Wholesale and retail trade

Trade is directly related to the purchase and sale of goods (Article 2 of the Federal Law of December 28, 2009 No. 381-FZ). Products are assets that a company originally purchased for resale rather than producing itself.

Accounting for goods is regulated by PBU 5/01. From this PBU we can conclude that the cost of goods includes the purchase price, transportation costs, customs duties, and more. Even interest on loans issued for the purchase of goods can reasonably be included in the cost price.

Companies can trade wholesale and retail. The difference between retail and wholesale trade lies in the volume of goods sold.

At retail, goods are sold in small quantities or individually to satisfy the personal needs of the buyer, while wholesale involves trading in large quantities of goods.

In addition, in retail trade, a transaction is made between a company and an individual, and in wholesale trade, goods are most often sold to a legal entity or individual entrepreneur.

Create receipt orders automatically, not manually! Connect Kontur.Market and Kontur.Accounting. The services are integrated and it will be easier for you to calculate taxes, maintain an income book and maintain cash discipline.

More details

Removal of expired goods from circulation

The company establishes the procedure for documenting the withdrawal of goods from circulation, their recycling or destruction. The forms of primary accounting documents are determined by its head. It should be remembered that any primary document, in addition to the content of the fact of economic life, must have the mandatory details specified in paragraph 2 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

As a rule, a report is drawn up for identified goods with an expired shelf life, indicating their name, quantity, and storage location. A special section of this document contains information about the withdrawal of goods from circulation and their disposal, or destruction or return to the supplier.

To formalize the withdrawal from circulation of these goods, a company can use a report on damage, damage, scrap of inventory items in the TORG-15 form, which was approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The document is signed by members of a specially created commission.

Important

It makes sense to also remove a product that is approaching its expiration date from circulation. After all, the seller, as a rule, is obliged to transfer the goods to the buyer in such a way that they can be used for their intended purpose before the expiration date (Article 472 of the Civil Code of the Russian Federation).

The decision to destroy expired goods is formalized by order (instruction) of the head of the company and an act, for example, in form No. TORG-16. It was approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The act is drawn up in triplicate and signed by members of the commission authorized to do so by the head of the company.

It is necessary to distinguish between the destruction of goods and their disposal.

Disposal of low-quality and dangerous food products, materials and products is their use for purposes other than those for which they are intended and used (Article 1 of the Federal Law of January 2, 2000 No. 29-FZ). For example, expired food products can be used for animal feed, as raw materials for processing or for technical disposal.

The transfer of expired goods to a third-party company for disposal is documented as their regular sale: invoices, acceptance certificates, etc.

Features of accounting in trade

Accounting in trade is about correctly executed documents and transactions drawn up on their basis.

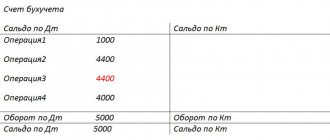

Goods for resale are accounted for in account 41. The account has several subaccounts. The most commonly used account is 41.4 “Purchased Items”.

Goods are accounted for by name, quantity, storage location and financially responsible persons.

The cost of a product is its acquisition price, delivery costs, duties, agency fees, etc. (clause 6 of PBU 5/01).

for finished products. This account cannot be used in trading. Here you will need account 41 “Goods”. Sub-accounts are opened for this account. The purchase of goods is reflected by posting Debit 41 Credit 60. If necessary, VAT is allocated as a separate posting.

The sale of goods includes three transactions:

- Debit 62 Credit 90 - revenue.

- Debit 90 Credit 68 - VAT.

- Debit 90 Credit 41 - cost.

Let's analyze the differences between accounting in trade for wholesale and retail sales.

Accounting for the purchase of goods

To reflect the cost of goods and their quantity, 41 accounts . Analytical accounting of the account is organized in the context of warehouses, names of inventory items, financially responsible persons, etc.

