Employees who combine work and study may go on study leave. This right is provided for by labor legislation.

Latest materials here:

Study leave: what an employer needs to know

Read in the berator “Practical Encyclopedia of an Accountant”

How to book a vacation

When is study leave granted without pay?

Only the organization that is the employee’s “main place of work” is obligated to provide study leave (Article 287 of the Labor Code of the Russian Federation). When a person works part-time in a company, the employer is obliged to release him for a session only if there are appropriate conditions in the contract (employment or collective).

Study leave cannot coincide with other leaves. For example, if an employee is on parental leave, then in order to receive educational leave, he will have to interrupt it.

By analogy, the issue of annual leave is resolved. In this case, study leave can be added to the annual leave. In this case, among other things, the employee will be required to apply for leave. An employee cannot demand a combination of two vacations; such a long absence from the workplace is possible only with the consent of the employer.

If an employee studies in two educational institutions at once, guarantees and compensation are provided only in connection with studies in one of them. The choice of educational institution in this case remains with the employee.

Attention

Please note that an employee who has gone on study leave cannot be deprived of the right to annual paid leave.

Study leave is granted in calendar days. In this case, non-working holidays that fall during vacation are included in the calculation of time. They are paid as regular calendar days.

Unlike annual study leave, it cannot be extended. Moreover, even if an employee falls ill during vacation: the period of illness that coincides with the vacation is not paid. But if the employee has not recovered after the end of the vacation, then starting from the day when he was supposed to return to work, he is accrued temporary disability benefits.

Also, once a year the employer is obliged to pay travel (round trip) to an educational institution for an employee who is studying in the correspondence department. In this case, the employee must study at a university or secondary vocational educational institution.

Travel for studying at a university is paid in full, in an institution of secondary vocational education - 50 percent of the cost of travel.

What the law says

Problem: a student has the right to work in his free time from studying. However, studies do not adapt to the needs of the student and can change their intensity (especially during the session). At the same time, the employer expects all employees to comply with the work schedule. How can a student combine work and study?

The Labor Code of the Russian Federation states that the employer is obliged to release the employee from work for the period of passing the session and final certification. To exercise this right, the student must be educated at an educational institution with state accreditation.

If a student needs to take a study leave, he or she can safely leave. At the same time, his job is preserved. As for maintaining wages during study leave, this is always at the discretion of the employer.

In some cases, a student at an unaccredited university may be able to receive legal student leave. For example, if this is specified in the collective/employment agreement

"Study leave to care for a child"

Providing guaranteed study leave is also possible when a parent is on parental leave. To avoid being on two leaves at the same time, a parent has the right to interrupt care leave for the period of the session, complete the study leave and then continue care leave.

The requirement to go to work to complete this procedure and work any days is illegal. It is enough to notify the employer in advance with two free-form statements.

The first statement: “Please consider June 15, 2016 to be the last day of parental leave, and from June 16, provide me with my workplace in accordance with Article 256 of the Labor Code of the Russian Federation.”

Second statement: “I request that you grant me study leave from June 16, 2016 for 40 calendar days in accordance with the attached summons certificate.”

At the end of the study leave - the third statement: “In accordance with Article 256 of the Labor Code of the Russian Federation, I ask you to grant me leave to care for a child up to 3 years old from July 25, 2016.”

If you are unsure of the employer’s adequate response, it is advisable to submit applications in two copies, and the second copies should bear an acceptance mark. It is better to send documents by mail in a valuable letter with a list of attachments.

When can an employer pay for study leave?

Is study leave paid if you study part-time? To answer this question, it is important to know how many days of study leave are paid per year. Respite from work is provided to a part-time student in the following cases:

- a first-year student is absent from the session for no more than 40 days a year;

- a middle and senior student is absent from the session for no more than 50 days a year;

- a graduate student is absent from the final year to prepare for and pass state exams for no more than 4 months.

If a student needs to be absent for more days, it must be borne in mind that the employer is not obliged to pay for them.

Sick leave pay during study leave

If an employee falls ill while on study leave, this does not affect payment for study leave. The employer does not have the right to withhold accrued money. If an employee falls ill during study leave, it may be extended. The employee must contact the educational institution with an application to extend study leave during illness. The educational institution will issue the employee a new summons certificate with different start and end dates for educational leave. The total duration does not increase. The employee will submit a new challenge certificate to the HR department. Based on this, the company will issue him the rest of his educational leave. Temporary disability benefits for sick days are not paid based on paragraphs. 1 tsp. 1 tbsp. 9 of the Federal Law of December 29, 2006 No. 255-FZ and subparagraph “a” of clause 17 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375. If the employee continues to be ill after the end of the study leave, then he has the right to benefits with the day he was supposed to go to work.

