you put it on arrival, materials count 10 it seems

Accounting book, furniture numbers, 10 accounting account.

Accounting for office furniture is carried out in accordance with the Chart of Accounts for accounting of financial and economic activities of organizations. Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, Accounting Regulations “Accounting for Inventories” PBU 5/01. The accounting procedure is fixed in the company's accounting policy. Office furniture worth over 20,000 rubles. and with a period of use of more than 12 months is taken into account in account 01 “Fixed Assets”. In this case, accounting is carried out at the original cost, which is obtained by subtracting taxes from the actual cost. The receipt of furniture is reflected by the following transactions: D-t 08 K-t 60 office furniture is capitalized D-t 19 K-t 60 the amount of VAT is reflected D-t 60 K-t 51, 52, 55 suppliers' invoices are paid. The disposal of office furniture can be reflected in the following transactions: D-t 91 K-t 01 residual value D-t 02 K-t 01 depreciation D-t 10 K-t 99 capitalization of material assets upon liquidation of the object D-t 91 K-t 99 profit from disposal (sale, transfer, liquidation) D-t 99 K-t 91 loss from disposal. With reflection in accounting of furniture worth less than 20,000 rubles. the situation is somewhat more complicated. In accordance with PBU 6/01, such objects can be accounted for either as fixed assets or as inventories. In the second case, accounting is kept in account 10 “Materials”. At the same time, the following entries are made: D-t 10 K-t 60 received office furniture from suppliers D-t 19 K-t 60 reflected the amount of VAT D-t 60 K-t 51, 52, 55 paid suppliers' bills D-t 68 K -t 19 deduction of VAT amount when making payments to the budget. In this case, furniture is written off when it is transferred to the place of use: D-t 79-1 K-t 10 furniture was transferred to structural units. The choice of accounting option must be reflected in the company's accounting policy. There it is also necessary to fix a limit on the cost of furniture, which is taken into account as inventory. It should not exceed 20,000 rubles. , but maybe less. If office furniture is accounted for as a fixed asset, according to its useful life it belongs to the fourth depreciation group and is depreciated in the manner established by the accounting policy. Depreciation is reflected in account 02 “Depreciation of fixed assets”. In this case, the following entries are possible: D-t 26 K-t 02 depreciation charge for office furniture D-t 83 K-t 02 additional assessment of depreciation D-t 02 K-t 83 depreciation markdown. The purchase of office furniture is documented by the “Acceptance and Transfer Certificate of Fixed Assets” (form OS-1). For each object (form OS-6) an entry is made in the “Inventory book of accounting for fixed assets” (form OS-6b). When furniture is disposed of, an “Act on the write-off of fixed assets” is drawn up (form OS-4).

People!! ! you are behind the times!! ! Both in PBU 6 and in the Tax Code, the cost criterion for classifying assets as fixed assets has long been 40,000 rubles!! !

Stationery in accounting - postings, accounting accounts, examples

That is, if your furniture costs more than 40,000 rubles. without VAT per unit, then this is definitely a fixed asset, it must be taken into account on account 01 and depreciation should be calculated: D 08 - K 60 D 01 - K 08 D 26... -K 02 If the cost of your furniture is less than 40,000 rubles. , then according to PBU 6 you can take it into account as part of the inventory (that is, on account 10, and not on 01!). Only this needs to be fixed in the accounting policy, since this is your right, not an obligation. Further, according to the rules for accounting for materials, you can immediately write off the entire cost at the time of commissioning, and take into account the quantity until complete wear: D 10.09 - K 60 D 26... -K 10.09

Hello, on this website next-meb.ru you can easily and simply order the best office furniture in Russia. I myself ordered furniture on this site a couple of months ago, everything arrived very quickly, and most importantly for little money, I recommend it.

Hello, on this website next-meb.ru/ you can easily and simply order the best office furniture in Russia. I myself ordered furniture on this site a couple of months ago, everything arrived very quickly, and most importantly for little money, I recommend

Login to write a reply

REMEMBER! Under the simplified tax system, only the cost of furniture purchased to solve the problems of the main activity can be written off as material expenses. For example, a refrigerator for personal use by staff cannot be recognized as a justified expense; its cost should not increase the amount of expenses when calculating the taxable base.