Commodity accounting in wholesale and retail trade is slightly different. Wholesalers account for goods at acquisition cost, and retail firms can choose how to account for inventory items: at purchase or at sales cost, taking into account trade margins. To account for trade margins, account 42 is used. The selected accounting option must be specified in the accounting policy.

Standard transactions for the purchase of goods:

- Dt 41 Kt 60 - purchased goods (excluding VAT);

- Dt 19 Kt 60 - the seller submitted VAT;

- Dt 41 (44) Kt 60 (76) - spent on delivery, legal support of the transaction, etc.

- Dt 19 Kt 60 - reflected VAT on the amount of additional costs;

- Dt 68 Kt 19 - input VAT on the cost of goods is accepted for deduction;

- Dt 60 Kt 51 - paid for delivery and additional services.

Additionally, companies can use accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets” to account for goods. This complicates accounting, but can be useful when you purchase items at a target price and then see the actual price documents to reflect the differences between plan and actual.

Accounting in wholesale trade

All transactions with goods are reflected by postings.

Receipt (purchase) of goods

Debit 41 Credit 60 - goods were purchased from the supplier.

Debit 19 Credit 60 - VAT allocated.

Debit 41 Credit 60 - reflected other costs that increase the cost of purchased goods.

Selling goods

Debit 62 Credit 90 - showed the proceeds from the sale of goods to the buyer.

Debit 90 Credit 68 - VAT was charged on the sale.

Debit 90 Credit 41 - the cost of goods was written off.

Internal movement

Debit 41 Credit 41 - goods were transported from one warehouse of the organization to another. The analytics reflects the corresponding warehouses or materially responsible person (MRP).

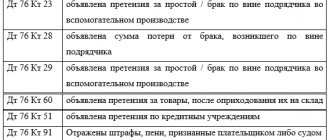

Marriage

Debit 94 Credit 41 - defective goods were found in the warehouse.

Debit 44 Credit 94 - the loss of goods was written off within the limits of natural loss.

Debit 91 Credit 94 - losses in excess of natural loss were written off.

Debit 73 Credit 94 - losses due to marriage were attributed to the guilty party.

Losses, damage, defects: accounting in trade

Postings in trade for writing off damaged or missing inventory items directly reflect their value and its subsequent write-off as losses of the enterprise or recovery from responsible persons who committed the losses:

| D/t | K/t | Operation |

| 94 | 41 | Damage to goods reflected |

| 44 | 94 | Losses were written off within the limits of natural loss norms |

| 73,76 | 94 | Article of damaged goods and materials for compensation from the guilty parties |

| 91/2 | 94 | Loss from damage is written off if the culprit is not identified, or as a result of irresistible force majeure circumstances |

In the same way, they write off defects in trade. The transactions presented in the table reflect the option when the company does not send the defective product to the supplier.

Accounting in retail trade

Accounting in retail can be carried out in two ways: the first method is similar to accounting for goods in wholesale trade, and with the second method of accounting, you need to use account 42 “Trade margin”. Let's consider transactions using account 42.

Receipt (purchase) of goods

Debit 41 Credit 60 - purchased goods from a supplier.

Debit 19 Credit 60 - VAT allocated.

Debit 41 Credit 60 - reflected other costs that increase the cost of purchased goods.

Debit 41 Credit 42 - showed the trade margin.

Selling goods

Debit 50 (62) Credit 90 - showed the proceeds from the sale of goods to the buyer.

Debit 90 Credit 68 - VAT was charged on the sale.

Debit 90 Credit 41 - the book value of goods was written off.

Debit 90 Credit 42 - the trade margin was minus (reversed).

Debit 90 Credit 44 - took into account the costs of selling goods.

Debit 90 Credit 99 - identified the financial result from the sale of goods.

Accounting for write-off of goods

When selling, donating, writing off due to damage, damage, return to the supplier, etc., the cost per unit and quantity is written off from 41 accounts.

