided.

4. “Products” tab. We fill in if the employee acquired any material assets or provided services for the benefit of the Organization, to do this, click “add” and proceed to filling out the table

4.1 Document: write the name of the document, for example: “Sales receipt No. 2551265 dated 07/11/2019”

4.2 Nomenclature: for example, “office supplies”, select a list or create the desired group of goods or services.

4.3 Quantity: 1.

4.4 “Amount”: indicate the amount in this check.

4.5 “VAT”: select “with VAT” or “without VAT” (look at the receipt)

4.6 If there is an invoice for purchased goods and materials, then you need to scroll through the table further and fill out the “supplier” tab, select and list or create based on the full details specified in the invoice. Next, put a tick in the column named “Invoice” (invoice) and in the next column indicate the date and invoice number.

4.7 “Accounting account”: 10.09 (when purchasing materials) or 41 (goods), is generated automatically based on the selected or created group of goods or services in the nomenclature (filled in at the beginning of the table).

4.8 “VAT invoice”: 19.03, is also generated automatically (it is better to immediately check the correctness of the postings)

5. We post the document and see what transactions have been generated. When registering, for example, the purchase of inventory items, the following posting is generated: Debit 10.09, Credit 71.01.

6. We print the document and collect signatures.

In order to check the correctness of the documents created in 1C, we create a revolving balance sheet for account 71.01 for the required period and look at the reflected amounts opposite the full names of the employees. Through this statement, it is convenient to control accountable persons and promptly remind them of debt or the need to report.

We store the signed advance report with neatly pinned checks, receipts, travel documents, invoices, invoices in the folder with reports, as a rule, for at least four years.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Procedure for compilation

Information required:

- about the establishment, number and date of the document being drawn up;

- about the employee who received an advance;

- the amount of funds issued and their intended purpose;

- actual expenses (all supporting primary documents are attached).

The front part contains data on the movement and write-off of advances and on analytical accounts reflecting the accounting of funds in the organization. All completed information is certified by the signatures of the responsible accountant who issued the money and accepted the return of the accountable amounts, the chief accountant and the employee who received the advance amount. The accountant fills out a tear-off receipt confirming the verification of the primary documents. This is confirmed by an example of filling out an advance report. After registration and tearing off, the receipt remains with the accountable person. On the reverse side, the employee enters a detailed breakdown of expenses, and the responsible accounting employee indicates the amount to be recorded and the accounting account through which the expenses will be posted.

Advance reporting is generated in a single original copy. This is the nomenclature internal document flow of the institution; it is not necessary to affix a seal.

IMPORTANT!

Corrections excluded! If you make any mistakes, or even more so, you will have to fill out a new form.

Issuance of accountable amounts in 1C 8.3 Accounting step by step.

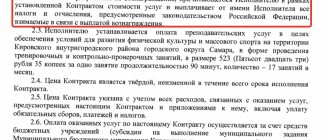

The basis for issuing an advance may be an order or instruction from the head of the Organization, or an application from an employee. Since 2018, writing an application from an employee is not mandatory. The application is written in any form, indicating the amount and what the funds are needed for. In this case, the next step will be the signing of this document by the Director of the Organization.

If you are creating an expense report for the first time, we recommend leaving a free request for 1C support through the Bit.Personal Account service. A 1C consultant will call you back and help.

Issuing an advance amount through the cash desk in the 1C 8.3 Accounting program.

We create an expense cash order in the 1C 8.3 Accounting program: 1. Sequentially open the tabs: “Bank and cash desk” - “Cash desk” – “Cash documents” – “Cash withdrawal (creation)”

2. We indicate (fill out the document):

2.1 Type of transaction: “issuance to an accountable person.”

2.2 The number and date are assigned automatically by the program.

2.3 Recipient: select from the list of employees.

2.4 Amount: indicate the required amount, starting from the basis (order or application).

2.5 Cash flow item: “issuance of accountable amounts.”

2.6 Comment: it is convenient to indicate what served as the basis for issuing an advance, for example, “order No. 124A dated July 11, 2019” or “application from an employee dated July 11, 2019.”

2.7 Account: “50.01” (automatic)

2.8 Organization: select and list if the program maintains reports on several enterprises. If there is only one Organization, it will be automatically selected.

2.9 Open the “Details of the printed form” - fill out the “ground”: write the number and date of the order from the director or the date of the application from the employee.

3. Next, click “conduct”.

4. Check the wiring generated by the program. To do this, press the “Dt/Kt” button. Postings: debit 71.01, credit 50.01.

Check: if we open the balance sheet for 71 accounts, we will see that the employee has an advance amount.

5. Go to the newly created cash receipt order and send it for printing (icon with a picture of a printer).

6. Sign the accountable person, accountant and manager.

7. The next step is to issue money to the employee.

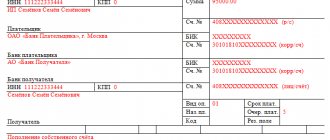

Transfer of funds in the 1C 8.3 Accounting program from the Organization’s account to the employee’s personal account.

We create a document in 1C Accounting 8.3, issuing funds by transferring non-cash funds to the employee’s personal account.

1. Sequentially open the tabs: “Bank and cash desk” - “Bank” - “Bank statements” - “Debit from current account (creation)”. We create a new document (payment order).

