You need to know the budget classification code (BCC) in order to report and pay taxes. The payment order for the payment of a particular tax must indicate the BCC. It should be reflected in field 104 of the payment order. Thanks to the correct indication of the KBK code, a specific payment is credited for its intended purpose.

If the tax payment order contains the wrong budget classification code, the payment will not be credited. Consequently, the amount will “hang” as arrears, despite the fact that it was paid by the taxpayer. Therefore, it is extremely important when filling out the “payment form” to correctly fill in all the KBK numbers.

Information about the BCC will also be needed when filling out a declaration for a particular tax.

Changes in the BCC for personal income tax in 2016

Instructions on the procedure for applying the budget classification of the Russian Federation were approved by Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. KBK is a combination of 20 digits divided into several blocks. Each tax has its own budget classification code. Moreover, the same tax may have its own code depending on the situation.

In 2016, payers and tax agents for personal income tax must use the same BCCs as in 2015, that is, there have been no changes to the budget classification codes.

Composition of KBK 2016

What does the budget classification code indicate?

1) The code is divided into 4 main blocks of income:

- Administrator code

- View

- Subspecies

- KOSGU code

| Administrator code | View | Subspecies | KOSGU code | ||||||||||||||||

| discharge | discharge | discharge | discharge | ||||||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

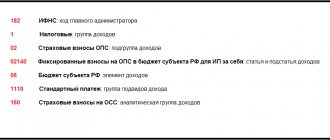

2) The first 3 digits identify the revenue administrator . Each main manager is assigned his own code. Designation 182 is assigned to the Federal Tax Service, 392 to the Pension Fund of Russia, 393 to the Compulsory Social Insurance Fund of the Russian Federation.

3) The code for the type of income is the longest - ten digits. The fourth digit of the code means belonging to the group: 1 – income transfers, 2 – gratuitous receipts, 3 – receipts from business activities.

4) Further transfers are detailed into subgroups - 5th and 6th category:

- 01 — income taxes;

- 02 – social contributions;

- …

- 06 – property taxes;

- 07 – fees for environmental management;

- …

- 13 – receipts from paid services.

5) The next five characters indicate an article or sub-item of the budget. Their meaning can be found in the KBK 2016 reference book. This is a fairly long list, and it is not practical to present the entire list here.

6) The twelfth and thirteenth digits of the code correspond to the budget level - the recipient of the tax (federal, regional or municipal).

7) The code for the subtype of income (programs) is designed to separate different types of income: 1000 is a tax, 2000 means a penalty, 3000 means a fine, respectively.

The last 3 digits show the classification code for operations of the public administration sector (KOSGU):

110 – tax revenues;

120 – funds from property;

130 – receipts from paid services;

140 – amounts forcibly seized;

160 – social contributions, contributions.

Thus, each employee can read any code that is unclear at first.

Returning to our example, BCC for 2016 182 1 01 02010 01 1000 110 means:

- 182 – recipient – Federal tax authority;

- 1 – tax received;

- 01 – refers to tax revenues;

- 02010 – budget item and subitem;

- 01 – receipts to the federal budget;

- 1000 – type of receipt – tax payment;

- 110 – payment relates to tax income.

More details about the changes in the BCC, their reasons and, directly, about the use of budget classification codes in this video:

What BCCs should be indicated for employees in 2016?

For personal income tax, there are several BCCs that are used depending on the situation. For example, for personal income tax paid by a company or individual entrepreneur from the salaries of its employees, the BCC will be 182 1 0100 110. Moreover, it does not matter which country the employee is a citizen of. In other words, the BCC for personal income tax on employee salaries is the same for everyone: both for employees who are citizens of the Russian Federation and for foreign employees.

But for the payment of a fixed advance payment for personal income tax, which is made by a foreign person when registering a patent, the KBK is different: 182 1 0100 110. This advance payment for personal income tax is transferred not by the employer, but directly by the foreign citizen himself in the manner described in Article 227.1 of the Tax Code of the Russian Federation. The personal income tax will be reduced by the amount of the fixed advance payment, which will be calculated by the company where the foreigner will be employed (clause 6 of Article 227.1 of the Tax Code of the Russian Federation).

Where to look

The most current BCCs for 3-NDFL for 2016 were approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. The updated version is valid from December 7, 2016.

