Any employee performing his work duties under a formal contract has the right to leave and can independently decide how to use it within the framework established by law. If an employee does not use the period of official leave as intended, he can count on compensation in monetary terms. The main thing is to comply with the conditions dictated by the law and know the established procedure.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

189 lawyers on RTIGER.com can help with this issue

Solve the issue >

In what cases is compensation for vacation provided without dismissal?

According to the Labor Code, each employee who has worked for the company for 1 year is entitled to at least 28 days of paid leave annually.

But in practice, few workers, especially in medium-sized and large companies, manage to take all 28 days off in a year. There can be many reasons: there was no desire, the manager did not let me go due to high workload, etc. For all possible reasons, the consequences are the same. Art. 126 of the Labor Code of the Russian Federation allows the company, instead of vacation days that the employee does not want to use, to pay him monetary compensation.

IMPORTANT! In Art. 126 of the Labor Code of the Russian Federation enshrines the right of the company’s management, and not the obligation, so the final decision on the issue in any case will remain with the organization.

However, the company does not always have the right to accommodate an employee who wants to receive money in exchange for certain vacation days. The Labor Code of the Russian Federation establishes a special list of persons who must be provided with leave, and not compensation replacing it. Such persons include (Article 126 of the Labor Code of the Russian Federation):

- pregnant women;

- minors (under 18 years of age);

- persons who work in conditions considered harmful or dangerous;

- employees who were exposed to radiation as a result of the accident at the Chernobyl nuclear power plant (letter of the Ministry of Labor of the Russian Federation dated March 26, 2014 No. 13-7/B-234).

NOTE! For persons working in harmful or dangerous conditions, one exception is established: only the minimum additional leave, which is 7 days, cannot be replaced with a cash payment. This means that if, for example, an employee has the right by law to 10 days of additional leave, then only instead of 3 days of such leave can money be paid.

If the employee does not fall into any of the listed categories, the company may, at his request, replace the vacation with a cash payment.

But the following is important here: you can pay money only in lieu of those days that exceed the 28 days of vacation that an employee is entitled to per year. This rule applies to vacation for each year separately. The parts of vacation not taken for different years in the amount of no more than 28 days are not summed up for the purpose of calculating compensation.

A situation similar to the above is when an employee decides to quit without taking the full vacation allotted to him. Can he then count on compensation?

For more details, see the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation .

Example

The employee did not take advantage of vacation during 2022; he had 28 days left. In 2022, a similar situation repeated itself. Neither in 2020 nor in 2022 did the total number of vacation days for an employee exceed (calculated separately for each year) 28 days. Therefore, the employee cannot count on replacing the 2020-2021 vacation with a cash payment.

The question arises: in what cases can one demand compensation for vacation left over from past years of work in the company? Only if the employee has the right to extended or additional leave (for example, disabled workers, etc.).

IMPORTANT! Even if the employing company is not obliged to provide increased leave to an employee due to the direct requirements of the Labor Code of the Russian Federation, it has the right to do this independently by securing such leave in the local regulatory legal acts (for example, upon reaching a certain number of years of work experience in the company, the employee’s leave increases by some amount of days).

How is part of the annual paid leave compensated?

Art. 126 of the Labor Code regulates whether additional leave can be replaced with monetary compensation upon written application. This is allowed for the part that has exceeded 28 days. This includes increased vacation time and additional days provided. The following categories of workers have the right to apply for them:

- pedagogical;

- working disabled people;

- with a working day exceeding 8 hours;

- with hazardous/harmful production factors;

- in the territories of the Far North;

- civil servants.

The Labor Code of the Russian Federation gives the employer the opportunity to set his own vacation days, when this is not provided for by the code, taking into account the production and budgetary capabilities of the enterprise, taking into account the opinion of the trade union. In these cases, replacing additional leave with monetary compensation is also possible.

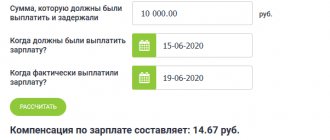

How is compensation for vacation without dismissal calculated in 2021?

The Labor Code of the Russian Federation does not indicate what specific amount of compensation a company must pay to an employee for each day of non-vacation, but establishes a calculation method.

As in the case of payment for the remaining days of vacation upon dismissal in our situation, if the employee does not leave the company, compensation is also calculated based on data on the specialist’s earnings on average for 1 working day:

Kneotg.otp. = Kzam.day.. × SRZP,

Where:

Kneotg.otp. — amount of monetary compensation;

Kzam.dn.. - the number of vacation days in lieu of which money will be paid;

SRWP is the average salary of an employee for 1 working day.

The greatest difficulties in practice are caused by the calculation of the employee’s average earnings per day for the purposes of this compensation. It is determined by the formula:

SRZP = salary accrual. / Heap days,

Where:

Salary accrual - the total amount of payments (salary, bonuses, etc.) that the employer accrued to the employee for the period under review;

Heap days — the number of days (calendar) that are taken into account when calculating the average salary of an employee for 1 working day.

At the same time, the number of days that are involved in calculating the average daily salary of an employee, for example, for 2022, is calculated differently for full and part-time months of work:

- if the months are fully worked out, then Kuch.days. is taken to be equal to the number of months of work multiplied by 29.3 (the average number of calendar days in a month);

- if some months of 2022 are not fully worked, then they are taken in proportion (the ratio of the number of days in a month during which the employee actually performed his official duties to the total number of days in such a month). And then this proportion for each month not fully worked is multiplied, as in the case of a full month, by 29.3.

