All employers are required to submit a 6-NDFL report quarterly. Despite the fact that a major update to the form of this report is expected in 2022, the assistants for checking the correctness of its completion will remain the same.

So, in the 1C: Salary and Personnel Management program ed. 3.1 the 6-NDFL report is generated in the “Reporting, certificates” section - “1C-Reporting”.

Click the “Create” button and in the “Federal Tax Service” section, find the “6-NDFL” report.

Use the arrow buttons to set the reporting period.

Click the "Fill" button.

The report has two sections:

Section 1 - “Generalized indicators”, including data on the amounts of accrued income, tax deductions, and amounts of calculated tax. The user can view the detailed sums of the report cells. To do this, right-click on the cell and select the “Decrypt” command.

Having received a decoding of the form data in the context of income codes, the user can analyze them.

Section 2 - “Dates and amounts of income actually received and personal income tax withheld.” Here the user can also get detailed information about decoding any cell. This method helps you analyze the data and find errors in the report.

In addition to detailing report cells, 1C also has “helper reports” that make it possible to analyze personal income tax data. They will help the user when filling out and checking the “6-NDFL” form:

- “Summary certificate 2-NDFL”;

- Analysis of personal income tax by date of receipt of income;

- Analysis of personal income tax based on documents;

- Analysis of personal income tax by month;

- Control of personal income tax payment deadlines;

- Accrued income in personal income tax reporting;

- Accrued and received income in personal income tax reporting;

- Detailed analysis of personal income tax for an employee;

- Checking section 2 6-NDFL;

- Tax accounting register for personal income tax;

- Withheld personal income tax.

They can be formed in several ways:

Option 1 - in the section “Taxes and contributions” - “Reports on taxes and contributions”.

By opening the section, you will see a list of personal income tax reports.

Option 2 - in the "Salary" section - "Salary reports".

Go to the very bottom of the list of reports and follow the “All reports” hyperlink.

Open the “Taxes and Contributions” section and a list of additional reports for personal income tax analysis will appear on the right side.

Let's take a brief look at these reports. What information can the user get from them?

“Summary” certificate 2-NDFL

The form itself “Income Certificate (2-NDFL) for an employee” can be generated in the “Reporting, Certificates” section.

The document contains information about the income and personal income tax of the selected employee.

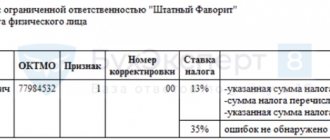

The “Summary” 2-NDFL certificate report contains information from which the 2-NDFL certificate is generated. The advantage of the report is that it generates data for all employees. With its help, you can check all the data on an employee’s income, personal income tax accruals and deductions, and applied deductions.

If necessary, you can set the selection in the “Settings” button.

If an error is detected, the user can make corrections in the program in a timely manner.

For example, a deduction to an employee was not provided, not closed, or was incorrectly indicated.

Go to the employee card - in the “Employees” directory and enter or correct the data on deductions in the “Income Tax” section.

In the section you can enter:

- new claim for standard deduction;

- notification of the tax authority about the right to deduction.

And also view all applications for employee deductions by clicking on the hyperlink of the same name.

What is the responsibility for providing a fake certificate?

Before talking about liability for a fake personal income tax certificate 2 to a bank, you need to understand what actions when filling it out are considered fraud. There are two criteria here:

- the certificate was issued by an organization that is not the employer of the bank client;

- in f. 2-NDFL the income of the owner of the certificate is overstated.

All other errors, including the use of old-style certificates, relate to the human factor, as a result of which inaccuracies are allowed in practice: inattention, lack of knowledge to fill out this type of form, etc.

When a fake document is discovered, events can develop in different directions. It all depends at what stage the forgery is discovered. If, when considering an application, the bank may:

- open a line of credit, but at the highest possible interest rate;

- simply reject the application;

- refuse a loan and put the client on an unofficial “stop list,” which almost always means closing access to loans in all major banks in the country (they exchange this kind of information).

Sometimes they write that banks in such cases go to court or the police. This is not entirely true. The police have no grounds to open a criminal case (against the bank client), because... no casualties. There is only an intention to commit a crime using fraudulent schemes.

But against those who issued or prepared the document, the prosecutor's office can initiate a criminal case for official forgery (Article 292 of the Criminal Code of the Russian Federation) or forgery of forms and seals (Article 327 part 3 of the Criminal Code of the Russian Federation).

