Fines, penalties and damages in accounting

Your counterparties may violate or fail to fulfill the terms of contracts on time.

For example, late delivery or payment of goods. For this, you have the right to demand that they pay a penalty (Article 330 of the Civil Code of the Russian Federation). The penalty must be provided for in the contract. This could be a fine or penalty.

For violation of the terms of the contract, you also have the right to demand compensation for losses incurred (Article 15 of the Civil Code of the Russian Federation).

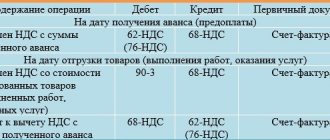

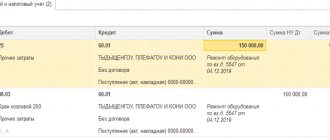

In accounting, the amounts of all these sanctions under contracts are accrued only after the debtor has recognized them or a corresponding court decision has been made.

The accountant classifies them as other income and reflects them by posting:

- Debit 76, subaccount for claims settlements Credit 91-1

- a penalty recognized by the buyer has been accrued.

In tax accounting, the amounts of sanctions under contracts are taken into account in non-operating income also after the debtor has recognized them or a court decision has been made. The date of receipt of such income is considered to be either the date of the debtor’s consent to pay them, or the date of entry into force of the court decision (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

conclusions

Thus, the interest established by Art. 317.1 of the Civil Code of the Russian Federation, and the interest provided for in Art. 395 of the Civil Code of the Russian Federation, have a different legal essence, the requirements for their payment are independent. Unlike the interest provided for in paragraph 1 of Art. 395 of the Civil Code of the Russian Federation, interest established by Art. 317.1 of the Civil Code of the Russian Federation are not a measure of liability, but represent a fee for the use of funds.

That is, the requirement to pay interest under Article 317.1 of the Civil Code of the Russian Federation is a requirement to pay for the use of funds, and the requirement to pay interest under Art. 395 of the Civil Code of the Russian Federation is a requirement to apply liability for non-fulfillment or delay in fulfilling a monetary obligation.

A penalty is a financial sanction for non-fulfillment or improper fulfillment of an obligation, in particular in case of delay in fulfillment.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Non-operating income

According to tax accounting rules, all income that is not revenue from the sale of goods (work, services) and property rights is considered non-sales (including those incomes that are considered other in accounting).

The list of non-operating income is in Article 250 of the Tax Code.

This list, and not even in the lowest positions, includes the amounts of fines, penalties and (or) other sanctions accrued for violation of contractual or debt obligations, as well as the amount of compensation for losses (damage) (clause 3 of Article 250 of the Tax Code of the Russian Federation) .

Firms that calculate income tax using the accrual method must include penalties as income on the date they are recognized by the debtor or on the date the court decision enters into legal force.

Read in the berator “Practical Encyclopedia of an Accountant”

Non-operating expenses that are taken into account in the tax base for profits

Tax consequences of litigation

If you find any errors, please report them to: [email protected]

General issues

Letter dated October 7, 2022 No. 03-02-07/1/76717

Suspension of debit transactions on the account of a tax agent (payer of insurance premiums) in the event of failure to submit a calculation of the amounts of personal income tax calculated and withheld by the tax agent (calculation of insurance premiums) to the tax authority also acts as an organizational measure and in the absence of documented debt to the budget does not interfere with the execution of a court decision that has entered into legal force.

VAT

Letter dated December 6, 2022 No. 03-07-11/95033

The basis for accepting the specified work for registration is the act of acceptance of completed work (form KS-2), signed by both parties. Moreover, if the customer or contractor has not signed the work acceptance certificate, but there is a court decision that has entered into legal force, from which it follows that the terms of the contract for the performance of work by the contractor have been fulfilled, the date of completion of the work for VAT purposes should be considered the date of entry into force legal force of the court decision.

Letter dated November 22, 2022 No. 03-03-06/1/90660

If the customer has not signed the acceptance certificate for the work performed, and there is a court decision, from which it follows that the terms of the contract for the performance of work by the contractor have been fulfilled, then the date of completion of the work for the purposes of value added tax should be considered the date of entry into legal force of the decision the court is currently unchanged.

