Bidding is one of the effective forms of concluding transactions, which guarantees maximum transparency and maximum benefit for both parties. This applies to both organizers and participants. In some cases, an agreement can only be concluded through participation in the procurement procedure through bidding, for example, if we are talking about buyers: municipal unitary enterprises, government agencies, state corporations.

Modern trading is conducted in a convenient electronic form on online electronic platforms. There is no need to leave the office to track trades and their results. The company's accountant first of all faces the question of how to take into account the amounts that ensure participation in an electronic trading procedure: an auction or competition.

What is the procedure to take part in an electronic auction held under Law No. 44-FZ?

Electronic trading and its support

Civil Code of the Russian Federation, in particular Art. 447-1, allows you to conclude a purchase and sale agreement, a lease agreement, a contract agreement, and the provision of services at auction. Bidding with the participation of government organizations and municipal unitary enterprises is regulated by Federal Law No. 44 of 04/05/2013 and a number of other regulations.

Bidding in the form of an auction assumes that the highest bidder will win, and bidding begins with the initial minimum price specified in the advertisement. Auction participants gradually increase the price of the lot until a winner is identified. The auction, organized as a competition, is won by the participant who offers the best conditions. The advertisement indicates the maximum possible price. The competition is held with the participation of a competition commission formed in advance. Participants in the competition present individual projects to the commission, and the most economical and creative one is selected.

The application participating in the auction must be secured. The security amount for the auction organizer is a guarantee of participation in them. The amount of the amount is determined by the organizer.

Competitions and auctions are provided (according to the text of Federal Law No. 44, Article 44):

- bank guarantee;

- in cash.

When trading on an electronic platform, the participant’s personal account and the funds on it are blocked. As part of government procurement, according to Federal Law No. 44, special accounts are opened not on an electronic platform, but in a bank. The list of banks is determined by Government Decree No. 1451-r dated 07/13/18.

The return of the security amount occurs in the following cases:

- based on the results of the competition or auction, the participant is not recognized as the winner;

- the auction was canceled on the initiative of the controlling authority or the organizer;

- the participant decided not to participate in them, or was withdrawn from the auction, or turned out to be the only supplier, for example, during a government procurement.

If the participant is recognized as the winner of the auction, but refuses to enter into the contract that was the subject of the auction, the security payment will not be returned.

Question: A Kazakhstan organization provides a Russian organization with the opportunity to participate in electronic trading. Do these services refer to services in electronic form in accordance with Art. 174.2 of the Tax Code of the Russian Federation? Does a Russian organization have obligations as a tax agent for VAT? View answer

When conducting auctions, it does not matter who makes the deposit for a potential participant

On May 15, the Supreme Court of the Russian Federation issued Ruling No. 310-ES19-26858 in the case of challenging the decision of the antimonopoly authority, which issued an order to the municipality for preventing a bidder from participating in the auction, for which a deposit was made by a third party.

OFAS and the courts disagreed on who could be admitted to the auction

In 2022, the administration of the municipal formation of the Yambirskoye rural settlement of the Shchatsky municipal district of the Ryazan region organized bidding in the form of an open auction for the lease of a number of agricultural land plots. According to the terms of the auction, the bidder had to transfer the deposit in non-cash form to the bank account of the auction organizer no later than 11 a.m. on December 14.

By the specified deadline, the administration received applications from two citizens for lot No. 1, but the organizer allowed only Alexander Chernyshov to participate in the auction, since the deposit for Viktor Merkushkin was transferred by another person. Subsequently, the auction commission declared the auction invalid and decided to enter into a lease agreement for the land plot in Lot No. 1 with the only auction participant.

