Inventory accounting tasks

The main tasks of accounting in this area:

- control over the safety of material assets in places of their storage and at all stages of processing;

- correct and timely documentation of all operations on the movement of material assets; identification and reflection of costs associated with their procurement; calculation of the actual cost of consumed materials and their balances by storage location and balance sheet items;

- systematic monitoring of compliance with established stock standards, identification of excess and unused materials, their sale;

- timely settlements with suppliers of materials, control over materials in transit, uninvoiced deliveries.

Accounting for inventories in accounting

All primary records of material assets must be transferred to the accounting department at the time established by the document flow schedule or other document of the internal control system. It is she who receives and checks the primary accounting documents for the correctness of their execution and the legality of the actions taken.

Accounting takes place in the context of specific material storage areas, and among them - for each name (item number), group of materials, subaccount and synthetic accounting account.

The accounting department should duplicate accounting in warehouses with the only difference being that it is supposed to keep numerical and monetary accounting, while in warehouses and divisions - only numerical ones.

Classification of inventories in accordance with PBU

Accounting for inventories must be carried out in accordance with PBU 5/01 “Accounting for inventories” (approved by order of the Ministry of Finance of Russia dated 06/09/01 N 44n).

According to the specified PBU, the composition of inventories includes: raw materials, materials, etc., used in the production of products intended for sale, assets used for management needs, finished products intended for sale, as well as goods purchased or received from other legal entities or individuals or intended for sale.

The main part of the materials is used as objects of labor and in the production process. They are entirely consumed in each production cycle and fully transfer their value to the cost of the products produced. Depending on the role played by various inventories in the production process, they are divided into the following groups:

- raw materials and basic materials;

- auxiliary materials;

- purchased semi-finished products;

- waste (returnable), fuel;

- containers and packaging materials, spare parts;

- inventory and household supplies.

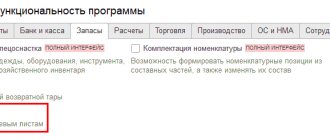

In addition to the item number, the accounting unit of inventories can be a batch, a homogeneous group, etc.

In this case, the selected unit must ensure the formation of complete and reliable information about inventories, as well as proper control over their availability and movement.

What applies to MPZ

Inventory in the accounting of Russian organizations are those assets that, according to clause 2 of the PBU:

- They are used in the manufacture of goods and materials/performing services as material resources, semi-finished products, and raw materials.

- Intended for resale.

- They are written off as administrative expenses of the company (household equipment, workwear, stationery, etc.).

Depending on the purpose, main and auxiliary supplies, semi-finished products, containers, spare parts, and returnable materials are distinguished. Inventory accounting reflects data on goods and GP (finished products), but excludes information on work in progress (clause 4 of PBU). The main typical accounting entries for inventories are given below.

Inventory valuation

Capitalization of inventories

In accordance with PBU 5/01, inventories are accepted for accounting at actual cost.

The actual cost of inventories purchased for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation). The actual costs of purchasing inventories may be:

- amounts paid in accordance with the agreement to the supplier (seller);

- amounts paid to organizations for information and consulting services related to the acquisition of inventories;

- customs duties and other payments;

- non-refundable taxes paid in connection with the acquisition of a unit of inventory;

- remunerations paid to the intermediary organization through which inventories were acquired;

- costs of procurement and delivery of inventories to the place of their use, including insurance costs;

- other costs directly related to the acquisition of inventories.

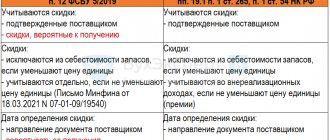

Valuation of inventory upon disposal

In accordance with PBU 5/01, when releasing inventories into production and otherwise disposing of them, their assessment is carried out by the organization (goods accounted for at sales (retail) cost) using one of the following methods:

- at the cost of each unit;

- at average cost;

- at the cost of the first acquisition of inventories (FIFO method);

The application of one of the methods by type (group) of inventories is carried out during the reporting year.

Documents that accompany the accounting of receipt of inventories

Inventory accounting is associated with the preparation of documents, which can be divided into two groups: external and internal.

External documents are those issued by suppliers of goods and materials: waybill and invoice, waybill. Internal documents document material assets moved within the organization.