ConsultantPlus experts explained in detail how to reflect the income of an employee who was paid compensation instead of additional leave in form 6-NDFL. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Payment of unused vacation upon dismissal

Upon dismissal, the employee is paid monetary compensation for all unused vacations.

The right to receive compensation for unused vacation does not depend on the reason for the employee’s dismissal. Her employer is obliged to pay the employee on the day of dismissal.

Compensation is not paid if the employee does not work the days for which he was granted leave. In such a situation, the amount of vacation pay that falls on unworked vacation days is withheld from the employee’s salary.

Read in the berator “Practical Encyclopedia of an Accountant”

Compensation for unused vacation upon dismissal

Tax consequences of paying compensation for leave without dismissal

Cash payments instead of unused vacation days are undoubtedly payments related to the existence of an employment relationship between the company and the specialist.

As a general rule, all payments from an employer to an employee are subject to personal income tax. The Tax Code of the Russian Federation contains special exceptions in this part: a list of payments not subject to personal income tax. The compensation in question is not mentioned among them. Consequently, personal income tax will have to be charged (paragraph 6, 7, paragraph 3, article 217 of the Tax Code of the Russian Federation).

In addition, the corresponding amount of insurance contributions should be added to the amount of compensation to working employees for unused vacation days (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation, clause 2, clause 1, article 20.2 of Law No. 125-FZ).

But the situation with income tax is better: the amount of such compensation can be taken into account in expenses, since this is provided for in clause 8 of Art. 255 Tax Code of the Russian Federation. However, it must be taken into account that only a part of the annual paid leave exceeding 28 calendar days can be taken into account in expenses (letters of the Ministry of Finance of the Russian Federation dated January 24, 2014 No. 03-03-07/2516, dated November 1, 2013 No. 03-03-06/1 /46713).

When you cannot replace vacation with compensation

It is prohibited to pay compensation instead of basic leave before dismissal. Days of additional or extended vacation cannot be replaced with compensation for employees of the following categories:

- pregnant women;

- minors. That is, employees who have not reached 18 years of age;

- those who are engaged in hard work and work with hazardous working conditions. It is permissible to replace additional leave for harmful or dangerous working conditions with compensation only to the extent that it exceeds seven calendar days. At the same time, the procedure, size and conditions for such replacement are established in industry or intersectoral agreements or in a collective agreement (Article 117 of the Labor Code of the Russian Federation).

Such restrictions are established in paragraph 3 of Article 126 of the Labor Code of the Russian Federation. Separate restrictions are provided for employees:

- customs authorities (clause 2 of article 35 of the Law of July 21, 1997 No. 114-FZ);

- drug control authorities (clause 16 of the Instructions, approved by order of the Federal Drug Control Service of Russia dated October 2, 2008 No. 323);

- internal affairs bodies (Part 3 of Article 45 of the Regulations, approved by Resolution of the Supreme Council of the Russian Federation of December 23, 1992 No. 4202-1);

- other government agencies, if this is directly established by internal orders or legislation.

Replacement of vacation with monetary compensation

Along with understanding the methodology for calculating the amount of monetary compensation in lieu of leave, as well as the tax consequences of its payment, the company must clearly understand what basic steps need to be taken in order to pay such compensation to an employee.

Often employees take the rest of their vacation and quit immediately after.

For more information on this, see Art. “How to properly arrange leave followed by dismissal?” .

First, it is necessary for the employee to contact the employer with a corresponding application.

After the application is received, the company's management must decide whether to provide compensation or not.

If it was decided to replace unused vacation with a certain amount of money, then the organization should then generate a corresponding order in any form.

IMPORTANT! Such an order must necessarily indicate information about the employee, the number of vacation days that the employer intends to compensate in money, as well as a reference to the basis for payment of such compensation (the corresponding statement from the employee).

Next, you should not forget to reflect the fact of replacing unused vacation days with a cash payment in the employee’s personal card (Form No. T-2). In particular, in section VIII “Vacation” of such a card, it is necessary to indicate the basis (for example, additional leave) for providing compensation, and also refer to the completed order of the manager for this employee.

After which, the fact of replacing vacation with a cash payment must be recorded in the vacation schedule in order to prevent confusion in the future. In the schedule, as a note (column 10), you need to indicate how many days were compensated with money, and also provide details of the manager’s order.

Find out how to prepare personnel documents in case of replacing vacation with monetary compensation in ConsultantPlus. Get free demo access to K+ and go to the HR guide to find out all the details of this procedure.

For more information on how to draw up such a vacation schedule, see the article “Vacation schedule - form and sample for filling out in 2022” .

How to correctly submit an application for compensation for unused vacation?

An employee who wishes to receive a certain amount of money in lieu of unused vacation may have questions, in particular, regarding the application for such compensation. How to compose it? Are there any statutory requirements for the application?

Neither the Labor Code of the Russian Federation nor Russian legislation on accounting impose special requirements for an employee’s application. It is only important that such a statement be written in the name of the head of the organization. The rest, including the form and content of the application, can be anything at the discretion of the employee.

You can find a completed sample application for vacation compensation on our website.

Results

Thus, it is important for employees in 2022 to remember that if they have more than 28 days of vacation left in 2022, then they can ask the employer to pay monetary compensation instead of these days. The employer needs to know that paying such compensation is his right, not his obligation. In addition, some groups of people (for example, pregnant women) cannot replace vacation with cash payments.

It is also important to understand that the payment of such compensation will be subject to personal income tax and insurance contributions, but the legislator allows it to be taken into account in income tax expenses. It is equally important for the employer to remember how to correctly calculate the amount of such compensation and document its payment (by order of the manager based on the employee’s application).

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.