Procedure for accounting for liquidation expenses

The costs of liquidating a fixed asset are accepted as part of non-operating expenses (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation). Such costs include:

- dismantling costs;

- services of contractors;

- garbage removal, etc.

A one-time inclusion of dismantling costs is possible only if the facility will no longer be used (Letter of the Ministry of Finance dated December 29, 2009 No. 03-03-06/1/828). If dismantling is carried out for the purpose of moving to another location, then the amount of work must be included in the cost of the fixed asset.

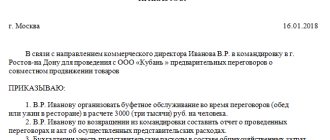

To write off property, you need to create an order from the manager and an act on the liquidation of the fixed asset.

For sample documents, see the materials:

- “Act for write-off of fixed assets - sample filling”;

- “We are drawing up an order for writing off fixed assets - a sample.”

Find out how to write off a fixed asset in a typical situation from ConsultantPlus. If you don't have access to the system, get a free trial online.

National accounting legislation is changing towards convergence with the principles set out in International Financial Reporting Standards (IFRS).

The Instructions for Accounting of Fixed Assets, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated April 30, 2012 No. 26 (hereinafter referred to as Instruction No. 26), define the procedure for forming the initial cost of fixed assets. It has some differences compared to the currently existing procedure for forming the initial cost of fixed assets. In particular, it is established that the initial cost of fixed assets can be increased by the amount of the reserve for the decommissioning of fixed assets and similar obligations, if, when accepting such fixed assets for accounting, the organization has obligations to carry out work on the dismantling and liquidation of these fixed assets, restoration natural resources on the land plots they occupy (clause 10 of Instruction No. 26). IFRS provides for the creation of a reserve.

In IFRS, expenses for decommissioning fixed assets are included in the initial cost of fixed assets. Thus, clause 16 of the International Financial Reporting Standard (IAS) 16 “Fixed Assets” stipulates that the cost of an item of fixed assets includes, incl. a preliminary estimate of the costs of dismantling and removing an item of property, plant and equipment and restoring natural resources on the site it occupies, for which the entity assumes an obligation either upon acquisition of the item or as a result of its use over a specified period for purposes other than the creation of inventories in during this period.

In addition, IAS 37 “Provisions, contingent liabilities and contingent assets” (clause 14) involves the formation of a reserve in the event that:

– the enterprise has a present obligation (legal or constructive*) arising as a result of a past event;

__________________________

* Implicit – aimed at concluding an agreement.

– it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation;

– it is possible to provide a reliable estimate of the amount of the obligation.

Thus, it is obvious that the appearance in the Belarusian legislation of a methodology for creating and using a reserve for the decommissioning of fixed assets and similar obligations (hereinafter referred to as the reserve) is another step taken by the Ministry of Finance to bring national accounting legislation closer to IFRS.

Conditions for creating a reserve

Please note that clause 10 of Instruction No. 26 establishes the following: the initial cost of fixed assets can be increased by the amount of the reserve. This means that the formation of a reserve is the right of the organization, and not an obligation, even in the case when there are conditions under which such a reserve is formed.

How should an organization indicate its decision to form (or not form) a reserve?

Let us turn to the norms of clause 12 of the Accounting Instructions “Accounting Policy of the Organization”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated April 17, 2002 No. 62 (hereinafter referred to as Instruction No. 62).

When forming an accounting policy, an organization for a specific area of maintaining and organizing accounting chooses one of several methods allowed by legislation and regulatory legal acts on accounting. If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, an appropriate method is developed based on Instruction No. 62 and other provisions on accounting and reporting.

Conclusion: the decision to create (or not to create) a reserve must be stated in the accounting policies of the organization.

Important! If an organization decides to create a reserve, then this will not have to be done in all cases, but only if the following conditions are met (clause 23 of Instruction No. 26):

– the organization has an obligation to carry out work to dismantle and liquidate fixed assets, restore natural resources on the land plot it occupies (hereinafter referred to as the obligation);

– assets are expected to be disposed of to pay off the liability;

– the amount of the liability can be reliably determined.

The obligation referred to above can usually arise either from concluded contracts or from legal requirements.

Valuation of the created reserve

In the event that an organization, in accordance with its accounting policies, has decided to create a reserve, and factors have arisen that indicate the need to create a reserve, it is necessary to determine the amount of the reserve.