Budget classification codes from this Ministry of Finance document are taken not only for filling out a declaration in form 3-NDFL (approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671), but also for generally transferring income tax to the treasury. Including penalties and fines on it.

As the KBK details in the 3-NDFL declaration for 2016 appear at the very beginning of Section 1 of this form (field 020):

Please note: required budget classification code for 3-NDFL for 2016 if you fill out this declaration using a program from the official website of the Federal Tax Service of Russia. Her work algorithm is structured in such a way that she herself will enter the necessary and correct BCC depending on the situation in which a person submits 3-NDFL.

Also see “Special Federal Tax Service program for 3-NDFL for 2016.”

KBK: penalties and fines for personal income tax

When paying a fine for personal income tax, which must be indicated in the payment order, the BCC will be different: depending on who is paying the fine. If the penalty lists:

- tax agent, then KBK 182 1 0100 110;

- an individual, then KBK 182 1 0100 110;

- individual entrepreneur, then KBK 182 1 0100 110.

The same principle applies to KBC regarding fines for non-payment of personal income tax. The code depends on who is transferring the fine amounts:

- tax agent, then KBK 182 1 0100 110;

- an individual, then KBK 182 1 0100 110;

- individual entrepreneur, then KBK 182 1 0100 110.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is KBC?

KBK is an abbreviated name that stands for “budget classification code.” It is a special code for making payments for taxes, fees, penalties and fines to the tax office.

In fact, the code is needed by the Federal Tax Service for internal sorting of incoming amounts to the budget and assigning them to the appropriate taxes. Then you can analyze tax collection. The code allows you to establish the purpose of the payment, where it came from, for what purposes the funds can subsequently be transferred and who is their addressee.

So, for example, if you take transport tax, then the code can be tracked to who made the payment - an individual or legal entity. Taxes collected from individuals are used to repair existing roads and build new ones, while legal entities finance the safety of transport infrastructure, and also help improve the environmental situation.

The OKATO code allows you to determine the territorial affiliation of the payment, which allows you to distribute it by region. The use of budget codes helped to significantly automate the process of analyzing incoming taxes, and also assisted in budget formation.

New BCCs for insurance premiums from 2017

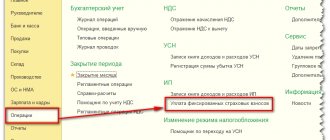

From 2022, insurance premiums (except for contributions for injuries) will be administered by the Federal Tax Service. See "Insurance premiums from 2022: overview of changes."

In this regard, insurance premiums will need to be transferred to new BCCs. Moreover, if we talk about the payment of insurance premiums for December 2016, then the formation of payment orders and BCC depends on when the payment is made:

- if insurance premiums for December 2016 are transferred ahead of schedule (in December 2016), then indicate the “old” KBK in the payment order, and indicate extra-budgetary funds as the recipient;

- if insurance premiums for December 2016 are transferred in January 2022, then in payment slips for some contributions you need to show new special KBK, and indicate the tax office as the recipient.

From January 1, 2022, new BCCs for insurance contributions to the Federal Tax Service are in effect. In particular, the administrator codes (the first three digits of the KBK) have changed - 182 instead of 392. All contributions must be paid to the tax office, and not to funds (except for contributions for injuries).

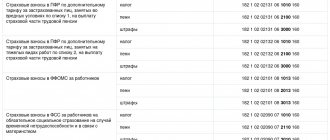

Let us show in the table how the BCC for insurance premiums has changed since 2017:

| Type of contributions | KBK in December 2016 | KBC from January 2022 |

| Pension contributions | Contributions 182 1 0200 160 | Contributions 182 1 0210 160 |

| Penalty 182 1 0200 160 | Penalty 182 1 0210 160 | |

| Fines 182 1 0200 160 | Fines 182 1 0210 160 | |

| Contributions to the FFOMS | Contributions 182 1 0211 160 | Contributions 182 1 0213 160 |

| Penalty 182 1 0211 160 | Penalty 182 1 0213 160 | |

| Fines 182 1 0211 160 | Fines 182 1 0213 160 | |

| Contributions to the Social Insurance Fund of the Russian Federation | Contributions 182 1 0200 160 | Contributions 182 1 0210 160 |

