Let's understand the concepts

The definition of what financial expenses are is given not only in accounting, but also in tax accounting. The concepts do not differ significantly; therefore, material costs include the following types of expenses:

- acquisition of inventories, raw materials, components and components for fixed assets of production departments;

- purchase of fuel and lubricants, electricity, thermal energy, water to carry out the technological process;

- procurement of works, goods and services necessary for the production cycle;

- losses and shortages of products within the established norms of natural loss;

- other expenses.

The amount of sold and returnable waste cannot be used in calculations. Waste should be subtracted from material costs.

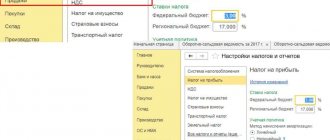

According to tax accounting standards, the list of costs is closed. But accounting contains only a definition, without a list of listings (clause 8 of PBU 10/99). The company must independently consolidate a comprehensive list of material costs in its accounting policies. The accounting policy will describe the same expenses as in fiscal legislation, only with certain considerations taking into account the specifics of the activity of an economic entity.

Material costs

One of the most significant cost items for any organization is material costs. This is especially true for those companies that produce products or perform work in the interests of the customer. However, even those companies whose main activity is the provision of services are unlikely to be able to avoid the need to reflect material costs in both accounting and tax accounting.

Material expenses in accounting and tax accounting

Material expenses in accounting are one of the main types of expenses for ordinary activities according to PBU 10/99. This legislative act does not provide a specific list of material costs or their definition. However, what relates to material expenses is stated in a number of other documents regulating the organization’s accounting procedures. Thus, on the basis of PBU 5/01, material costs include the purchase of raw materials or supplies used in the production process, as well as the cost of goods purchased for the administrative and general economic needs of the organization. Various guidelines for accounting include among material costs the cost of containers and packaging, the purchase of various types of energy, spare parts and materials for repairing operating systems, production work and services, the cost of issued workwear, special footwear, and so on.

In short, no closed list of material expenses is provided for accounting purposes. At the same time, a clearer list of material expenses is presented in Article 254 of the Tax Code. These are the following types of costs:

- for the purchase of raw materials or supplies used in the production of goods, performance of work, provision of services and for the purchase of components or semi-finished products used for further production (these types of expenses relate to direct material costs associated with the production and sale of goods, work or services in accordance with Article 318 Tax Code);

- for the purchase of materials used for packaging or other preparation of goods for sale, as well as for other production and economic needs;

- for the purchase of tools, equipment and devices, as well as special clothing and other personal and collective protective equipment (if provided by law). These acquisitions should not relate to fixed assets;

- to pay for fuel, water, energy of all types spent on technological purposes;

- to pay for work and services of a production nature, including transport services;

- to ensure the maintenance and operation of fixed assets and other property for environmental purposes, including those related to compliance with various environmental standards and regulations.

Also, material expenses in tax accounting for the purposes of calculating an organization’s income tax are losses from shortages and damage during storage and transportation of inventories within the limits of natural loss rates, as well as technological losses that may occur during the production and transportation of products.

For the convenience of reflecting material expenses, it is customary to take them into account according to the same principles; in other words, to classify certain types of expenses as material in both accounting and tax accounting.

In addition, this type of expense is one of the key ones when calculating the cost, because it is material costs that make up the bulk of the products, services or work produced by the organization. Accordingly, the analysis of direct material costs allows one to largely predict the profitability of production activities as a whole and determine the percentage of profit received by the company. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types of financial expenses

Despite the strict limitation of the types of expenses in the Tax Code, all financial expenses are classified into direct and indirect expenses. The division is enshrined in Art. 318 Tax Code of the Russian Federation. But companies have the right to independently determine the composition of direct and indirect expenses, taking into account legal requirements.

Direct material costs are the expenses of an economic entity aimed at providing the production cycle with the necessary materials, raw materials, semi-finished products, components, as well as for the purchase of services and work necessary in production. Direct expenses include expenses that are directly related to the implementation of the main activity.

The rest of the company's business expenses should be classified as indirect.

IMPORTANT!

Employee salaries, insurance premiums, as well as bonuses for the quality of work and other types of remuneration cannot be included in material costs. Labor costs are direct expenses of the company, but they cannot be classified as material expenses.

Direct and indirect costs

All production costs are divided into direct and indirect. It depends on the type how they are included in the cost of production.

Direct costs are involved in the production of a specific product (work, service) and are attributed specifically to it. For example, raw materials, materials, staff salaries and insurance premiums from them.

Indirect costs are involved in the production of all company products, so they cannot be attributed to a specific type. These are management and maintenance costs, for example, utilities, accounting salaries, rent, depreciation.

Since they apply to everything at once, they need to be distributed. To do this, companies choose a base and consolidate it in their accounting policies. This may be the volume of output, number of personnel, revenue, wages, volume of raw materials used, etc.

Example. The organization produces products A and B. Total costs for electricity amounted to 100,000 rubles. The accounting policy states that indirect costs are distributed in proportion to the share of raw materials used for each type of product. In a month, product A consumed 2 tons of raw materials, and product B - 4 tons.

Then the cost of electricity will be taken into account in the cost of goods as follows:

- for product A - 40,000 rubles (100,000 rubles × 2 tons / 5 tons);

- for product B - 60,000 rubles (100,000 rubles × 3 t. / 5 t.)

