The main purpose of direct journal keeping by the cashier-operator is to ensure that the owner himself has the opportunity to easily calculate the turnover of cash proceeds for the requested period. The log is also necessary so that the inspector can compare the readings of the cash register and cash registers with the readings in the log.

Sometimes the inspector himself gives suggestions for filling out the log. We will look at the basic aspects of filling out the cashier-operator’s journal.

Rules for keeping a journal for a cashier-operator

Detailed instructions for filling out the cashier-operator log.

First sheet:

Date (change) | Department (section) number | Last name, first name, patronymic of the cashier | Serial number of the control counter (fiscal memory report) at the end of the working day (shift) | Indications | Amount of revenue per working day (shift), rub., kopecks. | ||||

serial number of the control counter (fiscal memory report) recording the number of transfers of the summing money counter readings | summing money counters | ||||||||

at the beginning of the working day (shift) | at the end of the working day (shift) | ||||||||

amount, rub. cop. | signature | amount, rub. cop. | |||||||

cashier | admin. | ||||||||

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

09.08 | 1 | Beria L.P. | 0904 | 0904 | /signature/ | /signature/ | 11736355.62 | ||

10.08 | 1 | Beria L.P. | 0905 | 0905 | 11736355.62 | /signature/ | /signature/ | 11736356.73 | 1.11 |

11736356.73 | |||||||||

Second sheet:

Delivered | Amount of money returned to customers (clients) for unused cash receipts, rub. cop. | Signature at the end of the working day (shift) | |||||

cash, rub. cop. | paid according to documents | total, rub., kop. | cashier.Handed over money and paid bills | administrator (senior cashier)The meter readings were taken, the money was accepted | manager (senior cashier) | ||

quantity | sum | ||||||

11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 |

— | /signature/ | /signature/ | /signature/ | ||||

1,11 | 1,11 | — | /signature/ | /signature/ | /signature/ | ||

| / | |||||||

Important points

The cashier-operator's journal is an accounting document; its content and storage must be determined by legislative and local acts.

The book must be kept close to the cash register or in the accounting department, but in any case, inaccessible to prying eyes.

After the document expires, it is transferred to the archive, where its storage period is 3 years. After this period, the magazine must be disposed of in strict compliance with the regulations for such a procedure.

Before the introduction of online cash registers, the magazine required mandatory firmware, numbering and registration with the supervisory authority.

Now there is no need to register with the tax office; numbering and lacing is carried out at the personal request of the legal entity.

This right arises upon the final transition to online cash registers.

One of the advantages of an online cash register is the ability to issue receipts when making purchases through online stores in just a few minutes, which was not always possible with conventional cash registers.

Now, after making a purchase, the buyer is sent a check to the designated email address indicating the seller’s details and information about the product.

You can ask for a similar document in a regular store; the seller’s responsibility is to issue it.

A special software package for online cash registers allows you to analyze consumer behavior, take into account the sale of products, and also work with securities.

With its help, you can identify products that are in greatest demand and products that are stale on the shelves, the sales of which can increase if their price decreases.

Filling procedure

Column 1: Date (change)

The date of the Z-report is set and entered into the journal. If several Z-reports were taken for this date, then they all need to be entered in a separate line, but they will all be the same date. The word “shift” in this column means that if on one date you worked two shifts and two different cashiers, you can (not necessarily) put the shift number in brackets, for example: 02/01/2013 (1).

Column 2: Department (section) number.

This column contains the numbers of the departments to which the amounts for this shift were made. You don’t have to fill out this column if you are focusing everything on one department, for example the first. Even if you break down the amounts into several departments, you may not fill out this column, especially since division by department is not provided for in the Z - reports of many cash registers.

Column 3: Last name, first name, patronymic of the cashier.

Full name is written here. cashier. If the cashier, administrator, accountant, general director are all one person, then you need to enter his (her) last name in this column.

Column 4: Serial number of the control counter (fiscal memory report) at the end of the working day (shift).

The serial number number Z of the report is written here; it can be taken from the report itself (see example).