The receipt of material assets at the warehouse is accompanied by a receipt order in form No. M-4, an act of acceptance of materials in form No. M-7 (for uninvoiced deliveries). The release of materials into production and for other needs is accompanied by the issuance of a limit and intake card in form No. M-8.

The transfer of materials between structural units of the enterprise or responsible persons may be accompanied by a requirement-invoice for the release of materials in form No. M-11. This form is also used to return unused material to the warehouse.

If the structural units of the enterprise are located remotely from each other, an invoice in form No. M-15 is used to transfer materials between them. It is also used to transfer material assets to third-party companies, for example, when transferring raw materials.

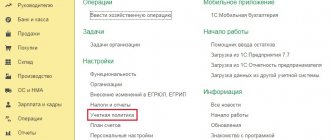

Since January 2013, the organization has the right to use its own forms of primary documents (Law “On Accounting” dated December 6, 2011 No. 402-FZ), securing them in its accounting policies.

Inventory of inventories

In accordance with the requirements of regulatory acts in the field of accounting, at least once a year, an organization must conduct an inventory of its property (assets).

During the inventory, the actual presence of the corresponding property objects (assets) is revealed, which is compared with the data of the accounting registers.

The procedure for conducting an inventory (the number of inventories in the reporting year, the dates of their conduct, the list of property checked during each of them, etc.) is determined by the head of the organization, except for cases when an inventory is required.

Basic information

Concept of accounting accounts

Understanding what posting is without knowing about accounts is not so easy.

An accounting account is one of the business accounting positions that shows the movement of the company’s property, as well as the sources of its receipt. The display is reproduced in double recording, when the transaction is recorded twice: as a debit and a credit. All existing accounts for accounting entries have their own plan, and it is grouped by basic concepts.

Important! When analyzing all transactions and posting for a specific period, it is better to have a list of accounts at hand.

All main accounts in accounting are divided into three groups and depend on the type of accounting:

- Active accounts are necessary to display information in monetary terms of business assets and resources. For example, these could be materials, a certain amount of money, as well as manufactured products. The entry is recorded as a debit if there is a noticeable increase in the company’s finances, and if resources have decreased – as a credit.

- Passive accounts display financial changes in the sources of funds, as well as their movement. This includes depreciation of equipment and markup on goods. Here both entries can be recorded by credit.

- Active-passive accounts play both roles, and it is important to know which of them is currently active. The initial difference between receipts can be recorded in both debit and credit. This is possible if there are accounts receivable, which relates to account No. 76.

Displaying Inventory in Invoices

The reserves of a particular organization consist of many types, therefore there are enough accounts in relation to them.

To know financial and commodity reserves, you need to obtain information on certain accounts:

- Account 10 gives an idea of the price of all resources involved in the production of the necessary products, this can include raw materials for production, containers, necessary equipment, flammable materials, and special clothing.

- Account No. 11 is typical for an organization engaged in livestock farming and it reflects the number of animals in the balance sheet.

- Accounts 15 and 16 may reflect purchased inventory. In case of receipt of goods from the supplier, an entry to the general balance is required according to entry D15 (or 16) K60, D10 K15/16. Due to the fact that there are many intermediate postings, accounts are rarely used.

- To receive calculations, you must take information about defects or semi-finished products, which is displayed on accounts 21 and 28. These amounts must be included in the calculation.

- Production information can be found on accounts numbered 20,23 and 29.

- To obtain data for line 1210, you need to pay attention to accounts from 41 to 45. Here you can find all the information about the enterprise’s finished products.

- Account number 97 is partially used, or rather, the amount of expenses written off for the last year is needed here.

Important! To compile the report, you should not lose sight of account 14, which displays the conditions of reserve funds that make it possible to reduce the cost of inventory. It is formed at the end of the year if the price of inventories is higher than the market value. The value in this case is considered the difference in amounts.

Characteristics of main inventory accounts

Account analysis:

- Account 10 provides information about the movement of all valuables belonging to the organization, this includes production inventories, fuel, raw materials, household supplies, and containers are recorded. All materials on this account are documented according to their cost for their manufacture or purchase. On this invoice, it is possible to show the materials necessary for the purchase, which are then used to complete the products. Any asset subject to write-off or sale at cost is recorded in debit to account 91.

