Dismissal at the initiative of the employee

An application for dismissal on the initiative of an employee (at his own request) does not imply approval by the employer and is of a notification nature. However, Article 80 of the Labor Code of the Russian Federation, which regulates the procedure for terminating an employment contract at the initiative of an employee, provides for compliance with certain rules by both the employee and the employer.

Note

The article does not discuss dismissal at the initiative of the employer.

As a general rule, an employee must notify the employer in writing of his dismissal no later than 2 weeks in advance. The two-week period begins on the day after the date the employer receives the application. The specified two-week period includes non-working days.

Please be aware of statutory exceptions. For example, dismissal during the probationary period: in this case, it is enough to notify the employer just 3 days before dismissal. If the head of an organization resigns, notice of dismissal must be given one month in advance.

By agreement between the employee and the employer, the period before dismissal can be shortened or extended by indicating the corresponding date in the resignation letter.

On the day of dismissal, the employer should complete all documents and issue the final payment to the employee (Article 140 of the Labor Code of the Russian Federation). If the last day of a two-week period falls on a non-working day, then the end of the period is considered to be the next working day following it (Article 14 of the Labor Code of the Russian Federation).

The law does not oblige an employee to be at the workplace during the period before dismissal. The Labor Code does not contain such a thing as “working two weeks before dismissal.” Part 1 of Article 80 of the Labor Code of the Russian Federation states the need to warn the employer in writing at least 2 weeks before dismissal.

An employee may go on vacation (according to a schedule or in agreement with management), be on sick leave, etc. In this case, the specified period is not extended and is provided to the employer to select a replacement for the resigning employee. The employee should be dismissed on the day agreed with the employer and specified in the application at his own request.

| 1C:ITS For more information on dismissal at the initiative of an employee, see the section “Consultations on Legislation”. |

Final settlement

In addition to determining the amount of “vacation” compensation, it is necessary to make a number of calculations and calculations. It all depends on the terms of the employment contract or agreement on its termination, as well as the presence in the company’s internal local acts of reference to compensation, severance pay or other “dismissal” payments.

First of all, you will need to calculate the salary for the days worked, and then make all the necessary deductions to obtain the final settlement amount issued to the employee in connection with his dismissal.

How to calculate salary upon dismissal, read here.

In addition, it is necessary to take into account that labor legislation protects the interests of the employee in a situation of dismissal, providing for the need to pay severance pay.

IMPORTANT! If an employee resigns due to the closure of a company or staff reduction, Art. 178 of the Labor Code of the Russian Federation obliges the employer to pay him severance pay in the amount of the average monthly salary. Find out how to calculate the amount of severance pay here . In addition, this article provides for cases of maintaining the employee’s average monthly earnings during the second (if he brings evidence that he is not yet employed) and third (by decision of the employment service) months after dismissal.

In some cases (for example, an employee is called up for military service), severance pay will have to be paid in the amount of two weeks' average earnings (Articles 77, 83, 178 of the Labor Code of the Russian Federation).

When making a final settlement with a resigning employee, it is necessary to take into account all benefits and compensations due to him (both under labor legislation and those provided for in the employment contract and internal company regulations).

Employee's right to leave

When planning dismissal, an employee can exercise the right to leave. An employee is entitled to paid leave for each year worked. An employee’s working year begins from the moment he is hired, and not from January 1 (Rostrud letter No. 854-6-1 dated June 14, 2012).

At the same time, the right to use vacation for the first year of work arises for the employee after 6 months of continuous work with this employer (Article 122 of the Labor Code of the Russian Federation). This means that if after 6 months of work (provided that this entire period is included in the length of service giving the right to basic leave), an employee applies for leave, then there are no grounds for refusal (letter of Rostrud dated February 27, 2013 No. 155- 6-1). After 6 months of work, the employee has the right to receive the entire annual basic paid leave (for the working year).

By agreement of the parties and based on the employee’s application, the employer may grant leave earlier, before the expiration of the six-month period. Before the expiration of 6 months of continuous work, paid leave must be provided (at the request of the employee):

- for women - before maternity leave or immediately after it;

- employees under the age of 18, etc.

The Labor Code does not provide for the provision of leave in proportion to the time worked in a given working year (in kind). In accordance with the vacation schedule, vacation for the second and subsequent working years can also be granted in full in the first month of the working year.