Letter dated October 18, 2022 No. 03-07-14/80174

If the revenue criterion established by paragraph 5 of Article 145 of the Tax Code of the Russian Federation is exceeded, the taxpayer loses the right to exemption for the period from the 1st day of the month in which this excess occurred until the end of the exemption period.

As for the restoration of the right to exemption lost by the taxpayer during the specified period, if a transaction, the proceeds of which were taken into account during the period of use of the right to exemption, was terminated (including in court), then the provisions of Article 145 of the Tax Code of the Russian Federation do not provide for such restoration .

Commentary on tax disputes for February 2020

Income tax

Letter dated December 6, 2022 No. 03-03-06/1/94824

There are no grounds for recognizing a debt as bad (unrealistic for collection) for the purposes of Chapter 25 of the Tax Code of the Russian Federation on the basis of a court decision of an arbitration court as an act of a government body specified in paragraph one of paragraph 2 of Article 266 of the Tax Code of the Russian Federation.

Letter dated November 29, 2022 No. 03-03-06/1/92788

The amount of fines, penalties and (or) other sanctions for violation of contractual obligations, as well as the amount of compensation for losses or damages payable by the debtor on the basis of a court decision that has entered into legal force, are reflected in the non-operating income of the taxpayer on the date the court decision enters into legal force .

Letter dated October 14, 2022 No. 03-03-06/2/78528

The issuance of a ruling by an arbitration court on the basis of which the obligations of a debtor - an individual declared bankrupt are considered extinguished - is the basis for recognizing the debt of such a debtor as uncollectible for the purposes of Article 266 of the Tax Code of the Russian Federation.

Letter dated September 26, 2022 No. 03-03-06/1/74141

Income in the form of the amount of sanctions from the date the court makes the relevant decision until the moment of actual repayment of the debt, subject to payment on the basis of this court decision, is taken into account for profit tax purposes at the end of the corresponding reporting period (tax period) or on the date of actual repayment of the debt, depending on , what event happened earlier.

Letter dated August 30, 2022 No. 03-03-06/1/66991

In case of voluntary recognition by the debtor of amounts of fines, penalties and (or) other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages, including executing decisions of an arbitration court or international commercial arbitration, such amounts are taken into account by the creditor as part of non-operating income on the date their recognition by the debtor.

A document indicating the recognition by the debtor of the obligation to pay the creditor in full or in a smaller amount of fines, penalties, other sanctions for violation of contractual or debt obligations, as well as compensation for losses (damages), may be a bilateral act signed by the parties (agreement on termination of the contract , reconciliation act, etc.), or a letter from the debtor or other document confirming the fact of violation of the obligation, allowing to determine the amount of the amount recognized by the debtor. Also, an independent basis indicating the recognition by the debtor of this obligation in whole or in part is, respectively, the full or partial actual payment by him to the creditor of the corresponding amounts. In this case, the amounts actually paid by the debtor are subject to inclusion by the creditor in non-operating income.

TOP 10 Tax disputes for 2022

Letter dated June 5, 2022 No. 03-08-05/40874

The courts do not examine and do not reflect in the operative part of the judicial act the duties of a tax agent assigned to the defendant to withhold to the budget of the Russian Federation tax on income from sources in the Russian Federation in relation to compensation awarded to a foreign organization for the illegal use of a trademark, in connection with which the foreign organization receives income without taxation on the territory of the Russian Federation.

Letter dated March 1, 2022 No. 03-03-06/1/13570

If a taxpayer recognizes fines for violation of contractual obligations or a court decision enters into legal force, expenses in the form of fines are taken into account when forming the tax base for corporate income tax. In this case, part of the amount of sanctions determined by the arbitration court is taken into account by the taxpayer for profit tax purposes only on the date of entry into force of the decision (ruling) of the competent state court on the recognition and enforcement of the above decisions.

Letter dated February 5, 2022 No. 03-07-11/6345

If, on the basis of a court decision, the prices used in the execution of contracts between the taxpayer and the counterparty are recognized as inflated, the taxpayer is obliged to recalculate the tax base for income tax taking into account the provisions of Article 54 of the Tax Code of the Russian Federation.