The amount of the created reserve is determined based on the estimated costs required at the end of the reporting period to repay the obligation. When determining the amount of the reserve created, income from the expected disposal of fixed assets should not be taken into account.

Thus, the organization estimates the composition of expenses that is expected to be necessary to fulfill the obligation, i.e. to carry out work on the dismantling and liquidation of these fixed assets, restoration of natural resources on the land plots they occupy. In this case, a document must be drawn up (for example, an estimate of such expenses) in which their total amount is displayed. Prices (tariffs) for proposed work should be taken on the scale valid in the current period, i.e. when assessing the reserve, they do not take the prices expected at the time of the work, but the prices at the end of the reporting period (month) in which the reserve is created.

If the liability is expected to be repaid more than 12 months after the reporting date, then the amount of the reserve created at the reporting date must be determined by multiplying the discount rate by the estimated cost required to repay the liability. In this case, prices (tariffs) are assessed on the scale that is expected to exist during the dismantling of fixed assets, i.e. When estimating the reserve, prices expected at the time of work are taken.

The discount rate is determined based on current market estimates of the time value of funds and the risks specific to the liability. For example, one of the options for such assessments can be used:

– the rate on loans that this organization attracts from banks to finance current expenses similar to those for which an obligation arises (indicated in the estimate);

– refinancing rate established by the National Bank.

Reflection of the reserve in accounting

The created reserve in the calculated amount must be reflected in the accounting records by recording:

Dt 08 “Investments in long-term assets” - Kt 96 “Reserves for future payments”.

The amount of the increase in the reserve due to the reduction in the discounting period must be reflected in the accounting entry:

Dt 91 “Other income and expenses” – Dt 96.

Over time, the information that was assessed when creating the reserve may change: for example, the composition of the work for which the reserve was created may change, their cost may be clarified, the expected timing of dismantling fixed assets and the discount rate may also change. If these circumstances arise, it is necessary to clarify the amount of the reserve based on new types of work, amounts, rates, etc., and reflect the resulting difference in accounting as follows:

1) if the fixed asset at the time of adjusting the reserve is accounted for at its original cost, i.e. it has not yet been revalued (see Table 1):

2) if the fixed asset at the time of adjusting the reserve is accounted for at its revalued value (see Table 2):

At the end of the useful life of a fixed asset, a different mechanism is used to reflect the amount of increase (decrease) in the reserve for a fixed asset accounted for at a revalued cost:

D-t (K-t) 91 – K-t (D-t) 96.

It is necessary to carry out an inventory of the reserve

The created reserve is subject to inventory. Currently, the procedure for conducting an inventory of assets and liabilities is regulated by the Instruction for the Inventory of Assets and Liabilities, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated November 30, 2007 No. 180. The reserve inventory should be carried out at least once a year when conducting an annual inventory (no earlier than December 1).

If, during the inventory, it is revealed that the organization does not need to carry out any work and incur corresponding expenses, the reserve is subject to restoration:

Dt 96 – Kt 91

– in the amount of restoration of the depreciation of a fixed asset as a result of previously carried out revaluations of this fixed asset, reflected in account 91;

Dt 96 – Kt 83

– reflects the remaining amount of the reserve.

Procedure for creating a reserve

Let's look at the procedure for creating a reserve using a conditional example.

Example

The organization received permission to construct a well for water extraction, and therefore was allocated a plot of land. The permit was received for a period of 3 years, after which, according to the terms of the permit, the organization will have to dismantle the well and restore the natural environment in the allocated area.

The cost of expenses associated with the construction of the well amounted to 600 million rubles.

The accounting policy provides for the creation of a reserve for the decommissioning of fixed assets and similar obligations, subject to appropriate conditions. When analyzing these conditions, the organization established the following.

1. The organization has an obligation to carry out work to dismantle and liquidate fixed assets and restore natural resources on the land plot it occupies. This obligation arises from the terms of the water extraction permit issued.

2. It is assumed that assets will be disposed of to pay off the obligation, since in order to fulfill the obligation to dismantle and liquidate the fixed asset and restore natural resources, it will be necessary to make certain expenses (pay for the services of third-party organizations, consume materials, fuel, pay employees, etc.).

3. The amount of the liability can be reliably determined. It can be calculated by drawing up an estimate for the work necessary to dismantle the well and restore the natural environment.

Thus, the conditions necessary for accrual of the reserve are met.

