Definition of additional capital

Additional capital is a form of capital of a company. It represents formed resources that are not related to fixed capital. An important feature of the DC is that the funds generated do not imply the fulfillment of obligations to partners. That is, capital constitutes net profit. For example, funds received as a result of a loan will not be considered additional capital, since they do not have the key characteristics of the definition. A loan involves liabilities and is therefore not a net asset.

IMPORTANT! By its nature, such capital is additional. Its formation indicates the successful development of the enterprise and increases its value. The funds are used to increase turnover. Can be used to improve equipment and improve the quality of products.

Question: In what cases can additional capital be used to pay (return) funds to the company’s participants? View answer

Sources of additional capital

It is important for a manager to take into account the sources of DC. This measure allows you to identify the strengths of the company. Sources of additional capital are:

- Carrying out additional valuation of non-current assets, upon which an increase in their value was discovered.

- Share premium. It is formed through the sale of securities. The transaction value must be greater than the nominal price. In this case, the company receives additional profit.

- An increase in the actual valuation of the contribution to the authorized capital relative to the nominal value.

- Receiving gratuitous contributions.

- The restored amount of VAT arising as a result of the transfer of property by the founder to the authorized capital.

- Budget allocations that were used to increase turnover.

- The difference between the rates that appeared when creating the authorized capital. This is relevant if you have deposits in foreign currency.

- Income for capital contributions that has not been distributed.

What accounting data is used when filling out line 1350 “Additional capital (without revaluation)” ?

Additional capital must have all the features listed above. Otherwise, the receipt will be classified as another form of income.

Exchange rate differences in settlements with founders

According to PBU (clause 14), exchange rate differences arising in settlements with shareholders or founders for contributions to the authorized capital are credited to account 83 as an increase or decrease in additional capital. The situation assumes that a contribution is made in the form of property, the value of which is determined in currency.

The posting of Dt “Settlements with founders” Kt “Authorized capital” records the debt of the founder on the deposit in rubles. Upon actual receipt of funds, the operation Dt “Currency account” Ct “Settlements with founders” occurs in rubles. Based on the difference between these two amounts, the exchange rate difference is determined, which is then written off to account 83: accounting account 75 is in debit, and 83 is in credit if the difference is positive, and vice versa otherwise.

Additional capital is an integral part of the enterprise’s own capital, which is formed for reasons beyond its control. As a rule, these are differences arising as a result of revaluation of property, sale of shares, settlements with founders for payment of authorized capital in foreign currency. Changes in the amount of additional capital are indicated annually in the financial statements (Form 3), which requires special care when keeping records on account 83.

How is DC recorded in accounting?

Data on additional capital must be accounted for using account 83. It is passive and refers to balance sheet accounts. The loan column records the formation or increase of capital. The debit column displays the following income:

- money allocated for the formation of authorized capital;

- funds that will be distributed among the co-founders;

- amounts compensating for the reduction in the value of non-current assets.

Transactions are indicated using subaccounts. If account details are missing, you need to open them.

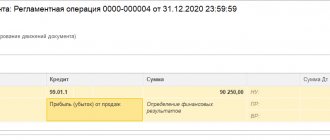

An increase in additional capital can be shown using the following entries:

- Debit 01 Credit 83 – increase in DC resulting from an increase in market prices for property.

- DT 02 CT 83 - an increase in additional capital caused by changes in depreciation deductions.

- DT 50.51 CT 83 – income from securities when they are sold at a value higher than their nominal value.

- DT 75 CT 83 – increase in DC caused by the difference between rates when creating the authorized capital.

All of these are transactions that are relevant when replenishing additional capital. However, it may also decrease. This usually happens due to markdowns or redistribution of DCs. The markdown must be indicated in the debit column of account 83. Let's consider the transactions when reducing additional capital:

- DT 83 CT 01 – decrease caused by the depreciation of enterprise resources.

- DT 83 CT 02 – displays the revaluation of depreciation deductions.

- DT 83 CT 75 – redistribution of company finances.