Choosing a winner

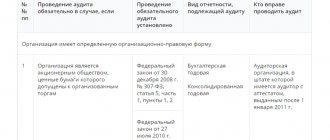

The customer commission checks applications for compliance with documentation requirements and takes into account the provisions of the national regime:

- When purchasing within the framework of Order No. 126n dated 06/04/2018, the algorithm for conducting email. An auction for the supply of furniture involves an additional reduction in the price of the winner by 15% if he offered imported products. When placing an order in other ways, the customer believes that the prices from offers with goods from the Russian Federation and the EAEU are lower than indicated in the application by 15 or 20% if the goods are purchased within the framework of a national project.

- When the tender is carried out according to the rules of PP No. 616 of 04/30/2020, applications of participants with imports will have to be rejected.

IMPORTANT!

If the participant has not confirmed that the product was manufactured in Russia or on the territory of the EAEU, then the product is considered imported.

Accounting and taxation of furniture components

When assigning part of the furniture to the inventory, it is necessary to approve a scheme for ensuring the safety of such assets. For this purpose, it is recommended to use an off-balance sheet account in accounting. This way, the enterprise will be able to attribute the cost of inexpensive items to expenses immediately, but will not forget about the existence of purchased and used furniture, which will be reflected in the accounting data until its cost is written off from the credit of the off-balance sheet account. As an additional control measure, furniture is assigned to financially responsible persons who monitor its safety.

We compile documentation

To place information about the tender in the Unified Information System, prepare documentation that contains:

- general requirements for participants and explanations of what documents are needed for the supply of furniture 44-FZ (Article 31 44-FZ);

- instructions for participation in the tender;

- technical task;

- justification of the NMCC;

- draft contract.

Be sure to include in the documentation prohibitions and special conditions for admission under the national regime:

- Most of the furniture is subject to special conditions of admission according to Order No. 126n dated 06/04/2018. To conclude a contract at the price specified in the proposal, the participant indicates in the application information that the product was manufactured in the territory of the EAEU.

- If the purchase falls within the scope of Decree of the Government of the Russian Federation No. 616 dated April 30, 2020, then the participant attaches to the application an entry from the register of the Ministry of Industry and Trade or goods that are manufactured in the EAEU, and indicates the register number of the entry and the amount of points for fulfilling specifications in the territory of the Russian Federation, if provided PP No. 719 dated July 17, 2015.

PP No. 616 dated 04/30/2020 explains which participants should be given benefits if the customer purchases an office desk and chair: the OKPD2 code of the goods is contained in the appendix to the resolution. This means that advantages are provided to suppliers of Russian products or goods from EAEU countries. In this case, the purchase of imports is prohibited.

Read more: new rules for national treatment under 44-FZ in 2022

We are figuring out whether it is necessary to establish a national regime for the manufacture of furniture: the work itself is not subject to restrictions and prohibitions under the national regime. However, the national regime applies to goods that are supplied during the performance of work.

How to properly record furniture in accounting

Determining the group to which the property belongs can help determine the depreciation period. To obtain the information of interest, you need to contact the classifier. Office furniture belongs to group 4. Its period of use ranges from 5 years 1 month to 7 years inclusive.

Info

If an accountant turns to a classifier in order to find out the group that includes office equipment, he will not be able to solve his problem. The type of property is not included in the document. According to the established rules, if an object is not on the list, its useful life is established based on the manufacturer’s recommendations (Article 258 of the Tax Code of the Russian Federation). To do this, you need to read the documentation accompanying the purchased item.

Based on the statement, office equipment can be included in group 2. The useful life of the item will be from 2 to 3 years.

Furniture accounting at the enterprise: postings

- home

- Fixed assets

Furniture is an integral part of every organization. Without it, it is impossible to carry out economic activity. However, not everyone realizes that every item should be listed on the company’s balance sheet.