Letter dated February 15, 2022 No. 03-03-06/1/9525

The date of incurring expenses in the form of sanctions for violation of contractual obligations, if the debtor does not recognize sanctions for violation of contractual obligations, is the date of entry into force of the court decision. If such a debtor has a decision of international commercial arbitration or a decision of an arbitration tribunal, and also taking into account the position stated in the letter of the Department dated 08.12.2014 N 03-03-06/1/62816, which has not currently changed, the date of the relevant expenses is the date of entry into force of the decision (ruling) of the competent state court on the recognition and enforcement of the above decisions.

Letter dated February 28, 2022 No. 03-03-06/3/12899

If an organization receives the right, on the basis of a court decision, to complete an unfinished construction project and at the same time the said organization does not receive any property or property rights, then it does not generate income in the form of the cost of the specified construction project.

Letter dated January 22, 2022 No. 03-03-06/2/3040

If documents confirming the legality of attributing write-offs to expenses for the purposes of taxing the profits of organizations, received through the Internet portal of the State Automated System “Justice”, are recognized as drawn up in accordance with the legislation of the Russian Federation, then such documents can be recognized as complying with the requirements of Article 252 of the Tax Code of the Russian Federation.

Review of tax news for March 2020

Personal income tax

Letter dated November 15, 2022 No. 03-04-05/88244

If an individual, on the basis of a court decision, was compensated for the amount of actual damage caused to his property, as well as the amount of compensation for moral damage, these amounts are not the income of the taxpayer and are not taken into account when determining the tax base for personal income tax.

Income in the form of compensation to the taxpayer for legal expenses made on the basis of a court decision is not subject to personal income tax.

Article 217 of the Tax Code of the Russian Federation does not contain provisions providing for exemption from taxation of amounts of fines paid on the basis of a court decision; accordingly, such income is subject to personal income tax in the prescribed manner.

Letter dated November 18, 2022 No. 03-04-05/88720

The moment of emergence of the ownership right of a member of a housing construction cooperative in the real estate of the cooperative is determined by a special norm of the Civil Code and is associated with the full payment of the share contribution and the fact of provision of premises. In this case, the transfer of real estate by the seller and its acceptance by the buyer are carried out according to a transfer deed or other transfer document signed by the parties (clause 1 of Article 556 of the Civil Code).

When the right of ownership is recognized by a court decision, the period of ownership of real estate is determined from the date of entry into force of this decision.

Letter dated October 15, 2022 No. 03-04-05/78921

The fine for failure to voluntarily fulfill the demands of the victim, as well as the penalty (fine) provided for in paragraph 3 and paragraph 4 of Article 16.1 of Law No. 40-FZ, meet the above criteria of economic benefit and are the taxpayer’s income subject to personal income tax. Article 217 of the Tax Code of the Russian Federation does not contain provisions providing for exemption from taxation of the amounts of the specified penalties (fines) and fines paid by an organization on the basis of a court decision; accordingly, such income is subject to taxation on personal income in the prescribed manner.

Letter dated September 5, 2022 No. 03-04-05/68722

If by a court decision a transaction for the alienation of real estate is declared invalid and the consequences of its invalidity are applied, then the minimum maximum period of ownership of such real estate for tax purposes is calculated from the date of the initial state registration of ownership rights to it. In this case, the date of making an entry in the Unified State Register of Real Estate on the taxpayer’s ownership of real estate in connection with the recognition of the purchase and sale transaction as invalid is not taken into account.

Tax news digest for March 2020

Letter dated August 20, 2022 No. 03-04-05/63709

If the ownership of an apartment is recognized directly by a court decision, then the minimum maximum period of ownership of the real estate object is determined from the date of entry into force of this decision.

Letter dated July 5, 2022 No. 03-04-05/49727

The amounts of penalties and fines for violation of the terms of the contract meet the above criteria of economic benefit and are the income of the taxpayer, subject to personal income tax.

The amount of compensation for moral damage paid to an individual on the basis of a court decision is not subject to personal income tax.

Income in the form of compensation to the taxpayer for legal expenses made on the basis of a court decision is not subject to personal income tax, subject to the conditions established by paragraph 61 of Article 217 of the Tax Code of the Russian Federation.

