At what rate is Belarusian VAT calculated?

When importing goods from Belarus, the Russian importer is obliged to pay import VAT, regardless of the territory of which country they were produced (this is evidenced by the letter of the Ministry of Finance of the Russian Federation dated September 8, 2010 No. 03-07-08/260). No exceptions are made for anyone: in this case, taxpayers pay VAT regardless of the chosen taxation system.

However, there is a list of goods exempt from import VAT. First of all, these are the lists given in Art. 150 of the Tax Code of the Russian Federation and the Decree of the Government of the Russian Federation dated April 30, 2009 No. 372, issued in accordance with it. The exemption under Art. 149 of the Tax Code of the Russian Federation.

For a list of cases when you do not need to pay VAT on imports from Belarus, see ConsultantPlus. Trial access to the system can be obtained for free.

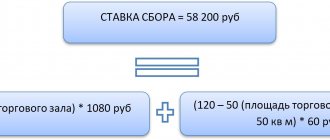

For non-tax-exempt goods, the usual rates for import from Belarus are 20% or 10%, depending on the type of goods. A reduced 10% rate is provided for goods included in special lists established by the Government of the Russian Federation. In particular, for food products and children's products, such lists were approved by Decree of the Government of the Russian Federation dated December 31, 2004 No. 908. Imported products for which no benefits are established are taxed at a rate of 20%.

For shipments during the transition period (2018-2019), it was necessary to choose the VAT rate based not on the date of shipment of goods by the foreign seller, but on the date of their acceptance for registration by the Russian buyer. If the goods were shipped in 2022 and registered in 2019, the rate should have been 20%.

A ready-made solution from ConsultantPlus will help you calculate VAT on imports from Belarus. You can view the material for free by obtaining demo access to the system.

When should VAT on imports from Belarus to Russia be transferred to the budget?

VAT must be paid by the 20th day of the month following the one in which the imported goods were registered.

Important! Tip from ConsultantPlus, when importing under a leasing agreement (if the transfer of ownership of the leased item is provided), pay VAT on each leasing payment no later than... For more details, see K+. This can be done for free.

KBK for payment: 182 1 0400 110.

You should pay the tax to your Federal Tax Service.

If a company has overpaid federal taxes, they may not remit import VAT at all. However, in this case, inspectors must submit a corresponding application requesting offset of the overpayment.

It should be borne in mind that, according to paragraph 4 of Art. 78 of the Tax Code of the Russian Federation, tax authorities are given 10 working days from the date of filing such an application to make a decision on the offset. And if the organization sends it without taking into account the fact that payment must be made by a certain day, it is quite likely that the inspectorate will carry out an offset when the VAT payment deadline has already passed, and then penalties will be charged.

What are the deadlines for reporting when importing goods from the EAEU?

A special deadline has been established for paying VAT when importing goods from the EAEU: no later than the 20th day of the month following the month in which imported goods were registered (paragraph 2, part 1, clause 19 of the Protocol on the procedure for collecting indirect taxes).

If the 20th is a day off and (or) a non-working public holiday (non-working holiday), then VAT is paid no later than the next working day (Part 7, Article 4 of the Tax Code).

Example

For goods imported from Russia that were registered in February 2022, the importer paid VAT on March 22, 2022 (March 20, 2021 - Saturday). The deadline for paying import VAT in this case has not been violated.

Regardless of which VAT reporting period the importer applies, Part II of the VAT return is submitted no later than the 20th day of the month following the month of registration of imported goods (clause 20 of the Protocol on the procedure for collecting indirect taxes). If the last day for reporting falls on a non-working day, then you can report on the next working day (Part 7, Article 4 of the Tax Code).

Note! Payers who calculate VAT monthly on goods imported from EAEU member countries must submit a VAT return containing parts I and II (Ministry of Taxation letter N 2-1-10/00880).

The day of submission of the electronic declaration is the date of receipt, recorded using the software of the tax authority. The tax authority will send confirmation of acceptance of such a declaration no later than the second working day following the day of receipt (Part 1, Clause 3, Clause 5, Article 40 of the Tax Code, Clause 8 of Instruction No. 7).

