General rules for issuing vacation pay

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

- Duration of vacation.

- Average employee salary.

- The period for which the calculation is performed.

The amount of the employee's salary is used to calculate the tax. This amount includes bonuses and various compensations issued for the year preceding the vacation.

IMPORTANT! Both budgetary structures and commercial enterprises and individual entrepreneurs are required to provide annual paid leave to their employees. The amount of vacation pay is calculated based on the official salary.

Conducting a mandatory audit of financial statements

Possible changes in legislation regarding the criteria for conducting a mandatory audit

Currently, the State Duma is studying a bill that considers increasing the size of the indicators that are the basis for conducting mandatory audits of enterprises.

The original text of the document suggests increasing the limits of financial indicators, which will enable small businesses to leave the category requiring a mandatory audit.

Estimated dynamics of growth in the value of limiting indicators

| Indicator name | Year | ||

| 2022 | 2022 | 2022 | |

| 1. Amount of income, million rubles. | 400,0 | 600,0 | 800,0 |

| 2. Amount of assets, million rubles. | 60,0 | 200,0 | 400,0 |

| 3. Number of employees, people. | more than 100 | ||

According to deputies, the adoption of the bill with amendments regarding increasing the criteria for conducting a mandatory audit will allow small businesses to legally avoid this procedure and direct the freed-up funds to their development.

Basic rules for calculating personal income tax

The object of taxation is the totality of all vacation payments. According to the provisions of Letter No. 8-306 of the Ministry of Finance, these funds cannot be considered as a component of salary. For this reason, personal income tax on vacation pay is calculated separately from payroll tax.

When to make tax payments?

Vacation pay is issued to the employee three days before his vacation. At the same time, income tax is withheld on the basis of Article 226 of the Tax Code of the Russian Federation. The timing of tax transfer to the treasury depends on how vacation pay is calculated:

- Cash - on the day the funds are issued or the next day . For example, if the money was issued on Friday, the tax is paid on the same day or Monday.

- When withdrawing cash from an organization's account - on the same day . Payment of personal income tax must be carried out on the date of withdrawal of vacation funds from the organization’s account, regardless of when the money will be transferred to the employee.

- Transfer to a bank card or account from a company card or account - on the day of accrual.

IMPORTANT! Some accountants transfer tax before the deadline for issuing vacation pay, when they are recorded in the payroll. This order is considered erroneous.

In 2016, an amendment was made regarding the tax calculation procedure. In particular, now the transfer can be made until the end of the month in which vacation pay was paid.

Let's look at an example

The employee goes on vacation on September 16, 2022. The funds are issued to him in 3 days, that is, on September 13. Personal income tax is transferred to the treasury on the day the money is actually issued. If the responsible persons did not have time to make all the necessary accruals, they can be made until September 30, 2022. The amendment has significantly simplified the work of tax agents. Now you can avoid making payments to employees, maintain accounting and tax records, and transfer personal income tax to the treasury on the same day.

When is tax paid on compensation for unused vacation?

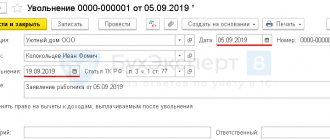

An employee must be granted leave after 6 months of work at the enterprise. If he quits without using his right to leave, compensation is due. It is also considered employee income and therefore subject to tax.

Compensation is issued on the day of dismissal. At the same time, tax is calculated. Funds are transferred to the country's budget on the last day of the month. The compensation paid must be indicated in the 2-NDFL certificate.

Types of compensation

There are two types of compensation, depending on the nature and order of their application:

- The compensations provided for by the Labor Code of the Russian Federation are so-called mandatory.

- Compensations that are established on a voluntary basis between the employer and the employee are so-called voluntary.

For example , one of the most common types of mandatory compensation may be compensation to an employee for vacation that he did not use.

How to calculate personal income tax?

The most convenient way: use an online personal income tax calculator.

First, the following amounts are deducted from the amount of vacation pay issued:

- Social Security contributions.

- Pension and medical contributions.

- Insurance premiums for occupational injuries and illnesses.

Only after this the tax is deducted. Its rate is 13%.