An employee may request more leave than is required based on the time actually worked during the working year as of the date of the application. The employer has no legal grounds for refusing to provide such leave. But the employer is not obliged to provide more days than the employee is entitled to under the Labor Code of the Russian Federation until the end of the current working year.

| 1C:ITS For more information on the calculation of length of service giving the right to annual basic paid leave, see the section “Legislative Consultations”. |

Results

The procedure for registering leave with subsequent dismissal is initiated by the employee’s application, followed by orders for leave and termination of the employment contract.

An integral stage of this event is the calculation of “vacation” compensation and other payments and deductions. The process is completed by issuing the resigning employee a set of documents (work book, certificates, etc.).

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Vacation granted, but not worked out

In practice, it is quite common for an employee to go on vacation for the next working year without having earned it yet.

For example, an employee has been working since May 12, 2018. In 2022, he fully used 28 days of allotted vacation for the working year 05/12/2018-05/11/2019. The next scheduled vacation is scheduled for June 2022. Regarding the working year 05/12/2019-05/11/2020, this will be leave provided in advance. An employer cannot refuse an employee to use all 28 days of vacation at once. The employer has the right not to agree to leave of longer duration.

If this employee expresses a desire to resign before the end of his working year, then the employer, in accordance with Article 137 of the Labor Code of the Russian Federation, has the right to withhold payment for unworked vacation days. The employee's consent to such retention is not required. However, Article 138 of the Labor Code of the Russian Federation limits such deductions to 20% of the amount payable. The employer has the right to voluntarily refuse withholding. Otherwise, amounts exceeding the established limit may either be withheld with the written consent of the employee, or recovered in court.

Withholding payment amounts for used but unworked vacation days from an employee’s salary can be interpreted in different ways:

- how to withhold from an employee the amounts of payment for used but unworked vacation days;

- as a refund by an employee of excessively accrued vacation pay.

On the one hand, Article 137 of the Labor Code of the Russian Federation states that the employer can make a deduction from the employee’s salary. There are two key words to pay attention to: “hold” and “may.” Considering this type of calculation to be withholding, it cannot be regarded as income and cannot be included in the calculation base for personal income tax and insurance premiums. Therefore, no compensation can arise. Let us add that even if the funds are withheld, the employee will receive non-refundable income in the form of vacation days, which is simply impossible to return. This is due to the fact that information about the days included in the length of service as part of the main vacation has already been transferred to the Pension Fund.

The word “may” used in the Labor Code, in contrast to the word “shall,” indicates that it is up to the employer to decide whether to apply this deduction or not. The employer has the option not to exercise this right.

On the other hand, there was an excessive accrual of vacation pay to the employee due to the fact that he quits without completing the working year. And these amounts should be reflected in the accounting records as reversals. Consequently, when reversing excessively accrued vacation pay, the employer must return the excessively withheld personal income tax to the employee and reduce the calculation base for insurance premiums. Reversal due to recalculation is not a withholding, and therefore does not entail the restrictions listed in Article 138 of the Labor Code of the Russian Federation.

| 1C:ITS For more information about reflecting deductions for unworked vacation days upon dismissal, including in 1C programs, see the section “Instructions for accounting in 1C programs.” |

To avoid disputes, the adopted calculation methodology must be enshrined in local regulatory documents and reflected in the settings of the 1C: Salaries and Personnel Management 8 program, edition 3.

Calculation of vacation compensation

In a situation where an employee goes on vacation and is subsequently fired, compensation for unpaid vacation days is not always calculated. There is no need for calculation if the employee has taken all vacation periods in full.

However, often workers are not allowed to fully rest due to production needs, or the reduced vacation is due to the desire of the employee himself. Then, before dismissal, the employer needs to calculate and pay “vacation” compensation. Its value depends on the number of unused vacation days and average daily earnings.

For information on the specifics of calculating vacation days not taken off, see the material “How to calculate the number of vacation days upon dismissal?” .

The calculation of “vacation” compensation is made not only by the number of vacation days not taken in the current year, but also taking into account the duration of all vacations not used by the date of dismissal. For example, for the last 3 years, an employee has only had 14 of the required 28 days of rest, but this year he earned 20 days of vacation, of which he used only half. By summing up the indicated non-vacation days, we get the number 52 (14 × 3 + 20 / 2) - it must be multiplied by the average daily earnings to determine the amount of “vacation” compensation.

Read more about calculating compensation for unused vacation here .