- DT 83 CT 75 – the difference between the courses, which has taken a negative value.

- DT 83 CT 80 – movement of cash flows in the authorized capital.

- DT 83 CT 84 – additional valuation of property that will be written off.

Postings allow you to reflect specific transactions and movements of funds.

Ways to “fight” losses: TOP-7

If a loss is received at the end of the reporting year, the accountant should inform the manager about the need to convene an extraordinary meeting of participants (shareholders) so that they can make a decision regarding the loss received.

The loss (both previous years and the current year) can be covered by retained earnings of previous years, reserve capital (fund) and targeted contributions from the owners of the company.

If this is not enough, an uncovered loss is left on the balance sheet.

When, at the end of the financial year following the second financial year or each subsequent financial year, at the end of which the value of the company’s net assets turned out to be less than its authorized capital, the current legislation requires, and the company is obliged to make a decision to reduce the authorized capital to the value of the net assets (clause 6, Article 35 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, paragraph 4 of Article 30 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”). This must be done no later than six months after the end of the relevant financial year.

Another option may be a decision to voluntarily liquidate the company. The algorithm for calculating net assets was approved by Order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

The operation of reducing the size of the authorized capital to the value of the company's net assets is a legal way to repay the resulting loss. At the same time, the indicator of retained earnings increases.

In addition, it is possible to increase the value of the net assets themselves through contributions from the founders to the property of the company.

Write-off of losses against profits of previous years

If there is a decision to repay such a loss using the profits of previous years, you need to make an internal entry to account 84:

Debit 84 subaccount “Retained earnings of the previous year” Credit 84 subaccount “Uncovered loss of the current year”

Without the owners' decision to repay the loss, there is no reason to make an internal entry to account 84.

Covering losses using reserve capital

Covering the loss using reserve capital funds is reflected by posting:

DEBIT 82 CREDIT 84

— the loss of the reporting year was repaid using reserve capital funds.

EXAMPLE 2. HOW TO WRITE OFF A LOSS

AT THE ACCOUNT OF RESERVE CAPITAL As of January 1 of the reporting year, Passive LLC has reserve capital in the amount of 30,000 rubles.

and a loss in the amount of 20,000 rubles. On March 15 of the reporting year, it was decided to cover the loss using reserve capital funds. The Passive accountant must make the following entries. December 31 last year (during balance sheet reformation): DEBIT 84 CREDIT 99

- 20,000 rubles.

– reflected uncovered loss; April 15 of the reporting year: DEBIT 82 CREDIT 84

- 20,000 rubles. – the loss of the previous year was repaid at the expense of reserve capital. In the balance sheet as of the beginning of the reporting year, line 1360 “Reserve capital” will show the amount of 30,000 rubles, and line 1370 “Retained earnings (uncovered loss)” - the amount of 20,000 rub. in parentheses.

Covering losses through targeted contributions from founders

If the organization does not have sources to repay losses, then the founders of the company may decide to cover them through additional contributions.

Reflect this operation with wiring:

DEBIT 75 CREDIT 84

— the loss of the reporting year was repaid at the expense of the founders’ funds.

EXAMPLE 3. COVERING LOSSES AT THE ACCOUNT OF TARGETED CONTRIBUTIONS OF THE FOUNDERS

As of January 1 of the reporting year, the uncovered loss of Passive LLC amounted to 50,000 rubles.

The founders decided to allocate additional funds to cover the resulting loss. The funds were deposited into the company's cash desk and into its current account. The Passive accountant must make the following entries: DEBIT 50 (51) CREDIT 75

- 50,000 rubles.

– funds were received from the founders to cover the loss; DEBIT 75 CREDIT 84

- 50,000 rub. – funds were allocated to repay the losses due to the founders’ contributions.

Reduction of authorized capital

The decision to reduce the authorized capital is made at the general meeting of shareholders, which is its exclusive competence (subclause 7, clause 1, clause 2, article 48 of the Law on Joint Stock Companies).