For this purpose, the organization has drawn up an estimate of the work in the prices expected at the time of the work necessary to dismantle the well and restore the natural environment. Based on the estimate, the cost of the work amounted to 70 million rubles.

According to the accounting policy of the organization, the current discount rate of the National Bank (30% per annum) is used as the discount rate. Since the work will be carried out in 3 years (when the production permit expires), the discounting period will be 3 years.

Let's calculate the amount of the reserve taking into account discounting:

70 / (1 + 0.3)3 = 31.862 million rubles.

We will calculate the reserve. Let's make an entry in accounting:

Dt 08 – Kt 96 – 31.862 million rubles.

Let us assume that over the next 3 years no changes occurred in the factors on the basis of which the reserve was calculated, as well as in the assessment of these factors, i.e. there was no need to clarify the reserve.

After 3 years, the organization dismantles the well and carries out environmental restoration work. Their cost amounted to 70 million rubles. In accounting, the cost of these works should be reflected in the accounting record:

Dt 96 – Kt 10, 70, 69, 60, etc. – 31.862 million rubles.

If at the time of dismantling the cost of dismantling work turns out to be higher than the amount of the created reserve, then an accounting entry will need to be made for the amount of work not covered by the reserve:

Dt 91 – Kt 10, 70, 69, 60, etc. – 38.138 million rubles.

If at the time of dismantling the cost of dismantling work is lower than the amount of the created reserve, then the amount of the excess reserve is subject to restoration:

D-t 96 – K-t 91 (83).

Features of the formation of residual value during complete liquidation

The residual value should be included in expenses depending on the method of calculating depreciation for the liquidated object.

- When using the linear method of calculating depreciation, the residual value of the fixed asset is written off in full at a time as non-operating expenses (paragraph 2, paragraph 8, paragraph 1, article 265 of the Tax Code of the Russian Federation). For buildings, structures and transmission devices of 8-10 depreciation groups, only the linear method of calculating depreciation is used (clause 3 of Article 259 of the Tax Code of the Russian Federation), therefore, the residual value of these objects is written off at a time in full (paragraph 2, paragraph 8, paragraph 1 Article 265 of the Tax Code of the Russian Federation).

- If the taxpayer uses the non-linear method, the fixed asset is taken out of service in the manner provided for in paragraph 13 of Art. 259.2 of the Tax Code of the Russian Federation: an object is excluded from the depreciation group on the date of its liquidation, but depreciation continues until the end of its useful life according to the previous scheme. In other words, with non-linear depreciation, the decrease in the taxable base for income tax occurs gradually through the calculation of depreciation (Letters of the Ministry of Finance of Russia dated 02/24/2014 No. 03-03-06/1/7550, dated 12/20/2010 No. 03-03-06/2/ 217).

Officials allow the depreciation bonus not to be restored, since in this case there is no fact of sale of property (Letter of the Ministry of Finance of Russia dated March 16, 2009 No. 03-03-05/37, Letter of the Federal Tax Service of Russia dated March 27, 2009 No. ШС-22-3 / [email protected ] ).

Find out which depreciation method to choose for tax accounting here.

If you have access to ConsultantPlus, check whether you are calculating depreciation correctly in tax accounting. If you don't have access, get a free trial of online legal access.

Features of the formation of residual value during partial liquidation

It is unlawful to apply the norms for writing off the residual value during the complete liquidation of property for non-operating expenses for partial liquidation, because there is no condition for decommissioning the equipment (clause 8, clause 1, article 265, clause 13, article 259.2 of the Tax Code of the Russian Federation). Therefore, it is allowed to write off the residual value of property with non-linear depreciation for partial liquidation of the object as one-time expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 19, 2011 No. 03-03-06/1/503).

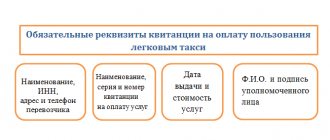

Certificate of liquidation (write-off) of an asset: basic requirements

To write off property, you can use unified forms No. OS-4, OS-4a, OS-4b, or independently develop a local document (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”) and be sure to secure the form in accounting policy of the organization. If a decision has been made to create an internal form of documents, then it is recommended to include the following sections in it (Letter of the Ministry of Finance of Russia dated October 21, 2008 No. 03-03-06/1/592):

- year of creation of the object;

- date of commissioning;

- original or replacement cost of the property;

- depreciation amount;

- number of major repairs;

- reasons for liquidation;

- the ability to use the object itself, parts or assemblies;

- Additional Information.