Important

For this reason, all company furniture is subject to accounting, which must be carried out in accordance with established rules. In the article we will talk about accounting for furniture in the office, in organizations and hotels, and give examples of postings. Accounting for furniture in the office Accounting for furniture in the office is a responsible undertaking.

To carry it out, a competent approach is required. Typically, updating and purchasing new furniture is carried out in small batches. Today a company can buy a cabinet, and a month later get new chairs. The procedure for decorating furniture depends on its cost. This indicator has a direct impact on whether the data will be classified as OS or MPS. Accounting for furniture in accounting must be organized in accordance with the norms of tax legislation (Article 257 of the Tax Code of the Russian Federation) and accounting provisions (clause 4 of PBU 6/01). Furniture items can be accounted for as inventories or fixed assets. The criteria for identifying ownership are the cost of the object, its service life and purpose. Clause 5 of PBU 6/01 sets a price limit for recognizing an inventory asset - the upper limit is 40 thousand rubles. If the cost of furniture is higher, then it is included as a fixed asset. The Tax Code of the Russian Federation recommends that valuables worth more than 100 thousand rubles be classified as depreciable property. To eliminate discrepancies, pieces of furniture with a purchase price above 40 thousand rubles. must be reflected in accounting as an object of fixed assets, charging depreciation on them.

How to account for furniture in accounting

Attention

This indicator affects the duration of transferring the value of assets into costs and the assignment of an object to a specific depreciation group. The classification of depreciation categories is given in Art. 258 of the Tax Code of the Russian Federation and correlates with the norms of government Decree No. 1 of 01.01.2002. FOR REFERENCE! If the expected life of an asset is unclear, it should be taken from the technical documentation.

If the accompanying forms do not contain the necessary information, you can check the data with the manufacturer. There is no designated category for furniture in the Classifier, so its depreciation group must be identified by its expected service life. The useful life period can be determined based on technical documentation, supplier recommendations, or asset characteristics. This method of working with the Classifier is fixed in Art. 258 Tax Code of the Russian Federation. To do this, it is necessary to determine which depreciation group these assets should belong to. Identification is carried out according to the criteria outlined in the government decree of January 1, 2002 under No. 1 and Art. 258 Tax Code of the Russian Federation. Furniture in the classification adopted by the legislator is not distinguished as a separate element. In such situations, it is allowed to focus on the service life. The value of this indicator should be taken from the technical documentation or recommendations of the furniture manufacturer. To avoid conflicts between accounting and tax accounting data, it is recommended that in relation to furniture, the same time interval for operation is established in different types of accounting. Depreciation is charged to account 02 by posting D26 - K02.

How furniture is accounted for in accounting

- D91 – K99 – the amount of funds received by the company as a result of decommissioning a set of furniture;

- D99 - K91 when the institution receives a loss after disposal of furniture items.

If furniture elements can be classified as inventories based on their estimated value, then the accounting entries will be different:

- D10 – K60 – when reflecting the fact of receiving inexpensive furniture;

- D19 – K60 – correspondence used to record the amount of VAT;

- D20 – K10 – write-off of the value of acquired assets after they are put into operation;

- D004 - to record the fact of receipt of inexpensive furniture.

The nuances of calculating depreciation for furniture Assets recognized as fixed assets must be depreciated regularly. The period for making depreciation charges directly depends on the expected service life.

To do this, it is necessary to determine which depreciation group these assets should belong to. Identification is carried out according to the criteria outlined in the government decree of January 1, 2002 under No. 1 and Art. 258 Tax Code of the Russian Federation. Furniture in the classification adopted by the legislator is not distinguished as a separate element.

In such situations, it is allowed to focus on the service life. The value of this indicator should be taken from the technical documentation or recommendations of the furniture manufacturer. To avoid conflicts between accounting and tax accounting data, it is recommended that in relation to furniture, the same time interval for operation is established in different types of accounting. Depreciation is charged to account 02 by posting D26 - K02.

The receipt of furniture can be reflected using the following postings:

- Dt 08 Kt 60 (posting of office furniture).