Events may develop completely differently if a loan or mortgage is issued. Here, the fate of an unscrupulous client is completely in the hands of the creditor, because When contacting the police, fraudsters face a real prison sentence with compensation for losses to the injured party, and if they file a lawsuit, they face termination of the contract. And if it is also a mortgage, then with the loss of the funds paid for the apartment and the apartment itself, as collateral (Article 450 of the Civil Code of the Russian Federation). There are already precedents in judicial practice.

Attention: with regular repayment of loan debt, the bank has no reason or time to double-check the documents submitted by the borrower. Therefore, if a forgery has been committed, the bank cannot be provoked to re-examine the package of documents submitted to obtain a loan.

When filing a complaint with the police regarding fraud, the case is considered in accordance with Art. 165 of the Criminal Code of the Russian Federation, which provides for a fine of up to 300.0 thousand rubles. or, in case of damage on a particularly large scale, 2 years of corrective labor. Particularly malicious fraudsters may be given a real prison sentence of up to 2 years by the court.

What is the threat of a fake personal income tax certificate 2 for a bank? Almost nothing. He always has the opportunity to collect the loan debt through the court. The debtor’s attempt to declare himself bankrupt in court in such a situation does not work precisely because of the fake certificate 2 of the personal income tax.

Analysis of personal income tax by date of receipt of income

The report allows the user to obtain information about accrued and paid income, calculated and withheld personal income tax, etc. Information is displayed in the report by date and combined by month. Using the grouping icons " " and "-" you can collapse and expand data.

Information presented in this form is easier to verify and analyze. It makes it easy to spot errors.

Using the “Settings” button, you can set additional report generation parameters.

Set the setting type to “Advanced” and on the “Selection” tab add additional selection. Click the "Add selection" button and add the "Employee" field.

Set “Employee”, the condition “Equal” and in the “Value” field select an employee from the directory. In our example - Akopyan M.S.

Click "Close and Generate". The data in the report will be displayed in accordance with the selection condition.

If you often use the report, for convenience, you can select by employee in his header. Then, to select an employee, you don’t have to go into settings every time. To do this, in the selection line, click on the symbol “-” and select “In the report header”.

As a result of the setup, a selection field by employee appeared in the report header.

This setting applies to any report in 1C.

As with any other report, the user can analyze the data by looking at its transcript. Double-click on the cell value and select the “Registrar” field value.

As a result, a transcript will be displayed in the context of documents that made an entry in the register. Double-clicking on the name of the base document will open the document itself.

Checking the 3-NDFL declaration

After the tax period is over, you are required to submit a report to the Federal Tax Service. You also have the right to file a return if you want to receive a tax deduction.

One of the possibilities to carry out tax control in this case is a desk audit.

The tax office will check the documentation without going directly to your company.

Verification period

The audit lasts three months from the moment you submit the report to the tax office.

Only the period for which you submitted documentation will be considered; the check will not be carried out a second time.

How does the procedure work?

After you submit all the necessary documents and a completed declaration, the verification will begin. However, no one will notify you about it.

The important thing is that it can be suspended if contradictions, errors or shortcomings of a different nature are discovered. The Federal Tax Service specialists will ask you for clarification or ask you to correct the mistakes made. You are given a five-day period for this.

You will be notified that the verification procedure has been interrupted by one of the following options:

- You will be sent a request to provide certain documentation;

- They will ask you to appear in person.

To prevent problems from arising, leave your contact phone number to the inspector.

It turns out that if you provided additional documentation or corrected something, the verification period increases. This decision of the head of the Federal Tax Service is not required.

After verification of the declaration is completed, the development of events may be as follows:

- If errors are found, you will need to bring an updated list of documentation;

- If inaccuracies are found, the declaration will need to be corrected and the check will be carried out again;

- If no errors or inconsistencies are identified, the tax paid will be refunded to you.

How to find out the verification status

If you want to personally control the procedure, you can do this in several ways:

- Through telephone calls to the inspector;

- By registering on the Federal Tax Service website, in the “Electronic Services” section.

Using these methods, you can track the actions of inspectors and immediately receive clarification on all questions that arise.