Viktor Merkushkin appealed the administration’s actions to the FAS Office for the Ryazan Region, which revealed a violation by the auction organizer of clauses 3 and 8 of Art. 39.12 Land Code. OFAS considered that the administration’s refusal to allow Viktor Merkushkin to participate in the auction was made without taking into account the provisions of Art. 182, 448 of the Civil Code. According to the antimonopoly authority, establishing the obligation of bidders to pay a deposit does not exclude the possibility of it being paid by a third party instead of the auction participant. As a result, the municipality received an order to cancel the protocol for considering applications for participation in the open auction for Lot No. 1 and to post information about this on its official website. In addition, the municipality was ordered to notify the participants who submitted applications for participation in the auction for Lot No. 1 of such a decision, reconsider them and conduct the auction in the manner prescribed by law.

In turn, Alexander Chernyshov challenged the decision of the regional OFAS in the arbitration court. The first and second instances satisfied his request. They interpreted the provisions of the auction documentation in such a way that the deposit must be made directly by the auction participant, since the auction rules did not provide otherwise. At the same time, the courts took into account the interests of the administration acting on behalf of a public legal entity represented by the owner of land plots, arising from the need to determine a solvent land user.

Subsequently, the district court upheld the judicial acts of the lower authorities, noting that in the case under consideration, the terms of the auction did not prohibit the payment of a deposit by a third party for the bidder, but the literal content of paragraph 5 of Art. 448 of the Civil Code of the Russian Federation allows us to conclude that the legal relationship between the auction organizer and the auction participant regarding the deposit, offset and return of the deposit is formed exclusively between them, which excludes the participation of third parties in such relations.

At the same time, the cassation indicated that the regulation of relations arising when making a deposit is subject to the general rules of civil law, since auctions by virtue of Art. 447 of the Civil Code of the Russian Federation are a form of concluding an agreement. At the same time, based on Art. 380 of the Civil Code of the Russian Federation, the payment of a deposit by a third party must be accompanied by an appropriate agreement providing for specific conditions for its payment. The district court added that, when making the contested decision, the antimonopoly authority did not indicate by virtue of what provisions of the law it considered the deposit agreement to be concluded in the absence of the will of the auction organizer, who did not directly provide for the possibility of making a deposit for the applicant by third parties. This circumstance, in the opinion of the district court, excluded the possibility of considering the condition of a written form of the deposit agreement to be met in the presence of only one-sided documents (an application from the applicant indicating that a deposit was made for him by a third party and the fact that it was transferred to the account of the auction organizer).

Referring in the cassation appeal to significant violations of substantive law, the antimonopoly authority appealed to the Supreme Court.

The Supreme Court did not agree with the lower courts

After studying the materials of case No. A54-263/2019, the Judicial Collegium for Economic Disputes of the Supreme Court recalled that Art. 313 of the Civil Code of the Russian Federation allows for the fulfillment of an obligation by a third party and recognizes such fulfillment as proper. The relevant judicial practice (in particular, the Ruling of the Supreme Court of the Russian Federation of June 16, 2016 No. 302-ES16-2049) proceeds from the fact that the above article is aimed, among other things, at expanding the mechanisms for the creditor to receive the performance due to him under the obligation (that is, under essentially, to protect the rights of the creditor).

“At the same time, the law does not give a bona fide creditor, who has no material interest either in studying the relations that have developed between a third party and the debtor, or in establishing the motives that prompted the debtor to entrust the fulfillment of his obligation to another person, with the authority to verify whether the debtor actually entrusted the fulfillment obligations to a third party. Consequently, performance by a bona fide creditor who accepted as due from the debtor what was offered by a third party cannot be considered improper if the creditor did not know and could not know that the fulfillment of the obligation was not assigned to the person who provided the performance and the rights and legitimate interests were not violated by the performance debtor (Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 28, 2010 No. 7945/10, dated July 15, 2014 No. 3856/14),” the Supreme Court indicated.

As the Court explained, in the case under consideration, neither the Land Code nor Art. 448 of the Civil Code of the Russian Federation, which establishes the procedure for conducting auctions, does not contain a prohibition on the fulfillment of the obligation to make a deposit by a third party. In addition, such a prohibition does not follow from the content of the obligation to make a deposit. According to paragraph 1 of Art. 380 of the Civil Code of the Russian Federation and clause 21 of Art. 39.12 of the Land Code of the Russian Federation, the deposit to a certain extent ensures the fulfillment of the obligation, allowing the creditor (the owner of the land plot) to count the amount received by him towards the fulfillment of the obligation in the event of a delay on the part of the debtor in the future when executing the contract. Accordingly, what matters to the creditor is the fact of receiving a deposit, through which his property interests can be satisfied in the future, and not the identity of the person making the deposit.