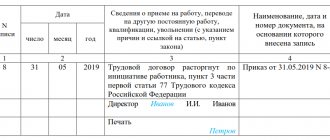

Deductions upon dismissal in “1C: Salaries and personnel management 8” (rev. 3)

In the section Deduction upon dismissal for vacation used in advance, select the appropriate switch position: Retention and does not reduce taxes and contributions or Reversal of accruals and reduces taxes and contributions (Settings menu - Payroll - link Setting up the composition of accruals and deductions - Deductions tab), rice. 1.

Rice. 1. Setting up deduction upon dismissal for vacation used in advance

By default, in the program “1C: Salary and Personnel Management 8” (rev. 3), the deduction upon dismissal for vacation used in advance is reversed and reduces personal income tax and insurance premiums.

Dismissal after vacation

An employee can resign of his own free will immediately after the vacation.

In this case, two options are possible:

- An employee writes a letter of resignation after taking a vacation (see Example 1).

- The employee simultaneously submits two applications: for leave and for dismissal immediately after the leave (see Example 2).

The first option is reflected in the usual manner. Vacation has been issued. Vacation days are provided in advance in full in accordance with the law.

Vacation pay based on average earnings is accrued and paid in accordance with the law.

Based on the resignation letter received after the vacation, during the final payment, together with accruals for the days of “work,” the employer, taking into account the salary regulations, makes all the necessary deductions or reversals.

Before the notice period for dismissal expires, the employee has the right to change his mind about resigning and may withdraw his application.

Part 4 of Article 80 of the Labor Code of the Russian Federation provides that an employee cannot withdraw his resignation letter only if another employee has already been invited in writing to take his place and who, in accordance with federal law, cannot be denied an employment contract.

If an employee falls ill during the vacation period, then, as a general rule, he has the right, in agreement with management, to extend, postpone the vacation, or receive compensation upon dismissal upon final payment.

In the 1C: Salary and Personnel Management 8 program, edition 3, the accounting of sick days during the vacation period, including before dismissal, is automated.

In the second option, providing leave followed by dismissal is a right, not an obligation, of the employer.

If such leave is granted, the day of dismissal is considered the last day of leave. For mutual settlements with the employee, the last day of work in this case becomes the day before the start of the vacation. On this day, the employee should be given a work book and all necessary settlements should be made. The employee does not have the right to withdraw his resignation from the moment the vacation begins. This is a kind of exception to the general rule, confirmed by judicial practice and clarifications of authorized bodies.

So, for example, the letter of Rostrud dated December 24, 2007 No. 5277-6-1 explains that in accordance with Article 127 of the Labor Code of the Russian Federation, upon a written application from an employee, unused vacations can be granted to him with subsequent dismissal (except for cases of dismissal for guilty actions). Leave followed by dismissal is granted for the full (i.e. established) duration, regardless of the time worked in the working year. However, only those vacation days that would be subject to monetary compensation upon dismissal are actually paid.

This is explained by the fact that the vacation to be replaced by monetary compensation upon dismissal of an employee is calculated based on the fact that full vacation is due to an employee who has worked a full working year.

For example, an employee has been working since May 12, 2018. Until 05/11/2019, he fully used 28 days of allotted vacation for the working year 05/12/2018-05/11/2019.

The employee goes on another 28-day vacation for the working year 05/12/2019-05/11/2020 according to the schedule from 05/15/2019 to 06/11/2019. The employee resigns on the day the vacation ends, June 11. In the next working year, only 1 month was worked, therefore, 2.33 days are subject to payment. This is how compensation for unused vacation would have been calculated if the employee had not gone on vacation.

The ruling of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-О-О confirms that, in fact, the employment relationship with the employee terminates from the moment the vacation begins. That is why, in accordance with Part 4 of Article 127 of the Labor Code of the Russian Federation, an employee who has been granted unused leave with subsequent dismissal on his own initiative does not have the right to withdraw his resignation letter after the start of the leave, even if this is only the first day of leave.

During illness during the vacation period followed by dismissal, the employee is paid temporary disability benefits. But the employer is not obligated to the employee to extend leave for sick days in accordance with Part 1 of Article 124 of the Labor Code of the Russian Federation, because the employee himself expressed the desire to terminate the employment relationship with the employer at the end of the leave. Moreover, all days of incapacity for work are subject to payment, regardless of when the sick leave period ends (Article 5 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ).

This position is confirmed by judicial practice - see Determination of the Supreme Court of the Russian Federation dated November 23, 2015 No. 34-КГ15-13. An employee’s illness during leave followed by dismissal does not reduce the number of days of annual leave that remained unused during work and were paid when granting leave followed by dismissal. Therefore, the employer has no reason to recalculate and reduce the amount of vacation pay paid.