When an employer does not pay for study leave

The issue of payment worries not only part-time students, but also full-time students. Full-time students do not have the right to legal compensation for wages during study leave. However, the employer, at its discretion, can encourage them.

But the employer is obliged to provide leave to a full-time student if:

- the session lasts no longer than 15 days a year;

- state exams last no longer than 1 month;

- Preparation for the defense of the diploma takes no more than 4 months.

If an applicant (who is not yet studying) wants to take a study leave, the employer is obliged to allocate 15 days for admission to pass the entrance exams. Leave is provided without pay.

Calculation and payment of study leave

In order for study leave to be paid, certain conditions must be met:

- the employee receives this education for the first time;

- the employer himself sent his employee for training;

- the form of training must be part-time or part-time;

- the educational institution has the appropriate accreditation.

An employee can receive education:

- at the university;

- at evening school or gymnasium;

- in a technical school or college;

- at school.

How study leave is paid at work: rules for processing payment according to the labor code

Having a student ID is not a basis for granting study leave. The main evidence for the employer is a summons certificate from a higher educational institution, which will indicate the data of the university, as well as the expected period of absence of the employee.

Also, the student, along with the summons certificate, submits an application addressed to the director.

Sample letter of invitation for student study leave:

This certificate is filled out by university employees for the student to provide at the place of work.

Based on this document, an employee of the HR department is preparing an order in the T-6 form for signature by the director. There are several nuances here that will help you prepare the document correctly:

- choose point B, since we are not talking about the main vacation, but about an additional one - educational;

- do not fill out the period of work - regardless of length of service, everyone is entitled to social security;

- if the employer plans to maintain the salary plan for the period of study leave, this will not affect the main annual leave.

Sample order T-6 for granting study leave:

The employer must create such an order. You can do it yourself only if you have a part-time job at your main place of work.

Vacation for the session

Paid leave is provided to employees who study part-time or part-time at universities and secondary vocational education institutions. Also, regardless of the form of education - in institutions of primary vocational education and evening general education institutions.

The Labor Code establishes specific terms for study leave, which the employer is obliged to pay to the employee. The duration depends on the level of the educational institution (see Table 1).

Table 1. Duration of paid leave

| Justification for leave | Type of education | |||

| Higher | Secondary vocational | Primary Evening vocational school | ||

| Passing the session in the 1st and 2nd courses | 40 calendar days | 30 calendar days | – | – |

| Passing the session in the 3rd and subsequent courses | 50 calendar days | 40 calendar days | – | – |

| Passing state exams | 1 month | 1 month | – | – |

| Defense of the diploma and passing state exams | 4 months | 2 months | – | – |

| Exams | – | – | 30 calendar days during the year | – |

| Passing final exams in IX grade | – | – | – | 9 calendar days |

| Passing final exams in XI (XII) grade | – | – | – | 22 calendar days |

However, at the discretion of the employer, these periods may be extended. The relevant remarks must be contained in the employment or collective agreement.

Article 173 of the Labor Code does not stipulate special rules for paying for study leave. In this regard, you should refer to the legal requirements for paying annual leave.

Thus, the employer is obliged to pay for study leave in full no later than three days before its start.

Also, the employer does not have the right to withhold the amount of vacation pay from the salary if the employee does not pass the exam. Since the basis for granting study leave is a summons certificate, it is admission to passing the exam and confirmation of the student employee’s successful studies. Consequently, the payment of vacation pay does not depend in any way on the results of the last exam.

How to pay for study holidays

The calculation of student leave days includes both holidays and other days. Payment for them is received, just like for working days.

At the request of the employee, it is possible to divide such leave into parts. According to the Labor Code, the employer does not have the right to recall an employee from study leave.

The employer’s attempts to replace study leave with payments of equivalent or any other funds are completely outside the scope of the law. The fact is that this period is guaranteed to the employee by law as time to obtain an education.

If an employee receives secondary education, his main employer is obliged to pay him half the cost of travel to the place of study and a return ticket once a year. If this is a higher education, then 100% of the round trip fare is paid.

Providing study leave for part-time study

According to the law, paid student leave for a citizen studying by correspondence is possible only if the following conditions are met:

- This is the first time a person has received an education of this level.

- The educational institution has state accreditation.

Article 173 of the Labor Code of the Russian Federation states that when a citizen is studying at a university, his employer must provide the employee with the following conditions:

- For the first two courses, 40 days of training are paid.