Thus, the execution carried out in accordance with Art. 313 of the Civil Code of the Russian Federation is recognized as appropriate, and, therefore, the payment of a deposit by a third party cannot serve as a basis for refusing to allow a person to participate in the auction. In the case under consideration, the courts found that the deposit was received by the administration in full and there was no reason to believe that a third party mistakenly transferred the deposit to the administration’s account, without intending to fulfill the obligation for Viktor Merkushkin.

The Supreme Court added that there is no evidence in the case that the fulfillment of the obligation to make a deposit by a third party for a bidder violated the rights and legitimate interests of the administration. The presence of an interest in the municipality, acting on behalf of the owner of the land plots, in determining a solvent land user based on the results of the auction could serve as a basis for refusing his admission to participate in the auction, if the behavior of the latter indicated his intention to obtain the right to lease a land plot without consideration.

“However, the mere fact that the bidder does not have the funds necessary to pay the deposit at the time of the auction cannot serve as a basis for concluding that he is dishonest, since it does not mean that he will not be able to pay rent in the future based on the income he receives and taking into account the value of other property belonging to such participant. On the contrary, making a deposit directly by a bidder does not eliminate the risk that in the future this bidder, who has become the winner of the bid, will not lose the opportunity to fulfill his obligations, especially in a situation where the land lease period is significant, amounting to 49 years, as provided for in the auction documentation in the present case,” the Supreme Court noted in its ruling. Thus, he overturned the judicial acts of the lower authorities and refused to satisfy the complaint of Alexander Chernyshov to invalidate the decision of the antimonopoly authority.

AG experts had mixed views on the definition

You & Partners partner Evgenia Zusman believes that the legal position given in the definition diverges from the previously adopted Ruling of the Supreme Court of December 8, 2016 No. 14-APG16-18 on a similar issue.

“In the case that formed the earlier position of the Supreme Court of the Russian Federation, the plaintiff petitioned to have the norm of the administrative regulations of the Department of Property and Land Relations of the Voronezh Region declared invalid. In his opinion, the specified administrative regulations, by their meaning, implied the possibility of paying a deposit for participation in the auction only by the applicant personally, which violated his right to participate in the auction in the event of a temporary lack of a current account or funds. Then the Supreme Court, with reference to clauses 18, 21 of Art. 39.11, paragraph 7, 11, 21 art. 39.12 of the RF Land Code rejected the plaintiff’s petition. The operative part of the ruling of the RF Armed Forces reflected the position that imposing directly on the auction participants the obligation to make a deposit is aimed at determining the solvency of the applicant and the seriousness of his intentions,” she noted.

The expert noted that the Supreme Court has now come to the conclusion that what matters to the creditor is the fact of receiving a deposit, through which his property interests can be satisfied in the future, and not the identity of the person making the deposit. “At the same time, the Supreme Court noted that the mere lack of funds from the bidder directly necessary to pay the deposit at the time of the auction cannot serve as a basis for concluding that he was dishonest, since it does not mean that he will not be able to pay rent in the future based on the income he receives and taking into account the value of other property owned by such participant. Moreover, the Court comes to the conclusion that in lease legal relations for a period of 49 years, the requirement for a deposit and its execution personally by the tenderer, on the contrary, can negatively affect the solvency of the person. This statement seems controversial and, in my opinion, may negatively affect law enforcement practice,” the lawyer is convinced.

Evgenia Zusman added that in general she adheres to the conservative position previously stated by the RF Supreme Court on the personal payment of the deposit by the tender participant. “Of course, the purpose of the lender receiving a deposit is economic; at the same time, a deposit is a way to verify the solvency of the tender participant. In this context, the identity of the person paying the deposit is important. In addition, if you agree with the position on the possibility of making a deposit by a third party, it is necessary to establish in the competition documentation the requirements for processing the payment of a deposit by a third party,” she noted.

