1C experts tell you how to calculate a monthly child care allowance in 2022 until the child reaches the age of 1.5 years and calculate it in “1C: Salary and Personnel Management 8” edition 3, taking into account the fact that from February 2022 social benefits , including child care benefits up to 1.5 years old, were indexed. From 06/01/2020, the minimum amount of such a monthly benefit has been increased and has become the same - 6,752 rubles, regardless of whether it is paid for the care of which child - the first or second and subsequent children.

One of the types of state benefits for citizens with children is a monthly child care allowance.

The right to a monthly child care allowance is given, in particular, to mothers or fathers, other relatives, guardians who are actually caring for the child, who are subject to compulsory social insurance and who are on parental leave. It should be taken into account that the right to a monthly child care allowance is retained even if the person on parental leave works part-time or at home, as well as in the case of continuing education. If a mother takes maternity leave while on maternity leave, she has the right to choose what benefit she will receive during the coincidental period of leave.

Monthly child care allowance is paid from the date of granting parental leave until the child reaches the age of 1.5 years.

The amount of the monthly child care benefit is determined by Article 11.2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

How to calculate maternity leave

Maternity leave is leave provided by the employer to the employee on the basis of a certificate of incapacity for work and her application.

Before calculating maternity leave (hereinafter referred to as M&R leave), you should take into account exactly when the pregnant woman will go on maternity leave.

A woman is given the right to go on such leave when she reaches 30 weeks (28 if the pregnancy is multiple). But the employee can continue to work further, refusing to register sick leave on time, while the actual number of vacation days will be reduced, since she will have to return to work from it strictly on the day calculated from 30 (28) weeks (p 57 of the order of the Ministry of Health dated November 23, 2021 No. 1089n).

Is it possible to go on maternity leave later, see here .

The basis for going on leave under the BiR will be a certificate of incapacity for work issued by the medical institution in which the woman is registered. In addition, she will need to write an application for this leave, to which she will need to attach sick leave.

The procedure for issuing sick leave is described in detail in section. VIII order No. 1089n.

For the nuances of filling out sick leave for maternity leave in 2022, see the Guide from ConsultantPlus. You can get trial access to the system materials for free by signing up for demo access.

Minor difficulties with how to calculate maternity leave will arise only in situations where there is a multiple pregnancy, or if the course of childbirth was complicated.

Let us give the terms of this type of leave specified in Art. 255 Labor Code of the Russian Federation:

- For uncomplicated singleton pregnancy and childbirth - 70 days before and after delivery, a total of 140 days.

- In case of multiple pregnancy - 84 before and 110 days after delivery, a total of 194 days.

- In case of complicated childbirth during a singleton pregnancy, postpartum leave is extended by 16 days - up to 86, for a total of 156 days.

- For pregnant women who live in the territory of a radioactive contamination zone (with the right to resettle), prenatal leave is extended to 90 days (Clause 6, Article 18 of Law No. 1244-I of May 15, 1991). This means that for such women with a singleton pregnancy the total period of leave will be 160 days (90 + 70), for complicated births - 176 days (90 + 86) and for a multiple pregnancy - 200 days (90 + 110).

ConsultantPlus experts spoke about the nuances of paying for additional leave. If you do not have access to the system, get a free trial online and proceed to the Ready Solution.

Additional payment for a pregnant woman

In addition to maternity benefits, a woman is paid a one-time benefit for early registration during pregnancy up to 12 weeks (Articles 6, 9 of Federal Law No. 81-FZ of May 19, 1995). Its size from 02/01/2021 is 708.23 rubles.

To receive benefits for registration in the early stages of pregnancy, a certificate from the antenatal clinic or other medical organization that registered the woman in the early stages of pregnancy is required (clause 22 of Order of the Ministry of Labor dated September 29, 2020 No. 668n).

About work experience

In accordance with Art. 256 of the Labor Code of the Russian Federation, a woman is also entitled to leave to care for children, also called maternity leave in everyday life. This leave is provided until the child's third birthday. The mother, who is on such leave, retains her job; for the period she is there, it is counted in the total length of service, but not more than 9 years in total (Clause 4, Article 30 of the Law “On Labor Pensions” dated December 17, 2001 No. 173-FZ).