- In all subsequent courses, payment is made for 50 days of vacation taken to pass the session.

- When passing state accreditation and passing a thesis, an employee can go on paid leave for up to 4 months.

In addition, the employer must provide the employee with the opportunity to receive 15 days of paid leave to complete:

- Entrance tests.

- Final tests.

In addition, at the legislative level, other benefits are defined that an employee undergoing training in the evening department can count on.

These include:

- A week before the start of the final assessment, the employee can work on a reduced schedule. According to labor legislation, there may be a reduction of up to 7 hours per week. The use of this opportunity appears 10 months before the start of the final tests.

- If the parties manage to reach an agreement on the previous issue, then for this period of time the employee also has the right to claim one non-working day per week.

- During the period of release from performing his official duties, the employee must receive 50 percent of his average earnings, but not less than the minimum wage.

If training is carried out in another city, then once a year the employer must pay for travel to the place of study and back. However, it is prohibited to withdraw insurance premiums from such amounts.

Procedure for paying study leave for part-time students

A student who needs to go to his educational institution to take midterm exams or final certification must first fill out an application addressed to his immediate employer.

This document should contain the following information:

- Position, full name of the manager.

- Full name of the organization.

- Position and full name of the applicant.

- A description of the reason why the employee needs to take student leave. Additionally, it is necessary to attach a summons certificate to the application to confirm that the session is being held officially, this is not a debt collection, and the employee has the right to receive payment for this period of time.

- Signature of the applicant, date of application.

Having received such an application, the HR specialist draws up an order to provide the employee with time to study. By law, payment of compensation for this period of time must be made 3 days before the first day of vacation.

Only 1 part of the certificate must be submitted along with the application. The second is transferred to the employer only after the end of the session, as confirmation that the student attended the exams and did not take a vacation in vain.

Calculation of average earnings during study leave

The average salary for the time an employee is on study leave should be paid on time. A common question: “Are study leave paid 3 days before the leave, just like regular leave?” Let me explain. The law does not indicate how many days before the start of the vacation the average salary should be paid to the employee (do not confuse it with the annual basic paid vacation!).

The employee must receive average earnings before the start of study leave. Please note that it is wrong to pay the average salary after the employee brings a confirmation certificate.

You may have another question: what to do if the employee did not bring a confirmation certificate? In this case, reversal entries should be made in accounting for the amount of average earnings paid to the employee before the start of the vacation.

Carefully read Chapter 26 of the Labor Code of the Russian Federation, as this chapter has undergone changes due to the entry into force of the new Law on Education.

Under what conditions is study leave granted?

An employee can count on study leave if he is receiving education at this level for the first time. For example, if an employee has already received a higher education and is receiving a second higher education, then according to the Labor Code he is not entitled to leave during the sessions. But everything changes if the employee is sent to receive education by the employer and a student agreement is concluded on this occasion or the conditions of study are stipulated in the employment contract. In this case, the employer may provide paid study leave.

If a student works in two companies, then guarantees and compensation are provided to him only in one - at the employee’s choice. If he needs to take leave from his second job in order to go to a session or prepare for the final state certification, then he can only count on agreements with management and unpaid leave.

One more nuance: the Labor Code provides for vacations for those students who study in institutions with state accreditation. Accreditation must be confirmed in a summons certificate sent to the working student by his university or college. In accordance with the rules, study leave can be granted upon presentation of a certificate of summons from an educational institution. The certificate should include:

- Accreditation registration number.

- Date of issue of accreditation.

- The body that issued the state accreditation certificate.

If the institution does not have state accreditation, then a working student can count on compensation only by establishing a collective agreement or employment contract.

Reduced working hours

In addition to the right to study leave, an employee who combines work with study is provided with other guarantees.

Thus, an employee receiving higher or secondary vocational education through correspondence and part-time forms of study for a period of up to 10 academic months before the start of the state final certification has the right to reduce the working week by seven hours. This time is paid in the amount of 50 percent of average earnings, but not lower than the minimum wage. In this case, an agreement must be concluded between the employer and the employee, which indicates how the working time will be reduced: one day off from work per week or a reduction in working hours during the week.

When receiving education under highly qualified personnel training programs, the employee has the right to one day off from work per week, which is paid in the amount of 50 percent of the salary received. Also, the employer, at its discretion, can reduce the working week by two days for an employee who is studying in a training program for highly qualified personnel in his final year (correspondence department). This time is not paid.