In the absence of the above points in the local act, the tax authorities may have justified claims.

Progress of the procedure

Previously, the process of writing off fixed assets was strictly regulated. During this procedure, a special commission was necessarily created, which was supposed to make the final decision on liquidation. Now this norm is not mandatory and write-off of fixed assets is carried out according to the rules established by local documents.

The requirements of Federal Law No. 402 “On Accounting” on the procedure for liquidation are advisory in nature, but are often practiced today.

The liquidation procedure for fixed assets involves the following stages:

- At the preparatory stage, the feasibility of further use of fixed assets, the effectiveness or ineffectiveness of restoration is determined . For this purpose, by order of management, a special commission of competent employees may be appointed. It usually includes accountants and persons responsible for the safety of fixed assets. Outside experts and inspectors may be invited to participate in the work of the commission. Based on the results of the commission's registration, an order is usually issued.

- Next comes the stage of the commission's work . The competence of the commission includes: inspection of the facility using certain technical documentation; establishing the impossibility of its use; assessment of the reasons for writing off an object; assessment of the possibility of using individual components and assemblies of the object and its assessment; control over the withdrawal of precious metals and non-ferrous metals from fixed assets; determining the weight of the object and transferring it to the warehouse, etc.

- The results of the commission's work and the decisions it makes are documented . Based on the results of the commission’s work, a decision may be made to write off a fixed asset or to repair it or disassemble it into spare parts. The decision made must be justified: members of the commission should indicate the reasons that prompted them to liquidate fixed assets.

- Parts, assemblies and assemblies (for example, suitable for repairing other operating systems) are received as scrap or waste , and unusable ones are received as recyclable materials.

- A note about disposal of fixed assets is made in the inventory card or book.

- An order to liquidate a fixed asset is created.

Decommissioning of an object without dismantling

The Ministry of Finance believes that it is possible to write off the facility without dismantling it. The position of officials is as follows: write-off of property occurs as a result of disposal of the object in accordance with a correctly executed liquidation act.

It is not necessary to confirm the fact of dismantling (Letter of the Ministry of Finance of Russia dated December 8, 2009 No. 03-03-06/1/793).

Tax authorities also believe that this condition is not mandatory and the costs of write-off and the amount of remaining depreciation can be included in non-operating expenses on the basis of a liquidation act without dismantling (Letter of the Federal Tax Service of Russia for Moscow dated September 30, 2010 No. 16-15 / [email protected ] ).

The earlier position of the tax authorities differed from the explanations of the Ministry of Finance. Federal Tax Service officials said that it was impossible to liquidate the facility without dismantling it. A taxpayer who has not carried out an analysis of a written-off fixed asset does not have the right to write off liquidation expenses, depreciation and residual value as non-operating expenses (Letter of the Federal Tax Service of Russia for Moscow dated 04/07/2009 No. 16-15/033038).

Since employees of the Federal Tax Service show an ambiguous decision on this issue, it is still recommended to take into account their wishes and carry out dismantling work. If the object has been lost and it is impossible to organize work to dismantle it, it is still necessary to carry out some work to eliminate the consequences. They should be documented with primary documents. In this case, you will have every reason to legally liquidate the property.

See also “Capitalization of materials after dismantling fixed assets - postings.”

Results

A fixed asset that has become unusable is written off based on the decision of the commission and the order of the director. There is no need to restore VAT. Materials remaining after the liquidation of the fixed assets must be capitalized at market value as part of inventories.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

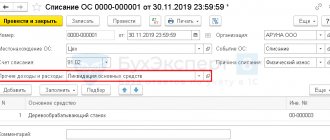

Reflection in accounting

Income and expenses from the disposal of fixed assets are subject to entry into the profit and loss account as other income and expenses and are reflected in accounting in the reporting period to which they relate.

Debit 01 Subaccount “Disposal of fixed assets” Credit 01 – the initial cost of the liquidated fixed asset item is written off;

Depreciation on fixed assets must be accrued for the last time in the month of its disposal. Depreciation is accrued for a full month, regardless of how many days in the last month the fixed asset was on the balance sheet.

Debit 02 Credit 01 Subaccount “Disposal of fixed assets” – the amount of accrued depreciation is written off;

Debit 91-2 Credit 01 Subaccount “Disposal of fixed assets” - the residual value of the liquidated fixed asset item is written off;