| Penalty 182 1 0200 160 | Penalty 182 1 0210 160 | |

| Fines 182 1 0200 160 | Fines 182 1 0210 160 | |

| Contributions for injuries | Contributions 393 1 0200 160 | Contributions 393 1 0200 160 |

| Penalty 393 1 0200 160 | Penalty 393 1 0200 160 | |

| Fines 393 1 0200 160 | Fines 393 1 0200 160 | |

| Additional pension contributions at tariff 1 | Contributions: - 182 1 0210 160, if the tariff does not depend on the special assessment; — 182 1 0220 160, if the tariff depends on the special estimate | Contributions: - 182 1 0210 160, if the tariff does not depend on the special assessment; — 182 1 0220 160, if the tariff depends on the special estimate |

| Additional pension contributions at tariff 2 | Contributions: - 182 1 0210 160, if the tariff does not depend on the special assessment; — 182 1 0220 160, if the tariff depends on the special estimate | Contributions: - 182 1 0210 160, if the tariff does not depend on the special assessment; — 182 1 0220 160, if the tariff depends on the special estimate |

Also see “Deadlines for payment of insurance premiums for December 2016”.

Payment of penalties: KBK UTII - 2020–2021

Registration of “imputed persons” and subsequent submission of reports is carried out at the tax office at the place of activity or at the place of registration of the taxpayer. Reports are submitted quarterly by the 20th day of the month following the reporting quarter. And the single tax is paid in the same month, but later: before the 25th.

You can see a sample payment form for transferring UTII, as well as comments from K+ experts on how to fill it out, in the UTII Guide. Get free trial access to ConsultantPlus and go to the material.

A fine is imposed for late submission of the declaration; penalties are charged for paying the tax later than the due date established by law.

You can calculate penalties for UTII using our auxiliary service “Fine Calculator”.

No changes were made to the BCC for 2020–2021 regarding penalties paid when working on imputation. For UTII KBK the penalty remained as follows: 182 1 0500 110.

New KBK

It is interesting that the periodic updating by tax authorities of the 3-NDFL declaration form directly affects the composition of budget classification codes for income tax. For example, a series of recent updates to this form concerned the foreign income of individuals. In this regard, the Ministry of Finance introduced a new tax code on December 7, 2016. For 3-NDFL for 2016 it has the following meaning:

| 1 0100 110 |

Also see “3-NDFL in 2022: what has changed.”

Medical fees

In January 2022, send medical contributions for December 2016 to a new special KBK 182 1 0211 160, and send the payment itself to the tax office. Indicate the Federal Tax Service Inspectorate as the recipient in the “Payment Recipient” field. In field 107, indicate MS.12.2016. This will indicate that you are paying December health insurance premiums. Here is a sample payment order.

In 2022, transfer medical contributions for December 2016 in rubles and kopecks.

Start adding the new BCC for medical premiums 182 1 0213 160 in the payment order starting with the payment of insurance premiums for January 2022.

Disability and maternity contributions

In January 2022, send insurance premiums for temporary disability and in connection with maternity for December 2016 to a new special KBK 182 1 0200 160, and send the payment itself to the tax office. Indicate the Federal Tax Service Inspectorate as the recipient in the “Payment Recipient” field. In field 107, indicate MS.12.2016. This will indicate that you are paying December social security contributions. Here is a sample payment order.

Start adding the new BCC for insurance premiums for temporary disability and in connection with maternity 182 1 0210 160 in the payment order starting with the payment of insurance premiums for January 2017.

Contributions for “injuries”

In 2022, insurance premiums for accidents at work and occupational diseases (contributions for “injuries” will continue to be administered by the FSS. Therefore, you will not need to indicate new BCCs in payment orders for this type of contributions. Use the same codes. Moreover, payments, as before, send not to the Federal Tax Service, but to the Social Insurance Fund.

In 2022, in field 101 of the payment order for insurance premiums for employees for organizations and individual entrepreneurs, the Federal Tax Service advises entering code 14. Such information can be found on the official website of the Federal Tax Service. If an individual entrepreneur pays insurance premiums “for himself,” then code 09 should be shown. Such information can be found on the official website of the Federal Tax Service. However, there is no official confirmation of this yet. At the same time, according to our information, if organizations and entrepreneurs transferred insurance premiums with code 01, then the inspectorate considers such payment to be correct and there will be no arrears.