If an employee receives basic or secondary general education through part-time study, then during the academic year he has the right to reduce the working week by one working day or by the corresponding number of working hours (if the working day is reduced during the week). In this case, it is also necessary to conclude an agreement that will determine the method of reducing working hours. Payment for these hours is made in the amount of 50 percent of average earnings, but not lower than the minimum wage.

Step-by-step procedure for calculating payment for student leave

Calculation of student leave is carried out on the basis of an order in the following order:

- establishing a billing period;

- calculation of total earnings for the selected period;

- identifying months partially worked and counting days worked;

- determination of the total number of days (calendar);

- calculation of average daily earnings;

- accrual of vacation pay for school weekends.

According to general standards, the calculation period is 12 months preceding the month of registration of student leave.

Example:

If the session begins in September 2022, then the accountant makes all calculations for the period from September 2022 to August 2019.

The calculation base includes the employee’s salary and additional incentive payments for actual time worked, regulated by the remuneration system.

But not all payments are included in the base.

The following payments are not taken into account in average earnings:

- social benefits (maternity, sick leave);

- payment for business trips;

- vacation pay;

- other accruals based on average earnings upon release from labor functions;

- material aid;

- compensation for food and travel, cellular communications.

We recommend reading: how to arrange a study leave?

Formulas for determining average earnings

Compared to last year, the algorithm for calculating study leave has not changed; it is similar to the procedure for calculating vacation pay for annual leave. The employee's average income for one day is taken as a basis. Funds for study leave are paid for each day of rest, including weekends (holidays).

General formula for calculation:

Vacation pay for study leave = SD * n,

where: SD - average daily earnings, n - number of days of student leave.

The average salary per day is calculated using the formula:

SD = Base / RD

where: Base - payments in favor of the employee for the previous 12 months, RD - number of days worked for the selected period.

The base includes: wages, additional payments for length of service, allowances for special working conditions, bonuses based on work results.

Formula for calculating days worked:

RD = 29.3 * months. + slave/cd * 29.3, where:

- months — the entire number of months worked;

- slave - the number of days worked in an incomplete month;

- kd - calendar days in partial months.

If there are several partial months in the billing period, then the days worked are calculated separately for each. The month in which there was a business trip, sick leave, vacation, maternity leave, absenteeism, or downtime is considered incomplete.

Example for 2022

Initial data:

An employee of Svoboda LLC, S.N. Kozlov, who is a first-year student at an accredited university through correspondence education, is sent to the session from June 24, 2022 for 21 days.

For the previous 12 months (from June 1, 2022 to May 31, 2019), he was accrued 425,000 rubles, which, in addition to salary, included:

- vacation pay - 18,000 rubles;

- sick leave benefit - 8,500 rubles;

- financial assistance - 10,000 rubles,

- travel compensation - 3000 rubles,

- one-time bonus on the occasion of the employee’s anniversary - 5,000 rubles.

The leave was issued in July 2022 for 14 calendar days from the 9th, a certificate of incapacity for work was issued in February 2022 for 7 days from February 11.

During the billing period, only 10 months or 293 days (10 * 29.3) were fully worked.

Calculation:

Calculation base = 425000 - 18000 - 8500 - 10000 - 3000 - 5000 = 380500.

The number of days worked for July 2022 is 16.07 = (29.3 / 31 days * (31 - 14 days), and for February 2022 - 21.98 = (29.3 / 28 days × (28 days - 7 days)).

The total number of days worked in the billing period is 331.05 = 293+16.07+21.98.

SD = 380500 / 331.05 = 1149.37.

Vacation pay to the student was accrued in the amount of 1149.37 * 14 days = 16091.18.

If an employee, by agreement with management, leaves for a session this year after working for less than 1 month, then payment for educational leave is calculated based on the time actually worked.

Example, if worked less than 1 month

Store administrator of Onyx LLC Potapov S.L. was hired on June 3, 2019 with a salary of 25,000 rubles.

From June 24, in accordance with the summons certificate, the student is sent to 14-day training, and he is issued a study leave at work.

Guided by clause 7 of the Regulations (Resolution No. 922), the accountant takes the accrual amount for days worked in June 2022 to calculate the average income for calculating educational leave.

For June 2022, the salary accrual amounted to 25,000 / 20 * 15 = 18,750 rubles.

The duration of the work period for calculating vacation pay was 21 (calendar days from June 3 to June 23) / 30 * 29.3 = 20.51.)

Average daily earnings = 18750 / 20.51 = 914.19.

Amount of vacation pay = 914.19 * 14 days. = 12798.66.

