New forms for the Social Insurance Fund

The transition to direct benefit payments occurred at the beginning of the year, and the documents were approved in May.

| We remind you that the Direct Payments Project previously operated as an experiment in 77 regions since 2011. From January 1, 2021, all constituent entities of the Russian Federation switched to a new mechanism for paying out insurance coverage. |

Some of the accepted forms have already been used previously on the basis of FSS order No. 578 dated November 24, 2017 in pilot regions. With the transition to direct payments in 2022 in all regions, new forms for the Social Insurance Fund were approved for use throughout the Russian Federation. The order approves 11 forms previously used in the pilot, and 3 new ones:

- information about the insured person;

- on recalculation of previously assigned benefits;

- on reimbursement of costs for measures to reduce injuries at work.

New registers for payment of benefits have been approved:

- for temporary disability, for labor and employment, for pregnant employees with early registration in the consultation;

- one-time benefit for the birth of a child;

- monthly for child care up to one and a half years.

| Note! Registers are filled in when transmitting information for a certain type of payment via electronic channels . |

These documents must be completed by the employer to pay benefits to employees.

New forms of FSS forms can be downloaded at the end of the article.

general information

The form was approved and put into operation by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The form was mandatory until the end of 2012. Since 2013, all unified forms have become only recommended for use (information from the Ministry of Finance No. PZ-10/2012). Organizations now have a choice of which forms to use when completing any actions: developed in-house for personal convenience or unified.

When choosing your forms, you must take into account that a number of mandatory details must always be present on the primary documents. There are only 7 of them, and they are listed in Part 2 of Art. 9 Federal Law No. 402. In addition, when choosing any of the options, management must remember to approve its choice in the company's accounting policies.

For your information! Unified forms have not lost their relevance. They are used in the organization’s work to avoid questions from inspection bodies that are accustomed to the “old” models.

What benefits does the Social Insurance Fund pay and what benefits does the employer pay?

Not all benefits under the new rules are paid directly from the Social Insurance Fund; some of them are calculated and paid by the employer.

The employer is obliged to send supporting documents to the Fund no later than 5 days after receiving them from the employee. List of benefits paid by the Social Insurance Fund:

- on sick leave (from the 4th day);

- according to BiR;

- one-time payment to women who registered with medical institutions early;

- one-time payment at the birth of a child;

- monthly child care up to 1.5 years old;

- on sick leave (work accident or occupational disease) starting from the 1st day.

These benefits are paid by the employer:

- the first three days of sick leave;

- extra days off to care for a disabled child;

- for the funeral of a family member of a deceased employee.

This also includes the costs of preventing injuries at work.

The social insurance fund can reimburse these expenses based on the employer's application.

Changes in interaction with the Social Insurance Fund from 2022

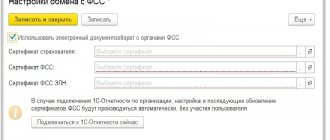

From 2022, all sick leave will become only electronic (the abandonment of the paper version of sick leave certificates should be completely completed during 2022). Also, sick leave will become proactive. This means that sick leave payment will be calculated automatically upon the closure of sick leave due to temporary disability or the issuance of maternity leave.

Benefits will be transferred to:

- to the bank account of the insured person specified in the application or in the personal account on the State Services portal;

- via mail or other organization of the insured's choice.

However, there should be no charge for banking services.

They further minimize the participation of the employer-insurer in the process. Automatic calculation of payments and data exchange between the Social Insurance Fund and other government agencies (for example, the Federal Tax Service) will allow Fund employees to receive data for calculating benefits without constantly contacting the employer. The employer will need to once transfer to the FSS the employee’s INN, SNILS, and current account, to which he will receive the benefit (or another method of receipt chosen by the employee). Then the FSS will request data only if it does not receive it through its channels.

The policyholder will be required to send the necessary documents and information to the FSS of Russia within 3 working days. Benefits will be paid within 10 working days from the date of receipt of complete information.

What documents must the employer submit to the Social Insurance Fund?

Despite the fact that payments are made directly from the fund to the employee’s card, they are paid on the basis of documents transferred to the fund by the employer.

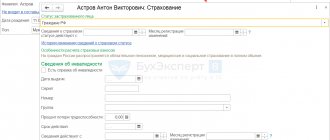

| Note! The employee no longer writes the application; it has been cancelled. In all cases, “Information about the insured person” - Appendix 2 to Order No. 26 - is filled out and submitted. The document must be completed and submitted only once. Resubmission is allowed if the employee's details have changed. |

The list of other documents depends on what the disability is related to:

- list of submitted documents - Appendix 3 to Order No. 26 sick leave;

- a copy of the work book to confirm the insurance record (or a copy of the T-2 with the completed insurance record);

- application for changing years in the billing period (if necessary);

- certificate 182n (about the amount of earnings received in the billing period from another employer);

- register of information - Appendix 15 to the Order when transmitting data in electronic form.

Download the table of the list of documents for the Social Insurance Fund depending on the type of payment.

| Let us remind you The form of information transfer depends on the number of employees. If there are more than 25, the information is transmitted electronically. The paper originals remain with the employer in case of inspection. |

How to request a reconciliation report with the Social Insurance Fund

It is worth noting that the application form as such is not established by law. Important parameters of the appeal are the details of the business entity, the account number of the reconciliation report and the date of the appeal. According to current legislation, a government agency has 5 days to respond to a written initiative to provide information for verification.

An alternative option for contacting regulatory authorities is to use the capabilities of telecommunication channels. The response from the fund may come in the form of a certificate with data on contributions already accrued, as well as fines.