Organizations themselves determine the exact list of direct and indirect costs. They must be reflected in accounting at the time of their occurrence and recognized on the basis of primary documents.

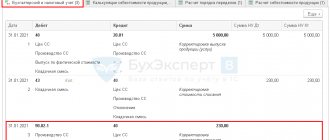

Accounting for material costs

There is no separate account in the Unified Chart of Accounts for the accumulation of financial expenses. To reflect information about the cost of expenses incurred in accounting, several accounts are used at once:

| Check | Name |

| 20 | "Primary production" |

| 21 | "Semi-finished products of our own production" |

| 23 | "Auxiliary production" |

| 29 | "Service industries and farms" |

| 28 | "Defects in production" |

In addition to the main accounting accounts, some expenses can be attributed to 25 “OPR” and 26 “OHR”. These accounts cannot have a balance at the end of the reporting period, that is, they must be included in the main cost accounting accounts.

Financial expenses in the balance sheet

The financial reporting forms approved by Order of the Ministry of Finance No. 66n do not contain a separate line to reflect information about the enterprise’s material costs indicator. However, the current accounting regulations determine that material costs should be reflected in the balance sheet, line 1210 “Inventories” (the second asset section of the balance sheet). Why? The presence of balances on cost accounts indicates an unfinished production cycle. And work in progress is recognized as an asset of the enterprise, and its price is included in the inventory of the economic entity.

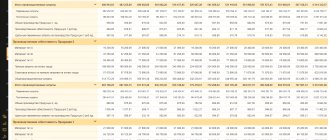

Calculation and evaluation formulas

Material costs have a direct impact on the cost of production, and therefore on revenue. Assessment, timely analysis of structure and dynamics, as well as systematic calculation of material costs are necessary. A tactical approach to planning and monitoring the indicator will provide the enterprise with maximum profitability, that is, it will increase its profitability.

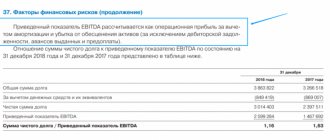

To determine the profitability of expenses, experts calculate a special coefficient that allows you to find out what profit per ruble of material costs is expected to be received, or to estimate losses.

The formula for profit per ruble of material costs—the definition of profitability—looks like this:

Profit (loss) per ruble of material costs = profit received from the sale of a specific type of product / total costs associated with the production of this product.

If the resulting value is less than one, this indicates that the enterprise is unprofitable. If the indicator is equal to one, it means that the profit received is equal to the expenses, and the organization did not earn anything in the reporting period. If the indicator is greater than one, this means that the enterprise is profitable, that is, its activities are profitable.

Concept and importance of cost of sales

Cost varies and is calculated in several ways depending on the purpose of the analysis. For example, if the cost of a product was 200 rubles, and the proceeds from the sale were 300 rubles, the profit would not necessarily be equal to 100 rubles. Several schemes are used to calculate such an important indicator as cost.

Production cost shows how much money was spent on creating the product.

When analyzing this indicator, the entire production process is divided into stages and each of them is evaluated. Such analytics makes it possible to understand where you can save in the production process: the use of cheaper materials, reducing non-production costs, reducing employee wages, reducing staff, and more.

To find out how much money production required, estimate the cost per month. In this case, comparison with revenue is not used.

The cost of selling a product is the full cost of the product, as it takes into account the funds spent on both the manufacture and sale of the product.

This option is very useful for entrepreneurs. Cost of sales is compared to revenue to determine the profitability of the business. Analysis of indicators is used to compile a report on financial results, which is the responsibility of the chief accountant of the enterprise. Consider the following example.

Comfort-mebel LLC produces office furniture.

In one day, the company manufactured and then sold 5 tables in its own workshop. To produce them, it was necessary to purchase materials for 20,500 rubles. The workers needed 5,000 rubles to pay their salaries. Expenses for advertising, office rent and consultant fees amounted to 10,000 rubles. We sold 5 tables for the amount of 35,000 rubles.

- Production cost = 25,500 rub. (RUB 20,500 + RUB 5,000).

- Cost of sales = RUB 35,500. (RUB 25,500 + RUB 10,000).

- Loss on sales = 500 rub. (35,000 rubles - 35,500 rubles).

If you look only at production costs, then the entrepreneur has a good profit from furniture sales. Actually this is not true.

Another example with the same data, but only 4 tables were sold per day.

- Production cost = 25,500 rub.

- Cost of sales = RUB 35,500. (RUB 25,500 + RUB 10,000)

- Loss on sales = 7,500 rubles. (RUB 35,500 - RUB 28,000)

Expenses increased by 7,000 rubles. – the cost of an unsold table. If purchased without advertising, it will bring some profit. When calculating the real income of an enterprise, all expenses are taken into account - depreciation of tools and equipment, energy, etc.

Manufacturing costs are the costs of manufacturing. This indicator will move into the category of expenses only when it is possible to sell the goods. This will be the full cost of selling the product.

Planning and budgeting of material costs

Planning the expenses of an economic entity is no less important than the assessment and final analysis of activity and profitability. A planning document for material costs is a budget for direct material costs. This document represents targets that must be achieved in the current period.

The budget helps to make planned calculations of sales volumes based on an assessment of the need for the use of raw materials, services and goods, as well as other types of knowledge. The analysis is compiled for a certain time, for example, for one calendar month or quarter.