You can write off goods in accounting at a cost assessed by one of three methods:

- by average cost - when we buy the same product at different prices, we calculate the total cost of the product and divide by the number of its units;

- at the cost of each unit - when we write off each unit of goods at the actual cost of its purchase;

- FIFO method - when we first write off all the goods from the balance at the beginning of the month, then - the goods from the first batch, followed by those from the second and further in order.

The most common and easiest to account for is the write-off method at the average cost per unit. It is convenient in retail and small wholesale trade, especially with a large assortment and small purchase quantities. This is the method used in Kontur.Accounting.

In case of sale of goods, the cost price is written off to account 90, on which, as we remember, revenue and expenses are compared. Standard transactions for sales of goods:

- Dt 90-2 Kt 41 - cost of goods sold is written off;

- Dt 62 Kt 90-1 - revenue from sales is recognized;

- Dt 90-3 Kt 68 - VAT is charged on the sale of goods.

Quick establishment of primary accounts, automatic payroll calculation, multi-user mode in Kontur.Accounting

Try

There are several other options for writing off the cost of goods:

- Shortages, losses, damage - goods from account 41 are written off to account 94 “Shortages and losses from damage to valuables.”

- Transfer of goods to a commission agent or agent for sale - the cost is written off from account 41 to account 45 “Goods shipped”. When agents sell our goods, account 45 will be debited to account 90 . The cost price is calculated in exactly the same way as if we were selling the goods ourselves.

Examples of accounting entries

LLC "Zapchast"

We bought seven fuel pumps at a price of 8,340 rubles per unit. Paid 58,380 rubles, including VAT 8,905.42 rubles. Accounting is carried out at sales prices. The trade margin for each pump is 10%.

The accountant reflected the transactions with the following entries:

| Wiring | Payment in rubles | Operation |

| Debit 41 Credit 60 | 49 474,58 (58 380 — 8 905,42) | Capitalized the pumps |

| Debit 19 Credit 60 | 8 905,42 | I allocated VAT on the purchase |

| Debit 41 Credit 42 | 4,947.46 (49,474.58 x 10%) | Added trade markup on pumps |

| Debit 41 Credit 42 | 890,54 | Included VAT as part of the markup |

| Debit 50 Credit 90 | 64 218 (58 380 + 890,54 + 4 947,46) | All pumps are sold at retail |

| Debit 90 Credit 41 | 64 218 | Wrote off the book value of the pumps |

| Debit 90 Credit 42 | 5 838 | Reversed the trade margin |

| Debit 90 Credit 68 | 9 795,97 | Charged VAT on the sale of pumps |

LLC "Raduga"

We bought nine KAMAZ-5320 brake pads at a price of 632 rubles per piece. Paid 5,688 rubles, including VAT 867.66 rubles. Accounting is carried out at sales prices. The trade margin on each block is 13%.

The accountant reflected the transactions with the following entries:

| Wiring | Payment in rubles | Operation |

| Debit 41 Credit 60 | 4 820,34 (5 688 — 867,66) | Capitalized the pads |

| Debit 19 Credit 60 | 867,66 | I allocated VAT on the purchase |

| Debit 41 Credit 42 | 626.64 (4,820.34 x 13%) | Added trade markup on pads |

| Debit 41 Credit 42 | 12.80 (626.64 x 18%) | Included VAT as part of the markup |

| Debit 50 Credit 90 | 6 427,24 (5 688 + 626,64 + 112,80) | All pads sold to retail buyer for cash |

| Debit 90 Credit 41 | 5 559,78 (4 820,34 + 626,64 + 112,80) | Wrote off the book value of the pads |

| Debit 90 Credit 42 | 739,44 (626,64 + 112,80) | Reversed the trade margin |

| Debit 90 Credit 68 | 848,10 | Charged VAT on the sale of pads |

Reflection in tax accounting

The cost of an expired product and the costs of its destruction (disposal) can be taken into account when calculating income tax as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code.