Column 5: Serial number of the control counter (fiscal memory report), recording the number of transfers of the summing money counter readings.

The data from column 4 is copied here. This is an outdated form of the document, which assumes in the old fashioned way that the Z-report counter will be reset to zero. In modern cash registers this function has been removed.

Column 6: Readings of summing cash counters at the beginning of the working day (shift)

This column is required to be filled out. It contains the cumulative total at the beginning of the day - the sum of all the money entered on the cash register for the entire period of its existence. This amount increases with each Z-report taken. After some time after working at the cash register, this amount can reach millions, and God willing, billions of rubles. If the cash register is new, then your first savings will be equal to 1 ruble. 11 kopecks — this is the amount the tax inspector requires to enter when registering a cash register.

If the cash register is not new, then the data for this column is taken from:

- columns 9 of the previous day (the most common method)

- from the morning X-report. True, not every cash register prints savings in X reports

- the amount in this column can be recorded at the end of the day by subtracting the amount of revenue for the day (column 10) from evening savings (column 9).

Columns 7 and 8: signature of the cashier and administrator.

The cashier and administrator must sign in these boxes respectively. If this is the same person, then the signatures will be the same.

Column 9: Readings of summing cash counters at the end of the working day (shift)

This is where savings are entered ("non-zeroable total", also called "gross total") at the end of the work shift. These are the same savings that were in Column 6, but revenue for the past day has been added to them. These savings are written off from the Z - report that the cashier takes at the end of the shift (example here). For convenience, you can immediately transfer this amount to the beginning of the next shift in column 6.

Column 10: Amount of revenue per working day (shift).

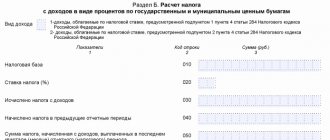

This includes the amount of revenue per day. This includes all cash proceeds (column 11), non-cash (column 12), returns (column 15). This data can also be taken from Z - reports (see example).

Box 11: Delivered in cash.

Cash revenue is included here; it does not include returns and non-cash payments.

Column 12: Paid according to documents, quantity

This column contains the number of non-cash payments (payments by bank cards, traveler's checks, bank checks, etc.). That is, if you were paid by bank transfer 5 times during the day, you enter the number “5” in the column. If you cannot calculate this amount, since many cash registers do not have cashless payment counters, then you do not need to enter anything.

Column 13: Paid according to documents, amount.

The total amount of non-cash payments is entered here; it is also highlighted in the Z-report (not on all cash registers).

Some cash registers do not have a cashless payment function, so often a certain department (section) is allocated for non-cash transactions and the non-cash payment is processed there. If you are sending all non-cash funds to one of the departments, then enter in column 13 the amount of sales for this particular department .

See below for an example of filling.

Column 14: Total handed over.

The amount of non-cash and cash payments minus refunds is written here.

Column 15: Refund amount.

The total amount of returns for the shift is written here. This line is taken from the Z - report. If you did not make a refund from the cash register (since this is not necessary), then do not forget to fill out the KM-3 act and enter the amount from this form in column 15. Read more about returns here.

Column 16: cashier's signature.

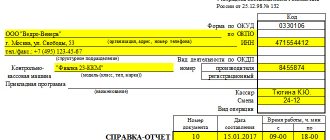

After filling out the cashier-operator journal, the cashier draws up a certificate-report of the cashier-operator (form KM-6), passes it to the administrator along with the cash, and signs in this column.

Very often, the cashier, administrator and manager are one person, so one signature is placed in columns 16, 17,18.

Box 17: administrator’s signature.

Having accepted cash from the cashier, the administrator checks the accuracy of the calculations and signs in this column.

Box 18: signature of the manager.

After the shift is completed, the manager signs here.

After filling out the cashier-operator's journal, do not forget to enter the data (record cash) in the cash book.

Examples of some Z-reports and information on them for filling out the KM-4 form.

| Mercury 180K | Alpha 400K | Mercury 130K | Kasby 02K | AMC 100K |

Examples of filling out the Cashier-Operator Log on different cash registers:

Elwes-MK:

Is it necessary to fill out the cashier-operator’s logbook if nothing was punched at the checkout?