At the same time, an employee who is on maternity leave can interrupt her vacation at any time and return to work. To provide this type of leave, a corresponding application is submitted to the employer. Also, upon application, you can go to work. At the same time, there is no prohibition on going back on vacation until the child turns 3 years old.

Read more about the differences between B&R leave and parental leave in this material .

Since 2015, with the entry into force of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, periods of maternity leave, both on sick leave associated with childbirth and bearing a child, are counted in the employee’s insurance length of service (subclause 2 p. 1 Article 12 of Law No. 400-FZ), and after his birth in connection with his care. However, in connection with care, only the first 1.5 years of care for each child and no more than 6 years in total are taken into account here (subclause 3, clause 1, article 12 of Law No. 400-FZ). And mothers who have given birth to more than 5 children or more than 2 (but in the conditions of the Far North or similar regions), subject to a number of conditions, have the right to early retirement in old age (subclause 1, 2, clause 1, article 32 of law No. 400 -FZ).

One-time benefit for the birth of a second child

The amount of a one-time benefit for the birth of a second child is determined according to the general rules for the date of birth (clause 3, part 2, article 1.3 of Federal Law No. 255-FZ):

| Date of birth of second child | Amount of one-time benefit for the birth of a second child, rub. |

| In January 2022 | 18 004,12 |

| After February 01, 2022 | 18 886,32 |

The amount of the benefit for the birth of a child increases by the regional coefficient if the employer is located in the regions of the Far North or equivalent areas and the regional coefficient is not taken into account as part of the salary (Article 5 of the Federal Law of May 19, 1995 No. 81-FZ, clause 1 of the Government Decree RF dated January 28, 2021 No. 73).

How is maternity leave calculated for a man?

There is also a practice when, according to Art. 256 of the Labor Code, it is not the mother, but the father of the child who goes on parental leave. At the same time, the calculation of parental leave in 2022 is done in exactly the same way as for the mother.

While the father is on this leave, he retains his job, work experience in his specialty continues, and the leave (with the same restrictions as for women) is counted towards the total work and insurance experience. An order is issued regarding the granting of leave, indicating the start date of the leave. The end date of the leave is the date of the child’s 3rd birthday, but it can be interrupted at any time at the request of the parent.

The only condition for the father to take the above-mentioned leave will be compliance with the requirement to provide actual care for the minor child. At the same time, the father is given the opportunity to work part-time while on vacation.

A man can go on parental leave to care for his children, even if they were not born in wedlock. The only important thing will be the presence of a record of his paternity in the child’s birth certificate.

In order for a father to be able to take leave during which he will care for his child, the employer will need to submit a package of documents including:

- application for leave;

You can learn about the nuances of filling it out from the article “Application for parental leave - form and sample” .

- a certificate from the place of work of the child’s mother stating that she is not on maternity leave and is not receiving state benefits (letter from the Federal Social Insurance Fund of the Russian Federation dated November 15, 1995 No. 07-639LR), or a certificate of similar content from the social security authority at the place of residence, if the mother is not included to the category of persons subject to compulsory social insurance in case of temporary disability and in connection with maternity;

- copy of the child's birth certificate.

When submitting a full package of documents, the employer does not have the right to refuse to provide the father with parental leave. In this case, the actual refusal can be appealed to the labor inspectorate and the court, since it will violate the rights of the parent enshrined in the Labor Code of the Russian Federation.

General calculation procedure

According to Art. 91 of the Labor Code of the Russian Federation, the administration is obliged to keep records of the time worked by each employee for the period. This is done primarily to calculate wages, including for an incomplete month worked. According to the norms of the Labor Code of the Russian Federation, labor must be paid in accordance with the time worked.

Question: The employee worked less than a full month, but at the same time exceeded the norm. Calculation based on the standard number of working hours will lead to the fact that the salary for the month in which the employee was released from work will be more than the salary for the full month. What to do? View answer

The general scheme for calculating wages for an incomplete month is presented below:

- Calculation of time worked according to the timesheet. The form of the timesheet can be unified, with a generally accepted designation of working and other days, or the form of this document developed in the organization can be used. In the latter case, the designations of working and non-working periods may differ from the generally accepted ones. To reduce the risk of error, it is recommended to consult the monthly production calendar.