- Dt 19 Kt 60 (reflection of the VAT amount).

- Dt 60 Kt 51, 52, 55 (payment of supplier bills).

There is another way to keep records. It can be carried out within a separate off-balance sheet account. If the company goes this route, it will need to create accounting cards for all furniture items.

For such purposes, unified or independently developed forms can be used. Carrying out accounting of office equipment Almost all office equipment objects are classified as mechanization equipment. The service life of such items is more than 1 year. Typically, office equipment is taken into account as part of the operating system.

During manipulations, the actual value of the property is taken into account. In this case, the service life of items is set within 5–7 years. Question No. 3. Can I independently develop a document form for furniture accounting? Yes, the law does not prohibit a specialist from independently developing a form for carrying out the procedure. Question No. 4. Which category should the property be included in if its value is more than 100,000 rubles? In both tax and accounting, the item can be classified as fixed assets. Question No. 5. How to confirm the transfer of property into operation? To carry out the action, you can use the invoice. The form of the document may be the same as for stationery. Rate the quality of the article.

01-01-2010

Accounting for office furniture in a company requires a competent and responsible approach. In most cases, furniture is purchased as separate objects, that is, today a table, a chair, after a while a cabinet and a wardrobe, etc.

How the furniture will be decorated depends on its cost. It is depending on the price that data is assigned to fixed assets or inventories when accounting. So, if the requirements of the fourth paragraph of PBU 6/01 are met, then the object belongs to the OS. The receipt of furniture is documented using primary documents of the appropriate category (all appropriate forms are approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7)

According to the fifth paragraph of PBU 6/01 “Assets in respect of which the conditions provided for in paragraph 4 of these Regulations are met, and with a value within the limit established in the accounting policy of the organization, but not more than 20,000 rubles per unit, may be reflected in accounting and accounting reporting as part of inventories.

Disposal of furniture: OS

- Debit 08 Credit 60 – purchase of office furniture using a bill of lading or a transfer and acceptance certificate;

- Debit 19 Credit 60 – VAT allocated (if furniture is purchased from a VAT payer);

- Debit 68 Credit 19 – VAT is accepted for deduction (if there is a correctly executed invoice);

- Debit 60 Credit 51 – payment was made to the OS supplier;

- Debit 01 Credit 08 – furniture was put into operation on the basis of the OS-1 act;

- Debit 20 (25, 26, 44 ...) Credit 02 – monthly depreciation.

You might be interested ==> Travel cards for pensioners in Volgograd in 2022

Purchasing furniture: accounting as OS

As a result of furniture write-off, the company may incur additional costs. expenses or additional income. For example, broken furniture should be sent for recycling. Or “crosspieces” from discarded office chairs can be used for repairs. Such expenses and income are charged to account 91 “Other income and expenses”.

In order to write off the value of the property specified in paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, during more than one reporting period, the taxpayer has the right to independently determine the procedure for recognizing material expenses in the form of the cost of such property, taking into account the period of its use or other economically justified indicators.

The courts, as a rule, take the side of organizations in such cases. For example, the Federal Antimonopoly Service of the Moscow District, in its Resolution dated June 28, 2012 in case No. A40-50869/10-129-277, recognized the legal attribution of accrued depreciation on such fixed assets as chairs for visitors to expenses that reduce the taxable base for income tax , sofas, wardrobe, office kitchen, refrigerators, TV, etc. Recognizing the decision of the tax authority in this part as invalid, the courts reasonably proceeded from the fact that the use of these facilities is aimed at ensuring normal working conditions and is the responsibility of the employer, and therefore the incurrence of expenses associated with the fulfillment of this obligation is directly related to the participation of employees in production process.

The table is the main tool or materials

In addition to SPI, it is also necessary to evaluate the cost criterion for classifying it as fixed assets or low value. The limit is set by the company's accounting policy, but the legislator also controls this parameter. For tax authorities, it is important what you immediately include in the costs of the period, and what stretches out for a period of more than 1 year.