The Federal Social Insurance Fund of the Russian Federation, in a letter dated January 28, 2014 No. 15-02-01/04-9363p, confirms that the payment of temporary disability benefits for calendar days of illness in the event of an employee’s illness occurring during the period of vacation followed by dismissal does not contradict the norms of Part 1 of Article 1.3 of the Law No. 255-FZ. The letter clarifies that the law does not provide for the extension of leave for employee days of illness. This means that both vacation and sick leave in this exceptional case actually fall on the same days.

As a general rule, if an employee becomes ill or injured within 30 days of dismissal, the employer is required to pay benefits calculated based on 60% of average earnings. In relation to leave followed by dismissal, 30 days are counted from the day following the day the leave ends. The case of illness on vacation followed by dismissal is rare, and in the 1C: Salaries and Personnel Management 8 version 3 program, manual adjustments may need to be made.

| “1C:ZUP 8” (ed. 3): setting up deduction upon dismissal for vacation used in advance (+ video) |

Application - the starting point for registration

The set of measures to formalize the “vacation-dismissal” procedure begins with an application from the employee. The employee writes it in his own hand in a generally accepted form addressed to the head of the company, indicating his position and surname. There is no special form for such a statement, and there are no restrictions on its volume and content.

Since a double event is planned (vacation - dismissal), there can also be 2 applications. The first will contain a request for leave with a special clause regarding its duration and starting date. The second statement will contain a written desire to sever the employment relationship with the employer.

There is no restriction on the number of statements in the law, so it is possible that the employee will combine the texts of both statements into one document.

If an employee decides to leave immediately after the vacation due to him according to the approved vacation schedule, then a separate application for vacation does not need to be written, since the schedule is already the basis for receiving vacation.

Applications can be found on our website using the link below:

Example

Timofeev N.L., an auxiliary worker in the mechanical section, decided to quit, having previously taken his legally earned regular vacation. He considered fiddling with individual applications to be an unnecessary waste of time and effort, so he expressed his will in one phrase: “I ask you to allow me to go on vacation from April 16, 2022 for 28 calendar days, followed by dismissal of my own free will.”

We will tell you how to apply for leave followed by dismissal in the following sections.

Dismissal after vacation in “1C: Salary and Personnel Management 8” (rev. 3)

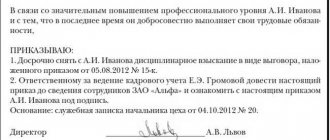

Let's consider the procedure for reflecting in 1C: Salaries and Personnel Management 8, edition 3, the dismissal of an employee after a vacation.

In the organization, local regulations stipulate that upon dismissal, deduction for vacation used in advance is registered as a reversal of accruals and reduces personal income tax and insurance premiums.

Employee S.S. Gorbunkov has been working since February 22, 2018. Starting from the next working year - 02/22/2019 S.S. Gorbunkov did not use his right to basic annual leave. Starting from the first day of the next working year (02/22/2019), the employee can use a full 28 days of vacation. The employee announced his intention to go on vacation in accordance with the schedule for 28 days from 08/01/2019. As of 08/01/2019, the accumulated vacation balance is reflected in the Certificate of Vacation Balances report and amounts to 8.67 days (Fig. 2). This means that 19.33 days of vacation are provided to the employee in advance.

Rice. 2. Certificate of vacation balances

The employee was accrued and paid for 28 days of vacation for the period 08/01/2019-08/28/2019 in the amount of RUB 28,668.92.

Example 1

| S.S. Gorbunkov, after his vacation on August 29, 2019, gave 2 weeks’ notice in a statement of his intention to resign effective September 12, 2019. In addition, the employee submitted an application agreed with management for leave without pay for the period from 08/29/2019 to 09/12/2019. Working days after leaving the vacation used in advance and the day of dismissal from S.S. Gorbunkov was not there. |

During the final calculation in the Dismissal document, on the Vacation Compensation tab, the number of days for which the vacation used in advance should be Withheld is calculated (Fig. 3).

As of the day of dismissal, September 12, 2019, this is 14.67 days. Of the previously accrued vacation pay, 15,020.47 rubles are reversed, and personal income tax in the amount of 1,953 rubles. returnable. If the employee had accrued amounts, then the vacation reversal could be offset. In accordance with the condition of Example 1, accruals upon final settlement from S.S. There is no Gorbunkov, therefore, there is no reason for the employer to receive excessively accrued vacation pay from the employee.

Rice. 3. Analysis of the vacation balance during the final payment upon dismissal