Personal income tax analysis by month

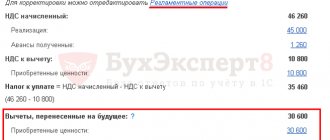

The group of reports “Personal Income Tax Analysis by Month” allows you to compare calculated, withheld and transferred personal income tax, analyze the tax base and applied deductions. The report is presented in a complete and simplified version, as well as with details of the months of the tax period and the months of mutual settlements with employees.

The simplified version contains summary information on the indicators.

To detail records by employee, check the “Detail by employee” checkbox. A section of the same name will be added to the report.

The second version of the “Analysis by Month” report displays the same information, but in a slightly different interface.

The report “Analysis of personal income tax by months of the tax period and months of mutual settlements with employees” has added additional settings and selections. The user can specify:

- period of income;

- settlement period;

- organization and branch;

- Inspectorate of the Federal Tax Service.

Amounts in this report, as in all other reports, can be drilled down by right-clicking and selecting an option to drill down. For example, by the “Registrar” field, i.e. according to the document.

How the tax office checks 6-NDFL

Since 2022, form 6-NDFL has been radically updated.

A ready-made solution from ConsultantPlus will help you fill out and submit 6-NDFL for 2022 using the new form. Trial access to the system can be obtained for free. The camera room is held directly within the walls of the tax authority, without visiting the tax agent. This type of verification lasts for 3 months from the date of submission of the calculation (clause 2 of Article 88 of the Tax Code of the Russian Federation).

Data analysis occurs within the calculation (control ratios in the letter of the Federal Tax Service dated March 23, 2021 No. BS-4-11 / [email protected] ), as well as in comparison with the card of settlements with the budget and other reports submitted to the Federal Tax Service, for example, ERSV (reconciliation with this calculation is carried out according to the control ratios from the letter of the Federal Tax Service dated February 19, 2021 No. BS-4-11 / [email protected] ).

Let's list what control ratios tax authorities use to find inconsistencies in the calculation of 6-NDFL:

- The date of submission of the calculation, recorded by the tax authority on the title page, is tracked. It must not be later established by law.

- The value on line 110 must be greater than or equal to the value on line 130.

- The value on line 140 must be greater than or equal to the value on line 150.

- The following equality must be observed: line 140 = line 100 × (line 110 – line 130).

Note that the equality of lines 140 and 160 should not be observed, since personal income tax can be accrued in one period and withheld in another. For example, if employees' salaries are paid the next month after the month in which they were accrued. In such a situation, personal income tax on wages for the last month of the quarter is calculated in one quarter, and is withheld and transferred to the budget in the next.

Let us repeat, tax authorities verify the data in 6-NDFL with the ERSV. ConsultantPlus experts explained what to do if a gap is identified between reports. Get free demo access to K+ and go to the Ready Solution to see expert recommendations.

Detailed analysis of personal income tax for an employee

The report allows you to view all information on the selected employee:

- Accrued and paid income;

- Deductions applied;

- Tax base;

- Accrued, withheld, transferred personal income tax and tax debt.

The report is generated indicating the primary documents, broken down by accrual months.

Checking sec. 2 6-NDFL

To help you check section 2 of the “6-NDFL” report, the report form of the same name will serve. It contains information about the amounts of personal income tax withheld and income received, indicating the document, the transfer period and the date of withholding.

Conducting an on-site personal income tax audit

An on-site tax audit is carried out based on the requirements of the Tax Code of the Russian Federation.

In one inspection, your company can be checked as follows:

- Taxpayer;

- Payer of fees;

- Tax agent.

In this case, the audit may cover the last three years of your company’s activity.

But it is worth noting that the current period may also be subject to verification, although, judging by practice, this circumstance is rarely used.

This is easily explained: it is easier to check the current period without going to your office, that is, through a desk check.

Another fact due to which the inspector may ignore the current period is the specifics of the taxation procedure itself.

For some tax payments, the results are determined for the current calendar year. It turns out that there is simply nothing to check before the next calendar year begins.

Federal Tax Service inspectors check:

- Timing and completeness of payment of taxes to the budget;

- How correctly the tax rate is applied;

- Correct registration of tax deductions;

- Is the tax base determined correctly?

What documentation may be requested:

- Personnel documentation;

- Statistical forms;

- Tax cards for personal income tax;

- Certificates 2-NDFL;

- Primary financial documentation.

This list is open, since if such a need arises, inspectors may request additional documents.