- Account 11 relates to livestock organizations; in it you can find information about the movement of all available animals raised on the farm. Young animals, as well as animals for fattening, must be recorded. The costs of cultivation are shown in accounts 20 and 29. All offspring received are displayed as a debit income, where credit is the cost of their maintenance. Animals that die or are slaughtered are forced to be recorded as property damage and are written off as a credit from this account.

- Account 14 includes reserve savings associated with a decrease in the cost of materials depending on the market price. This applies to fuel or necessary raw materials stored in warehouses; this also includes goods in circulation or work in progress.

- Account 15 includes procured and purchased material assets and here is generalized information indicating the amount of inventories in circulation. This account is convenient for imports that involve long-term price formation. The debit indicates the cost of inventories received according to supplier documents.

- Account 16 summarizes information about the difference in the price of purchasing the necessary materials. The balance of materials received, which is calculated by the actual cost of production, can be written off as a debit or credit. If the resulting difference accumulates in the account because the cost price is less than the market price, then the amount is indicated in the debit where production costs are taken into account.

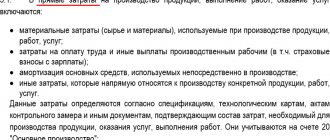

- 20 account “on main production” is intended to obtain general data on production costs for the manufacture of products or provision of services, depending on the goals of a particular enterprise. It is necessary for organizations involved in the production of agricultural or industrial goods, construction or other work, provision of transport services, road repairs, etc. The debit column indicates the expenses allocated for the manufacture of a product or the provision of services; it also includes expenses for the management and maintenance of production, as well as defects.

- Account number 21 shows information that reflects the movement of semi-finished products or their availability in production. Here the materials necessary for the manufacture of products are indicated: cast iron, rubber, glue, yarn, acid, etc., depending on the type of industry. If the organization does not keep records of semi-finished products, all existing values are simply recorded in account 20.

- Account 23 provides information about auxiliary production and here you can find all the costs of auxiliary organizations. This includes the maintenance of production with such resources as steam, air, gas, electricity, transport and repair work, the production of the necessary stamps, parts and structures, mining, as well as the procurement of products are also recorded here. The debit records inventories spent on manufacturing products and servicing production; credit is characterized by displaying the actual amount in accordance with the cost of the operation.

- Invoice 28 contains the results of existing defects and any losses in production. Here the costs for a specific situation are summarized. To reduce losses, it is necessary to indicate the defective product with the price, possible use, those responsible for the defect in production with recovery, as well as the amount that the supplier will reimburse for the defective product.

- Invoice 29 summarizes all costs related to the production and manufacture of the product. This includes expenses associated with the economy or production that are not related to the manufacture of goods, but are on the balance sheet of this organization. This may apply to hostels, residential buildings, educational institutions or sanatoriums.

- Account 41 provides information about goods that were purchased for resale. This account is necessary for organizations conducting trade or working in public catering. For other organizations, it may be used if goods or materials were purchased for further sale together with manufactured products. But in this case, the cost of the goods is not summed up with the cost of production. This account includes warehouse goods, for retail trade, and packaging containers.

- Invoice 42 records the markup or, conversely, discounts on the goods sold, which applies to a greater extent to retail organizations. Here it is necessary to indicate the discounts received from suppliers in case of loss of delivery or in case of inflated transport costs. The amount of the discount or markup is added to the available balance in the warehouse, according to the turnover for the last month.

- 43 account for finished products is intended to obtain information about the turnover of finished goods. It is needed by organizations conducting agricultural, industrial or manufacturing activities. If a finished product is purchased that is necessary to complete a specific product, the recording is carried out in 41 invoices. Inventory registration occurs when finished goods are available for sale or for personal use by the organization.

- Account 44 records the expenses allocated for the sale of a service, product or work. At industrial enterprises, this item is necessary to record the costs of containers and packaging, for the delivery of the finished product, loading it into any means of transportation, it also includes a commission fee, as well as expenses for the maintenance of warehouse premises. In this case, advertising financing, salesperson salaries and other similar expenses are taken into account.

- 45 account gives an understanding of the goods shipped, the revenue for which has not yet been recorded in the accounting department due to the long export period. Goods transferred to distributors for sale are also included here.

- Account 97 is necessary to record expenses that will be incurred in the next period. If we talk about the mining industry, this could be preparatory work that is associated with seasonality, installation of the necessary equipment or its dismantling.