If the cash register did not display any amounts during the current day, then it is not necessary to make a report, especially since many cash registers do not allow you to make a Z-report. In a word, if you do not work on a cash register, then you do not need to fill out the cashier-operator log.

But, if you still want to write something down in the cashier-operator’s journal, then remove the zero check and make an evening Z-report, and then enter it in the cashier-operator’s journal.

When do you need to fill out the cashier-operator log?

The cashier-operator's journal is filled out immediately after the Z-report is taken. This can be once a day, for example in the evening - at the end of the working day. Or maybe your store is open around the clock and the shift ends in the morning, then the report is taken in the morning.

Is it possible to make several reports per day?

If you have two or three shifts per day, then you respectively take out two or three reports per day, but the most important thing is that each of the Z reports be entered as a separate line in the cashier-operator’s journal. This results in several records with the same date, but with different shift numbers.

If the cashier forgot to withdraw Z - report.

If the report was not taken in the evening, it doesn’t matter; it can be taken in the morning the next day or even the next day. In this case, in the cashier's journal, the operator needs to enter the date taken from the Z-report and spend the money on the date when it was withdrawn. Or, if the money has already been posted in the cash book, you can put the required date in the cashier’s journal, and ask the cashier to write an explanatory note in free form addressed to the director - this will force the cashier to be more careful next time.

If the cashier accidentally removed several extra reports during the day.

If several evening Z-reports for the day were accidentally taken at the cash register, then each one needs to be entered into the cashier-operator’s book separately; several reports will be issued under different numbers, but for the same date. Typically these are zero amount reports. You can also ask the cashier to write an explanation for educational purposes.

Is it possible to recover a lost Z-report?

Z - the report can be restored in two ways:

- Create a fiscal memory report. To do this, you need the tax inspector’s password; if you don’t know it, it’s better to call a cash register mechanic who will help you get the report. Do not try to remove the fiscal report yourself, as your cash register may be blocked if you enter the tax inspector's password incorrectly. The fiscal report will give you information only on the total amount for the day, that is, it will not contain information on each purchase for the day.

- Make a report on ECLZ . The EKLZ stores all information on all cash receipts punched on the cash register. That is, from the ECLZ block you can extract detailed information for any working day. Remember that the EKLZ block changes once a year, so information can only be obtained from the current block.

Corrections in the cashier's journal.

Each error in the cashier-operator's journal must be certified by the signature of the person responsible for maintaining the journal. That is, next to each correction you need to write: “believe the corrected one” and sign.

Are the cashier's journal and the cash book the same thing?

No. A cash book is another document that individual entrepreneurs and organizations are also required to have in order to maintain accounting records.

Fine for the absence of a cashier's journal.

Tax inspectors try from time to time to fine entrepreneurs for the absence or failure to fill out a cashier-operator's register, charging them under Article 15.1 of the Code of Administrative Offenses of the Russian Federation, and the fine under this article is rather large: from 40,000 to 50,000 rubles. So there were several court proceedings (one of them: No. A56-9691/2005 dated July 28, 2005), which entrepreneurs won each time. But how many entrepreneurs did not file a lawsuit against the illegal actions of tax officials remains a mystery. Therefore, decide for yourself whether you need to keep a journal or not.

And it looks completely ugly when tax inspectors try to bring the absence of a cashier-operator’s journal under Art. 14.5 Code of Administrative Offences. In my practice, there was one such case in the Leningrad region. The entrepreneur chose not to contact the tax authorities and paid a fine of 4,000 rubles. For organizations it would be 40,000 rubles.

There is also Article 120 of the Tax Code, which talks about gross violation of the rules for accounting for income and expenses. But failure to keep a journal for a cashier-operator is not a gross tax violation. Although some tax authorities also refer to this article when trying to put pressure on an entrepreneur so that he pays a fine.

Correctly filling out the cashier's journal will not save you from tax fines if you WANT to pay them))).