The fact is that the company initially purchased goods with an expiration date in order to generate income. In addition, as already mentioned, the sale of goods after the expiration date is prohibited (Clause 5, Article 5 of Law No. 2300-1). Thus, the withdrawal of expired goods from circulation is mandatory for companies, and the costs incurred during its destruction (disposal) will be justified.

The company must also have appropriate documentary evidence of the write-off of goods, their disposal, or removal to landfills and destruction. These documents must be drawn up in accordance with established requirements and contain all the mandatory details of primary accounting documents.

Similar conclusions are presented in letters of the Ministry of Finance of Russia dated June 26, 2013 No. 03-03-06/1/24154, dated December 20, 2012 No. 03-03-06/1/711 and dated September 10, 2012 No. 03- 03-06/1/477.

Important

Firms that sell expired goods to third-party companies for disposal usually do so at a loss. Its amount reduces taxable profit on the basis of paragraph 2 of Article 268 of the Tax Code.

Let’s say a company disposes of a product without examining it at a time when such a procedure is mandatory. Then the disposal operation cannot be considered as part of an activity aimed at generating income, and disposal costs, including the cost of disposed products, cannot be taken into account in reducing the income tax base. The reason is not meeting the conditions of Article 252 of the Tax Code (see letter of the Federal Tax Service of Russia dated July 16, 2009 No. 3-2-09/139).

There are letters from the Russian Ministry of Finance, according to which the costs of destruction (disposal) of expired products cannot be taken into account when calculating corporate income tax. Indeed, as part of expenses that reduce taxable profit, the cost of purchased goods is taken into account when they are sold or transferred to production (clause 3, clause 1, article 268, clause 2, article 272 of the Tax Code of the Russian Federation). In case of destruction (disposal) of expired goods, their sale or transfer to production does not occur. Therefore, the mentioned costs cannot be considered as expenses incurred as part of generating income from business activities. In this regard, they do not meet the criteria of Article 252 of the Tax Code (see letters of the Ministry of Finance of Russia dated July 5, 2011 No. 03-03-06/1/397, dated June 14, 2011 No. 03-03-06/1/ 342).

According to the judges, the cost of expired goods and the costs of its destruction (disposal) are taken into account when calculating corporate income tax in other expenses. After all, recycling (destruction) of expired goods is provided for by law. Therefore, the mentioned costs are associated with activities aimed at generating income.

In addition, the very fact that during the sale of food products that are unfit for consumption (due to expiration, loss of presentation, short sales period) is a common consequence of the company’s business activities in this area. However, it is important to comply with the approved rules for the withdrawal of goods from circulation. This is evidenced by resolutions of the FAS Moscow District dated March 19, 2013 No. 09AP-29791/2012-AK, FAS Ural District dated August 24, 2011 No. F09-5075/11, FAS Northwestern District dated July 6, 2009 No. A05-9935/2008.

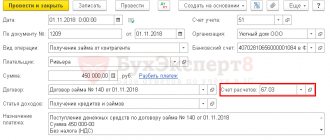

Receipt of goods in 1C 8.3 - step-by-step instructions

Receipt of goods to the wholesale warehouse

Let's look at how to deliver goods to receipt in 1C 8.3 using an example.

The organization entered into an agreement with the Russian supplier MebelLand LLC for the supply of upholstered furniture in the amount of 979,400 rubles.

Under a purchase and sale agreement, the transfer of ownership of goods occurs at the moment of their transfer at the seller’s warehouse to the buyer’s representative.

On January 22, the goods were received by the buyer’s representative and accepted for accounting:

- Sofa ANGELO CAPPELLINI SITTING ROOMS (Italy, GTD 10032020/101017/1238513) - 2 pcs. at a price of RUB 283,200. (including VAT 18%);

- Sofa SAMOA STRIPPY (Italy, GTD 10032020/281217/1538710) — 3 pcs. at a price of 59,000 rubles. (including VAT 18%);

- Sofa SUNSET Softtouch 33 (Russia) – 5 pcs. at a price of 47,200 rubles. (including VAT 18%).