Form 21-FSS RF

A unified reporting form put into effect by order of the Social Insurance Fund number 457 in 2016. The current version of the document includes details of accruals for debt or arrears of insurance premiums, penalties, fines, as well as outstanding payments.

There are three columns for reconciliation. The first is for information provided by the policyholder, the second is for data in the fund’s database, and the third is for clarifying discrepancies.

Most often the form is filled out by hand, but can be reproduced using software.

Application and letter

The application to the FSS should reflect the following points:

- Information about who the request is being sent to (territorial representation);

- Detailed information about who is sending the appeal;

- Document details, date, contacts. The request is signed by the head of the enterprise;

- Formulation of the request.

Sample application

Receiving the form

The application form can be downloaded on the official website of the fund, take the document to fill out at the territorial representative office, or download it for free here. Industry-wide form of form 22-FSS.

Subjects of the request

Either party can submit an application for reconciliation between legal entities. It would be more correct to first request a certificate of the status of settlements, check all accruals on the spot, and only then request the act itself.

Process

Advanced accountants today actively use telecommunications. Communication with fund representatives can be established through your personal account after registration.

If a government department has five days to respond to a written request, they usually respond via electronic communication channels on the next business day. This way you can save both time and money on the exchange of correspondence.

Mistakes made by employers when creating registers for the Social Insurance Fund

Order No. 26 approved document forms for the new rules for payment of benefits, which the Social Insurance Fund will send to the employer in case of incorrect filling out of the forms:

- notifications about the submission of missing documents are sent - if not all documents are provided for calculation and payment;

- on making corrections to the certificate of incapacity for work - if violations of the issuance procedure are identified;

- decisions to refuse to assign and pay benefits for temporary disability - if the grant of benefits is refused;

- decisions to refuse to consider documents (information) - if there is a delay in sending documents to the Social Insurance Fund and there is no confirmation of a valid reason for the delay.

The FSS indicated the most common errors in submitted documents - employers.

In 2022, the fund will have the right to conduct an unscheduled on-site inspection of the policyholder:

1. If a complaint is received that the employer did not provide the necessary information and documents to assign benefits.

2. Government agencies, local authorities, as well as extra-budgetary funds will not confirm the information provided by the employer. The basis for this is clause “c”, clause 10, article 1, clause 8, art. 3 No. 126-FZ, which comes into force on January 1, 2022.

Nuances of direct payments important for the employer

In connection with the introduction of direct payments of FSS benefits, the work procedure of policyholders has changed. Let's note some important nuances:

- Do not forget that the first 3 days of illness are financed by the employer. In this matter, direct payments to the Social Insurance Fund did not bring any changes.

- The procedure for calculating benefits has not changed.

- Mandatory insurance premiums for temporary disability and in connection with maternity are paid in full. It is no longer possible to reduce them by the amount of benefits. This also applies to benefits that the Social Insurance Fund still reimburses to the employer.

- The procedure for filling out reports regarding the reflection of insurance premiums has changed. In the calculation of contributions (DAM), the lines responsible for expenses (line 070 of Appendix 2) and compensation from the Social Insurance Fund (line 080 of Appendix 2) are not filled in. This also applies to benefits that the Social Insurance Fund reimburses: they are not reflected in the reporting. Line 080 can only include those reimbursements that came from the Social Insurance Fund for previous periods (until 2021).

We explained how to fill out the calculation of insurance premiums in 2022 in the article “DAM for the 1st quarter of 2021”

For failure to provide information to the Social Insurance Fund for the purpose of granting benefits, an official may be subject to a fine of 300 to 500 rubles (clause 4 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). If, based on incorrect information from the policyholder, the Fund transfers an excess amount of benefits, it is subject to return by the policyholder.

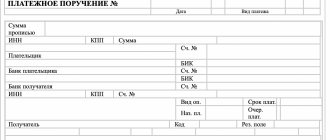

Application to the Social Insurance Fund for reconciliation of calculations: structure of the document

As a guideline when forming this application, you can use any similar document, for example, an application form on the status of settlements with the Federal Tax Service of the Russian Federation for taxes. The corresponding document is given in Appendix No. 8 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

The application, which can be drawn up on the basis of a form developed by the Federal Tax Service, reflects:

- information about the recipient of the document - the territorial representative office of the Social Insurance Fund;

- information about the payer of contributions (registration number in the Social Insurance Fund, code of subordination, address, INN, KPP);

- wording reflecting the essence of the request on behalf of the manager);

- date of document preparation, signature of the head of the company, contact details of the requester.

The legislation does not regulate the period within which the FSS must respond to the application. But taking into account the fact that within 10 days from the moment of detection of overpayments on insurance premiums, the fund is obliged to inform payers about this (clause 3 of Article 26 of Law No. 212-FZ), it is legitimate to expect a response from the Social Insurance Fund on the application under consideration within a comparable time frame.

The FSS response is drawn up in the form of a statement of reconciliation of calculations, which is drawn up in the form approved in Appendix No. 1 to the FSS order No. 49 dated February 17, 2015.

The Social Insurance Fund issues a reconciliation report for insurance premiums in the form approved by the Social Insurance Fund by order No. 49 dated February 17, 2015. It includes contributions for maternity and injuries. Therefore, dealing with payments to the Social Security Fund is quite simple.

Immediately after submitting the reports, you should clarify the balance of contributions and, if necessary, offset or return the overpayment. To receive a reconciliation report for insurance premium payments to the Social Insurance Fund

(Form 21-FSS), you must write an application to your fund department. The form of such an application is free.

For a sample of filling out a reconciliation report for insurance premium payments, see below.