The issue of reducing the authorized capital is within the competence of the general meeting of participants of the limited liability company (subclause 2, clause 2, article 33 of the LLC Law).

In a joint stock company, the reduction of the authorized capital is carried out by reducing the par value of the shares (without paying cash to shareholders or transferring issue-grade securities to them) (Clause 1, Article 29 of the Law on Joint Stock Companies). The total number of outstanding shares does not change.

In an LLC, the reduction of the authorized capital is carried out by reducing the nominal value of the shares of all participants in the company in the authorized capital of the company. At the same time, the size of the shares of all participants in the company does not change (Clause 1, Article 20 of the LLC Law).

The decision to reduce the authorized capital to the net asset value must be made no later than six months after the end of the relevant financial year. After making such a decision, the company must, within three working days, report this to the body that carries out state registration of legal entities - the tax inspectorate (Article 30 of the Law on Joint Stock Companies, paragraph 3 of Article 20 of the Law on LLCs).

In addition, the company is obliged to publish a notice of the decision twice (once a month) in the media, where data on state registration of legal entities is published (the dates of publication of these messages are indicated in the application for state registration of changes made to the constituent documents).

Then you need to submit a package of documents to the tax office. It includes, in particular:

- application for state registration of changes made to the constituent documents (form R13001, approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] );

- decision of the meeting of owners (participants, shareholders) to reduce the authorized capital;

- changes made to the constituent documents, or constituent documents in a new edition in two copies;

- document confirming payment of the state duty (according to subparagraph 3, paragraph 1, article 333.33 of the Tax Code of the Russian Federation, its amount is 800 rubles).

The registration authority is obliged to carry out state registration of changes in the authorized capital of the company within five working days from the date of submission of documents.

The date of reduction of the authorized capital will be considered the day of making changes to the Unified State Register of Legal Entities. In the accounting registers, the decrease in the authorized capital should be reflected by posting on this date:

DEBIT 80 “Authorized capital” CREDIT 84 “Retained earnings from previous years”

As a result, society acquires a more stable financial position.

Let us also dwell on the fact that when registering a decrease in the authorized capital, the company incurs certain expenses. This:

- payment of state duty;

- payment for publications in the media;

- notarization of documents if necessary, etc.

All these expenses in accounting are classified as other expenses and are accrued by postings:

DEBIT 91-2 “Other expenses” CREDIT 68 Subaccount “state duty”

— a state fee has been charged for registering a decrease in the authorized capital;

DEBIT 91-2 “Other expenses” CREDIT 76 “Settlements with various debtors and creditors”

— costs associated with registering a decrease in the authorized capital are reflected.

EXAMPLE 4. REDUCTION OF AUTHORIZED CAPITAL TO THE VALUE OF NET ASSETS

At the end of the reporting year, the uncovered loss of Passive LLC amounted to 200,000 rubles.

The value of net assets as of December 31 of the reporting year amounted to 70,000 rubles. The authorized capital of the company is 300,000 rubles. An extraordinary meeting of the company's participants decided to reduce the authorized capital by 230,000 rubles. (from 300,000 rubles to a net asset value of 70,000 rubles) by reducing the nominal value of the shares of all participants. Registration of changes in the charter was made on May 15 of the following year. On this date, the accountant made the following entry: DEBIT 80 “Authorized capital” CREDIT 84 “Retained earnings of previous years”

- 230,000 rubles. – the authorized capital was reduced. As a result, the resulting loss was completely covered, and an indicator of retained earnings in the amount of 30,000 rubles was formed in the accounting. (RUB 230,000 – RUB 200,000).

As for tax accounting, all other expenses associated with registering a decrease in the authorized capital are taken into account when taxing profits as part of other non-operating expenses on the basis of subparagraph 49 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. Amounts by which a decrease in the company's authorized capital occurred in the reporting (tax) period, in accordance with the Tax Code, are not taken into account when determining the tax base for income tax (subclause 17, clause 1, article 251 of the Tax Code of the Russian Federation).