Example of calculating study leave

Let us give an example of accrual of vacation pay for study leave. A company employee is studying in the 1st year of correspondence education at a higher educational institution, which has state accreditation for this area of training. The employee provided the HR department with a summons certificate for the session for a period of 15 days. Over the previous 12 months, the employee’s salary amounted to 234,756 rubles. The accounting department calculated the average earnings per day for the previous 12 months: 234,756 / (12 x 29.3) = 667.67 rubles. The resulting average wage per day is multiplied by the number of days provided for study leave (15). In this case, the amount of vacation pay for study leave will be: 667.67 x 15 = 10,015.05 rubles.

When to pay for vacation

In cases where a citizen can prove that he is receiving additional education, the enterprise in which his main work activity takes place must provide him with leave to undergo testing. This could be exams, a diploma, a session, etc.

During study leave, the subordinate receives exactly the same earnings as during regular vacation days. But sometimes the employer has every right during such a period not to keep his salary. This occurs when a full-time employee:

- passes entrance exams, final testing at the preparatory department, intermediate certification, passes state exams, prepares for and conducts a diploma defense (higher education);

- passes entrance exams, passes intermediate and final state certification (secondary vocational education).

In other cases, the employee can count on receiving his salary on all vacation days.

Regarding leave without pay, such leave for educational purposes is also provided for by law. As the name suggests, he is not entitled to a salary on days when the subordinate does not appear at the workplace. Meanwhile, his job is guaranteed to be retained.

There is a rule: graduation certificates are issued three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). But when an employee provides a summons certificate only a day before the planned vacation, the accounting department is obliged to arrange payments as soon as possible.

The employee brings the second part of the certificate to the accounting department after completing the training tests. Keep in mind: if an organization tries to delay payments until a certificate of passing exams is received, this is a direct violation of the law. The employer will not only be required to pay vacation pay, but will also be fined.

How many days of study leave are paid per year?

The number of paid study leave days per year varies depending on the place and direction of study, as well as some additional factors:

- University students, when passing intermediate certification in the 1st or 2nd year, receive 40 days of paid leave, in senior courses - 50 days when studying in the evening or part-time department;

- for postgraduate studies in the correspondence department – up to 30 calendar days;

- in accordance with the individual curriculum when passing state certification - up to 4 months. Training is carried out via correspondence or evening courses.

When receiving a second higher education, study leave is not provided. However, the conditions of such leave can be separately discussed personally with the employer.

Registration procedure

The registration procedure is very similar to that for a regular annual holiday.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

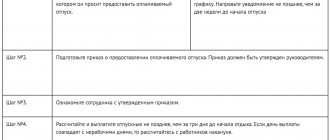

Let's consider what steps must be taken to properly design it:

| The employee must write and submit to the employer an application for additional study leave and payment for it. | It is better to do this in advance, i.e. no less than 15 days before the start of training. It is important not to forget that traveling to an educational institution may also require some time. |

| HR department employees accept and register vacation applications | After this, they will have to prepare an order and submit it to the manager for signature. The employee himself must be familiar with the completed order and sign it. When all formalities are completed, it must be filed in a personal file. |

| Based on the order, a corresponding note is made in the employee’s personal card | The HR department also fills out its own part of the calculation note in the T-60 form |

| The half completed T-60 form is sent to the accounting department | Which makes the calculation and fills out its part of the document |

| No later than 3 days before the start of the vacation, the employee is paid the required accruals | They can be transferred to a card or issued in cash |

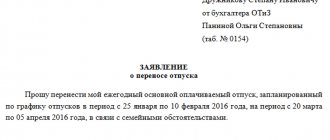

Application writing sample

An employee can prepare an application for study leave entirely independently. There are no strict forms for this document.

But preparing on your own may take extra time, which could be used to greater advantage.

In this situation, it is better to take as a basis a ready-made sample application, which you can use as a ready-made template, i.e. simply replace all the data with your own and indicate the correct information about the employer.

How to reflect in accounting and tax accounting

Employers must include vacation pay amounts as part of labor costs in tax accounting. It does not matter whether a general or simplified taxation system is used.

Personal income tax must also be withheld from this amount and transferred to the budget, and the employer must also pay insurance contributions on it.

In accounting you will need to make the following entries:

| Calculation of average earnings for the period of study leave | Debit account 20 – Credit account 70 |

| Calculation of insurance premiums | Debit 20 – Credit 69 |

| Withholding personal income tax | Debit 70 – Credit 68 |

| Payment of vacation pay | Debit 70 – Credit 50 (or 51) |

It should be taken into account that instead of account 20, other accounts can be debited (23, 25, 26, etc.), but always the same as when paying salaries.