An application for the import of goods as part of a certain package of documents must be submitted simultaneously with the VAT declaration, as established by an international treaty. That is, the deadline for filing an application for the import of goods is also no later than the 20th day of the month following the month of registration of imported goods (clause 20 of the Protocol on the procedure for collecting indirect taxes, clause 5 of Article 139 of the Tax Code, letter of the Ministry of Taxes No. 2- 1-10/00880).

ESCHF is created and sent to the Portal no later than the 20th day of the month following the month in which the imported goods were registered. But only if the following conditions are met in total (Part 2, Subclause 9.2, Article 131 of the Tax Code):

— VAT was paid (credited) within the period established by law;

— an import application has been submitted to the tax authority.

Note In the ESFF created for goods imported from the EAEU, the number and date from Section I of the application for the import of goods must be indicated (subclause 23.12, paragraph 6, part 1, clause 42 of Instruction No. 15).

When paying (offsetting) VAT in violation of the established deadline, the ESCF is created and sent to the Portal no later than the 20th day of the month following the month in which the following conditions are met in aggregate (Part 3, Subclause 9.2, Article 131 of the Tax Code):

— the final payment (offset) of the due amount of VAT has been made;

— an application for the import of goods has been submitted to the tax authority.

Read this material in ilex >> *

* following the link you will be taken to the paid content of the ilex service

Import from Belarus to Russia: what is submitted to the tax office

For imported goods and materials, a special declaration on indirect taxes is filled out. In addition, tax officials should send a number of papers confirming the fact of import and payment of VAT to the budget.

The declaration is completed for the month in which the imported goods and materials were recorded. Moreover, if there was no fact of import, there is no need to compile it.

This declaration is sent to the inspectorate no later than the 20th day of the month following the one in which the assets were recorded. If the company had 100 or fewer employees last year, the declaration can be submitted in paper form. It should be remembered that the mandatory electronic form is provided only for regular (quarterly) VAT returns. The tax authorities themselves speak about this (letter from the Federal Tax Service of the Russian Federation for Moscow dated March 11, 2014 No. 16–15/021948).

In case of import of non-excise goods, only section 1 will be required to be completed in the declaration (in addition to the mandatory title page). In this case, the amount of import tax payable to the budget will be reflected in line 030 of section 1.

See the Sample of filling out a declaration on indirect taxes when importing from Belarus and other EAEU countries from K+, free of charge, by signing up for trial access.

Features of filling out the declaration

Correct completion of the declaration is of great importance. When filling it out, you must adhere to the rules for preparing up-to-date tax reporting. In this case, all possible specific requirements are taken into account.

Double-sided printing of the declaration is not allowed.

Sample VAT return

The current declaration includes the following components"

- Main sheet.

- The first section includes information regarding the amount of VAT.

- The second section, which includes the cost of excise duty.

- Application.

The main declaration sheet must be provided by organizations that have registered goods that were imported into the territory of the Russian state. These organizations must also provide the first section.

Sample of the first section of a tax return

If the company imported excisable products into Russia, then there is a need to fill out the second section and appendices to the current document.

There are also some recommendations regarding filling out the fourth section of the declaration. In this section, the importer undertakes to reflect all export transactions.

- In the first column, the importer undertakes to indicate the code of the current operation.

- In the second, you must indicate the name of the tax base.

- In the third - the amount of input VAT deductions.

- In the fourth - the previously calculated VAT amount.

- The fifth column must contain the amount of input VAT taken into account before export confirmation.

Sample VAT return, section 4

Documentation confirming import

Along with the tax declaration, it is necessary to submit a certain package of documents, or rather their certified copies (with the exception of the application for the import of goods, which is submitted in the original):

- Bank statements as confirmation of payment of import VAT (naturally, if the tax authorities decided to offset the overpayment, then it will not be needed). If we talk about how this situation works in practice, then tax officials prefer copies of payment slips with a bank mark and seal to bank statements.

- An agreement for the supply of imported goods concluded with a Belarusian counterparty. If the goods and materials were supplied through an intermediary, it is necessary to attach the corresponding intermediary agreement, as well as an information message with information about the supplier.

- Transport and accompanying papers.

- Invoices.

- Applications for the import of goods and payment of indirect taxes. It is submitted in paper form (in 4 copies), as well as in electronic form (its format is approved by order of the Federal Tax Service of the Russian Federation dated November 19, 2014 No. ММВ-7-6 / [email protected] ).