The all-Russian classifier OK 013-2014 (SNS 2008) (hereinafter referred to as the new OKOF) was adopted and put into effect by order of Rosstandart dated December 12, 2014 N 2022-st. The objects of classification in OKOF are fixed assets. The classifier was developed on the basis of harmonization with the System of National Accounts (SNA 2008) of the United Nations, the European Commission, the Organization for Economic Cooperation and Development, the International Monetary Fund and the World Bank Group, as well as with the All-Russian Classification of Products by Type of Economic Activity (OKPD2) OK 034- 2014 (CPA 2008) and is intended, among other things, for the transition to the classification of fixed assets accepted in international practice. Until January 1, 2022, the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF), approved by Decree of the State Standard of Russia dated December 26, 1994 N 359 (hereinafter referred to as the old OKOF), was used. In order to simplify the use of the new OKOF, by order of Rosstandart dated April 21, 2022 N 458, direct and reverse transitional keys between editions of classifiers (hereinafter referred to as the Transitional Key) were approved. The search for the code of a new OKOF can be carried out by the name of the OS or by its purpose. If searching for the code of a new OKOF does not lead to the desired result, then you can use the old OKOF and search for it. Next, find the code from the new OKOF using the Transitional key. At the same time, financial department specialists note that in the description of the new OKOF there is no procedure for assigning classification objects to a specific code. Therefore, the determination of the OKOF code is in any case based on subjective judgment. In addition, when choosing an OKOF code, it is advisable to proceed from the principle of prudence. The main thing is to prevent overestimation of depreciation charges and, as a result, underestimation of the taxable base for property tax (see letter of the Ministry of Finance of Russia dated September 21, 2022 N 02-06-10/61195). Regarding the telecommunications cabinet, we note the following. In our opinion, a telecommunications cabinet according to the new OKOF belongs to communication equipment with code 320.26.30. According to the Classification, a telecommunications cabinet with the new OKOF code 320.26.30 assigned to it can be classified as the fourth depreciation group for industrial and household equipment with a useful life of over 5 years up to 7 years inclusive. We draw your attention to the “Note” column, which contains an indication of “furniture for cable and wire communications enterprises”. We also believe that it is possible to establish a useful life based on information from the manufacturer or (for accounting purposes) the expected useful life. Regarding office furniture, we note the following. According to the old OKOF, furniture for offices (code 163612450 “Furniture sets for administrative premises”) is classified in the subsection “Industrial and household equipment” (code 160000000), in the class “Special furniture” (code 163612000). According to the Classification as amended, valid until 01/01/2022, “Special furniture” (code 163612000) belonged to the 4th depreciation group (property with a useful life of over 5 years up to 7 years inclusive). At the same time, according to the new OKOF (as amended from 01/01/2022 to 07/31/2022), “Furniture sets for administrative premises” are classified under code 330.31.01.1 “Furniture for offices and trade enterprises.” This conclusion also follows from the direct transition key. However, in the current edition of the Classification “Furniture for offices and retail establishments” (code 330.31.01.1) is not named. At the same time, we draw your attention to the explanations of representatives of the financial department, which were given in relation to the budget organization in letter dated December 27, 2022 N 02-07-08/78243: “In case of any contradictions in the use of direct (reverse) transition keys approved by the Order N 458, and OKOF OK 013-2014, as well as the absence of positions in the new OKOF OK 013-2014 codes for accounting objects previously included in the groups of material assets, which, according to their criteria, are fixed assets, the commission for the receipt and disposal of assets of the accounting subject can accept an independent decision to classify these objects into the appropriate group of OKOF OK 013-2014 codes and determine their useful life. In relation to material assets that, in accordance with Instruction 157n, relate to fixed assets, but these assets are not included in OKOF OK 013-2014 (SNA 2008), in this case such objects are taken into account as grouped according to the All-Russian Classifier of Fixed Assets OK 013-94″. See also letter of the Ministry of Finance of Russia dated December 30, 2022 N 02-08-07/79584. In our opinion, it would be more correct to classify office furniture as belonging to the group of the new OKOF 330 “Other machinery and equipment, including household equipment, and other objects.” The most suitable code in this grouping would be OKOF code 330.28.99.39.190 “Other special-purpose equipment, not included in other groups” or 330.28.29 “Other general-purpose machines and equipment, not included in other groups.” In relation to the situation under consideration, in the absence of a direct indication of the corresponding grouping in the Classification for office furniture for tax accounting purposes, it is possible to establish a useful life based on the manufacturer’s information. If we follow the above explanations, since before the introduction of the new OKOF, office furniture belonged to the 4th depreciation group, for which the useful life ranged from 5 years to 7 years inclusive, then the organization has the right to office furniture purchased after January 1, 2022, also classified as 4th depreciation group.