According to the expert, now in practice controversial situations may arise related to the withdrawal of the deposit by the person who made it, the assignment of the deposit to a specific participant in the procedure, and the return of the deposit. “There may also be a risk of a claim to conclude a contract by a third party who paid the deposit, on the basis of Art. 380 Civil Code of the Russian Federation. Taking into account the adopted definition of the Supreme Court, I would not recommend that auction organizers establish a ban on the payment of a deposit by a third party in order to minimize the likelihood of an appeal against the results of the auction by a participant suspended from participation in the auction,” summed up Evgenia Zusman.

Lawyer of the Moscow AP Alina Emelyanova believes that the position set out in the commented ruling of the RF Armed Forces is not new. “The courts have previously followed the approach according to which, in the absence of an indication in the competition documentation of the need to make a deposit directly (personally) by the applicants, the deposit can be made by third parties on the basis of Art. 380, 313 of the Civil Code (see, for example, Ruling of the Supreme Court of the Russian Federation No. 308-ES15-13667 of October 23, 2015, Resolution of the Moscow District Arbitration Court of November 30, 2017 in case No. A40-34429/2017). One should agree with the conclusion that what matters for the creditor is the fact of receiving a deposit, through which his property interests can be satisfied in the future, and not the identity of the person making the deposit, however, the justification for this conclusion of the RF Armed Forces does not seem indisputable,” – she noted.

According to the expert, on the one hand, the Supreme Court of the Russian Federation refers to the admissibility of fulfillment of an obligation by a third party on the basis of Art. 313 Civil Code, clause 1, art. 380 of the Civil Code and the absence of a ban on the fulfillment of the obligation to make a deposit by a third party (Article 448 of the Civil Code). On the other hand, he ignores the imperative provisions of paragraph 2 of Art. 380 of the Civil Code, according to which the agreement on the deposit, regardless of the amount of the deposit, must be made in writing, this is what the lower courts referred to in justifying the judicial acts issued. Since the Court did not provide an explanation for this argument, a situation has arisen in which the Supreme Court, recognizing the payment made by an applicant for participation in the auction as a classic deposit (clause 1 of Article 380 of the Civil Code), rejects the argument about the mandatory written form of the deposit agreement,” noted Alina Emelyanova.

The lawyer believes that the main problem is that the legal nature of the payment made by the applicant for participation in the auction is of a special nature, different from the legal nature of the classic deposit. “In science, there is still no consensus on what constitutes a payment called a deposit, within the meaning of Art. 448 of the Civil Code,” the expert indicated. At the same time, she also recalled the position of the Supreme Court from Determination No. 14-APG16-18.

Alina Emelyanova is convinced that the payment made by the applicant for participation in the auction cannot be subject to the rules of Art. 380 of the Civil Code on the classic deposit, and therefore the rules for the written form of the deposit agreement are not applicable to it. “However, such a payment is of an obligatory nature; the identity of the person making such a payment does not matter to the creditor, and therefore the provisions of Art. 313 Civil Code. Unfortunately, in the judicial act, the highest authority avoided discussing what constitutes a payment made by a future bidder (Article 448 of the Civil Code), whether it is possible to apply the provisions of the classic deposit to it (Article 380 of the Civil Code), whether it can have the importance for the auction organizer is the identity of the person making the payment in accordance with clause 5 of Art. 448 of the Civil Code, taking into account the specifics of relations related to the holding of auctions,” the lawyer summarized.

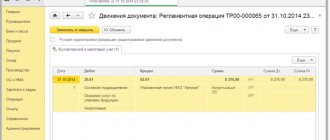

Accounting for security payments

Security payments are reflected in accounting using account 76, to which it is recommended to open a “purchases” subaccount. The collateral amount is simultaneously reflected in off-balance sheet account 009. Expenses for using the electronic platform can be reflected in accounts 20, 26, 44, etc.