For information on the basis of which documents can be used to deduct import VAT paid by an intermediary, read the material “How to deduct VAT if an intermediary paid it at customs?”

Filling out an application

Domestic companies are quite actively purchasing products from Belarusian counterparties. Today, those involved in this field prefer to enter into contracts in foreign currency. At the same time, the Russian ruble is moving somewhat into the shadows. Against this background, payment for imported products by the domestic importer occurs in dollars or euros.

The application must be completed correctly. A person must fill out all the fields regarding the payment of indirect taxes and the transportation of products. You must submit an application to the tax office in advance. This is necessary in order to have “insurance” in case of failure.

A person who submits an application on time has the opportunity to pay “import” VAT.

If tax officials discover an error or inaccuracy in the application, a mark on the application that would confirm payment of indirect tax will be refused. Without this mark, it will be impossible to deduct VAT that was paid when importing Belarusian products.

Filling Features

The application must be submitted in two copies. Both copies must be submitted to the supplier. An application must be submitted to the supplier to confirm the zero VAT rate.

Procedure for filling out the application:

- entering a currency code;

- entering the cost of the imported goods;

- note about additional expenses;

- indication of the amount of taxes paid.

The completed application must be certified with a personal signature.

Question of currency

The application does not have a separate column intended to indicate the official exchange rate of foreign currency in relation to the Belarusian ruble. Against this background, the applicant undertakes to indicate the foreign currency code in the 5th column. It is indicated on the basis of the invoice.

In the 6th column, the person undertakes to indicate the price of imported products in foreign currency. In columns 7-16, except for columns 9,10,13 and 14, it is necessary to display currency indicators in Russian rubles. There is no need to indicate the exchange rate when filling out the application.

The procedure for filling out an application for importing products from the Russian side was established by employees of the Belarusian Tax Ministry.

Belorussian rubles

Application for import when importing from the Republic of Belarus

Importing companies fill out section 1 of the application, entering information about the supplier and buyer, information about the contract and the cost of imported goods and materials. Section 2 of the application is filled out by the inspectors themselves (here they also put their mark on payment of VAT). In some situations, for example, during mediation, the importer must also complete the third section.

You can download the application form on our website:

Explanations and a sample from ConsultantPlus experts will help you fill out the application, which you can view for free after receiving trial access to the system.

Inspectors review the application within 10 working days and confirm payment of VAT:

- A mark on a paper application. In this case, one copy of the application remains with the controllers, and the rest are returned to the importing company. Of these, one document is intended for the company itself, and the other 2 must be transferred to the Belarusian supplier so that he can confirm the zero export rate on his territory.

- A separate electronic document when sending an electronic application. In this case, the buyer must provide the seller with electronic or paper copies of his application and the supporting document received from the Federal Tax Service.

How is VAT deducted?

After the importer receives his copy of the application with the mark of the tax authorities, he can claim a deduction (letters of the Ministry of Finance of the Russian Federation dated 07/02/2015 No. 03-07-13/1/38180, dated 08/17/2011 No. 03-07-13/01-36) . Tax legislation (clause 2 of article 171, clause 1 of article 172 of the Tax Code of the Russian Federation) contains 3 conditions, if simultaneously met, the importer has the right to declare a VAT deduction when importing from Belarus:

- The goods were purchased for VAT-taxable transactions.

- Inventory and materials have been registered.

- Import VAT paid.

However, the rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, put forward one more additional requirement: an application for the import of goods with a mark from controllers must be recorded in the purchase book indicating the number of the payment document on the basis of which VAT was paid to the budget (the date and number of the application are entered in column 3 of the book, and the details of the payment order - in column 7).

Attention! The deduction of import VAT is declared in the regular (quarterly) declaration - do not confuse it with the declaration of indirect taxes. The declared deduction amount will be reflected in line 190 of section 3 (letter of the Federal Tax Service of Russia dated October 20, 2010 No. ШС-37-3/ [email protected] ).

See also the material “What is the procedure for refunding VAT when importing goods?” .

However, there are cases when VAT paid when importing goods from the EAEU must be taken into account in their cost. Check out such cases in the Ready-made solution from ConsultantPlus for free.

general information

The agreement concluded by the leadership of Belarus and the Russian Federation became relevant 11 years ago. It was ratified by the relevant law of the Russian state.