You might be interested ==> How much does a kindergarten in the Moscow region cost per month?

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property for the purposes of Chapter 25 of the Tax Code of the Russian Federation includes property with a useful life of more than 12 months and an initial cost of more than 100,000 rubles. In accordance with paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life. The useful life is the period during which the asset serves to fulfill the goals of the taxpayer's activities. The useful life is determined by the taxpayer independently on the date of commissioning of this depreciable property in accordance with the provisions of Art. 258 of the Tax Code of the Russian Federation and taking into account the Classification. The norm of paragraph 6 of Art. 258 of the Tax Code of the Russian Federation establishes that if any types of fixed assets are not indicated in depreciation groups, their useful life is established by the organization taking into account the technical conditions or recommendations of manufacturers. Thus, if, based on the documents available to the organization, it is impossible to determine the useful life of the OS, then you can contact the manufacturer (seller) with a corresponding request. Next, based on the established useful life, you can determine the depreciation group in accordance with clause 3 of Art. 258 Tax Code of the Russian Federation. Let us note that specialists of the Ministry of Finance of Russia, when considering taxpayers’ questions regarding the determination of depreciation groups, also often refer to the norm of paragraph 6 of Art. 258 of the Tax Code of the Russian Federation (see, for example, letters of the Ministry of Finance of Russia dated 03/06/2022 N 03-03-06/1/12629, dated 12/30/2022 N 03-03-06/1/79707, dated 11/03/2022 N 03-03- 06/1/64814, dated 04/03/2015 N 03-03-06/4/18874). At the same time, on the issue of classification of fixed assets included in depreciation groups, the Russian Ministry of Finance refers taxpayers to the Russian Ministry of Economic Development (see letters of the Russian Ministry of Finance dated April 25, 2022 N 03-03-06/1/23916, dated November 3, 2015 N 03-03-06 /1/63570, dated 04/03/2015 N 03-03-06/4/18874, dated 08/25/2014 N 03-03-06/1/42310).

On this issue, we adhere to the following position: For office furniture, the most suitable code would be OKOF code 330.28.99.39.190 “Other special-purpose equipment, not included in other groups” or 330.28.29 “Other general-purpose machines and equipment, not included in other groups” groups." The telecommunications cabinet belongs to communication equipment with code 320.26.30. For accounting purposes, the useful life for fixed assets is established by the organization in accordance with the accounting policies of the organization. Based on the Classification, both the telecommunications cabinet and office furniture can be classified in the fourth depreciation group for industrial and household equipment with a useful life of over 5 years up to 7 years inclusive. We also believe that it is possible to establish a useful life for accounting purposes based on information from the manufacturer or the expected useful life, unless otherwise specified in the accounting policy. For tax accounting purposes for office furniture, due to the lack of a direct indication of the grouping in accordance with the Classification, it is possible to establish a useful life based on the manufacturer’s information.

You might be interested ==> Is collection for major repairs mandatory or not 2022

Inventory is classified as fixed assets if its useful life is more than 12 months and its cost is more than 40,000 rubles. (Clause 4 PBU 6/01). At a lower cost, it is allowed to take it into account as part of the inventory (clause 5 of PBU 6/01). At the same time, the organization can set its own cost limit between fixed assets and inventories at the above limit. For example, how to take into account objects costing over 20,000 rubles as fixed assets, and cheaper ones as inventories. The cost threshold must be fixed in the accounting policy.