2. We indicate:

2.1 Type of transaction: “transfer to an accountable person”

2.2 The date and document number are assigned automatically.

2.3 Recipient: select from the list of employees.

2.4 Amount: we deposit the required amount specified in the basis for issuing the advance.

2.5 Purpose of payment: “issuance of funds on account for the purchase of office supplies based on order No. 1020A dated July 11, 2019.”

3. Write down the document and close.

4. Next, you will need to upload a file to send to the bank, or generate a payment order directly in the online bank (in organizations, communication with the bank is configured differently).

5. After a bank statement is received from the bank with the actual debit from the Organization’s current account, the accountant posts it in the program and again goes into the document created when transferring funds, ticks “confirmed by bank statement” and attaches the payment order. Post the document.

6. The program generates transactions: debit 71.01, credit 51.

Step-by-step instruction

In an organization, the reporting employee and accountant are responsible for filling out the advance report.

The employee who received the advance funds fills out the front side. Information required:

- short, full name of the organization, its code in accordance with the OKPO classification;

- details of the document - its number and date;

- next, it is necessary to leave a place for the head of the company to endorse the statements - after checking the document by an accountant, the head puts his signature, date and indicates the accountable amount in words;

- last name, first name and patronymic of the accountable person, his position, personnel number and structural unit;

- purpose of the amount issued under the report.

After entering the primary information, the reporting employee must fill out the tabular part of the report.

If you are guided by form AO-1, then the employee must enter information in the left and right tables.

The left table shows data on advances:

- total amount;

- advance monetary unit - ruble or foreign currency;

- balance or overrun (if any).

The right table provides accounting information: accounts and subaccounts for which the advance is made, indicating the exact amounts of costs. This part is completed by the accountant.

Next, you need to register supporting documentation: the number of checks and receipts confirming expenses.

The front part of the document contains space for the resolution of the chief accountant. After checking the table information and documents submitted on time, the chief accountant writes down the reporting amount in figures and words.

If there is an overexpenditure on the advance payment or, conversely, a balance of funds, reflect this in the reporting. The incoming (outgoing) cash order on the basis of which transactions with balances were carried out is also indicated.

After the tabular part, the accountant, cashier and chief accountant sign.

Next, fill out the back side.

First of all, the table contains the details and names of all applications - supporting documentation (checks, invoices, tickets, receipts). Write down not only their number and date, but also the exact accounting amount and accounts, sub-accounts on which transactions will be carried out. The tabular part of the reverse side is certified by the signature of the person who received the advance.

At the end, an accountant's receipt is issued, which is cut off and given to the employee. The cut-off part confirms the fact that the employee accounted for the advance payment and provided all the necessary documents. The accountant fills in the following information under his signature: Full name. the responsible employee, details of JSC-1, the amount of the advance in words, the number of supporting documents and the date on which the employee reported. The accountant signs the document only if the reporting is submitted on time.

Checking the attached documents

As a rule, employees collect everything that can be collected, including personal checks and other garbage, and simply dump it on the accountant’s desk - sort it out.

The situation is complicated by the fact that the list of supporting documents is not legally defined, and expenses are confirmed by a wide variety of documents (tickets, acts, checks, waybills, contracts, etc.). Therefore, you have to pay special attention to the execution of the attached documentation, first of all, cash receipts . According to Article 4.7 of Law No. 54-FZ, the check must contain the following details :

- name of company;

- TIN;

- date, time and place (address) of settlement;

- position, full name cashier;

- Title of the document;

- calculation sign;

- CCP registration number;

- FN serial number;

- website address for checking the FCC (fiscal cash receipt);

- shift number, serial number of the FCC for the shift;

- name of goods (works, services), quantity, price per unit, cost including discounts;

- calculation form;

- VAT (rate, amount);

- an indication of the taxation system;

- product code;

- QR.

Personal services “Delis Archive” for the chief accountant allow you to build a high-quality document management system: collect documents from suppliers and contractors, check their completion, and also provide instant access to any necessary document within a few minutes.

To learn more

Paper cash receipts may not be attached to the advance report in some cases, for example, if the place of business trip was one of those where, by virtue of the law, it is possible to make payments without a cash register, see paragraphs 3, 8 of Art. 2 of Law No. 54-FZ. Instead, you can attach a sales receipt, BSO. The check can also be submitted in electronic form (link to electronic document).

The details of the electronic fiscal check are named in the order of the Federal Tax Service of Russia dated September 14, 2022 No. ED-7-20/662. It can be printed and attached to the expense report.

If there are no required details, and also if the documents:

- faded;

- damaged;

- contain unreadable details;

- contain transactions that do not correspond to the nature of the reporting transaction,

they cannot be taken into account and, moreover, expenses cannot be reimbursed (accounted for) on their basis.

The person who provided such a document will have to either bring the correct document or return the money to the employer. Let us remind you that in the absence of supporting documentation, it is possible to take into account only daily allowances.

How can an accountant check a report?

The advance report is submitted to the accounting department on time. The head of the enterprise has the right to approve a different deadline for submitting the report, enshrining this standard in his local legal acts and accounting policies.

After the employee has submitted reports on the advance payment issued to the accounting department, it must be checked. The accountant checks not only the correctness of filling out the documentation, but also the correctness of the amounts entered and their compliance with the provided checks and other supporting registers.

After the check, the accountant fills out the front side of the report and gives the responsible employee a tear-off receipt confirming the submission of advance reports.