Postings:

- Dt 76 Kt 51 - security payment transferred.

- Dt 009 - the amount of security is fixed.

- Dt 51 Kt 76 - security deposit returned.

- Kt 009 - the security amount has been written off.

If special bank accounts are used when recording security payments, it is advisable to generate transactions involving account 55. Many organizations participating in electronic trading use this BU account when working directly with the personal account of the electronic platform.

Postings:

- Dt 55-sv. Kt 51 - transfer of funds to a special account (personal account).

- Dt 55-bl. Kt 55-sv - blocking of funds in the amount of the security deposit on the application.

- Dt 009 - the amount of security is fixed.

- Dt 55-sv Kt 55-bl. — the security deposit is unblocked.

- Kt 009 - the security amount has been written off.

- Dt 51 Kt 55 - funds were transferred to the current account.

Sub-accounts “electronic platform”, “trading”, etc. can be opened for account 55. When creating internal transactions, blocked funds and free funds are separated using sub-accounts.

If the winner does not want to fulfill his duties and avoids concluding an agreement, the monetary security is transferred to the customer - Dt 91-2 Kt 55 (76). In this case, if there was a bank guarantee, internal posting is made Dt 76 (customer) Kt 76 (bank) - the debt is repaid by the bank, and then the winner pays it: Dt 76 (bank) Kt 51.

Tariffs TEK-Torg

ETP "TEK-Torg" has defined the following conditions for participation in procurement:

| Charge Condition | Commission amounts, in rubles. |

| Signing of a government contract at the end of bidding under 44-FZ, including from the participant who evaded. | 1% of NMCC, but not more than 5000. VAT is not assessed. |

| Signing of a government contract at the end of bidding under 44-FZ with restrictions for SMP and SONKO. | 1% of NMCC, but not more than 2000. Including VAT. |

IMPORTANT!

For procurements 223-FZ, which were carried out with restrictions for SMEs, the updated fee for participation in the electronic procedure will be charged from 03/24/2021.

| Procurement Section | |

| PJSC NK Rosneft, Inter RAO, general | |

| Tariff name | Commission |

| Procedure for SMEs only | 1% of the NMC, but not more than 4500 (excluding VAT). |

Costs of providing electronic trading

In a broad sense, ensuring participation in bidding on electronic platforms is not limited only to the security payment as such. The company bears the necessary costs, without which participation in the auction is impossible. They must be reflected correctly in accounting, also guided by the norms of the Tax Code of the Russian Federation.

Let's look at the most common correspondence accounts. Services of an electronic platform as costs associated with the preparation of tenders can be deducted for VAT for tax purposes if there is an invoice and the provisions of Art. 172 of the Tax Code of the Russian Federation. Based on bank documents, acts and invoices from the electronic operator, accounting entries are made:

- Dt 76 (60) Kt 55 – the electronic platform withdrew the amount for services.

- Dt 26 (20, 44, etc.) Kt 76 (60) – amount of electronic services. sites (excluding VAT).

- Dt 19 Kt 76 (60) – VAT is recorded on the amount of electronic services. sites.

For income tax purposes, organizers classify such expenses as other expenses related to production and sales, by type (Article 264 of the Tax Code of the Russian Federation). An entry is made in the BU : Dt 91-2 Kt 60 (76) .

A bank guarantee, as one of the types of tender security, is of a paid nature. The commission is reflected by postings:

- Dt 91-2 Kt 76 (60) – fixed bank commission.

- Dt 76 (60) Kt 51 – bank commission paid from the current account.

On a note! Making a security payment is not taken into account for tax purposes, in income and expenses in calculating the base for income tax, VAT until the winner is determined. Then he can receive a VAT deduction if the amount is an advance payment (payment) for participation in the competition and the subject of the auction was the conclusion of an agreement. A similar principle applies when calculating income tax.