What should you do after filling out the cashier/operator log?

Prepare a certificate-report from the cashier and transfer the data to the cash book.

How to register a cashier's journal.

The cashier's journal is tied to a specific cash register. Therefore, the journal is registered along with the cash register registration. When the magazine comes to an end, you need to buy a new one, stitch it and number it, and then go to the tax office and have it certified. The certification of KM 4 journals is carried out by the operational control departments in the relevant Interdistrict Tax Inspectorate where the cash register was registered. The old completed log must be kept in the organization’s archives for 5 years. Although its storage became meaningless with the introduction of EKLZ - now all information is stored on electronic media.

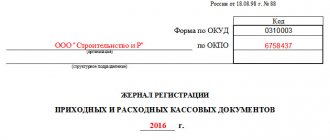

Examples of a certified cashier's journal.

Where to register the cashier-operator's journal.

At the tax office - in the operational control department of the MIFTS (cash register registration department), in which the cash register was registered. For individual entrepreneurs - at the place of registration, and for organizations (LLC, OJSC, CJSC, etc.) at the place of registration of the enterprise or separate division.

Documents required for registering a new cashier-operator journal.

Different tax offices may have different rules regarding the documents presented. The law also does not specify the necessary documents for registering a replacement journal. In each specific case, it is better to call the tax office and ask what they want. Here are several types of documents that tax authorities in St. Petersburg require:

- passport (form) to the cashier.

- old journal of the cashier-operator.

- new cashier-operator's journal, stitched and numbered

- registration card for the cash register

- passport of the person presenting the documents and a power of attorney, if this is not the head of the enterprise.

First entry in the journal.

During the initial registration of the cashier-operator’s journal along with the cash register, the tax inspector makes the first entry in the journal, on the removed Z - a report and punched 1 ruble, 11 kopecks, although some tax authorities do not do this, but simply certify the journal with a signature and stamp.

An example of the first entry that the tax inspector leaves when registering the KM-4 journal.

The person responsible for maintaining the cashier-operator's journal.

Appointed by order of the director if the director does not want to be responsible for its maintenance. Usually this is a cashier, administrator or chief accountant. It would be a good idea for a manager to create a job description for a cashier-operator. In practice, no one fills out this column and tax inspectors do not find fault with it. If the column is not filled out, responsibility for maintaining it automatically falls on the head of the company or individual entrepreneur.

Types of cashier-operator journals.

I've met two types. Samples of cashier-operator logs:

- Vertical magazine. Pros: more lines on the page - enough for a larger number of records - less often you will have to change it at the tax office. Disadvantages: the columns are too narrow - large amounts do not fit.

- Horizontal magazine. Pros: easy to fill - wide lines that can accommodate large amounts. Cons: enough for fewer records - will have to be changed frequently.

How long does the cashier's journal last?

horizontal journal contains about 50 sheets and 20 lines on each sheet. 20 multiplied by 50 equals 1000, which means the magazine is enough for about a thousand days or shifts.

The vertical magazine has from 29 to 40 lines and 50 pages, that is, it is enough for about 2000 days (shifts).

You will notice that columns 6 and 9 are too narrow (especially in a vertical journal) to write large amounts of savings in them, and columns such as 5 and 15 are too wide for their meanings. Could Russian officials have come up with something smarter?

How to register a return in the cashier's journal.

Refunds at the cash desk are issued in column 15. If there were several returns for the current day, then they are all summed up and filled in with one amount. When returning, it is not necessary to punch out refund receipts at the checkout (although you can do this for beauty), but you must fill out the KM-3 form.

A detailed description of how to process a return can be found in this article.

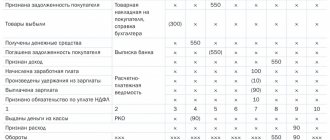

An example of filling out a return in KM-4 (returns for a total amount of 1000, it does not matter how many returns there were): Please note that columns 11 (deposited in cash) and 14 (deposited in total) are less than the amount of returns.