This means that on the date of reflection in the accounting records of a decrease in the authorized capital in the organization’s accounting, a permanent difference and a corresponding permanent tax liability arise (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n), if the organization applies PBU 18/02.

This operation is reflected by the posting:

DEBIT 99 “Profits and losses” CREDIT 68 “Income tax calculations”

— a permanent tax liability has been accrued for the amount of the reduction in the authorized capital.

EXAMPLE 5. CALCULATION OF PNO WHEN THE AUTHORIZED CAPITAL IS REDUCED TO THE VALUE OF NET ASSETS

Let's use the data from the previous example.

The company applies the general taxation system and applies PBU 18/02. On the date of registration of the decrease in the authorized capital and simultaneously with the reflection of this operation in the accounts, the accountant made the following entry: DEBIT “Profits and losses” CREDIT 68 “Calculations for income tax”

- 46,000 rubles . (RUB 230,000 × 20%) – a permanent tax liability has been accrued when the authorized capital is reduced. In the income statement, this value will be reflected on line 2421.

We also note that the company has the right to reduce its authorized capital on a voluntary basis, without waiting for conditions to arise for a mandatory reduction of the authorized capital or the use of an alternative option in the form of liquidation of the company.

Investments in property

The charter of a limited liability company may provide for the obligation of its participants to make contributions to the property of the company (Clause 1, Article 27 of Federal Law No. 14-FZ of 02/08/1998).

For joint stock companies, this opportunity is provided by amendments made to Federal Law No. 208-FZ dated December 26, 1995 by Federal Law No. 339-FZ dated July 3, 2016. The contribution is formalized by an agreement between the company and the shareholder.

Contributions to property do not change the size and nominal value of the shares of company participants or shareholders in its authorized capital. The purpose of such investments is to finance and support the activities of the society.

The Ministry of Finance of Russia in its Recommendations for auditors on conducting an audit of the annual financial statements of organizations for 2016 (attachment to the letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875) explains that such deposits are reflected separately - on account 83 “Additional capital” .

Please note: there is no direct opportunity to use additional capital generated from participants’ contributions to directly repay losses.

However, additional capital is one of the components of equity capital. Therefore, investments in property will prevent the formation of negative net assets. EXAMPLE 6. FORMATION OF ADDITIONAL CAPITAL THROUGH CONTRIBUTIONS TO PROPERTY

The Charter of Passive LLC provides that its participants are obliged to make contributions to the property of the company.

At the end of the year preceding the reporting year, “Passive” received a loss in the amount of 120,000 rubles. The general meeting of participants made a decision to make contributions to the property in this amount (subclause 13, clause 2, article 33 of the Federal Law of 02/08/1998 No. 14-FZ). The Liability accountant will make entries: DEBIT 75 CREDIT 83

- 120,000 rubles .

– a decision was made on the amount of contributions to the property; DEBIT 51 CREDIT 75

- 120,000 rub. – participants made deposits in cash. This operation will increase the amount of additional capital on line 1350 of the balance sheet in the reporting year by 120,000 rubles.

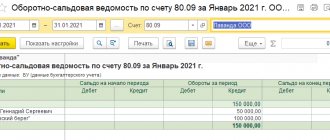

Additional capital in reporting

Information about the DC, according to the chart of accounts, is indicated on account 83 of the passive type “Additional capital”. The plan does not indicate how subaccounts are opened for the account in question. Some transactions, based on accounting standards, must be indicated separately:

- revaluation of non-current assets;

- income generated as a result of the issue.

This list is not exhaustive.

An accountant, depending on the needs of the enterprise, can open the following sub-accounts:

- “Increase in the value of objects during revaluation”;

- "Income from issue."

IMPORTANT! Accounting for account 83 also displays the sources of DC creation.

Use of additional capital

The expenditure of resources from additional capital is limited by law. Funds can be spent on the following needs:

- Covering the negative difference between the price of fixed assets and intangible assets. If, as a result of the assessment, a negative difference is revealed between the actual and market value, it can be repaid from the capital. However, this is only possible if the DC was created due to the difference in past revaluations. The write-off amount should not exceed the amount of the revaluation.