The acquisition of digital signature is reflected according to Dt 97, from the credit of accounts payable to suppliers. In this case, the media, disk, if it is highlighted in the documentation, is immediately written off as expenses - Dt 20,26, 44, etc. Kt 60 (76). The electronic key, certificate, and the cost of warranty service are written off evenly over the entire period that the key will be used (usually a year) - Dt 20,26,44, etc. Kt 97.

How to take into account for tax purposes under the simplified tax system the costs of remuneration for the operator of the auction and electronic trading platform and payment for services for documentary support of participation in procurement?

Main

- Accounting for the opportunity to participate in electronic trading and deposits is carried out on account 76 or on account 55, using subaccounts.

- The use of account 55 is exceptional when it comes to government procurement in accordance with Federal Law No. 44.

- To strengthen control over the movement of funds, use off-balance sheet account 009.

- Other costs that ensure participation in trading are taken into account by standard accounting entries, in accordance with the recommendations for the use of the Chart of Accounts, taking into account the provisions of the Tax Code of the Russian Federation.

- Accounting entries depend on the stage at which the application is located, the results of the auction, and the form of securing participation in it.

Tariffs for gas stations of the Republic of Tajikistan

From 04/01/2021 on the ETP AGZ RT the following platform commission for winning under 44-FZ has been determined:

| What do participants pay for? | How much interest do auctions take, in % and rubles. |

| Conclusion of a government contract based on the results of a tender within the framework of 44-FZ, including from the participant who evaded. | 1% of NMCC, but not more than 5000. Excluding VAT. |

| Conclusion of a contract after procurement from a single supplier in electronic form under Part 12 of Art. 93 44-FZ, if the NMCC is more than 100,000 rubles. | 1% of NMCC, but not more than 5000. Excluding VAT. |

| Conclusion of a contract after procurement from a single supplier in electronic form under Part 12 of Art. 93 44-FZ, if the NMCC is less than 100,000 rubles. | 0 % |

| Conclusion of a contract based on the results of procedures among SONCOs under 44-FZ. | 1% of NMCC, but not more than 2000. Including VAT. |

| Signing an agreement based on the results of a tender with restrictions for SMEs under 223-FZ. | 1% of NMCC, but not more than 5000. Excluding VAT. |

How to take into account payment for participation in electronic trading under the simplified tax system

Expert recommendation For profit tax purposes, the economic feasibility of expenses for participation in tenders is obvious not only to entrepreneurs, but also to tax authorities. Therefore, they recognize that, regardless of the results, the organization’s expenses associated with participation in competitive bidding that are lost can be recognized for profit tax purposes as part of non-operating expenses if they are incurred in connection with the fulfillment of the requirements imposed by the bidding organizers on the bidding participants, and are not returned to them if they lose. In the event that the auction organizers return the amounts paid by the bidders for participation in the tender, such amounts from the participant are included in non-operating income (Letters of the Ministry of Finance of Russia dated January 16, 2021 N 03-03-06/1/7, dated November 7, 2021 N 03- 11-04/2/109, dated 10/31/2021 N 03-03-02/121).

However, this position is relevant only for income tax payers. For organizations using the simplified tax system, the tax authorities refuse to take into account these expenses, due to the fact that the list of expenses taken into account when calculating the tax base for the tax paid under the simplified tax system is presented in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation and is closed, and this type of expenses, such as expenses associated with participation in auctions, is not provided for by current legislation. This opinion is presented, in particular, in Letters of the Ministry of Finance dated 07/02/2021 N 03-11-04/2/173 and dated 05/13/2021 N 03-11-06/2/85.

Participation in trading transactions

• The Ministry of Finance in its letters dated 12/07/2021 N 03-11-05/317, dated 08/08/2021 N 03-11-11/39673 indicates that the costs of the electronic signature key for bidding, the security payment for the application, the costs associated with information support for bidding, for an electronic digital signature certificate for bidding, cannot be taken into account as part of expenses under the simplified tax system. Since these costs are not included in the list approved by paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, which is closed.