Registration of sales by bank card / non-cash / credit

If you make sales using bank cards through bank terminals, or accept money through a checkbook, or by any other non-cash payment, then this money also needs to be entered at the cash register. In the evening Z-report you will have a separate line showing the number of sales by bank transfer and the total amount for the day by bank transfer. These two parameters must be written down in columns 12 and 13 of the cashier’s journal.

Columns 12 and 13 are responsible for breaking through funds not for cash payments - that is, by any other means:

- with a bank card - the entry of funds received through the bank terminal must occur twice: 1 - at the bank terminal itself 2 - at the cash register

- travelers checks

- sales on credit, etc.

There is no need to enter into the journal funds that were received into a non-cash bank account.

In column 12 - write the number of checks by bank transfer. Column 13 shows the total amount of checks by bank transfer. In column 11 - deposited in cash, the amount must be less than in column 14 by the amount in column 13, that is:

Is registration with the tax service required?

The KM-4 journal, like the cash register device itself, must be registered with the tax service. It is noteworthy that even the initial entry is made in this documentary register simultaneously with the registration of the cash register with the state.

The tax inspector independently enters the first check through a registered cash register device for an amount equal to 1 (one) ruble 11 kopecks. The accountant and tax office subsequently do not take this value into account.

In order for the tax registration of a cash register device to be successful, the business entity must provide authorized employees of the Federal Tax Service with the cash register device itself, the KM-4 journal, as well as the following important documents:

- a statement of relevant content (application for registration of a cash register);

- registration documentation of a business entity (registration certificate of an organization/individual entrepreneur);

- passport of the registered cash register device;

- a valid lease agreement for the retail space used (if the business entity does not have its own retail space);

- service agreement for a cash register concluded with a specialized service organization;

- other papers, the full list of which is specified directly in the territorial division of the tax service.

Procedure and rules of conduct

The cashier-operator log form, compiled according to the generally accepted KM-4 standard, can be freely purchased at any office supply store.

The journal is kept only on paper and must be laced. All sheets of this register are marked with serial numbers.

Form KM-4 is signed by the head of a business entity (optionally, an individual entrepreneur), the chief accountant, as well as an authorized tax officer.

If a business entity has a seal, its imprint is also affixed to the KM-4 form as a certification procedure.

It is noteworthy that the electronic format for maintaining and filling out this journal is not provided for by current legislation.

However, currently, as is known, there is a massive transition of business entities that carry out cash transactions and use cash registers to online cash registers.

If an online cash register is used to record cash received from a buyer, all information that was previously entered into the cashier-operator’s journal is now automatically recorded in the taxpayer’s personal account on the tax service website.

Form KM-4 should be maintained separately for each cash register device.

The journal is registered with the local tax department at the same time as the cash register device for which it is created.

The first such log is registered for a specific cash register device by an authorized employee of the Federal Tax Service through two procedures:

- a Z-report is generated for the registered cash register;

- the first entry is made in KM-4.

What to do if it runs out?

The KM-4 register must be filled out while there are free lines in it. When the journal is completely completed, you should create a new form, for registration of which you will need to contact the tax service again.

To register a new KM-4 form, you will need to provide the Federal Tax Service employee with the previous form of this journal, as well as a number of other documents, the current list of which is always checked with the specialists of the local tax office.

Shelf life

A fully completed KM-4 journal should be stored for 5 (five) years in the archives of a business entity using a cash register, since this register, as mentioned earlier, is actually tied to a specific cash register device.

However, keeping a completed journal lost its practical meaning after the introduction of the EKLZ device, which provides electronic registration of all transactions performed.

From 01/01/2017, so-called fiscal drives began to be installed in all cash register devices, replacing EKLZ devices.

How do I make corrections?

Any errors, inaccuracies, or blots are not allowed when filling out this form. If such inconsistencies are identified, they should be corrected as appropriate.

Each error detected and corrected in the KM-4 register is certified by the signature of the authorized entity responsible for entering information into this journal.

Next to the corrected data there is a standard statement stating that the corrections made can be trusted. The chief accountant and the head of the organization also certify this correction with their personal signatures.