Letter dated July 16, 2022 No. 03-04-05/52684

The amount of compensation collected by a court decision in favor of the taxpayer in connection with the loss of property does not lead to economic benefits for the taxpayer and, accordingly, is not his income.

Letter dated July 12, 2022 No. 03-04-05/51725

When the right of ownership is recognized by a court decision, the period of ownership of real estate is determined from the date of entry into force of this decision. In this regard, if the apartment was owned by the taxpayer for less than the minimum period of ownership of the real estate property, then income is generated that is subject to personal income tax in the generally established manner.

Letter dated June 14, 2022 No. 03-04-05/43684

Income in the form of a penalty for failure to comply with a judicial act, paid by an organization to an individual in whose favor the court made a corresponding decision, is the income of the said person, subject to personal income tax in the prescribed manner.

In the event of a change by the court in the manner prescribed by the legislation of the Russian Federation, the person in whose favor the court awards a penalty for failure to execute a judicial act, the income of an individual who is no longer the person in whose favor the court awards the specified penalty does not arise.

Letter dated June 28, 2022 No. 03-01-15/47867

Since the funds received by the arbitrator (arbitrator) as part of his arbitration (arbitration proceedings) are not income from business activities, these funds are not taken into account when determining the object of taxation for the tax paid in connection with the application of the simplified taxation system. Taking into account the above, the income of an arbitrator (arbiter) received from this activity is subject to personal income tax in the manner established by Chapter 23 of the Tax Code of the Russian Federation.

Letter dated May 23, 2022 No. 03-04-05/37209, dated May 22, 2019 No. 03-04-05/37000, dated June 7, 2022 No. 03-04-05/41959

The moment of emergence of the ownership right of a member of a housing construction cooperative in the real estate of the cooperative is determined by a special norm of the Civil Code and is associated with the full payment of the share contribution and the fact of provision of premises. In this case, the transfer of real estate by the seller and its acceptance by the buyer are carried out according to a transfer deed or other transfer document signed by the parties (clause 1 of Article 556 of the Civil Code). Taking into account the above, income received from the sale by a taxpayer of an apartment acquired under an agreement with a housing construction cooperative is exempt from taxation on personal income on the basis of clause 17.1 of Article 217 of the Tax Code of the Russian Federation only if such an apartment was owned by the taxpayer for a minimum period of time. the maximum period of ownership of the real estate object and more, starting from the date when both of the above conditions were met.

When the right of ownership is recognized by a court decision, the period of ownership of real estate is determined from the date of entry into force of this decision.

Letter dated January 25, 2022 No. 03-04-05/4014

If, when making a decision, the courts do not separate the amounts due to an individual and subject to withholding from the individual, the tax agent organization, when paying income to an individual by court decision, subject to personal income tax, does not have the opportunity to withhold income tax from the taxpayer individuals from the specified income.

Letter dated January 25, 2022 No. 03-04-05/4176

When the right of ownership is recognized by a court decision, the period of ownership of real estate is determined from the date of entry into force of this decision.

Letter dated November 19, 2022 No. 03-04-05/83184

Compensation for actual damage caused by the developer to the taxpayer in the form of the amount of actual costs for a rented apartment for the period of violation of the deadline for the transfer of a shared construction project, made on the basis of a court decision, does not constitute an economic benefit for the taxpayer and, accordingly, is not his income subject to income tax individuals.

Letter dated November 19, 2022 No. 03-04-05/83283

Paragraph 61 of Article 217 of the Tax Code of the Russian Federation provides that income in the form of legal expenses reimbursed to the taxpayer on the basis of a court decision, provided for by civil procedural, arbitration procedural legislation, and legislation on administrative proceedings, incurred by the taxpayer when considering a case in court, is not subject to taxation on personal income. At the same time, the specified paragraph of the Tax Code of the Russian Federation does not contain restrictions regarding the nationality of the court, on the basis of whose decision the reimbursement of legal expenses is made. The amount of compensation for moral damage paid to an individual by the Russian Federation on the basis of a decision of the European Court of Human Rights is not subject to personal income tax

Self-employed tax

Letter dated December 18, 2022 No. 03-11-11/99133

An individual providing legal services, including representation in court, on the territory of the constituent entities of the Russian Federation included in the experiment, on the basis of civil law contracts, provided that the customers of such services are not his employers (or persons who were his employers for less than two years ago), and not conducting business activities in the interests of another person on the basis of agency agreements, commission agreements or agency agreements, has the right to apply a special tax regime for NAP, subject to compliance with the restrictions established by Federal Law.