- Determination of the remuneration system and calculation in accordance with the concluded employment contract. Typically, time-based, piece-rate and commission payments are used as remuneration for work. The methodology for calculating wages varies, but each time you need to take into account the factor of incomplete use of working time in the current month. We'll talk about this in more detail later.

- Taxation and deductions for less than a month. Less than a month's salary is subject to personal income tax and contributions in accordance with the general procedure. If a citizen has writs of execution, deductions for them are also made in the general manner.

Important! The amount of tax deduction for a month, for example, for a child, is fixed and cannot be recalculated according to the time worked.

An example of calculating the number of days of maternity leave in 2022

Let's give an example of how maternity leave is calculated. If a pregnant employee decides not to go on maternity leave in the 30th week because she feels well and would like to continue working, then, having taken leave 10 days before the birth, which occurred on May 21, 2022, she must return to work from leave after 70 days after birth - 07/31/2022. That is, the duration of leave under the BiR will be only 80 days.

Then this employee, having returned to work on July 31, can write an application on the same day for leave to care for the child she gave birth to. At the same time, after going on vacation, she can continue working on a part-time basis.

An example of calculating maternity leave in 2022

When calculating vacation, no less important is the issue of calculating vacation pay, because leave for employment and parental leave is paid. Let's look at how maternity leave is calculated in 2022.

Important! In 2022, maternity benefits are calculated and paid by Social Insurance. Employers do not do the calculations, but they can help the employee with the calculation so that she knows how much she is owed.

To calculate vacation pay, you will first need to determine the average daily earnings of a pregnant woman, based on accruals for the last 2 years preceding the year of vacation. To do this, the amount of her earnings received at her place of work over the last 2 years should be divided into 730 days (731 if one year in the period was a leap year or 732 days if, when replacing years, two leap years are included in the calculation - FSS information dated January 17 .2013) (clause 3.1 of article 14 of the law “On compulsory social insurance” dated December 29, 2006 No. 255-FZ). If a woman went on sick leave during these 2 years (for 15 days, for example), then from 730 (731 or 732) days the number of days absent from work due to illness should be subtracted (730 – 15 = 715).

When calculating the average daily earnings, it is important to take into account that the amount of earnings received during the year does not exceed the maximum limit of the base for calculating insurance contributions to the Social Insurance Fund. In 2022, this limit was 912,000 rubles, in 2021 - 966,000 rubles.

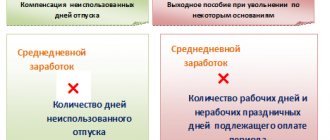

Then, to determine vacation pay, the number of vacation days should be multiplied by the average daily earnings. Formula for calculating maternity benefits in 2022:

OBR = (D2020 + D2021) / 731 × 140,

Where:

D2020 - total earnings for 2022;

D2021 - total earnings for 2022;

731 - total number of days in the billing period;

140 - the number of days of leave according to the BiR, if the pregnancy is singleton and the birth is not complicated.

The total earnings for each year should be compared with the maximum value of the base for calculating insurance premiums determined by the Government, and if earnings turn out to be higher, then the amount corresponding to the maximum base is taken for calculation. Moreover, if the total earnings for the last 2 years of work are, on the contrary, too small - less than the minimum wage multiplied by 24, then the value calculated according to the minimum wage is taken.

You can learn about the minimum wage in 2022 from this article .

The minimum amount of vacation pay (OBRmin) is calculated using the following formula:

OBRmin = minimum wage × 24 / 730 × 140;

where: minimum wage is the minimum wage in force on the day of the leave under the Labor and Labor Act.

If a pregnant woman has not worked at the enterprise for 2 years in a row before going on such leave, then all the income she received from other employers for this period, from which insurance premiums were calculated, is added up.

If a woman, before going on maternity leave, was on leave to care for her other child, then the earnings she received for the 2 years preceding going on leave for the previous pregnancy must be calculated.

If you doubt the correctness of your calculation of maternity benefits, use the advice of ConsultantPlus experts. Get trial access to the system for free and move on to the Ready-made solution.