A person importing goods across the customs border of Belarus is obliged to pay VAT at customs.

The procedure for paying VAT involves five important steps:

- Determination of the tax base and calculation of VAT for the import of goods.

- Payment of VAT for the import of goods.

- Report on the import of goods from the countries of the customs union.

- Acceptance of VAT deduction for import of goods.

Sometimes situations arise when the cost of delivery when importing goods is highlighted in the contract with a red line. In this regard, many are interested in the answer to the question of whether there is a need to include expenses in the VAT base.

The VAT base is the contractual value of the transaction. This is the amount that must be paid by the person importing the goods. The legislation does not provide for an increase in cost when importing.

Even more subtle situations occur when importing goods. Some imported goods sometimes turn out to be of poor quality. If the person who imported paid the VAT, he may try to make the tax amount a little less.

What to do with deadlines

In practice, there are often situations when VAT on imports from Belarus is paid in one quarter, and the importer receives a tax mark on the application in the next. According to officials, in this case, VAT is deducted only after the appropriate mark is made (letter of the Ministry of Finance of the Russian Federation dated July 2, 2015 No. 03-07-13/1/38180).

However, judges in such situations often take the side of taxpayers who claim a deduction during the period of actual payment of VAT to the budget, without waiting for the inspectors’ mark (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 25, 2011 No. KA-A41/7408–11). However, if you don’t want to argue with the tax office, then it would be more advisable to wait for the mark.

Results

Goods imported from the EAEU countries (including from Belarus) are subject to VAT at regular rates (20 and 10%), unless they are exempt from tax. Payment of such tax is mandatory for all importers, regardless of the tax regime they apply. The deadline for payment and reporting of tax accrued on imports from the EAEU expires on the 20th day of the month following the reporting month.

The reporting is presented by an indirect tax declaration and an import statement, accompanied by copies of documents confirming the import and payment of tax. For a month in which there are no import transactions, reporting is not submitted. The paid tax, subject to the acceptance by the Federal Tax Service of the import documents, is subject to deduction.

See also our articles:

- “VAT on imports from Kazakhstan to Russia”;

- “VAT on the import of goods from Kyrgyzstan to Russia”;

- “VAT on the import of goods from Uzbekistan to Russia”;

- “Payment and restoration of VAT when importing goods from China to Russia.”

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of April 30, 2009 N 372

- Decree of the Government of the Russian Federation of December 31, 2004 N 908

- Order of the Federal Tax Service of Russia dated November 19, 2014 N ММВ-7-6/ [email protected]

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

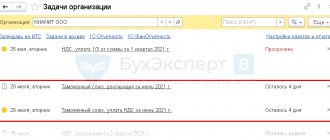

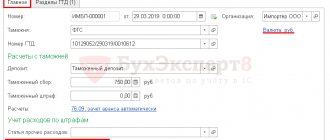

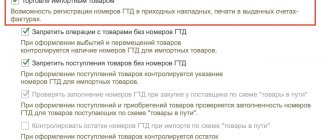

Registration of receipt of imported goods

To further consider the procedure for filling out the application, we will reflect in “1C: Accounting” the operation of receipt of imported goods. When filling out the importer's counterparty card, you need to pay attention to the additional fields that appear when selecting the country of origin of the imported product. If the country is different from Russia, then you must fill in the fields - tax number in the country of registration and registration number in the country of registration. This data will appear on the application for import of goods.

Fig.4 Registration of receipt of imported goods

When filling out data about a product in the “Nomenclature” directory, you must fill in the country of origin, the customs declaration number and the code according to the TN FEA classifier (commodity nomenclature of foreign economic activity).

Fig.5 Filling in product data

Fig.6 Classifier of Commodity Nomenclature of Foreign Economic Activity

Receipt of goods is reflected in the usual manner - menu item “Purchases” - “Receipts (acts, invoices)”.

Fig. 7 Receipts (acts, invoices)

Do not forget to indicate the information about the shipper and the type of transport.

Fig.8 Data on the shipper and mode of transport

As a result of posting the document, in addition to accounting entries, an entry is created in the register “Import of goods from the states of the customs union”. You can view document movements by clicking the Dt/Kt button.

Fig.9 Import of goods from the states of the customs union