Calculation of tax on additional vacation days

An employee may request additional paid vacation days. They are also taxed. For each day of vacation, the employee's average salary for the shift is calculated. For example, it is 300 rubles. In this case, for 3 days of additional vacation, vacation pay will be 900 rubles. To calculate the tax, you need to multiply this amount by the rate of 13%. Personal income tax will be 117 rubles.

Calculation example

Ivan Sidorov goes on vacation from June 20 to July 3, 2022. First you need to calculate the amount of his vacation pay. They are determined depending on the size of the salary. Ivan Sidorov receives 47 thousand a month. The average salary per shift is 1,600 rubles. In June, the employee worked 10 shifts. His actual salary for the month was 23,500 rubles. The accountant makes the following calculations:

- 47 thousand rubles * 5 months (time worked in 2016) + 1,600 rubles * 14 (number of vacation days) = 257,400 rubles.

- 1,600 *14 days – 1,400 (standard deduction). The result is multiplied by 13%. Income tax is 2,730 rubles.

The procedure for calculating tax on compensation for unused vacation is similar.

Calculation of the number of days to pay compensation

In order to correctly calculate the amount of compensation for unused vacation, it is necessary to determine the correct number of days for which this compensation is due.

Due to the fact that paid leave is provided to an employee every year, it is necessary to start counting from the day of his employment in the institution. In accordance with clause 35 of the Rules on regular and additional leaves, approved. NKT of the USSR dated April 30, 1930 No. 169, it follows that when calculating, the month is taken into account in full if the employee has worked at least half. Otherwise, this time is excluded from the calculation. Also, the calculation does not take into account the days the employee is absent without a valid reason or due to suspension under Art. 76 Labor Code of the Russian Federation. The period of parental leave up to three years is also excluded from the calculation, while maternity leave is included in the calculation on the basis of Art. 121 and 261 of the Labor Code of the Russian Federation.

If an employee has worked for the organization for 11 months, he is entitled to full compensation, and if not, then it is calculated in proportion to the time worked. An important point is that employees with whom labor relations have been terminated due to the liquidation of the institution are also entitled to full compensation for unused vacation.

Compensation for unused vacation is calculated based on the employee’s average earnings multiplied by the number of days for which annual paid leave was not provided.

Average earnings are determined by the following formula:

SZD = ZP / 12/ 29.3

where ADD is average daily earnings;

Salary - wages accrued to the employee for the last 12 months of work;

29.3 is the average number of days in a month.

When calculating the average salary of an employee, all types of payments provided for by the salary regulations in a given institution are taken into account, regardless of the sources of financing, with the exception of social payments (material assistance, food, etc.)

If at the time of dismissal the employee does not have actually accrued wages or actually worked days, the average earnings are determined based on the amount of wages accrued for the previous period equal to the calculation period (Letter of the Ministry of Labor of the Russian Federation dated November 25, 2015 No. 14-1/B-972 ).

It should be noted that the average monthly earnings of an employee who has worked the full number of days during the billing period should not be less than the minimum wage.

Holiday pay accounting

When withholding income tax, the following entries are used:

- DT 68 “Calculations for tax collections.”

- DT 70 “Wages and salaries”.

Accounts numbered 68, 51 can be used for the loan.

Examples

Employee Vasiliev will go on vacation for 28 days from July 2, 2022. His salary was 38,629 rubles. Funds are transferred to the company's reserve account. No deductions are made from vacation pay. Their size will be 5,022 rubles. In this situation, the following wiring is used:

- DT 70 CT 68. Explanation: tax withholding. Amount: 5,022 rubles.

- DT 68 CT 51. Explanation: tax transfer. Amount: 5,022 rubles.

Employee Vasiliev goes on vacation. His salary is 30 thousand rubles. An employee has the right to a tax deduction in the amount of 1,900 rubles. As a result, the amount of vacation pay will be 3,653 rubles. The following wiring is used:

- DT 70 CT 68. Explanation: personal income tax withholding. Amount: 3,653 rubles.

- DT 68 CT 51. Explanation: transfer of the amount to the treasury. Amount: 3,653 rubles.

The information specified in the accounting must be confirmed by primary documentation.