The amount of money contributed by a participant in placing an order to secure an application for participation in the auction (it must be returned by the customer in certain cases specified by law) from an accounting point of view is not an expense of the organization, as follows from clause 2 of PBU 10/99, therefore For this amount, an entry is made Dt 76 Kt51. At the same time, in the context of trading, an entry is made to the off-balance sheet account 009

The company is a competitor at the auction: accounting and taxes

In order to correctly reflect transactions related to participation in tenders for a competing company, it is necessary to clearly differentiate all arising payments and obligations. After all, they have a different nature and, accordingly, should be reflected differently.

Most often, companies become bidders in the form of a competition or auction if they want to become participants in the placement of orders within the framework of the requirements of the Federal Law of July 21, 2021 N 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for government and municipal needs” with the aim of subsequently concluding a state or municipal contract (with state bodies, management bodies of state extra-budgetary funds, with local governments or with government institutions and other recipients of budgetary funds) or a civil contract with a budgetary institution. In accordance with Law No. 94-FZ, customers do not have the right to charge participants a fee for participation in competitions and auctions, with the exception of fees for providing tender documentation in established cases. In particular, customers do not have any obligations to pay the cost of services for placing orders of a specialized organization, which it provides to a state or municipal customer on a contractual basis (Letter of the Ministry of Economic Development of Russia dated September 15, 2021 N D28-376). However, the customer and the authorized body may establish a requirement to deposit funds as security for an application for participation in a tender or auction, and then such a requirement applies equally to all participants in the placement of the relevant order and is indicated in the tender documentation or in the auction documentation. The participant can independently choose one of the following security methods: - irrevocable bank guarantee issued by a bank or other credit institution; — guarantee agreement; — transfer of funds to the customer as collateral (including in the form of a contribution or deposit). Security is not required to be provided only if the winner of the competition or auction - or the participant with whom the contract is concluded - is a budgetary institution. If the winner of a competition or auction (as well as the “second in line” participant in the event of the winner’s refusal) avoids concluding a contract, the funds contributed by him as security for the application for participation in the competition are not returned. In other cases, for example, if the customer refused to hold a competition or auction, if the application was received late (after the end of their acceptance), if the participant was not allowed to participate in the competition or auction or did not become a winner, the security amount must be returned to him. Refunds are also made after concluding a contract with the winning participant (or, if he refused, with the participant who was assigned the second number following the results of the competition or who made the penultimate offer on the contract price at the auction).

Bidding: costs of participation in them

Even if there is one seller and one buyer, during bargaining there is a kind of competition between them to establish a favorable price or other conditions for the sale of goods. Moreover, as noted above, the obligation to conduct public auctions in certain cases is provided for by law (for example, #M12291 901941785 Federal Law of July 21, 2021 N 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs " #S ).

But the fact is that the List of expenses taken into account when determining the tax base by taxpayers applying the simplified tax system and choosing income reduced by the amount of expenses as an object of taxation is established #M12293 0 901765862 0 0 0 0 0 0 0 398263088 clause 1 of Art. 346.16 Tax Code of the Russian Federation #S.

Expenses for participation in open electronic auctions

Note that an electronic signature is a requisite of an electronic document, intended to protect this electronic document from forgery, obtained as a result of cryptographic transformation of information using the private key of an electronic digital signature and allowing to identify the owner of the signature key certificate, as well as to establish the absence of distortion of information in the electronic document ( Article 3 of the Federal Law of January 10, 2021 N 1-FZ “On Electronic Digital Signature”).

Topic: Postings for provision in competitions

We mainly do repairs and maintenance. We mainly use 20 counts. Can it be transferred to it? Money was withdrawn from the additional account for signing the contract. (AST Sberbank - 3000.00). If I understand correctly, then should I attribute their act to the 20th count? Thanks for understanding.

Dt 55 - Kt 51 ... 100000 :: money transferred to the electronic platform Dt 76 - Kt 55 ... 60000 :: part of the money was reserved as a security payment to the customer (deposit) Dt 91 - Kt 55 ... 3000 :: commission for the electronic platform was removed