Letter dated June 28, 2022 No. 03-11-11/47696

The Federal Law does not contain a prohibition on the use by an individual entrepreneur who has been declared insolvent (bankrupt) by a court and in respect of whom a procedure for the sale of property has been introduced, of the special tax regime “Professional Income Tax”.

Letter dated March 7, 2022 No. 03-11-11/14884

The provisions of the Federal Law do not provide for a prohibition on the application of the special tax regime “Professional Income Tax” for individuals providing services for leasing a non-propelled vessel to legal entities, subject to compliance with the provisions of the said Federal Law.

Letter dated February 21, 2022 No. 03-11-11/11352

At the same time, according to paragraph 1 of part 2 of Article 6 of Law N 422-FZ, for the purposes of Law N 422-FZ, income received within the framework of labor relations is not recognized as an object of taxation.

In this case, the payment of fees to the arbitrators for the provision of services during the arbitration process can be made by a permanent arbitration institution, which is a division of a non-profit organization with which the arbitrators may or may not have labor or civil relations. To resolve the issue of the possibility of applying the NPA in relation to the activities of the arbitrator (arbitrator), an examination of the relevant specific contractual relations between the organization, the arbitrators and the parties to the arbitration is required

Insurance premiums

Letter dated March 11, 2022 No. 03-15-06/15497

The fact that an individual entrepreneur is in custody and (or) in prison does not in itself indicate that he does not have the opportunity to promptly renounce the status of an individual entrepreneur or carry out business activities through representatives.

In order to interconnect the norms of the Tax Code of the Russian Federation with the legislation on insurance pensions, as well as to minimize the number of individual entrepreneurs' appeals to the court with statements recognizing the absence of grounds for collecting arrears on insurance premiums, we are ready to consider the issue of supplementing the periods for which individual entrepreneurs do not pay insurance premiums for themselves , periods of their detention and serving sentences in places of deprivation of liberty, provided that they do not carry out entrepreneurial activities during these periods.

At the same time, we draw your attention to the fact that at present, if an individual entrepreneur, upon actual termination of business activity due to insurmountable circumstances, could not in a timely manner renounce the status of an individual entrepreneur in the prescribed manner, he is not deprived of the opportunity when a requirement is presented to him to pay arrears on insurance premiums for the appropriate period, defend your rights in court, presenting arguments and objections, presenting documents and other information confirming the specified circumstances (clause 2 of the Determination of the Constitutional Court of the Russian Federation dated May 12, 2005 N 213-O).

simplified tax system

Letter dated December 27, 2022 No. 03-11-11/102731

Funds received by the taxpayer as compensation for legal expenses, which were recovered from the plaintiff by a court decision, are taken into account as income when determining the object of taxation for the tax paid in connection with the application of the simplified tax system.

Letter dated November 26, 2022 No. 03-11-11/91465

The amount of state duty reimbursed to the taxpayer on the basis of a court decision by the defendant is taken into account as part of income when determining the object of taxation for the tax paid in connection with the application of the simplified taxation system.

Letter dated October 29, 2022 No. 03-11-11/82968

Funds for services provided within the framework of the application of the STS by an individual entrepreneur, collected by a court decision and received after the expiration of the patent and the transition of the entrepreneur to the simplified taxation system (hereinafter referred to as the simplified taxation system), are taxed within the framework of the simplified taxation system.

Letter dated August 2, 2022 No. 03-11-06/2/58327

The amount of excess rent paid by the tenant for 2014 - 2016, collected by court decision from the landlord in 2022, is taken into account when determining the tax base for the tax paid in connection with the application of the simplified taxation system, as part of non-operating income on the date of its receipt.