Calculation of benefits for an incomplete month

Rarely, the benefit is issued on the 1st day of the month and ends being paid on the last day of the month. Therefore, the task arises of calculating benefits for an incomplete period.

The benefit for an incomplete period is calculated as follows: you need to multiply the benefit amount by the number of days for which it must be paid and divide by the number of calendar days in the month.

For example, the benefit was accrued in the amount of 15,000 rubles. The woman took a leave from July 11, she must be paid for 20 days. There are 31 days in July. The calculation will look like this: 15000/20/31=9677.42 rubles.

Procedure for calculating benefits for child care up to 1.5 years

While on parental leave, one of his parents (at their choice) is paid a benefit in the amount of 40% of the average daily earnings.

In 2022, to calculate the state allowance for child care per month (SURm), we will use the formula:

PURM = (D2020 + D2021) / 731 × 40% × 30.4,

where: D2020 - total earnings for 2022;

D2021 - total earnings for 2022;

731 - total number of days in the billing period (see FSS information dated January 17, 2013);

40% - absolute amount of benefit;

30.4 is the average monthly number of days.

To find out whether the B&R benefit will be subject to personal income tax, read the material “Are maternity benefits subject to personal income tax?” .

Subjects of the federation may assign additional benefits to the child’s parents. The conditions for its appointment and the procedure for payment can be found in the relevant regional regulations.

Benefit calculation examples

For clarity, we provide examples of calculations of child care benefits for children up to 1.5 years old.

Example 1. A citizen applies for parental leave in 2022. For 2022, her earnings amounted to 500 thousand rubles, for 2016 - 450 thousand rubles. The indicated values are less than the limits of 755 and 718 thousand rubles, therefore they can be taken into account in the calculations in full. Over the two years under review, the citizen was on sick leave for 34 days.

The calculation of the average daily earnings for her will look like this: (500,000 + 450,000)/ (730-34) = 1364.94 rubles. This value is less than the limit of 2022.81 rubles, so it is allowed to take it into account in full without reduction.

Finally, you can calculate the amount of child care benefits up to 1.5 years old, which will be transferred to the woman monthly. It will be: 1364.94*30.4*40%=16597.7 rubles.

Example 2. A company employee earned 986 thousand rubles in 2017, and 855 thousand rubles in 2016. These values are greater than the established limits for 2016-2017 in the amount of 718 and 755 thousand rubles, therefore only the maximum earnings values will be included in further calculations.

The employee was on sick leave for 15 days. The calculation of average daily earnings will look like this: (718000+755000)/(730-15)=2060.13 rubles. This is more than the maximum daily average earnings of 2022.81 rubles. A woman is entitled to a maximum child care allowance of 24,536.57 rubles.

Example 3. An employee gave birth to twins and wrote an application for maternity leave. In 2016, her income amounted to 98 thousand rubles, in 2022 - 150 thousand rubles. This is less than the limits. She did not use sick leave.

Average daily earnings will be calculated as (150000+211000)/730 = 339.73 rubles.

The benefit for caring for the first child will be 339.73 * 30.4 * 40% = 4131.12 rubles. This value is less than the calculated minimum wage benefit from May 2022. Therefore, for caring for the first child, a woman will receive 4465.2 rubles.

The allowance for caring for a second child will also be paid in the minimum amount, namely 8930.4 rubles. It turns out that a woman will simultaneously care for two children, so she will receive monthly (4465.2 rubles + 8930.4 rubles) = 13395.6 rubles.

Results

Maternity leave is often referred to as both labor and labor leave and leave to care for newborn children. Labor leave is granted on the basis of a certificate of incapacity for work (otherwise called sick leave) for a period of 140 to 200 days (depending on the circumstances in the form of the number of children born, the status of the mother in labor and the course of childbirth) and begins from the date of registration of the sick leave.

Sick leave can be issued no earlier than the 30th week of pregnancy (or from the 28th week for those who are expecting the birth of two or more babies). In addition, before or immediately after the BiR leave, a woman will be able to apply for her annual leave, if the time has come for it.

Leave to care for a newborn child can be taken out immediately after the end of leave under the BiR or at any other time before the child reaches 3 years of age.

Both one of the parents and their other close working relatives who are actually caring for the child can go on such leave. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.