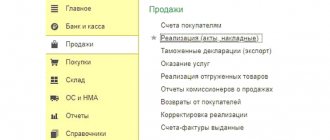

How to add a product to 1C? Receipt of goods from the supplier in 1C 8.3 is reflected in the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

In the header please indicate:

- Invoice No. from - invoice number and date specified by the supplier;

- Warehouse - a warehouse or storage location where goods are received. Selected from the Warehouses .

If ownership of the goods has transferred to the Organization, but the goods have not actually arrived at the warehouse, then it is recommended to use a virtual warehouse, for example, Goods in transit .

How to fill in an item in 1C

In the tabular part of the invoice, reflect the goods received from the supplier: indicate their name from the Nomenclature , quantity, purchase price, VAT amount, accounts for goods and VAT.

You can add a product to the table section:

- automatically, if the invoice is filled out on the basis of the document Invoice from the supplier or Power of Attorney ;

- by clicking the Add ;

- Click the Selection ;

- by clicking the Add by barcode .

Learn more about setting up item accounts

If the supplier’s invoice contains imported goods, then when entering the Receipt document (act, invoice) in the tabular section, fill in the fields Customs declaration number and Country of origin :

- CCD number - registration number of the customs declaration. The customs declaration number is selected from the directory Customs Declaration Numbers .

- Country of origin - the country of origin of imported goods and materials. This column is automatically filled with the value specified in the Imported goods of the item card. If the country of origin is not filled in the nomenclature card, then it can be selected from the directory Countries of the World .

Postings

Documentation of goods acceptance

The organization must approve the forms of primary documents, including the document on the receipt of goods. In 1C, a Receipt Order in form M-4 is used.

The receipt order is signed by the employee who accepted the goods (for example, a storekeeper) and the person who handed over the goods (for example, a cargo carrier, an accountable person).

The form can be printed by clicking the Print button - Receipt order (M-4) of the document Receipt (act, invoice) . PDF

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the Receipt document form (act, invoice) , click the Register .

Study the detailed scheme for purchasing goods in 1C

Receipt of goods to the retail warehouse

The receipt of goods at a retail warehouse in 1C 8.3 is generally no different from the receipt of goods at a wholesale warehouse. The only thing you need to pay attention to when goods arrive at a manual point of sale is the settings: if accounting is kept at sales value

and without taking into account the nomenclature,

then in the document Receipt (act, invoice) Nomenclature column is not displayed , but simply indicates the total amount of goods received and their retail value.

Example of postings for 41 accounts

The Alpha organization carries out wholesale and retail trade. The goods were shipped to Omega after receiving full payment in the amount of RUB 274,520. (VAT RUB 41,876). Three days later the goods were shipped to the buyer.

Cost of goods sold RUB 129,347. In retail, daily revenue amounted to 17,542 rubles. (VAT 2676 rub.). The sale was carried out using ATT. To account for the trade margin, account 42 was used. The amount of the margin was 6,549 rubles.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Money has been deposited into the bank account from Omega | 274 520 | Bank statement |

| 76.AB | 68.02 | An advance invoice has been issued | 41 876 | Outgoing invoice |

| 62.01 | 90.01.1 | Revenue from sales of goods is taken into account | 274 520 | Packing list |

| 90.02 | 68.02 | VAT charged on sales | 41 876 | Packing list |

| 90.02.1 | 41.01 | Sold goods written off | 129 347 | Packing list |

| 62.02 | 62.01 | Advance credited | 274 520 | Packing list |

| An invoice for sales has been issued | 274 520 | Invoice | ||

| 68.02 | 76.AB | VAT deduction on advance payment | 41 876 | Book of purchases |

| 50.01 | 90.01.1 | Retail revenue taken into account | 17 542 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.03 | 68.02 | VAT charged | 2676 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 41.11 | Write-off of goods at sales price | 17 452 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 42 | Accounting for mark-ups on goods | -6549 | Help for calculating the write-off of trade margins on goods sold |