State duty

Letter dated December 6, 2022 No. 03-05-06-03/95011

If a counterclaim to invalidate a receipt entails the return of property or reimbursement of the cost of property (hereinafter referred to as the return of property), then in this case the state duty is payable in accordance with subparagraph 1 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation, and if the specified counterclaim does not entail the return of property, then the state duty is paid in accordance with subparagraph 3 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation.

Letter dated August 5, 2022 No. 03-05-05-03/58740

If the plaintiff increases the amount of the claim, the missing amount of the state duty must be paid within ten days from the date the court decision enters into legal force.

Letter dated July 2, 2022 No. 03-05-06-03/48460

When filing a supervisory appeal to the Chairman of the Supreme Court of the Russian Federation or the Deputy Chairman of the Supreme Court of the Russian Federation about the review of court decisions in the manner of supervision, the payer is the interested person. For performing this action, a state fee must be paid in accordance with subclause 12.2 of clause 1 of Article 333.21 of the Tax Code of the Russian Federation in the amount of 6,000 rubles.

Letter dated July 15, 2022 No. 03-05-06-03/52104

The amount of the state duty when filing a statement of claim with the court containing a demand to recognize the reconstruction of a residential building as legal and to preserve it in a reconstructed state is calculated from the value of the object stated in the statement of claim.

Letter dated May 23, 2022 No. 03-05-05-03/37376

When submitting statements of claim to courts of general jurisdiction, as well as to magistrates, containing demands for recognition of ownership of real estate, a state fee must be paid in accordance with subparagraph 1 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation, depending on the value of the property, as when filing a statement of claim property nature subject to assessment. For claims for recognition of property rights in cases considered by arbitration courts, a state fee must be paid in accordance with subparagraph 4 of paragraph 1 of Article 333.21 of the Tax Code of the Russian Federation in the amount of 6,000 rubles.

When filing statements of claim with courts of general jurisdiction containing demands to recognize transactions (purchase and sale agreements) as invalid, a state fee must be paid in accordance with subparagraph 1 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation, depending on the value of the property determined by the transaction (agreement). When filing a statement of claim with the arbitration court for disputes regarding the recognition of transactions as invalid, a state fee must be paid in accordance with subparagraph 2 of paragraph 1 of Article 333.21 of the Tax Code of the Russian Federation in the amount of 6,000 rubles.

When filing statements of claim containing demands for termination of contracts to courts of general jurisdiction, as well as to magistrates, a state fee must be paid in accordance with subparagraph 3 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation, depending on the status of the person applying. When filing a statement of claim with the arbitration court for disputes arising from the termination of contracts, a state fee must be paid in accordance with subparagraph 2 of paragraph 1 of Article 333.21 of the Tax Code of the Russian Federation in the amount of 6,000 rubles.

Documents acknowledging debt

Documents that indicate the debtor’s recognition of the obligation to pay fines, penalties, penalties under the contract may be:

- an agreement providing for the payment of sanctions;

- a bilateral act signed by the parties (agreement on termination of the contract, reconciliation act, etc.);

- a letter of agreement to pay sanctions to the counterparty (in full or in a smaller amount based on the terms of the concluded agreement), confirming the fact of violation of the terms of the agreement and allowing to determine the amount of the recognized amount.

An agreement concluded with a counterparty may:

- provide that sanctions are assessed only after the debtor is presented with a claim;

- do not provide for the obligation of the creditor company to file a claim.

In the first case, the creditor will reflect the sanctions in tax accounting only after filing a claim with the debtor.

In the second, when the partner violates his obligations and, according to the contract, the seller is due and must be accrued appropriate sanctions.

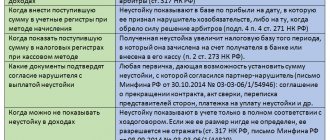

When there is no income

According to Article 317 of the Tax Code of the Russian Federation, when determining non-operating income in the form of fines, penalties or other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages, taxpayers determining income on the accrual basis reflect the amounts due in accordance with the terms of the agreement.

If this condition is not specified in the agreement, the recipient of fines is not obliged to take this type of income into account as non-operating income. The Ministry of Finance drew attention to this in a letter dated September 3, 2022 No. 03-03-06/1/77241.

If the counterparty does not agree to pay the fine (penalty), then the amount of the sanction must be included in non-operating income only after the corresponding court decision comes into force.