In what cases is vacation compensation paid?

According to Articles 126-127 of the Labor Code of the Russian Federation, monetary compensation to employees is provided to:

- upon dismissal, as well as upon transfer to another enterprise - for all unused vacation days;

- without dismissal - for part of the vacation exceeding 28 days.

On a note!

After working even for half a month, an employee receives the right to compensation for unused vacation days.

This applies to annual paid basic and additional leaves. An employee has the right to compensation regardless of:

- reasons for dismissal;

- professional category;

- working conditions - under a fixed-term employment contract, part-time, etc.

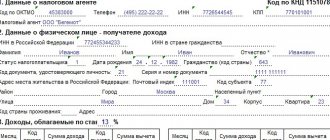

Fixation of vacation pay in 2-NDFL

Vacation pay is subject to taxation. Therefore, they must appear in the 2-NDFL certificate as the employee’s income. Displayed in the month in which the funds were actually issued to the employee. For them you need to provide a separate line with code 2012.

Fixing compensation for unused vacation in 2-NDFL

When displaying compensation on a tax certificate, you must use the code. There is no special number for the payments in question. The following codes are allowed:

- 4800 (payment of compensation upon dismissal).

- 2000 (income related to wages).

- 2012 (vacation pay).

IMPORTANT! According to the explanations of the Federal Tax Service, code 2012 should be used. However, the use of other numbers will not be considered a serious error.

Correct reflection of vacation pay in accounting and tax documentation allows you to avoid problems during audits.

From what payments is personal income tax withheld upon dismissal?

Personal income tax stands for personal income tax. They are subject to most of the payments, including compensation upon dismissal. For residents of the Russian Federation, its value is 13%, for non-residents – 30%.

Compensation for unused vacation is transferred regardless of the reason for the employment contract. Taxation of personal income tax is a priority: only after the tax has been calculated, alimony and other payments are withheld from the amount received.

Personal income tax is also transferred from the following income:

- salary, bonuses, allowances;

- temporary disability benefits.

The employing organization is a tax agent, therefore the obligation to transfer personal income tax rests with it. Violation of this rule is subject to administrative liability in the form of a fine, so it is very important to comply with the deadlines and procedure for calculating the tax.

The procedure for calculating the number of compensated days upon dismissal

When dismissing, it is important to take into account that in some years the employee may not have used several days of entitlement leave. In the event of an incomplete year of work, each month worked for this employer must be calculated based on the proportion of vacation days:

Number of vacation days / 12 months

With a 28-day vacation, for each month worked, 2.33 days of vacation are due, which can be rounded in favor of the employee.

Based on this, you need to calculate:

- total length of service in the organization

- the total number of days of entitlement leave for all years of work

- number of holidays used

- difference between allocated and used vacation

Types of payments that are tax-free upon dismissal

A separate section of the Tax Code (clause 1, subclause 2 of Article 422) sets out events when payments accrued to workers are not subject to mandatory insurance contributions. These include, in particular:

- severance pay

- average monthly salary upon dismissal

Amounts not exceeding 3 times the employee’s average earnings are not included in the tax calculation. (For workers in the northern regions, the limit is increased to six average wages).

As for CCW, it is emphasized: all payments are calculated on a general basis.

Is it subject to income tax or not?

Yes, according to clause 3 of Article 217 of the Tax Code of the Russian Federation, compensation for unused vacation is subject to income tax at a rate of 13%, which is deducted from the accrued amount.

Personal income tax is a tax burden that falls entirely on the shoulders of the employee, while the employer does not incur any losses.

The tax is deducted from the calculation and transferred to the budget. The employee is paid the amount minus 13 percent.

Taxation of compensation includes not only the withholding of personal income tax, but also the calculation of insurance premiums.

This type of tax already falls on the employer, who must calculate the percentage of the accrual and pay it to the budget.

The total percentage of contributions is 30%, plus deductions for injuries and accidents are added to this.

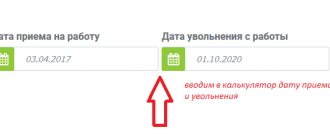

Online calculator for calculating vacation compensation.