- Funds can be used to increase the authorized capital. The exact amount that can be taken from the DC is not specified in the law. It is assumed that all capital can be used for the purposes considered;

- The DC will be useful when distributing additional resources between the founders. This procedure is relevant when liquidating an enterprise;

- Coverage of losses for previous periods.

It is not recommended to spend funds from additional capital for purposes not provided for by law. This can lead to problems later on.

So. Additional capital is the company’s own funds, formed from sources specified in the law. Their main feature is the absence of encumbrances in the form of obligations to counterparties. Can only be used for purposes specified by law. The DC is fixed in the wiring.

Accounting

To reflect in accounting transactions related to the use of additional capital, use account 83 “Additional capital”. If you have shortcomings in your knowledge of accounting, read the article debit and credit for dummies. Using simple examples, we examined the principles of debit, credit and their balances in simple words.

When paying the founders (participants, shareholders) funds in excess of the amount of reduction in the authorized capital of the organization, make the following entries in the accounting records:

Debit 83 Credit 75-1

– additional capital funds are distributed among the founders (participants, shareholders) of the organization;

Debit 75-1 Credit 51 (52, 50)

– funds of the organization’s additional capital are transferred to the founders (participants, shareholders).

For more information on accounting for transactions related to the use of additional capital for various purposes, see:

- How to reflect the revaluation of fixed assets in accounting;

- How to reflect in accounting an increase in the authorized capital of an LLC at the expense of its own property;

- How to reflect in accounting an increase in the authorized capital of a joint-stock company due to additional placement of shares;

- How to reflect in accounting an increase in the authorized capital of a joint-stock company due to the conversion of shares.

Situation: can additional capital be used to cover losses from previous years?

The answer to this question depends on how the additional capital was formed.

The legislation does not contain a direct indication of the possibility of using additional capital to pay off losses, as well as a direct prohibition on this.

As a rule, the additional capital of an organization is formed from additional property received by the company. An exception is cases of revaluation of fixed assets and intangible assets. The fact is that the revaluation amounts do not reflect the value of the actual property received, since they were formed “virtually” according to accounting rules.

The owner of property created from the contributions of the founders, as well as produced and acquired by the company in the course of its activities, is the company itself (Clause 1, Article 66 of the Civil Code of the Russian Federation). That is, the organization can dispose of it at its own discretion.

Thus, the organization has the right, by decision of the founders (participants), to allocate funds from additional capital to repay received losses. The exception is the amount of additional capital that was formed as a result of the additional valuation of property. This amount can only be used to depreciate the fixed asset or intangible asset in the future. It cannot be used to cover losses (paragraph 6, paragraph 15 of PBU 6/01, paragraph 2, paragraph 21 of PBU 14/2007, letter of the Ministry of Finance of Russia dated July 21, 2000 No. 04-02-05/2).

Confirms the possibility of using additional capital to cover losses and that the list of options for using additional capital given in the Instructions for the chart of accounts is open. At the same time, the openness of this list is indicated by the fact that the last paragraph of the list ends with the words “etc.”

In accounting, reflect the use of additional capital funds to cover losses of previous years by posting:

Debit 83 Credit 84

– additional capital funds are aimed at covering losses of previous years.

An example of using additional capital to cover losses of previous years. Additional capital was formed from the share premium of the organization

As of December 31, 2014, Alfa CJSC recorded additional capital in the amount of RUB 300,000. It was formed through the placement of company shares at a price above their par value (i.e., at the expense of share premium).

Based on the results of activities for 2014, the organization received a loss in the amount of 360,000 rubles. In 2015, it was decided to use the full amount of additional capital to pay off the loss.

In 2015, Alpha’s accountant made an accounting entry:

Debit 83 Credit 84 – 300,000 rub. – additional capital generated from share premium was used to cover the 2014 loss.

The amount of the organization's uncovered loss for 2014 amounted to 60,000 rubles. (360,000 rub. – 300,000 rub.).